Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help( step by step please) A newly issued bond pays its coupons once a year. Its coupon rate is 5.1% its maturity is

I need help( step by step please)

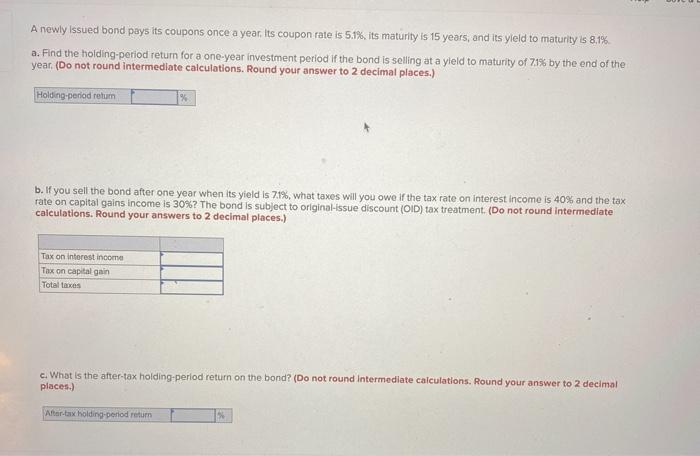

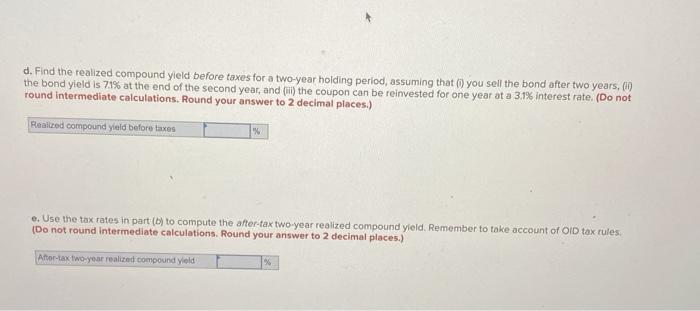

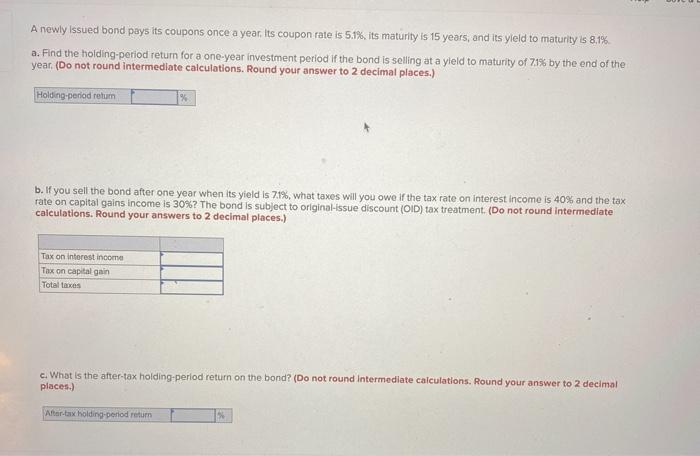

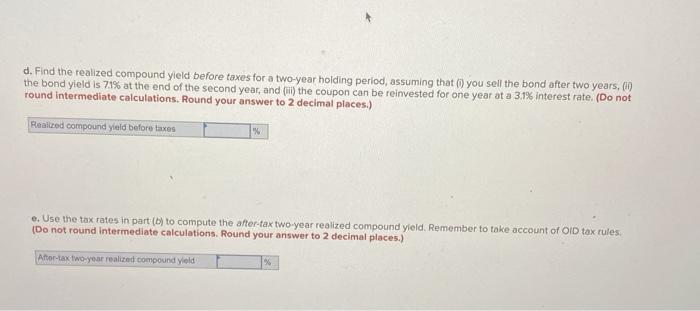

A newly issued bond pays its coupons once a year. Its coupon rate is 5.1% its maturity is 15 years, and its yield to maturity is 8.1% a. Find the holding period return for a one-year investment period of the bond is selling at a yield to maturity of 71% by the end of the year (Do not round intermediate calculations. Round your answer to 2 decimal places.) Holding period retum b. If you sell the bond after one year when its yield is 7.1%, what taxes will you owe if the tax rate on interest income is 40% and the tax rate on capital gains income is 30%? The bond is subject to original-issue discount (OID) tax treatment. (Do not round Intermediate calculations. Round your answers to 2 decimal places.) Tax on Interest income Tax on capital gain Total taxes c. What is the after-tax holding period return on the bond? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) After a holding period retur d. Find the realized compound yield before taxes for a two-year holding period, assuming that () you sell the bond after two years, (I) the bond yield is 71% at the end of the second year, and (iii) the coupon can be reinvested for one year at a 3.1% interest rate (Do not round intermediate calculations. Round your answer to 2 decimal places.) Realized compound yield before taxes e. Use the tax rates in part() to compute the after-tax two-year realized compound yield. Remember to take account of OID tax rules (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Afor-tax two-year realized compound yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started