I need help solving all the tabs in this excel

i need help solvong all the tabs on this excel

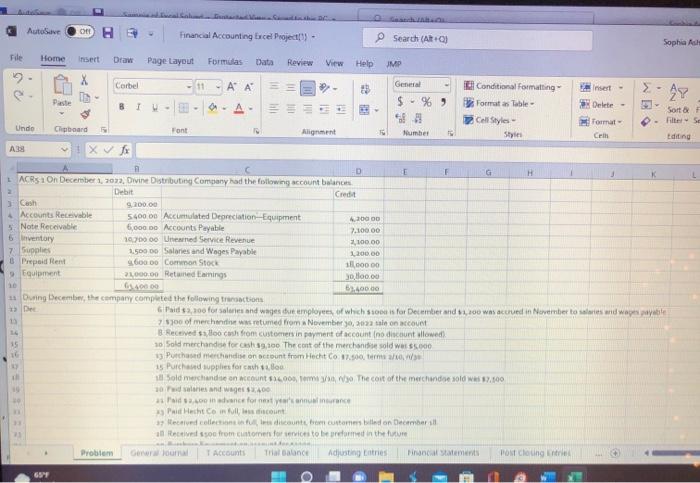

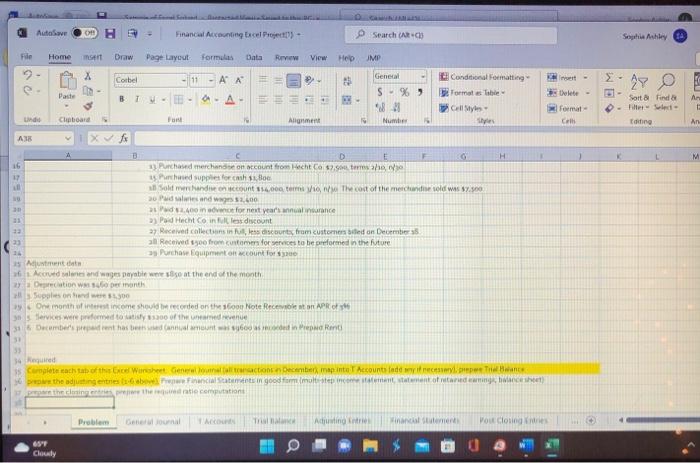

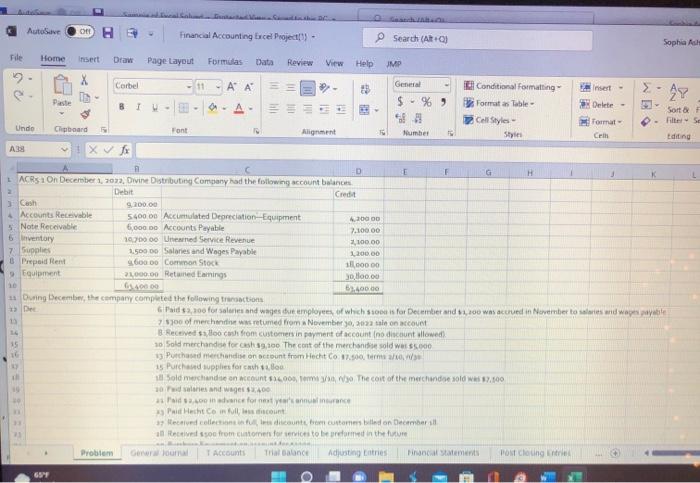

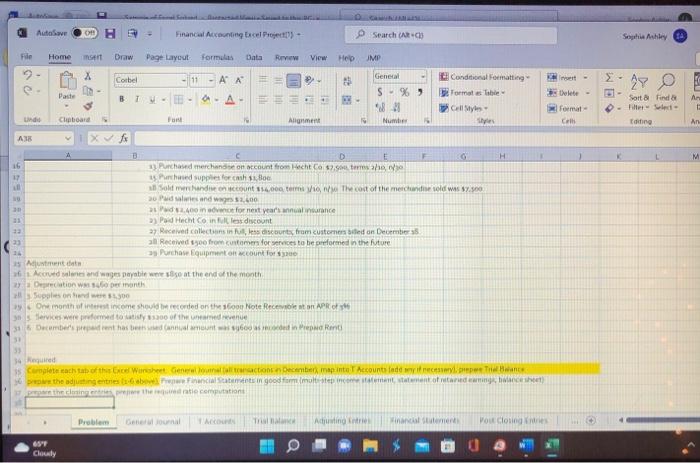

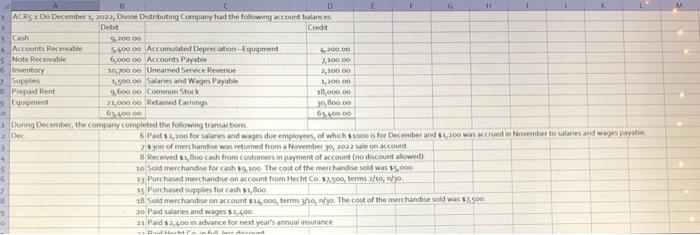

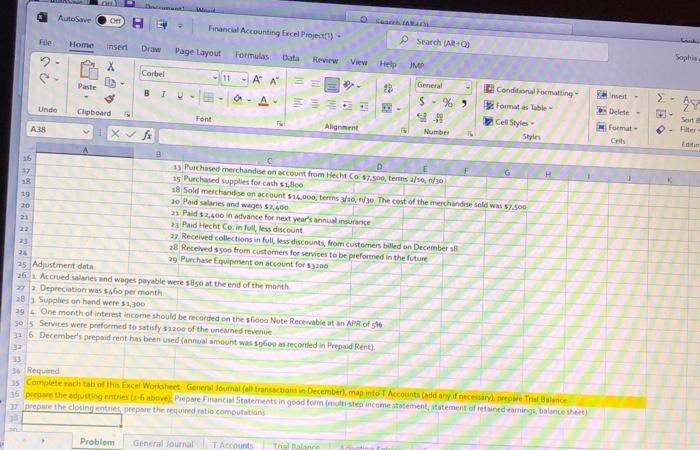

File AutoSave Off Financial Accounting Excel Project) Sophia Asht Home Insert Draw Page Layout Formulas Data Review X Corbel 11 A A ME Conditional Formatting Insert Paste Format as Table- Delete- BIU- 1 -> Cell Styles- Format Sort & F Filter Se Editing Clipboard Font Alignment Styles Cein A38 fx D LACRS 1 On December 1, 2022, Divine Distributing Company had the following account balances Debit Credit 3 Cash 9,200.00 5400 00 Accumulated Depreciation Equipment 4,20000 Accounts Receivable 5. Note Receivable 6,000.00 Accounts Payable 7,100.00 6 Inventory 10700 00 Unearned Service Revenue 2,100.00 7 Supplies 1,500 00 Salaries and Wages Payable 1,200.00 8 Prepaid Rent 9,600.00 Common Stock 18,000.00 9 Equipment 21,000.00 Retained Earnings 30,800.00 61.400.00 10 61.400.00 11 During December, the company completed the following transactions 22 Dec 6 Paid $3,300 for salaries and wages due employees, of which ssoon is for December and $1,200 was accrued in November to salaries and wages payable 13 7 $300 of merchandise was retumed from a November 30, 2022 sale on account 14 8 Received $1,lloo cash from customers in payment of account (no discount allowed) 15 so Sold merchandise for cash $9,300 The cont of the merchandise sold was $5,000 16 13 Purchased merchandise on account from Hecht Co. 17.500, terms a/10, 1/3 15 Purchased supplies for cash loa 18 Sold merchandise on account $16,000, temms 3/30, 30 The cost of the merchandise sold was $7.500 20 Paid salaries and wages $400 as Paid $2,400 in advance for next year's annual insurance 3 Paid Hecht Co in full, les discount 37 Received collections in full, les discounts, from customers billed on December sl all Received ssoc from customers for services to be preformed in the future Barbara Ka und das AAAAA, Trial Balance General Journal T Accounts Adjusting Entries Financial Statements Unde ==== 659 Problem 4 0 114 11 Search Jen Search (Alt+Q) General $ - % 9 56 Number View Help JMP Post Closing Entries WES A38 16 ARBARA File 17 19 Fanai Serband time to the DG AutoSave OHE Financial Accounting Excel Project) Home sert Draw Page Layout Formulas Data Review X Corbel 11 e. D A A 3 A- Paste 1 15-> EI Und Clipboard Fort Alignment N Number F B G H 13 Purchased merchandise on account from Hecht Co $7,500 terms 2/10, 00 15 Purchased supplies for cash $1,Bloe Sold merchandise on account $14,000 terms /so, n/e The cost of the merchandise sold was $7.500 20 Paid salaries and wags $2,400 21 Paid $2,400 in advance for next year's annual insurance 23 Paid Hecht Co in full less discount 27 Received collections in full, less discounts, from customers billed on December 5 all Received 1500 from customers for services to be preformed in the future as Purchase Equipment on account for $3200 30 32 x fx View Help 25 GAMINIMANIGRA Search (ARC) General S % 9 582 JMP Conditional Formatting Format es Table- Cell Styles styles Kert- Delete- format- Cell 26 as Adjustment deta 26 Accrued salanes and wages payable were saso at the end of the month Depreciation was sufo per month 27 alls Supplies on hand were $1,300 ay One month of interest income should be recorded on the 16oon Note Recevable at an APR of Services were preformed to satisfy s3200 of the uneamed revenue 316 December's prepaid rent has been used Cannual amount was sg600 as recorded in Prepaid Renti 34 Required 15 Complete each tab of this Excel Wansheet General Journal fall transactions in December, map into T Accounts laddsy if necessery), prepee Tral Bance prepare the adjusting entries (x-6 above Prepare Financial Statements in good form (multi-step income statement, statement of retaried earnings, balance sheet) 37 prepare the closing entries, prepare the required ratio computations Problem General Journal Accounts Trial Balance Acusting Intries Financial Statements Post Closing Entries 65'9 Cloudy Sophia Ashley 27 O An Sort & Find & Filter-Select- F Editing An M D ACRS1 On December 1, 2022, Divine Distributing Company had the following account balances 2 Debit Credit 3 Cash 9,200.00 4 Accounts Receivable 5 Note Receivable 5.400 00 Accumulated Depreciation Equipment 6,000.00 Accounts Payable 6 Inventory 30,700 00 Unearned Service Reventue 7 Supplies 1,500.00 Salaries and Wages Payable 3,600.00 Common Stock Prepaid Rent Equipment 21,000.00 Retained Earnings 0 61,400.00 During December, the company completed the following transactions Dec 1 4 5 6 7 8 9 O E F G H 4,200,00 7,100.00 7,100.00 1,200.00 15,000.00 30,000 00 61,400.00 6 Paid $3,200 for salaries and wages due employees, of which $1000 is for December and $1,200 was accrued in November to salaries and wages payable 7joo of merchandise win returned from a November 30, 2022 sale on account 8 Received $1,800 cash from customers in payment of account (no discount allowed) 10 Sold merchandise for cash $9,100 The cost of the merchandise sold was $5,000 13 Purchased merchandise on account from Hecht Co. $7,500, terms 2/10, 1/30 15 Purchased supplies for cash $1,Boo 18 Sold merchandise on account $14,000, terms 3/ho, n/30. The cost of the merchandise sold was $7,500 20 Paid salaries and wages $2,400 31 Paid $3,400 in advance for next year's annual insurance Duit Hight in fill lave det AS O Search A Formulas Data Review View Help 11 -AA = General 5-%9 Font 94 Number Alignment F B F G H 13 Purchased merchandise on account from Hecht Co $7.500, tenms 2/10, n/jo 17 15 Purchased supplies for cash $1,Boo 18 18 Sold merchandise on account $14,000, terms 3/10, 1/30 The cost of the merchandise sold was $7,500 19 20 Paid salaries and wages $3,400 20 21 Paid $2,400 in advance for next year's annual insurance 21 23 Paid Hecht Co. in full, less discount 22 27 Received collections in full, less discounts, from customers billed on December 18 23 28 Received s500 from customers for services to be preformed in the future 24 29 Purchase Equipment on account for s3200 25 Adjustment data 26 1 Accrued salaries and wages payable were s8so at the end of the month 27 2 Depreciation was $460 per month 28 1 Supplies on hand were $1,300 294 One month of interest income should be recorded on the $6000 Note Recevable at an APR of 5% 30 5 Services were preformed to satisfy $1200 of the unearned revenue 316 December's prepaid rent has been used (annual amount was s9600 as recorded in Prepaid Rent) 32 33 34 Required 35 Complete each tab of this Excel Worksheet General Journal (all transactions in December), map into T Accounts (add any if necessary), prepare Trial Balance 36 prepare the adjusting entries (s-6 above) Prepare Financial Statements in good form (multi-step income statement, statement of retained earnings, balance sheet) 37 prepare the closing entries, prepare the required ratio computations Problem General Journal T Accounts Trial Balance dation Ext File 16 A38 AutoSave Undo 000 Home C insert X Paste Clipboard Draw Corbel B Ta x fx Wid IU Financial Accounting Excel Project) Page Layout a E Search (Alt+Q JMP Conditional Formatting- Format as Table- Cell Styles Styles mest Delete- Format - Cell WES Sophiaa - 23 Sort & Filter- Edifin File AutoSave Off Financial Accounting Excel Project) Sophia Asht Home Insert Draw Page Layout Formulas Data Review X Corbel 11 A A ME Conditional Formatting Insert Paste Format as Table- Delete- BIU- 1 -> Cell Styles- Format Sort & F Filter Se Editing Clipboard Font Alignment Styles Cein A38 fx D LACRS 1 On December 1, 2022, Divine Distributing Company had the following account balances Debit Credit 3 Cash 9,200.00 5400 00 Accumulated Depreciation Equipment 4,20000 Accounts Receivable 5. Note Receivable 6,000.00 Accounts Payable 7,100.00 6 Inventory 10700 00 Unearned Service Revenue 2,100.00 7 Supplies 1,500 00 Salaries and Wages Payable 1,200.00 8 Prepaid Rent 9,600.00 Common Stock 18,000.00 9 Equipment 21,000.00 Retained Earnings 30,800.00 61.400.00 10 61.400.00 11 During December, the company completed the following transactions 22 Dec 6 Paid $3,300 for salaries and wages due employees, of which ssoon is for December and $1,200 was accrued in November to salaries and wages payable 13 7 $300 of merchandise was retumed from a November 30, 2022 sale on account 14 8 Received $1,lloo cash from customers in payment of account (no discount allowed) 15 so Sold merchandise for cash $9,300 The cont of the merchandise sold was $5,000 16 13 Purchased merchandise on account from Hecht Co. 17.500, terms a/10, 1/3 15 Purchased supplies for cash loa 18 Sold merchandise on account $16,000, temms 3/30, 30 The cost of the merchandise sold was $7.500 20 Paid salaries and wages $400 as Paid $2,400 in advance for next year's annual insurance 3 Paid Hecht Co in full, les discount 37 Received collections in full, les discounts, from customers billed on December sl all Received ssoc from customers for services to be preformed in the future Barbara Ka und das AAAAA, Trial Balance General Journal T Accounts Adjusting Entries Financial Statements Unde ==== 659 Problem 4 0 114 11 Search Jen Search (Alt+Q) General $ - % 9 56 Number View Help JMP Post Closing Entries WES A38 16 ARBARA File 17 19 Fanai Serband time to the DG AutoSave OHE Financial Accounting Excel Project) Home sert Draw Page Layout Formulas Data Review X Corbel 11 e. D A A 3 A- Paste 1 15-> EI Und Clipboard Fort Alignment N Number F B G H 13 Purchased merchandise on account from Hecht Co $7,500 terms 2/10, 00 15 Purchased supplies for cash $1,Bloe Sold merchandise on account $14,000 terms /so, n/e The cost of the merchandise sold was $7.500 20 Paid salaries and wags $2,400 21 Paid $2,400 in advance for next year's annual insurance 23 Paid Hecht Co in full less discount 27 Received collections in full, less discounts, from customers billed on December 5 all Received 1500 from customers for services to be preformed in the future as Purchase Equipment on account for $3200 30 32 x fx View Help 25 GAMINIMANIGRA Search (ARC) General S % 9 582 JMP Conditional Formatting Format es Table- Cell Styles styles Kert- Delete- format- Cell 26 as Adjustment deta 26 Accrued salanes and wages payable were saso at the end of the month Depreciation was sufo per month 27 alls Supplies on hand were $1,300 ay One month of interest income should be recorded on the 16oon Note Recevable at an APR of Services were preformed to satisfy s3200 of the uneamed revenue 316 December's prepaid rent has been used Cannual amount was sg600 as recorded in Prepaid Renti 34 Required 15 Complete each tab of this Excel Wansheet General Journal fall transactions in December, map into T Accounts laddsy if necessery), prepee Tral Bance prepare the adjusting entries (x-6 above Prepare Financial Statements in good form (multi-step income statement, statement of retaried earnings, balance sheet) 37 prepare the closing entries, prepare the required ratio computations Problem General Journal Accounts Trial Balance Acusting Intries Financial Statements Post Closing Entries 65'9 Cloudy Sophia Ashley 27 O An Sort & Find & Filter-Select- F Editing An M D ACRS1 On December 1, 2022, Divine Distributing Company had the following account balances 2 Debit Credit 3 Cash 9,200.00 4 Accounts Receivable 5 Note Receivable 5.400 00 Accumulated Depreciation Equipment 6,000.00 Accounts Payable 6 Inventory 30,700 00 Unearned Service Reventue 7 Supplies 1,500.00 Salaries and Wages Payable 3,600.00 Common Stock Prepaid Rent Equipment 21,000.00 Retained Earnings 0 61,400.00 During December, the company completed the following transactions Dec 1 4 5 6 7 8 9 O E F G H 4,200,00 7,100.00 7,100.00 1,200.00 15,000.00 30,000 00 61,400.00 6 Paid $3,200 for salaries and wages due employees, of which $1000 is for December and $1,200 was accrued in November to salaries and wages payable 7joo of merchandise win returned from a November 30, 2022 sale on account 8 Received $1,800 cash from customers in payment of account (no discount allowed) 10 Sold merchandise for cash $9,100 The cost of the merchandise sold was $5,000 13 Purchased merchandise on account from Hecht Co. $7,500, terms 2/10, 1/30 15 Purchased supplies for cash $1,Boo 18 Sold merchandise on account $14,000, terms 3/ho, n/30. The cost of the merchandise sold was $7,500 20 Paid salaries and wages $2,400 31 Paid $3,400 in advance for next year's annual insurance Duit Hight in fill lave det AS O Search A Formulas Data Review View Help 11 -AA = General 5-%9 Font 94 Number Alignment F B F G H 13 Purchased merchandise on account from Hecht Co $7.500, tenms 2/10, n/jo 17 15 Purchased supplies for cash $1,Boo 18 18 Sold merchandise on account $14,000, terms 3/10, 1/30 The cost of the merchandise sold was $7,500 19 20 Paid salaries and wages $3,400 20 21 Paid $2,400 in advance for next year's annual insurance 21 23 Paid Hecht Co. in full, less discount 22 27 Received collections in full, less discounts, from customers billed on December 18 23 28 Received s500 from customers for services to be preformed in the future 24 29 Purchase Equipment on account for s3200 25 Adjustment data 26 1 Accrued salaries and wages payable were s8so at the end of the month 27 2 Depreciation was $460 per month 28 1 Supplies on hand were $1,300 294 One month of interest income should be recorded on the $6000 Note Recevable at an APR of 5% 30 5 Services were preformed to satisfy $1200 of the unearned revenue 316 December's prepaid rent has been used (annual amount was s9600 as recorded in Prepaid Rent) 32 33 34 Required 35 Complete each tab of this Excel Worksheet General Journal (all transactions in December), map into T Accounts (add any if necessary), prepare Trial Balance 36 prepare the adjusting entries (s-6 above) Prepare Financial Statements in good form (multi-step income statement, statement of retained earnings, balance sheet) 37 prepare the closing entries, prepare the required ratio computations Problem General Journal T Accounts Trial Balance dation Ext File 16 A38 AutoSave Undo 000 Home C insert X Paste Clipboard Draw Corbel B Ta x fx Wid IU Financial Accounting Excel Project) Page Layout a E Search (Alt+Q JMP Conditional Formatting- Format as Table- Cell Styles Styles mest Delete- Format - Cell WES Sophiaa - 23 Sort & Filter- Edifin