Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I NEED HELP THE ASSETS PART BELOW, I HAVE THE GEN. LEDGER BELOW COMPLETED FOR REREFERENCE Delinquent taxes of $13.592 were deemed uncollectible and written

I NEED HELP THE ASSETS PART BELOW, I HAVE THE GEN. LEDGER BELOW COMPLETED FOR REREFERENCE

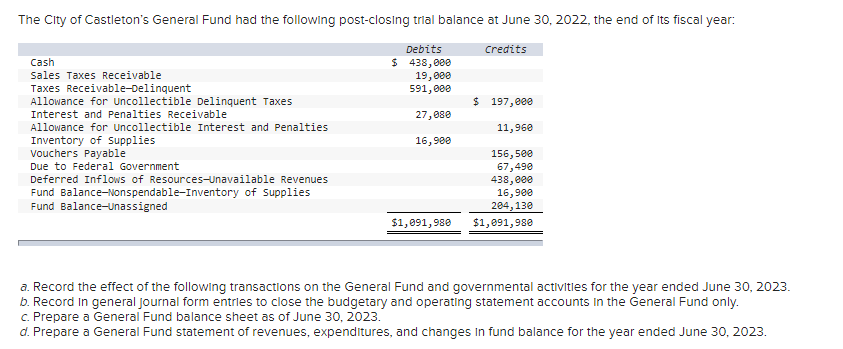

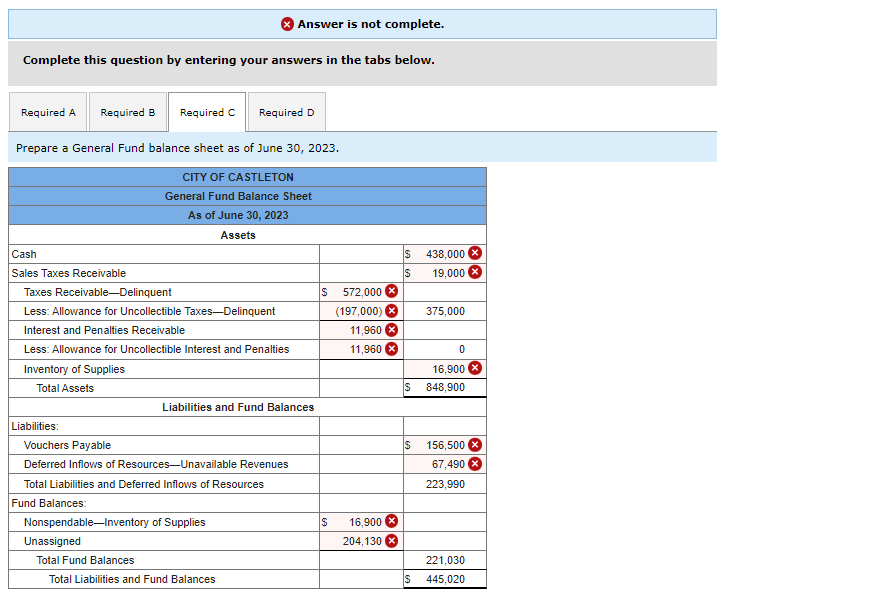

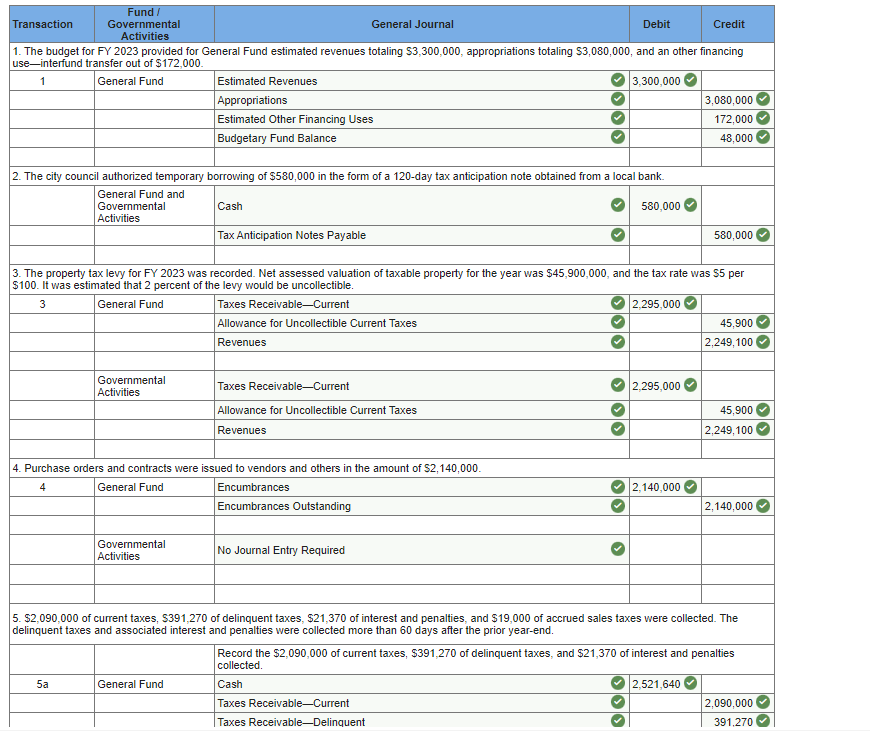

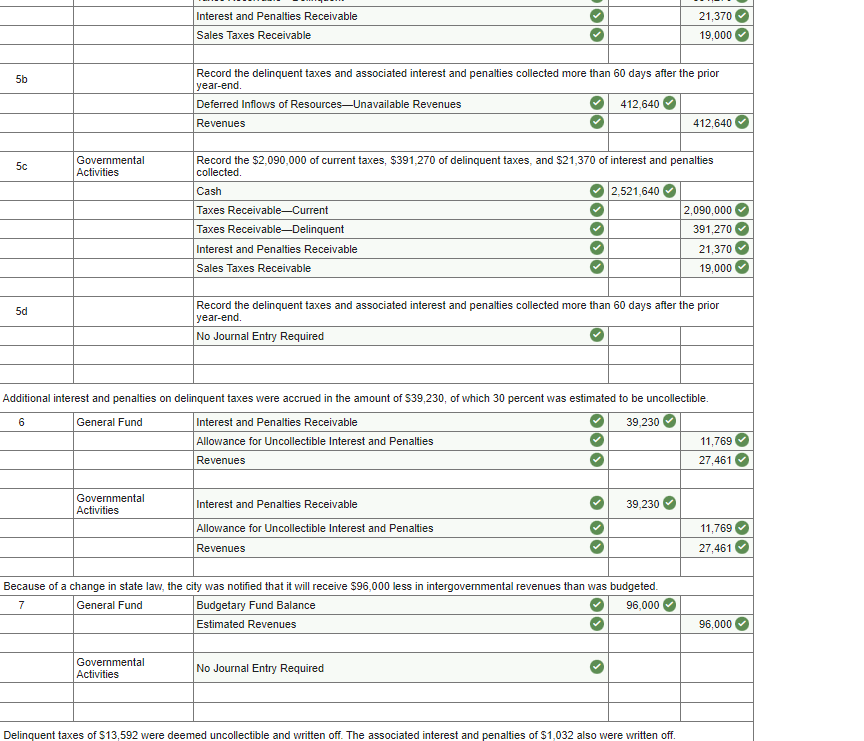

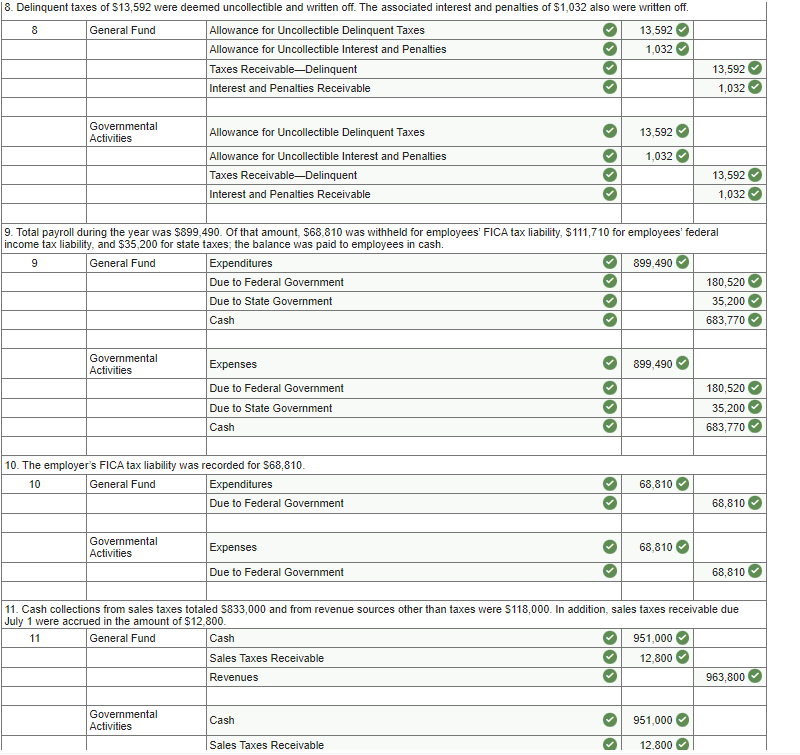

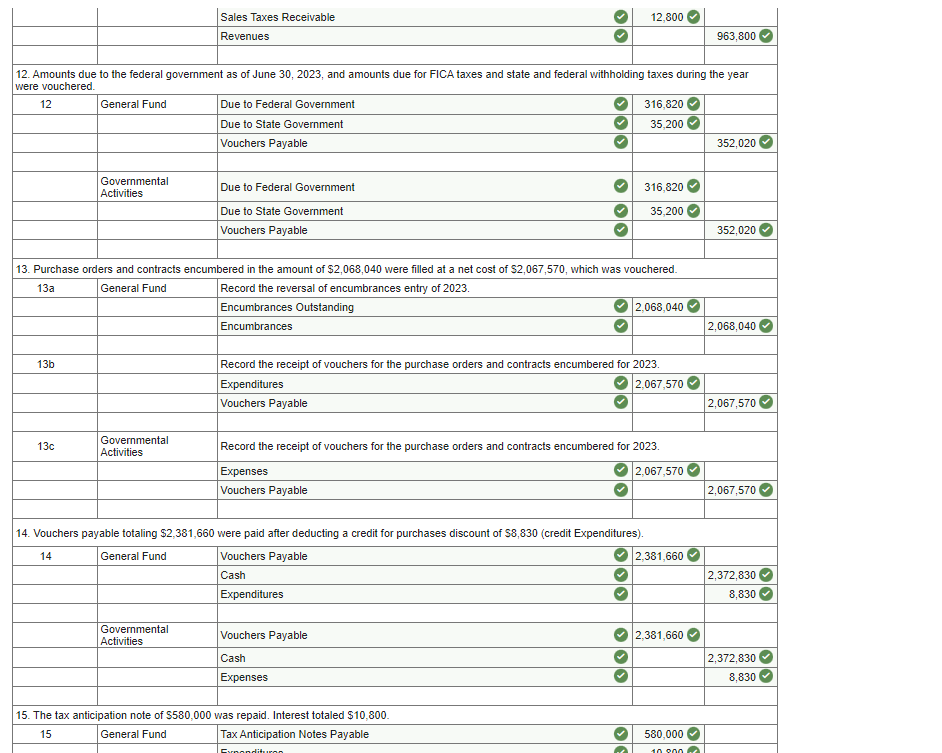

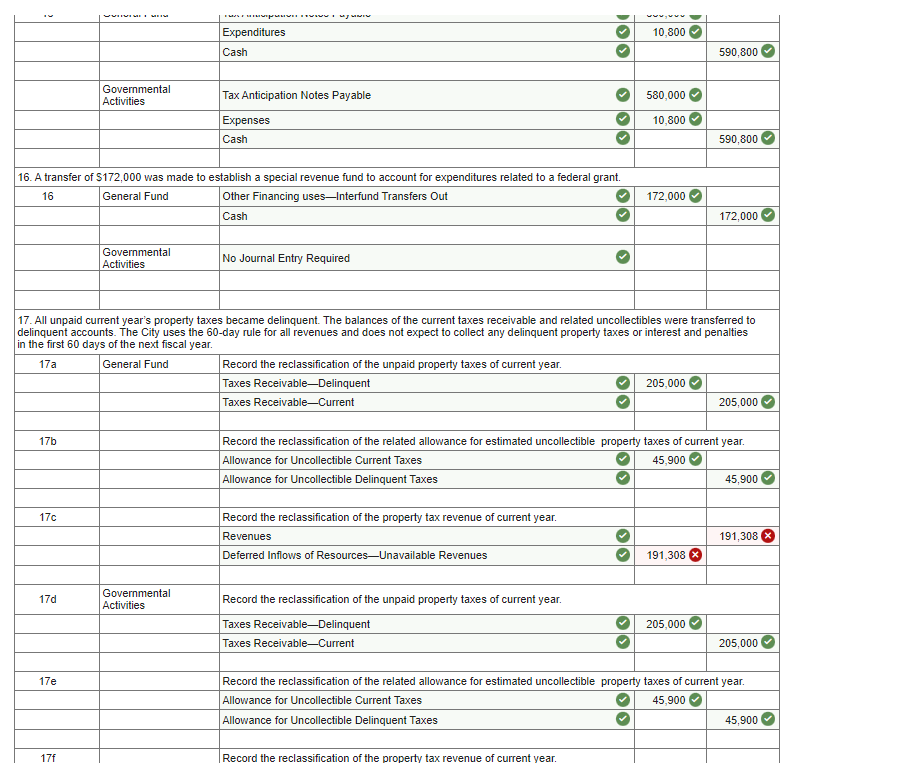

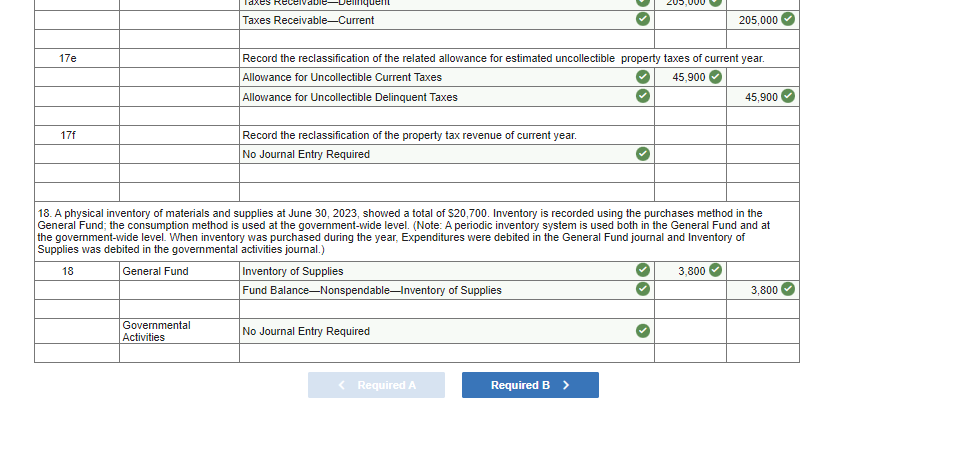

Delinquent taxes of $13.592 were deemed uncollectible and written off. The associated interest and penalties of $1,032 also were written off. Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a General Fund balance sheet as of June 30, 2023. 8. Delinquent taxes of $13,592 were deemed uncollectible and written off. The associated interest and penalties of $1,032 also were written off. 9. Total payroll during the year was $899,490. Of that amount, $68,810 was withheld for employees' FICA tax liability, $111,710 for employees' federal income tax liability, and $35,200 for state taxes; the balance was paid to employees in cash. 11. Cash collections from sales taxes totaled $833,000 and from revenue sources other than taxes were $118,000. In addition, sales taxes receivable due July 1 were accrued in the amount of $12,800. 18. A physical inventory of materials and supplies at June 30,2023 , showed a total of $20,700. Inventory is recorded using the purchases method in the General Fund; the consumption method is used at the government-vide level. (Note: A periodic inventory system is used both in the General Fund and at the government-wide level. When inventory was purchased during the year, Expenditures were debited in the General Fund journal and Inventory of Supplies was debited in the governmental activities journal.) The City of Castleton's General Fund had the following post-closing trlal balance at June 30,2022 , the end of Its fiscal year: a. Record the effect of the following transactions on the General Fund and governmental actlvitles for the year ended June 30, 2023. b. Record In general Journal form entrles to close the budgetary and operating statement accounts in the General Fund only. c. Prepare a General Fund balance sheet as of June 30, 2023. d. Prepare a General Fund statement of revenues, expenditures, and changes In fund balance for the year ended June 30,2023

Delinquent taxes of $13.592 were deemed uncollectible and written off. The associated interest and penalties of $1,032 also were written off. Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a General Fund balance sheet as of June 30, 2023. 8. Delinquent taxes of $13,592 were deemed uncollectible and written off. The associated interest and penalties of $1,032 also were written off. 9. Total payroll during the year was $899,490. Of that amount, $68,810 was withheld for employees' FICA tax liability, $111,710 for employees' federal income tax liability, and $35,200 for state taxes; the balance was paid to employees in cash. 11. Cash collections from sales taxes totaled $833,000 and from revenue sources other than taxes were $118,000. In addition, sales taxes receivable due July 1 were accrued in the amount of $12,800. 18. A physical inventory of materials and supplies at June 30,2023 , showed a total of $20,700. Inventory is recorded using the purchases method in the General Fund; the consumption method is used at the government-vide level. (Note: A periodic inventory system is used both in the General Fund and at the government-wide level. When inventory was purchased during the year, Expenditures were debited in the General Fund journal and Inventory of Supplies was debited in the governmental activities journal.) The City of Castleton's General Fund had the following post-closing trlal balance at June 30,2022 , the end of Its fiscal year: a. Record the effect of the following transactions on the General Fund and governmental actlvitles for the year ended June 30, 2023. b. Record In general Journal form entrles to close the budgetary and operating statement accounts in the General Fund only. c. Prepare a General Fund balance sheet as of June 30, 2023. d. Prepare a General Fund statement of revenues, expenditures, and changes In fund balance for the year ended June 30,2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started