I need help solving this case please.

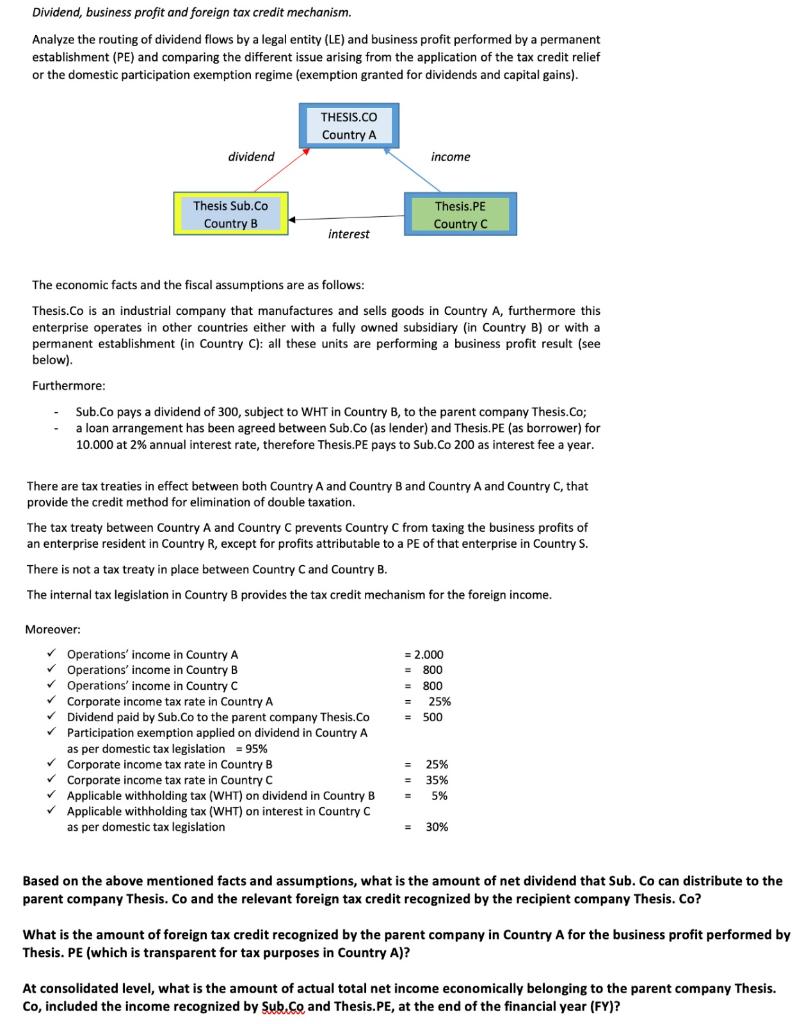

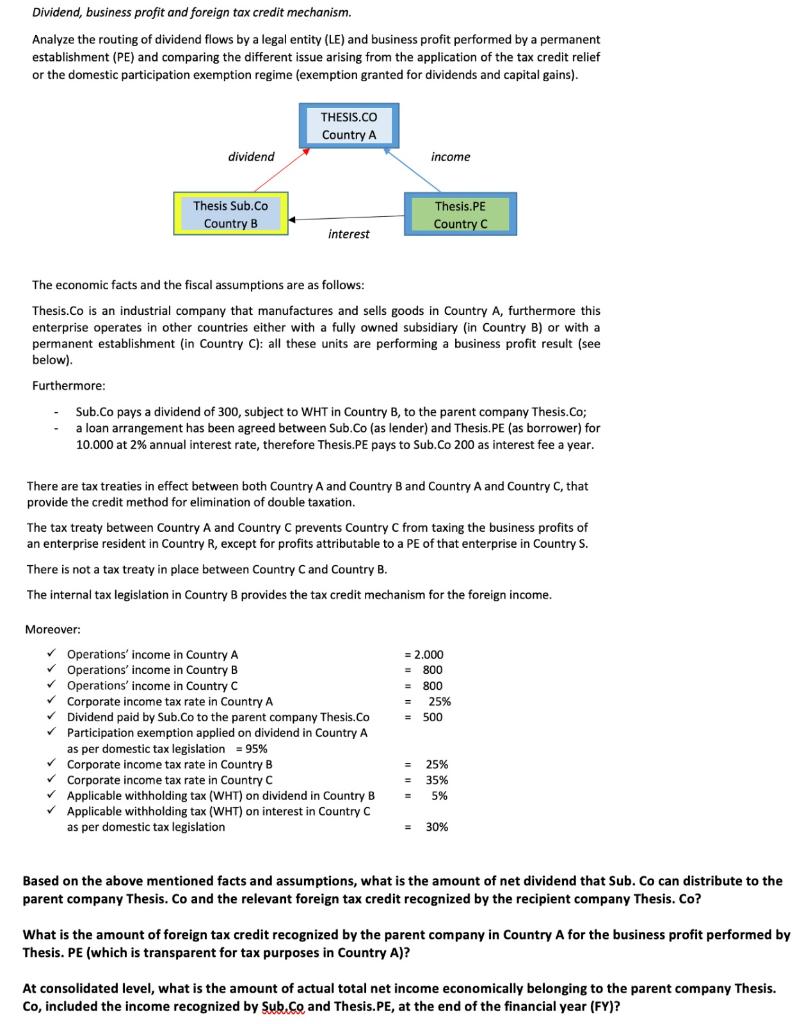

Dividend, business profit and foreign tax credit mechanism. Analyze the routing of dividend flows by a legal entity (LE) and business profit performed by a permanent establishment (PE) and comparing the different issue arising from the application of the tax credit relief or the domestic participation exemption regime (exemption granted for dividends and capital gains). The economic facts and the fiscal assumptions are as follows: Thesis.Co is an industrial company that manufactures and sells goods in Country A, furthermore this enterprise operates in other countries either with a fully owned subsidiary (in Country B) or with a permanent establishment (in Country C): all these units are performing a business profit result (see below). Furthermore: - Sub.Co pays a dividend of 300, subject to WHT in Country B, to the parent company Thesis.Co; - a loan arrangement has been agreed between Sub.Co (as lender) and Thesis. PE (as borrower) for 10.000 at 2% annual interest rate, therefore Thesis.PE pays to Sub.Co 200 as interest fee a year. There are tax treaties in effect between both Country A and Country B and Country A and Country C, that provide the credit method for elimination of double taxation. The tax treaty between Country A and Country C prevents Country C from taxing the business profits of an enterprise resident in Country R, except for profits attributable to a PE of that enterprise in Country S. There is not a tax treaty in place between Country C and Country B. The internal tax legislation in Country B provides the tax credit mechanism for the foreign income. Moreover: Operations' income in Country A =2.000 Operations' income in Country B =800 Operations' income in Country C =800 Corporate income tax rate in Country A =25% Dividend paid by Sub.Co to the parent company Thesis.Co =500 Participation exemption applied on dividend in Country A as per domestic tax legislation =95% Corporate income tax rate in Country B =25% Corporate income tax rate in Country C =35% Applicable withholding tax(WHT) on dividend in Country B =5% Applicable withholding tax (WHT) on interest in Country C as per domestic tax legislation =30% Based on the above mentioned facts and assumptions, what is the amount of net dividend that Sub. Co can distribute to the parent company Thesis. Co and the relevant foreign tax credit recognized by the recipient company Thesis. Co? What is the amount of foreign tax credit recognized by the parent company in Country A for the business profit performed by Thesis. PE (which is transparent for tax purposes in Country A)? At consolidated level, what is the amount of actual total net income economically belonging to the parent company Thesis. Co, included the income recognized by Sub.Co and Thesis.PE, at the end of the financial year (FY)