I need help this income statement

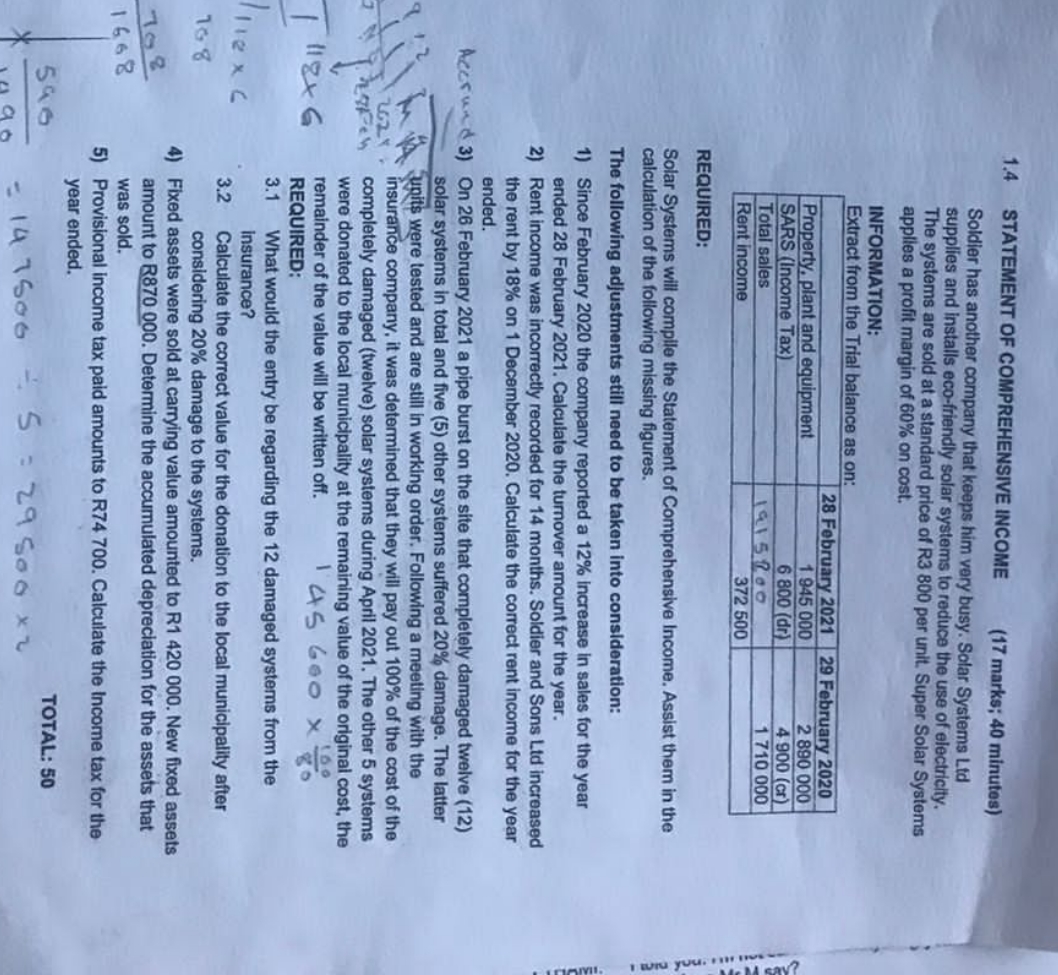

1.4 STATEMENT OF COMPREHENSIVE INCOME (17 marks; 40 minutes) Soldier has another company that keeps him very busy. Solar Systems Ltd supplies and installs eco-friendly solar systems to reduce the use of electricity. The systems are sold at a standard price of R3 800 per unit. Super Solar Systems applies a profit margin of 60% on cost. INFORMATION: Extract from the Trial balance as on: 28 February 2021 29 February 2020 Property, plant and equipment 1 945 000 2 890 000 SARS (Income Tax) 6 800 (dr) 4 900 (cr) Total sales 1915706 1 710 000 Rent income 372 500 REQUIRED: Solar Systems will compile the Statement of Comprehensive Income. Assist them in the calculation of the following missing figures. The following adjustments still need to be taken into consideration: 1) Since February 2020 the company reported a 12% increase in sales for the year ended 28 February 2021. Calculate the turnover amount for the year. 2) Rent income was incorrectly recorded for 14 months. Soldier and Sons Lid increased the rent by 18% on 1 December 2020. Calculate the correct rent income for the year ended. Accrued 3) On 26 February 2021 a pipe burst on the site that completely damaged twelve (12) solar systems in total and five (5) other systems suffered 20% damage. The latter units were tested and are still in working order. Following a meeting with the insurance company, it was determined that they will pay out 100% of the cost of the completely damaged (twelve) solar systems during April 2021. The other 5 systems were donated to the local municipality at the remaining value of the original cost, the 1 118 x 6 remainder of the value will be written off. 145 600 X 20 REQUIRED: What would the entry be regarding the 12 damaged systems from the liexc Insurance? 3.2 Calculate the correct value for the donation to the local municipality after 76 8 considering 20% damage to the systems. 4) Fixed assets were sold at carrying value amounted to R1 420 000. New fixed assets amount to R870 000. Determine the accumulated depreciation for the assets that 1658 was sold. 5) Provisional income tax paid amounts to R74 700. Calculate the Income tax for the year ended. 596 TOTAL: 50 = 14 7606 - 5 : 29 500 x2