Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help posting journal entries to a T account for allowance for bad debt. i am comfortable with the journal entries, but i am

i need help posting journal entries to a T account for allowance for bad debt. i am comfortable with the journal entries, but i am so lost on posting it to the t account and making that work.

I am just lost on adding the journal entries to the T account for the last step

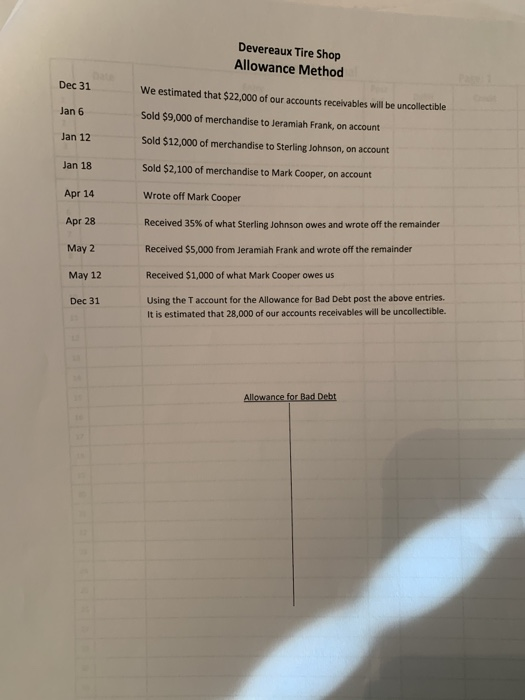

Devereaux Tire Shop Allowance Method Dec 31 We estimated that $22,000 of our accounts receivables will be uncollectible Jan 6 Sold $9,000 of merchandise to Jeramiah Frank, on account Jan 12 Sold $12,000 of merchandise to Sterling Johnson, on account Jan 18 Sold $2,100 of merchandise to Mark Cooper, on account Apr 14 Wrote off Mark Cooper Apr 28 Received 35% of what Sterling Johnson owes and wrote off the remainder May 2 Received $5,000 from Jeramiah Frank and wrote off the remainder May 12 Received $1,000 of what Mark Cooper owes us Dec 31 Using the T account for the Allowance for Bad Debt post the above entries. It is estimated that 28,000 of our accounts receivables will be uncollectible. Allowance for Bad Debt Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started