i need help preparing a bank reconcilliation using the information provided.

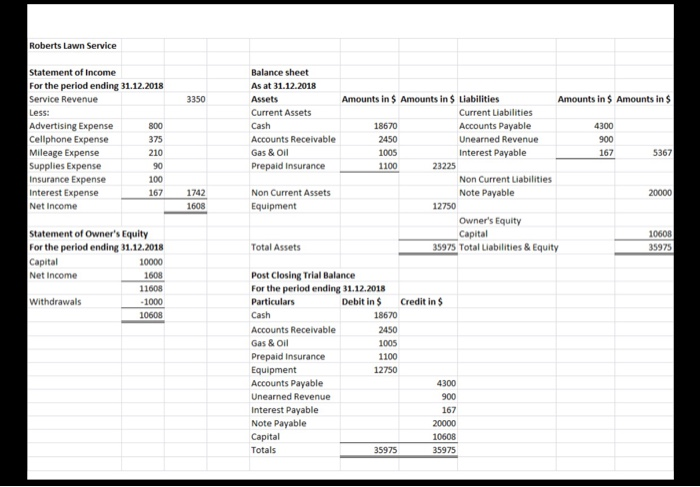

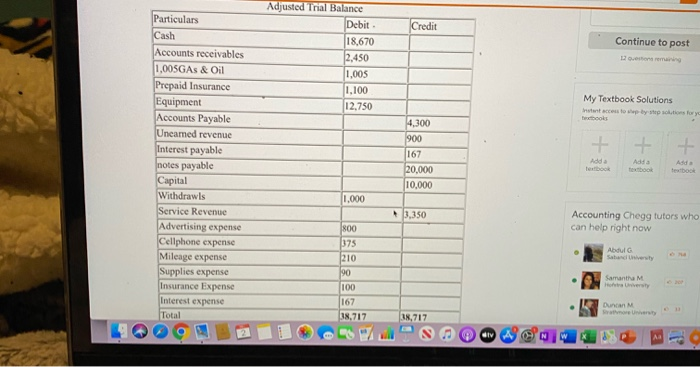

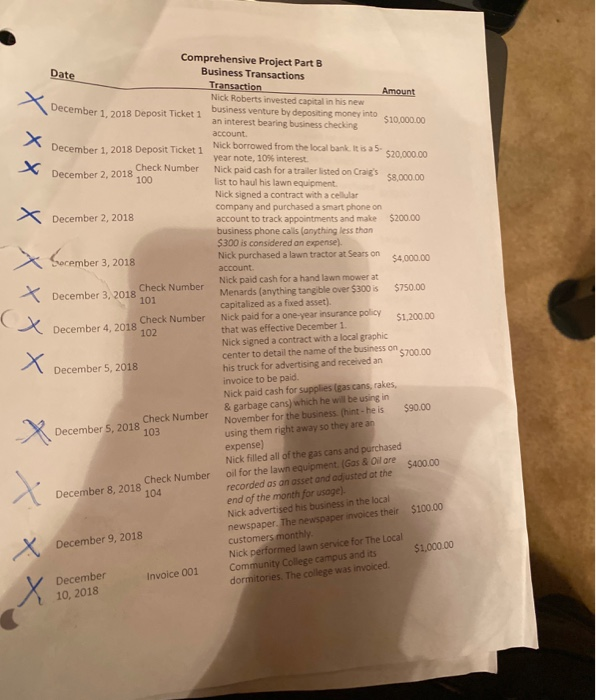

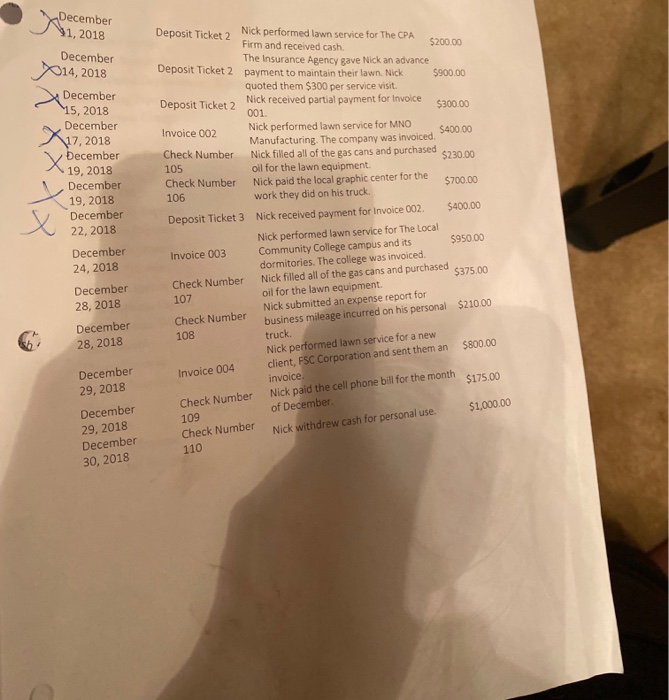

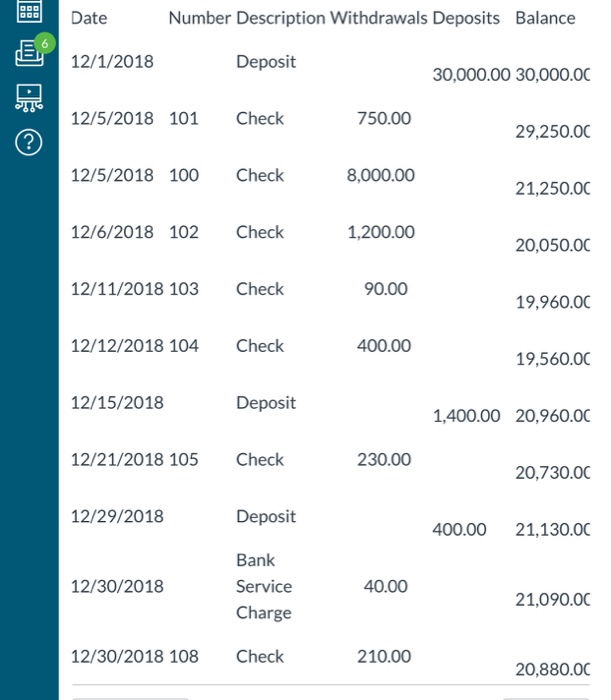

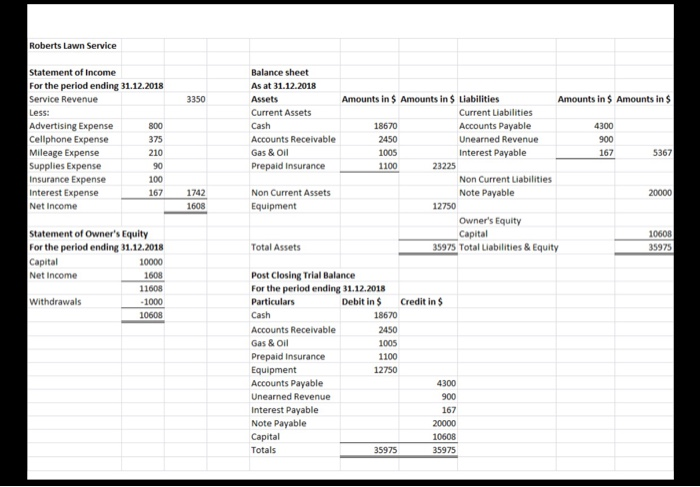

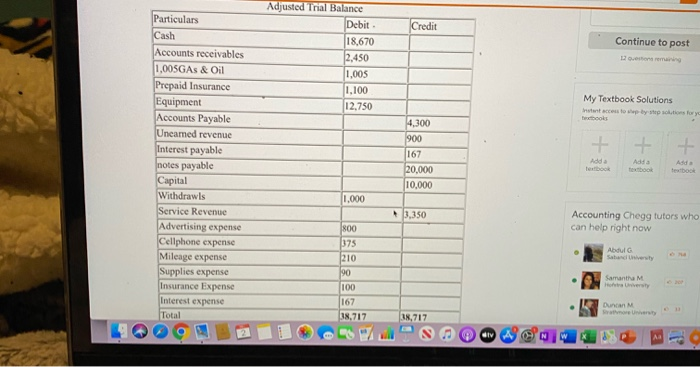

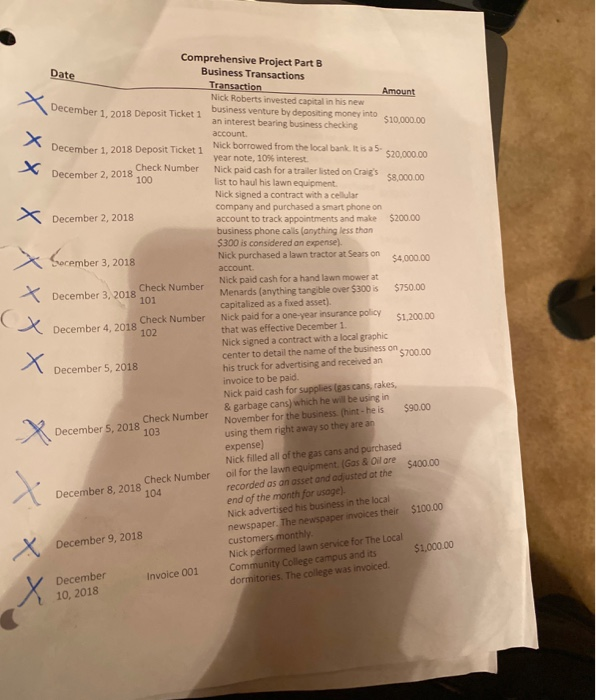

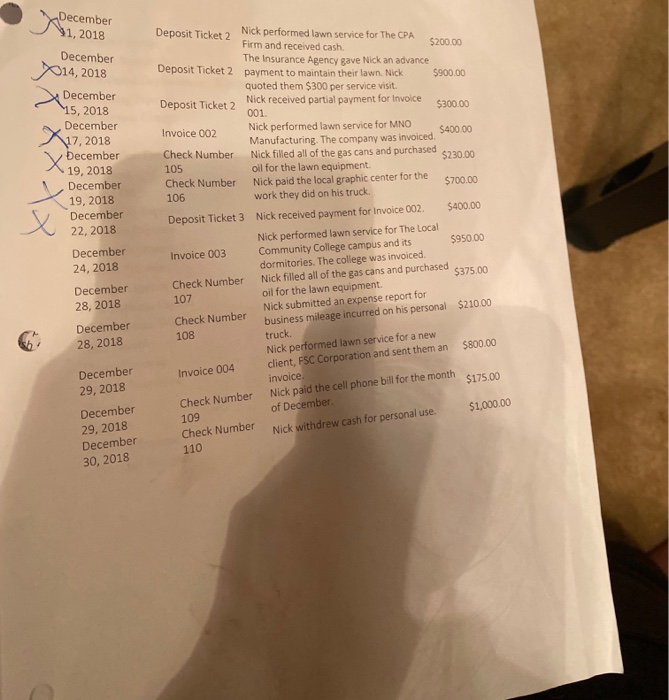

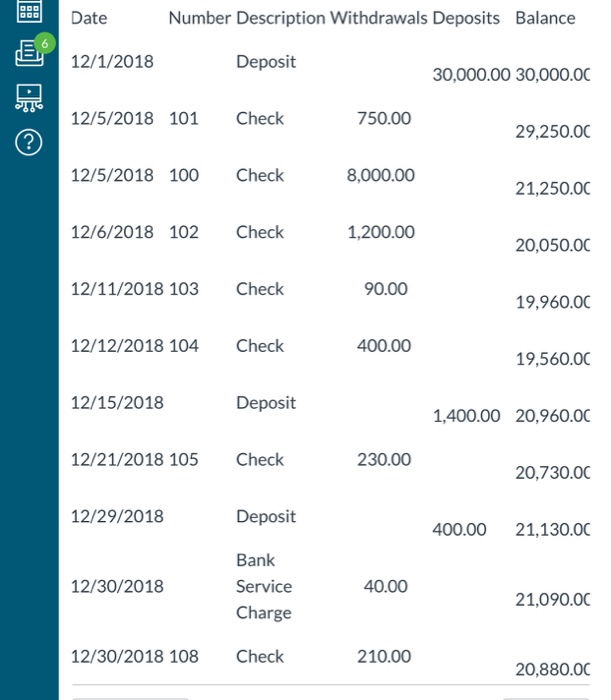

Anonymaus anwered this 143 aners Was this answer heipfu Based on the adiusted Trial Balance, please find attached Income statement Baiance Sheet an Stockholder's equity schedde Rate answer here tdnhe ue M ed Am Ne n Sev vene mee anL tgt Avertg m nens t ve her p Sem penw do g Non eg Te on rg m st La Nay we fen tean'se eree 64 Commert dtv Roberts Lawn Service Statement of Income For the period ending 31.12.2018 Service Revenue Less: Advertising Expense Cellphone Expense Mileage Expense Supplies Expense Insurance Expense Interest Expense Net Income Balance sheet As at 31.12.2018 Amounts in $ Amounts in $ Liabilities Amounts in $ Amounts in 3350 Assets Current Assets Current Liabilities Cash Accounts Payable 800 18670 4300 Accounts Receivable 375 2450 Unearned Revenue 900 210 Gas & Oil 1005 Interest Payable 167 5367 90 Prepaid Insurance 1100 23225 Non Current Liabilities 100 20000 Note Payable 167 1742 Non Current Assets 12750 1608 Equipment Owner's Equity Statement of Owner's Equity For the period ending 31.12.2018 Capital Net Income Capital 35975 Total Liabilities & Equity 10608 35975 Total Assets 10000 Post Closing Trial Balance For the period ending 31.12.2018 Debit in $ 1608 11608 Withdrawals Credit in S Particulars 1000 Cash 10608 18670 Accounts Receivable 2450 1005 Gas & Oil Prepaid Insurance 1100 Equipment 12750 Accounts Payable 4300 Unearned Revenue 900 Interest Payable 167 Note Payable Capital 20000 10608 Totals 35975 35975 Adjusted Trial Balance Debit Particulars Credit Cash 18,670 2,450 Continue to post Accounts receivables 12 ouestons remaining 1,005GAS & Oil 1,005 1,100 12,750 Prepaid Insurance Equipment Accounts Payable Unearmed revenue Interest payable My Textbook Solutions stnt access to sep-by step scktions for yca eooks 4,300 900 + + 167 20,000 10,000 Add a Add a textbookd notes payable Capital Withdrawls Service Revenue Advertising expense Cellphone expense Mileage expense Supplies expense Insurance Expense Add a textbook textbook 1,000 3,350 Accounting Chegg tutors who can help right now 800 375 Abdul G Sabanci Universty 210 90 Samantha M Ho University 100 Interest expense 167 18,717 Duncan M Satmore Universty Total 38,717 Aa Comprehensive Project PartB Date Business Transactions Transaction Nick Roberts invested capital in his new business venture by depositing money into an interest bearing business checking X Amount December 1 2018 Deposit Ticket 1 $10,000.00 account Nick borrowed from the local bank. It is a 5- December 1, 2018 Deposit Ticket 1 year note, 10% interest Nick paid cash for a trailer listed on Craig's list to haul his lawn equipment. Nick signed a contract with a cellular company and purchased a smart phone on account to track appointments and make business phone calls (anything less than $300 is considered an expense). Nick purchased a lawn tractor at Sears on account Nick paid cash for a hand lawn mower at Menards (anything tangible over $300 is capitalized as a fixed asset). Nick paid for a one-year insurance policy that was effective December 1 Nick signed a contract with a local graphic center to detail the name of the business on his truck for advertising and received an invoice to be paid Nick paid cash for supplies (gas cans, rakes, & garbage cans) which he will be using in November for the business. (hint-he is using them right away so they are an expense Nick filled all of the gas cans and purchased oil for the lawn equipment. (Gas & Oil are recorded as an asset and adjusted ot the end of the month for usage) Nick advertised his business in the local newspaper. The newspaper invoices their customers monthly Nick performed lawn service for The Local Community College campus and its dormitories. The college was invoiced $20,000.00 Check Number December 2, 2018 100 $8,000.00 December 2, 2018 $200.00 bocember 3, 2018 $4,000.00 Check Number December 3, 2018 101 $750.00 (X Check Number $1,200.00 December 4, 2018 102 $700.00 December 5, 2018 $90.00 X Check Number December 5, 2018 103 $400.00 Check Number December 8, 2018 104 $100.00 December 9, 2018 $1,000.00 December 10, 2018 Invoice 001 X December 1, 2018 Deposit Ticket 2 Nick performed lawn service for The CPA Firm and received cash. December $200.00 014, 2018 The Insurance Agency gave Nick an advance Deposit Ticket 2 payment to maintain their lawn. Nick quoted them $300 per service visit. Nick received partial payment for Invoice 001 $900.00 December Deposit Ticket 2 15, 2018 $300.00 December 17, 2018 Nick performed lawn service for MNO Manufacturing. The company was invoiced Nick filled all of the gas cans and purchased oil for the lawn equipment. Nick paid the local graphic center for the work they did on his truck. Invoice 002 $400.00 December 19, 2018 December 19, 2018 December 22, 2018 Check Number 105 $230.00 Check Number $700.00 106 Nick received payment for Invoice 002. $400.00 Deposit Ticket 3 Nick performed lawn service for The Local Community Colllege campus and its dormitories. The college was invoiced. Nick filled all of the gas cans and purchased oil for the lawn equipment. Nick submitted an expense report for business mileage incurred on his personal $210.00 truck Nick performed lawn service for a new client, FSC Corporation and sent them an invoice Nick paid the cell phone bill for the month of December December 24, 2018 $950.00 Invoice 003 Check Number 107 $375.00 December 28, 2018 Check Number December 108 28, 2018 $800.00 December Invoice 004 29, 2018 $175.00 Check Number 109 Check Number 110 December $1,000.00 29, 2018 December Nick withdrew cash for personal use. 30, 2018 Date Number Description Withdrawals Deposits Balance DOO 12/1/2018 Deposit 30,000.00 30,000.00 Check 12/5/2018 101 750.00 29,250.00 ? 12/5/2018 100 Check 8,000.00 21,250.00 12/6/2018 102 Check 1,200.00 20,050.00 12/11/2018 103 Check 90.00 19,960.00 400.00 12/12/2018 104 Check 19,560.00 12/15/2018 Deposit 1,400.00 20,960.00 12/21/2018 105 230.00 Check 20,730.00 12/29/2018 Deposit 21,130.00 400.00 Bank Service 40.00 12/30/2018 21,090.00 Charge 12/30/2018 108 Check 210.00 20,880.00