I need help solving for 1 and 3

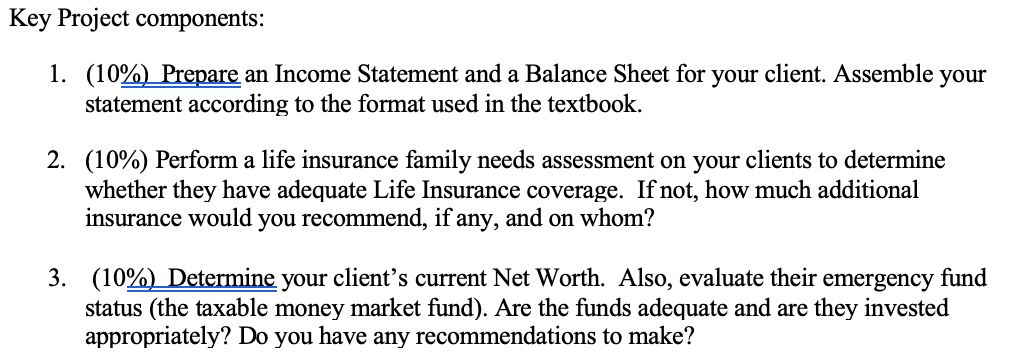

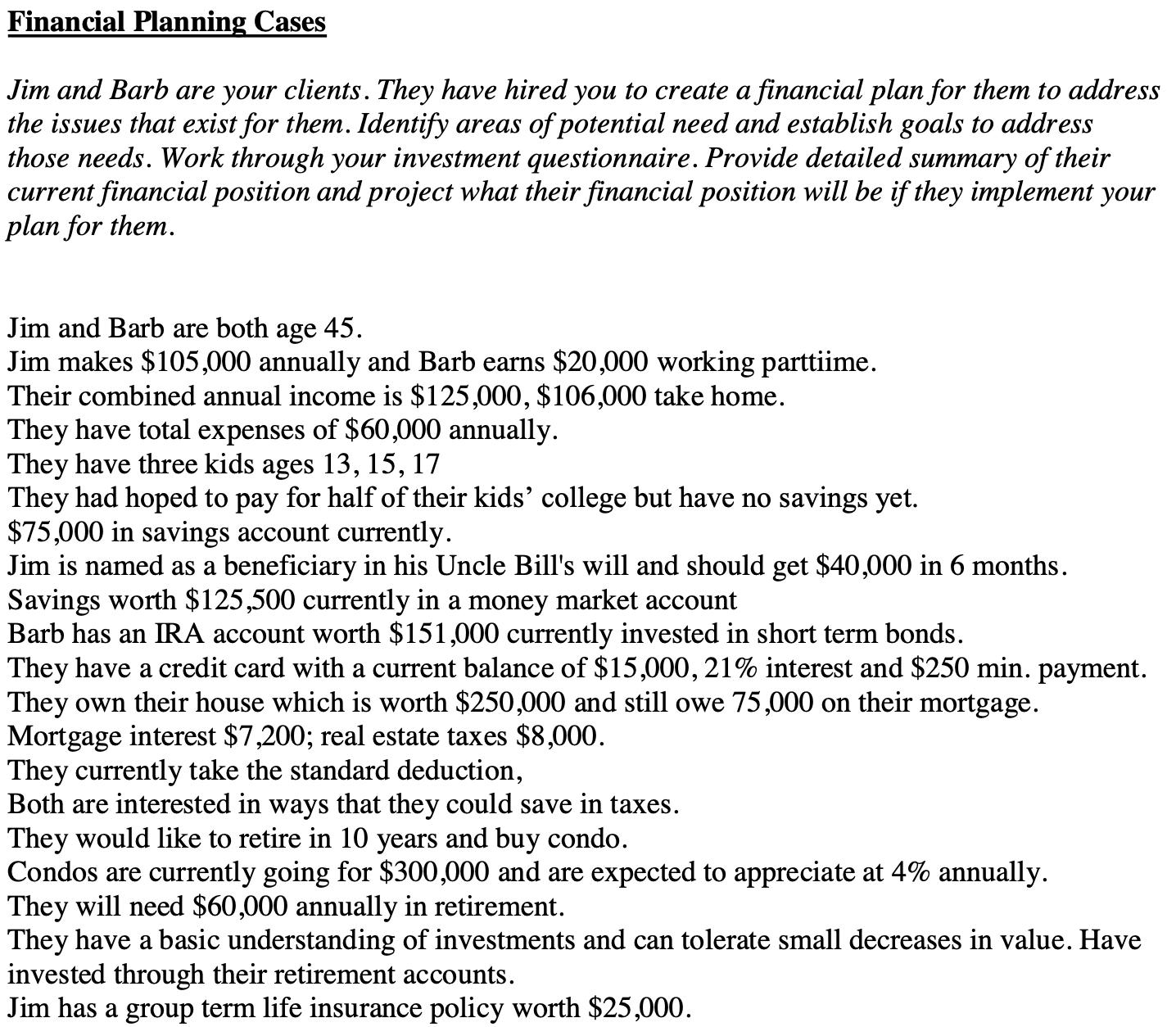

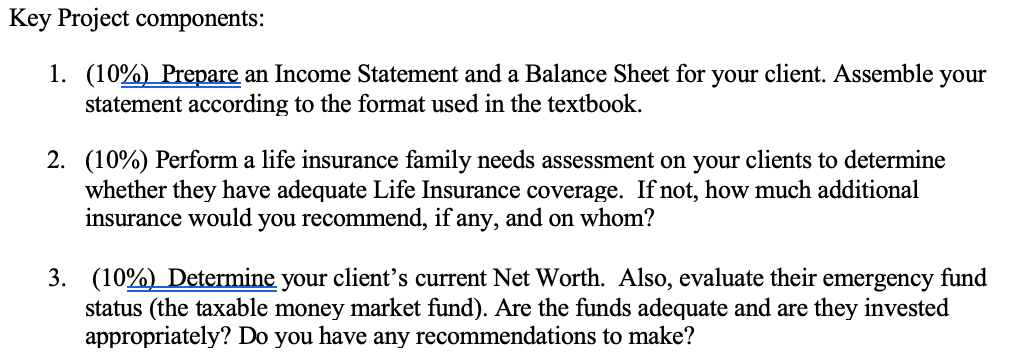

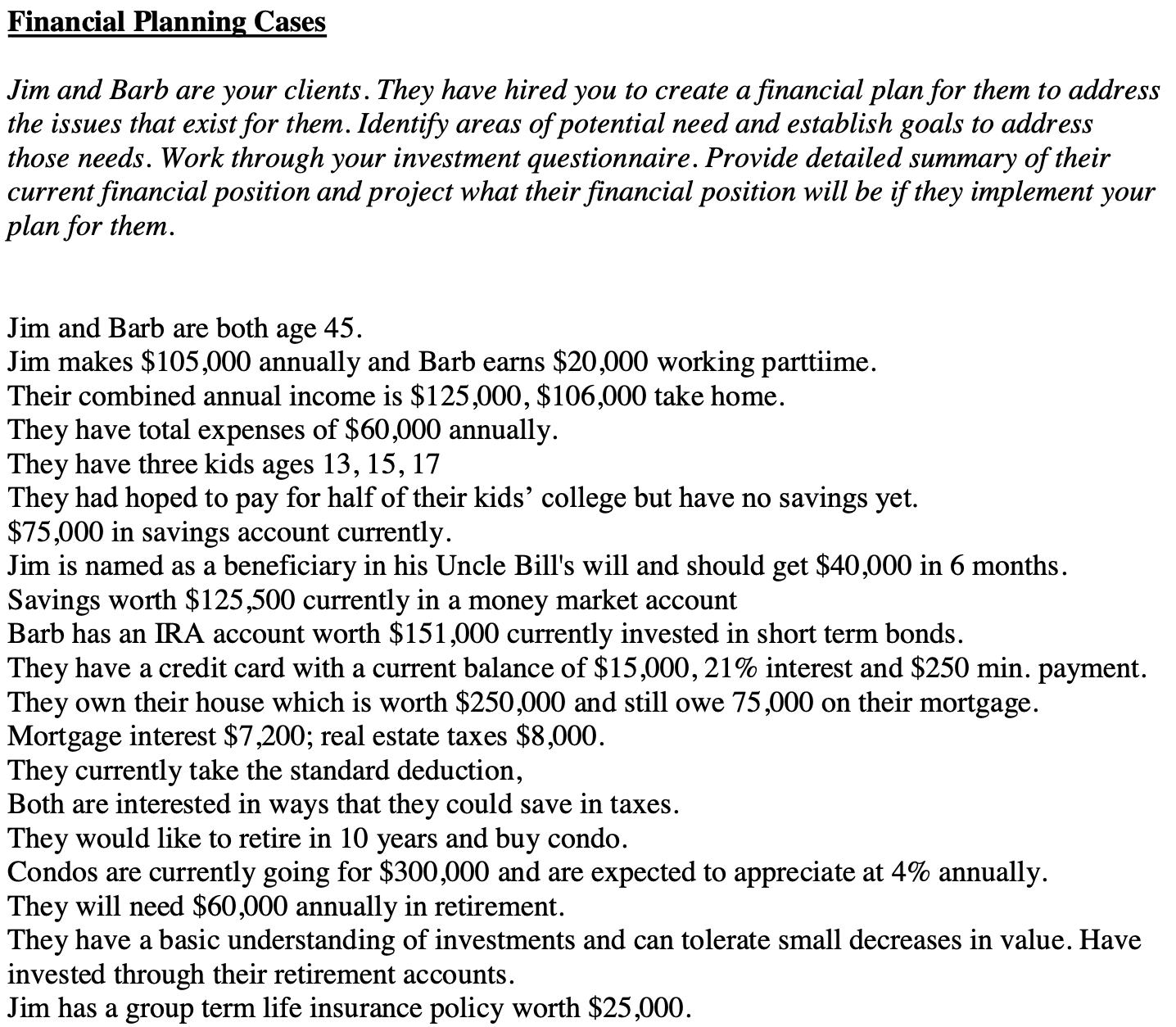

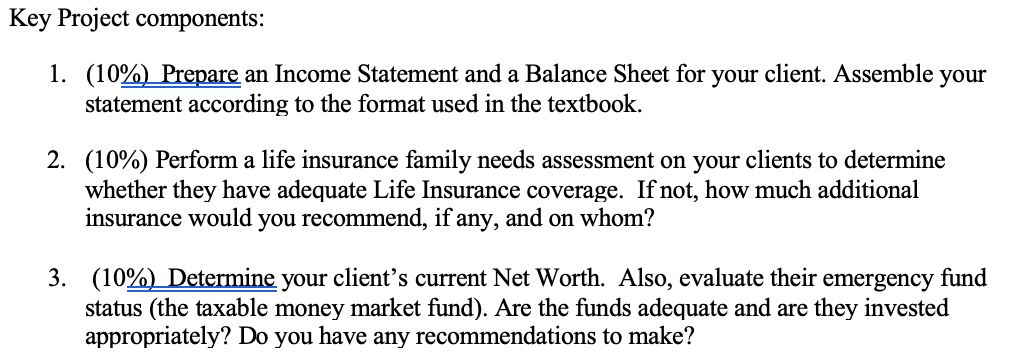

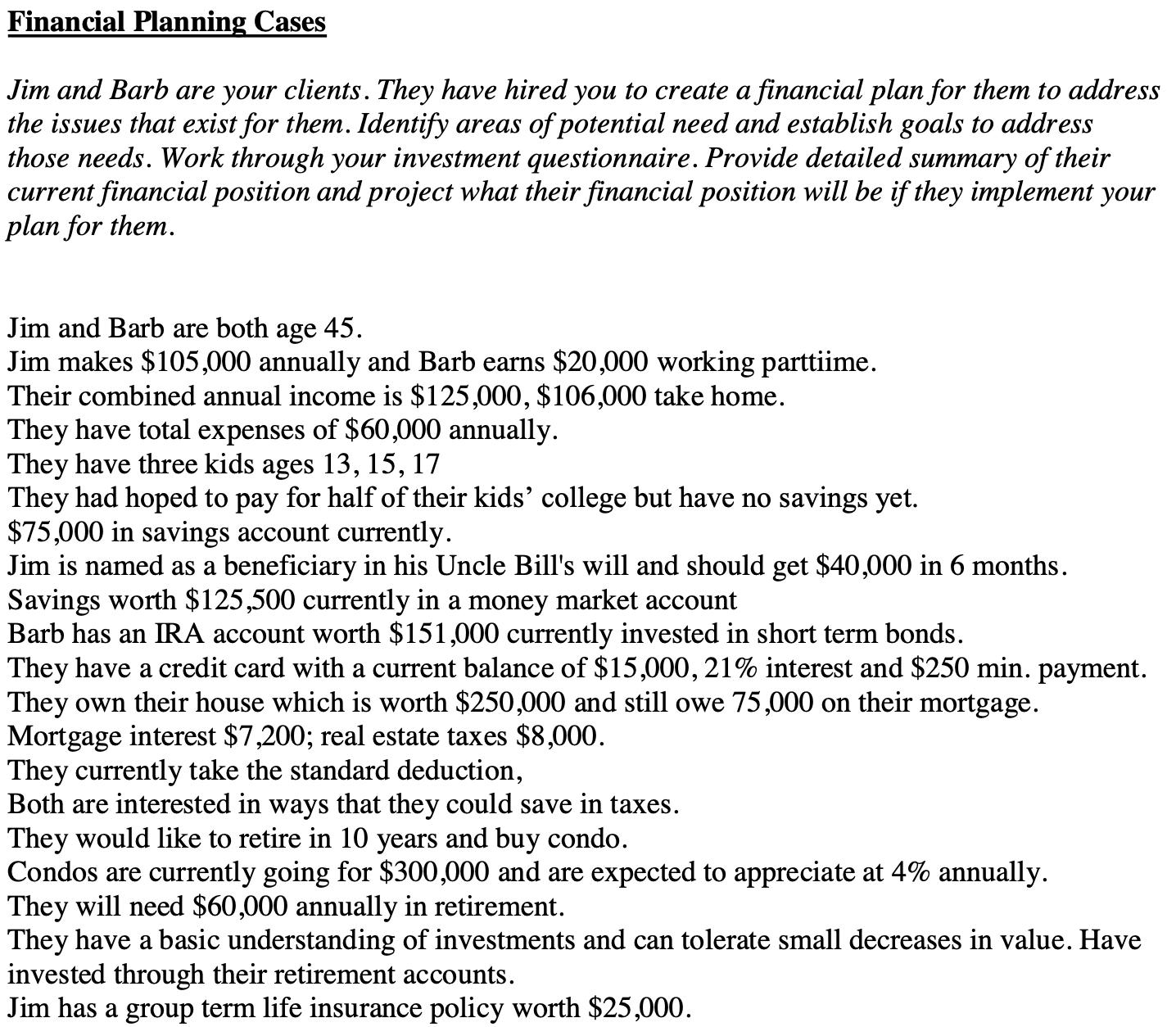

Key Project components: 1. (10m an Income Statement and a Balance Sheet for your client. Assemble your statement according to the format used in the textbook. 2. (10%) Perform a life insurance family needs assessment on your clients to determine whether they have adequate Life Insurance coverage. If not, how much additional insurance would you recommend, if any, and on whom? 3. (10M your client's current Net Worth. Also, evaluate their emergency ind status (the taxable money market ind). Are the inds adequate and are they invested appropriately? Do you have any recommendations to make? Financial Planning Cases Jim and Barb are your clients. They have hired you to create a nancial plan for them to address the issues that exist for them. Identify areas of potential need and establish goals to address those needs. Work through your investment questionnaire. Provide detailed summary of their current financial position and project what their nancial position will be if they implement your plan for them. Jim and Barb are both age 45. Jim makes $105,000 annually and Barb earns $20,000 working parttiime. Their combined annual income is $125,000, $106,000 take home. They have total expenses of $60,000 annually. They have three kids ages 13, 15, 17 They had hoped to pay for half of their kids' college but have no savings yet. $75,000 in savings account currently. Jim is named as a beneficiary in his Uncle Bill's will and should get $40,000 in 6 months. Savings worth $125,500 currently in a money market account Barb has an IRA account worth $151,000 currently invested in short term bonds. They have a credit card with a current balance of $15,000, 21% interest and $250 min. payment. They own their house which is worth $250,000 and still owe 75 ,000 on their mortgage. Mortgage interest $7,200; real estate taxes $8,000. They currently take the standard deduction, Both are interested in ways that they could save in taxes. They would like to retire in 10 years and buy condo. Condos are currently going for $300,000 and are expected to appreciate at 4% annually. They will need $60,000 annually in retirement. They have a basic understanding of investments and can tolerate small decreases in value. Have invested through their retirement accounts. Jim has a group term life insurance policy worth $25,000