Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help please. this is for my intermdiate accounting class that is all the information i was provided with by my teacher . 3rample

i need help please.

this is for my intermdiate accounting class

that is all the information i was provided with by my teacher .

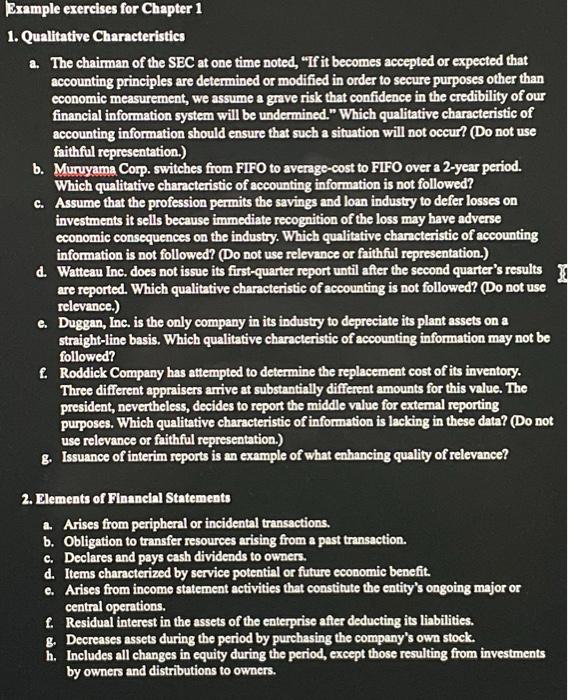

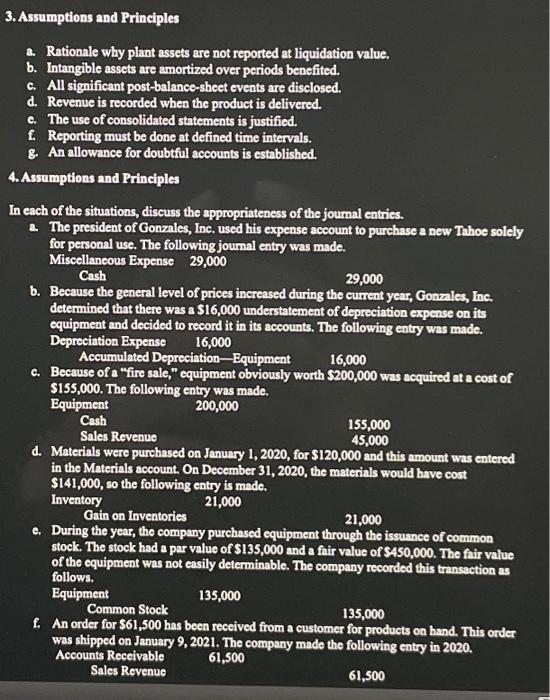

3rample erercises for Chapter 1 1. Qualitative Characteristics a. The chaiman of the SEC at one time noted, "If it becomes accepted or expected that accounting principles are determined or modified in order to secure purposes other than cconomic measurement, we assume a grave risk that confidence in the credibility of our financial information system will be undermined." Which qualitative characteristic of accounting information should ensure that such a situation will not occur? (Do not use faithful representation.) b. Muryyama Corp. switches from FIFO to average-cost to FIFO over a 2-year period. Which qualitative characteristic of accounting information is not followed? c. Assume that the profession permits the savings and loan industry to defer losses on investments it sells because immediate recognition of the loss may have adverse cconomic consequences on the industry. Which qualitative chancteristic of accounting information is not followed? (Do not use relevance or faithful representation.) d. Watteau Inc. does not issue its first-quarter report until after the second quarter's results are reported. Which qualitative characteristic of accounting is not followed? (Do not use relevance.) e. Duggan, Inc. is the only company in its industry to depreciate its plant assets on a straight-line basis. Which qualitative characteristic of accounting information may not be followed? f. Roddick Company has attempted to determine the replacement cost of its inventory. Three different appraisers arive at substantially different amounts for this value. The president, never theless, decides to report the middle value for external reporting purposes. Which qualitative characteristic of information is lacking in these data? (Do not use relevance or faithful representation.) B. Issuance of interim reports is an example of what enhancing quality of relevance? 2. Elements of Financial Statements a. Arises from peripheral or incidental transactions. b. Obligation to transfer resources arising from a past transaction. c. Declares and pays cash dividends to owners. d. Items characterized by service potential or future economic benefit. e. Arises from income statement activities that constitute the entity's ongoing major or central operations. f. Residual interest in the assets of the enterprise after deducting its liabilities. g. Decreases assets during the period by purchasing the company's own stock. h. Includes all changes in equity during the period, except those resulting from investments by owners and distributions to owners. 3. Assumptions and Principles a. Rationale why plant assets are not reported at liquidation value. b. Intangible assets are amortized over periods benefited. c. All significant post-balance-sheet events are disclosed. d. Revenue is recorded when the product is delivered. c. The use of consolidated statements is justified. f. Reporting must be done at defined time intervals. 8. An allowance for doubtful accounts is established. 4. Assumptions and Principles In each of the situations, discuss the appropriateness of the joumal entries. a. The president of Gonzales, Inc. used his expense account to purchase a new Thhoe solely for personal use. The following journal entry was made. Miscellaneous Expense 29,000 Cash 29,000 b. Because the general level of prices increased during the current year, Gonnales, Inc. determined that there was a $16,000 understatement of deprecintion expense on its equipment and decided to record it in its accounts. The following entry was made. Depreciation Expense 16,000 Accumulated Depreciation-Equipment 16,000 c. Because of a "fire sale," equipment obviously worth $200,000 was acquired at a cost of Equipment Cash Sales Revenue 200,000 155,000 45,000 d. Materials were purchased on January 1, 2020, for $120,000 and this amount was entered in the Materials account. On December 31, 2020, the materials would have cost $141,000, so the following entry is made. Inventory 21,000 Gain on Inventories 21,000 e. During the year, the company purchased equipment through the issuance of common stock. The stock had a par value of $135,000 and a fair value of $4$0,000. The fair value of the equipment was not easily determinable. The company recorded this transaction as follows. Equipment 135,000 Common Stock 135,000 f. An order for $61,$00 has been received from a customer for products on hand. This order was shipped on January 9, 2021. The company made the following entry in 2020. Accounts Receivable 61,500 Sales Revenue 61,500 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started