i need help

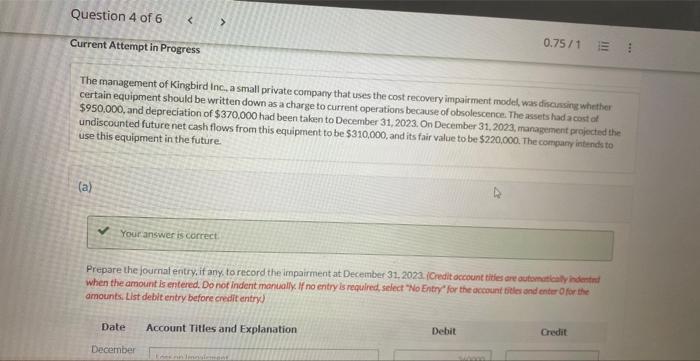

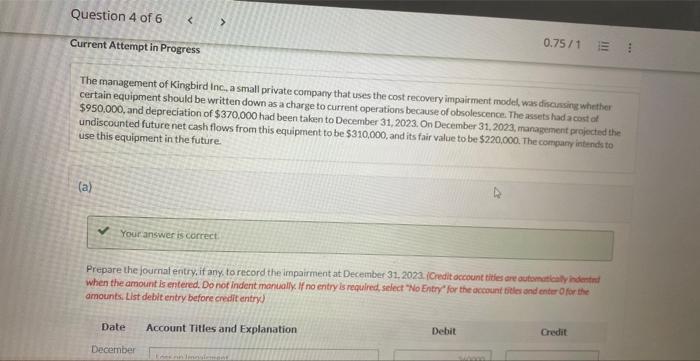

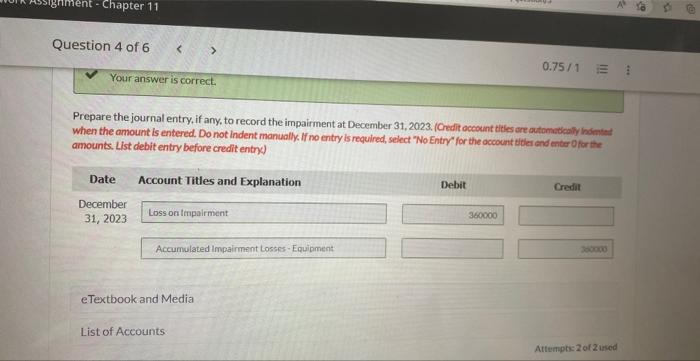

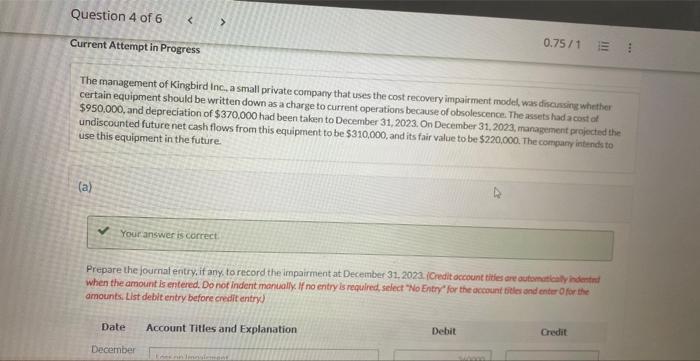

The management of Kingbird Inc. a small private company that uses the cost recovery impairment model, was discissing whether certain equipment should be written down as a charge to current operations because of obsolescence. The assets had a cost of $950,000, and depreciation of $370,000 had been taken to December 31,2023 . On December 31,2023 , management projected the undiscounted future net cash flows from this equipment to be $310,000, and its fair value to be $220,000. The compary intends to use this equipment in the future. (a) Prepare the journat entry, if any, to record the impairment at December 31,2023. iCredit occount tities ere autanet leity hidental when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account bide and enter of ar ithe amounts. List debit entry before credit entry) Prepare the journal entry, if any, to record the impairment at December 31, 2023. (Credit occount ticles are automationly indment when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount tider end enter 0 for the amounts. List debit entry before credit entry) At December 31, 2024, the equipment's fair value increased to $270,000. Prepare the journal entry, f ary, fo record thit in or ase in fair value. (Credit account tities are outomotically indented when the amount is entered Do not indent manualy If ne en th a a a si.at Seleet "No Entry" for the account titles and enter O for the amounts List debit entry before crefit entivi Assume instead that, as at December 31, 2023, the equipment was expected to have undiscounted future net cash flows of $600,000, and that its fair value was estimated to be $500,000. Prepare the journal entry to record the impairment at December 31,2023, if any. (Credit occount vitles are outomatically indented when the amount is entered. Do not indent manually If no entry is required; select "No Entry" for the account titles and enter O for the amounts, List debit entry before credit entryJ Assume instead that, as at December 31,2023 , the equipment was expected to have undiscounted future net cash flows if $51,000 per year for each of the next 10 years, and that there is no active market for the equipment. Kinghird uses a 10 oss dinceunt rate in its cash flow estimates. Prepare the journal entry to record impairment at December 31, 2023, if any. (Crait occount bides are automotically indented when the amount is entered, Do not indent manually if no entry is requind, select "No Entry" for the octount titles and enter of for the amounts List debit entry before oredit entry. Round foctor values to 5 decimal ploces eg. 1.25124 and fine answers to Odecimal places, eg. 1,251.] Click here to view Table A.4 - PRESENT VALUE OF AN ORDINARY ANNUTTY OF 1 eTextbook and Media The management of Kingbird Inc. a small private company that uses the cost recovery impairment model, was discissing whether certain equipment should be written down as a charge to current operations because of obsolescence. The assets had a cost of $950,000, and depreciation of $370,000 had been taken to December 31,2023 . On December 31,2023 , management projected the undiscounted future net cash flows from this equipment to be $310,000, and its fair value to be $220,000. The compary intends to use this equipment in the future. (a) Prepare the journat entry, if any, to record the impairment at December 31,2023. iCredit occount tities ere autanet leity hidental when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account bide and enter of ar ithe amounts. List debit entry before credit entry) Prepare the journal entry, if any, to record the impairment at December 31, 2023. (Credit occount ticles are automationly indment when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount tider end enter 0 for the amounts. List debit entry before credit entry) At December 31, 2024, the equipment's fair value increased to $270,000. Prepare the journal entry, f ary, fo record thit in or ase in fair value. (Credit account tities are outomotically indented when the amount is entered Do not indent manualy If ne en th a a a si.at Seleet "No Entry" for the account titles and enter O for the amounts List debit entry before crefit entivi Assume instead that, as at December 31, 2023, the equipment was expected to have undiscounted future net cash flows of $600,000, and that its fair value was estimated to be $500,000. Prepare the journal entry to record the impairment at December 31,2023, if any. (Credit occount vitles are outomatically indented when the amount is entered. Do not indent manually If no entry is required; select "No Entry" for the account titles and enter O for the amounts, List debit entry before credit entryJ Assume instead that, as at December 31,2023 , the equipment was expected to have undiscounted future net cash flows if $51,000 per year for each of the next 10 years, and that there is no active market for the equipment. Kinghird uses a 10 oss dinceunt rate in its cash flow estimates. Prepare the journal entry to record impairment at December 31, 2023, if any. (Crait occount bides are automotically indented when the amount is entered, Do not indent manually if no entry is requind, select "No Entry" for the octount titles and enter of for the amounts List debit entry before oredit entry. Round foctor values to 5 decimal ploces eg. 1.25124 and fine answers to Odecimal places, eg. 1,251.] Click here to view Table A.4 - PRESENT VALUE OF AN ORDINARY ANNUTTY OF 1 eTextbook and Media