Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help!! Stock Risk and Return This is the third and final group project, dealing with stock risk and retum. Use the Group Discussion

I need help!!

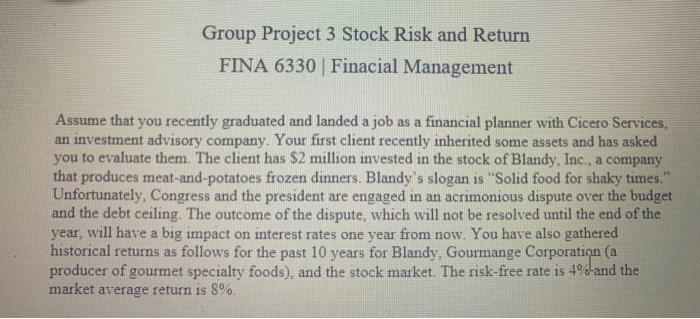

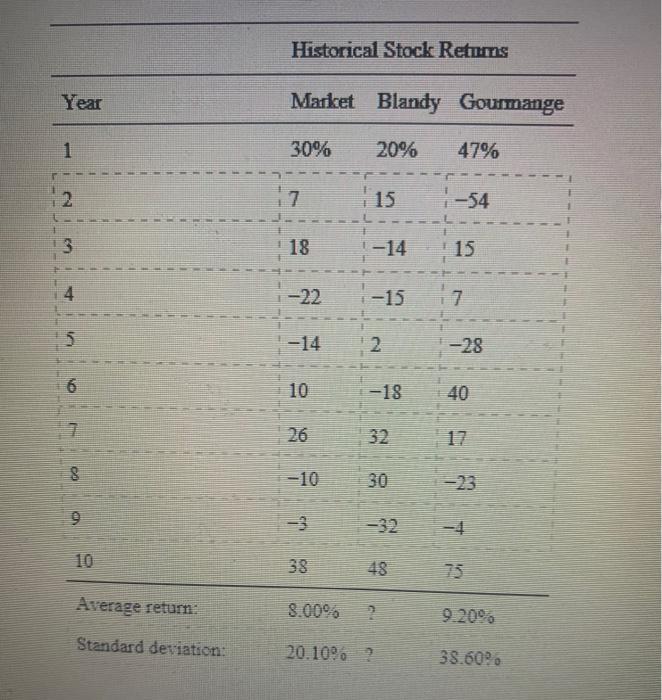

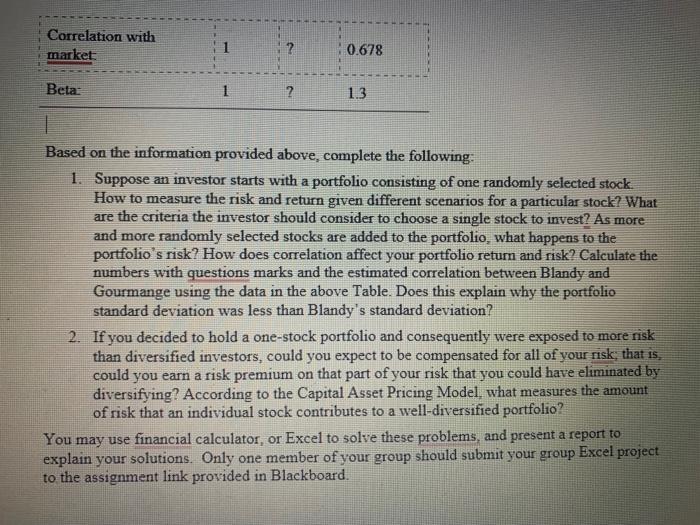

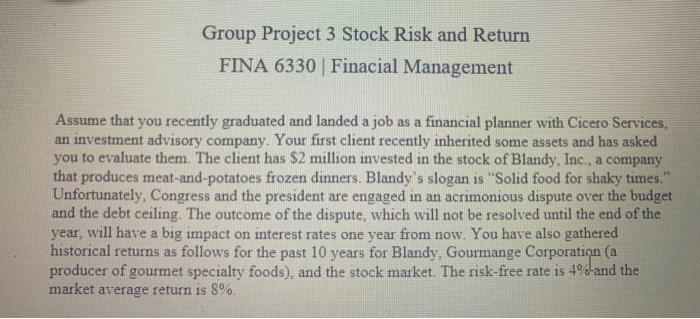

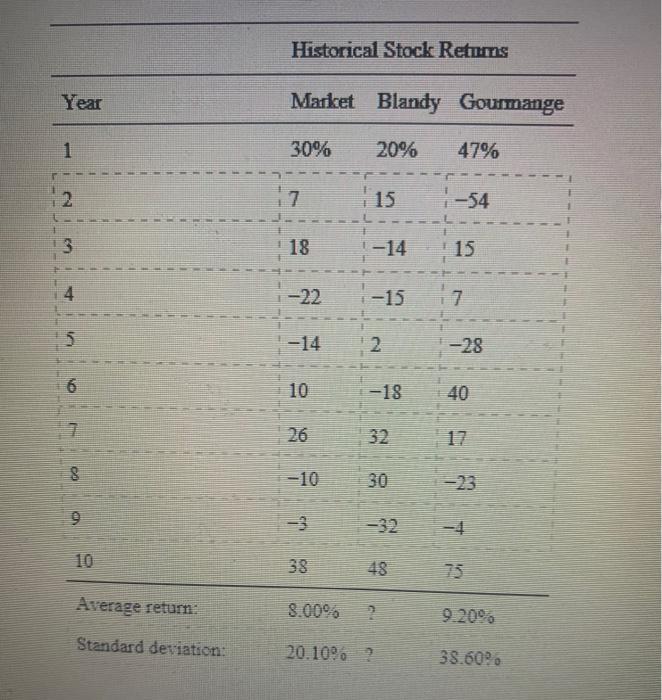

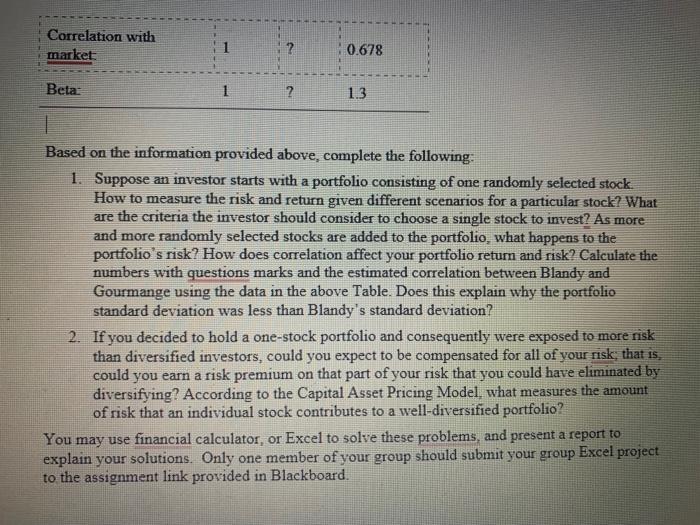

Stock Risk and Return This is the third and final group project, dealing with stock risk and retum. Use the Group Discussion Board Forum within your Group to work together to answer several finance questions based on the provided case study When your assignment is complete you should be more familiar with the concepts of stock risk and return The information needed to complete the assignment can be found in the attached "Group Project 3 Stock Risk and Return" document Once your group has met and completed the assignment, one group member will upload the final document to this the document before submission. Be sure each group member is satisfied with the final product and has hisher own copy of This assignment utilizes the SafeAssign originality tool Upon submission, SafeAssign will generate an originality report that detects plagiarism. This report will be sent to your instructor. Submit Group Project 3 by 11.59 p.m (CD) on Sunday of ModuleMeek 5 Group Project 3 Stock Risk and Return FINA 6330 Finacial Management Assume that you recently graduated and landed a job as a financial planner with Cicero Services, an investment advisory company. Your first client recently inherited some assets and has asked you to evaluate them. The client has $2 million invested in the stock of Blandy, Inc., a company that produces meat-and-potatoes frozen dinners. Blandy's slogan is "Solid food for shaky times." Unfortunately, Congress and the president are engaged in an acrimonious dispute over the budget and the debt ceiling. The outcome of the dispute, which will not be resolved until the end of the year, will have a big impact on interest rates one year from now. You have also gathered historical returns as follows for the past 10 years for Blandy, Gourmange Corporatinn (a producer of gourmet specialty foods), and the stock market. The risk-free rate is 4% and the market average return is 8%. Historical Stock Retmms Based on the information provided above, complete the following: 1. Suppose an investor starts with a portfolio consisting of one randomly selected stock. How to measure the risk and return given different scenarios for a particular stock? What are the criteria the investor should consider to choose a single stock to invest? As more and more randomly selected stocks are added to the portfolio, what happens to the portfolio's risk? How does correlation affect your portfolio return and risk? Calculate the numbers with questions marks and the estimated correlation between Blandy and Gourmange using the data in the above Table. Does this explain why the portfolio standard deviation was less than Blandy's standard deviation? 2. If you decided to hold a one-stock portfolio and consequently were exposed to more risk than diversified investors, could you expect to be compensated for all of your risk; that is, could you earn a risk premium on that part of your risk that you could have eliminated by diversifying? According to the Capital Asset Pricing Model, what measures the amount of risk that an individual stock contributes to a well-diversified portfolio? You may use financial calculator, or Excel to solve these problems, and present a report to explain your solutions. Only one member of your group should submit your group Excel project to the assignment link provided in Blackboard

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started