i need help solving exercise 15-4. please go in detail on how you did it

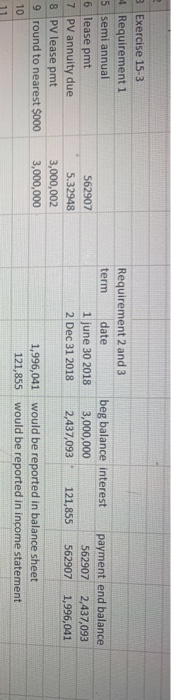

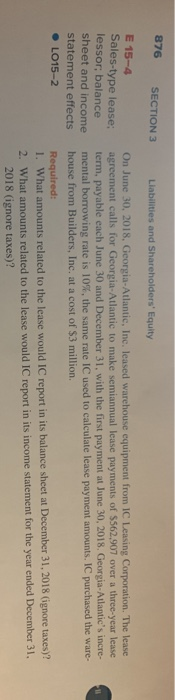

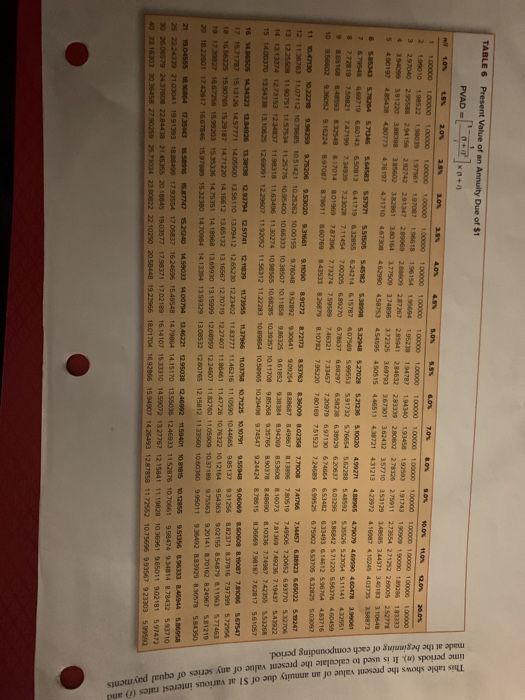

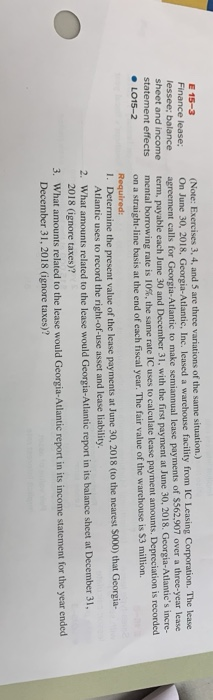

E 15-3 Finance lease: lessee; balance sheet and income statement effects LO15-2 (Note: Exercises 3, 4, and 5 are three variations of the same situation.) On June 30, 2018, Georgia-Atlantic, Inc. leased a warehouse facility from IC Leasing Corporation. The lease agreement calls for Georgia Atlantic to make semiannual lease payments of $562,907 over a three-year lease term, payable each June 30 and December 31, with the first payment at June 30, 2018. Georgia-Atlantic's incre- mental borrowing rate is 10%, the same rate IC uses to calculate lease payment amounts. Depreciation is recorded on a straight-line basis at the end of each fiscal year. The fair value of the warehouse is $3 million. Required: 1. Determine the present value of the lease payments at June 30, 2018 (to the nearest S000) that Georgia- Atlantic uses to record the right-of-use asset and lease liability. 2. What amounts related to the lease would Georgia-Atlantic report in its balance sheet at December 31, 2018 (ignore taxes)? 3. What amounts related to the lease would Georgia-Atlantic report in its income statement for the year ended December 31, 2018 (ignore taxes)? 3 Exercise 15-3 4 Requirement 1 5 semi annual 6 lease pmt 7 PV annuity due 8 PV lease pmt 9 round to nearest $000 10 Requirement 2 and 3 term date 1 june 30 2018 2 Dec 31 2018 beg balance interest 3,000,000 2,437,093 121,855 562907 5.32948 3,000,002 3,000,000 payment end balance 562907 2,437,093 562907 1,996,041 1,996,041 would be reported in balance sheet 121,855 would be reported in income statement 876 SECTION 3 Liabilities and Shareholders' Equity E 15-4 Sales-type lease: lessor; balance sheet and income statement effects LO15-2 On June 30, 2018, Georgia-Atlantic, Inc. leased warehouse equipment from IC Leasing Corporation. The lease agreement calls for Georgia-Atlantic to make semiannual lease payments of $562,907 over a three-year lease term, payable each June 30 and December 31, with the first payment at June 30, 2018. Georgia-Atlantic's incre- mental borrowing rate is 10%, the same rate IC used to calculate lease payment amounts. IC purchased the ware- house from Builders, Inc. at a cost of $3 million. Required: 1. What amounts related to the lease would IC report in its balance sheet at December 31, 2018 (ignore taxes)? 2. What amounts related to the lease would IC report in its income statement for the year ended December 31, 2018 (ignore taxes)? TABLE 6 Present Value of an Annuity Due of $1 PVAD = con 10 15 2.0 3.0 4.ON 4.5 5.05 6.0% 7.0 8.0 9.01 10.0 11.0 20.0% 1 100000 1.00000 100000 100000 100000 100000 100000 10000000000 1.00000 100000 100000 100000 197563 100618 1 95218 1.94787 1.94140 193458 +93503 191743 297040 3 2 04156 190909 190000 1 292742 2 89969 11133 2.88009 237267 2.85941 204632 283339 2.0802278326 2.75911 2.77554 271252 26000 25278 4 3164 177500 2.74896 17225 369193 3.67301 362412357710 35312948695 144371 310648 5 4.8077 476197 471710 467308 462990 454595450515 4.46511 43721 431213 42972 4.10T 410245 40395358873 6 57264 706 5.64583 S1505 5.4512 5.32949 5.27028 5.21236 5.10020 499221 465 4.70 4.60 4.60173 3.99051 7 679548 669719 650143 6.50R13 6.41719 632855 624214615787 607569 591732 5.7665456228543592 5.35526 527054 511141432551 8 7 47100 7.74930 723028 7.11454 7.00206689270 6.78817 6582 6.389296.20637 6.03295 586842 571220 5.56376460459 . &17014 01969 787396773274 750589 746321 733457 720979 6971306746646.53482.33493 614612 556164483716 10 902 9.36052916224 891087 70611 3.60759 8.10732 7.95220 780160 751523 724689 699525 6.75002 653705 632025 503097 11 0.47130 10722 259 7206 9.53020 93161 9.00 3272 8.72173 3.350098.023507.71000 741766 7.14457 6.23 6.650225.73247 12 11 367531107112 107868510 51421 10 25262 10.00155 376048952892 9.30641 909254 8886878.4906713896 780519 749506 7.20052 693770 532706 131225508 11 90751 157534 11257751095400 10.56333 10 38507 10.1156 9.86325061852 9.3838489420953608 16073 781369 749236 7.19437 14 13 13374 12.73153 1234807 1198318 11.63496 11.30274 1098565 10.68285 1039357 10.11700 9852589.35765 890378 8.48690 B.10236 774087 7.42355 553268 15 14 00370 1354338 13.10525 1269001 12 29607 11 92052 1156312 11.22283 089854 10 50965 10.29490974547 924424 8.78515 8.36669 7.90187 7.62817 5.61057 16 416505 14341233849267138138 2.90794 2.51741 1211839 17155 11.37966103781071225 0.10791 95594306000 8.60606 3.07 781006 5.67547 1715 71787 15 13126 14577711405500 13.56110 13.09412 12.65230 12 234021183777 1146216 11.10500 10.44665985137 9.31256 8.82371 3.37916 797399 5.7204 902155 8 549 1193 577463 18160225 15.30765 15 29187 14 71220 14 166121365132 13.16567 12.70719 12 27407 1186461 11.47726 10.322 10.12164 954363 9 20141 BT0162 8 24967 5.81219 19 1730027 1667256 15.90203 15 35336 1475351 14.18968 1365930 13.15999 1268959 1224607 1182760 11.05009 10.37189 975563 9.76492 8.83929 836578584350 2018. 22001 17.42617 16.67846159780915 32300 1410084 14.13394 13.59329 13.08532 12.60705 12.15812 11.33560 10.60360 995011 made at the beginning of each compounding period. time periods (). It is used to calculate the present value of any series of equal payments This table shows the present value of an annuity due of S1 at various interest rates (6) and 21 19.04555 064 1735543 16.5096 5.87747 5521240 1459033 .00734 1.46221 2.95038 12.46992159401 10.81815 10.12855 9.5356 3.96333 8.46944 5.3095 25 22 241 21.00041 19 913931889499 1793554 17.05837 16.24616 15.49548 1479864 14.15170 13.55036 1246933 1152876 10.70661 9.98474 9.34814 8.78432 593710 30 26.00570 24.37608 2284435 2145355 20.18945 19.03577 1798371 17.02189 16.14107 15.33310 14.50072 13.27767 12.15841 11 19828 1036961 9.65011 902181 597472 033.16303 30 36458 2790258 25.73034 2380822 22.10250 20.58448 19.22966 18.01704 1692866 15.94907 14 26493 12 87858 1172552 10.75696 993567 923303599992