Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help this is accounting hfac232-1 Crudential Ltd is an oil refinery that owns several offshore oil rigs from where they supply oil to

I need help this is accounting hfac232-1

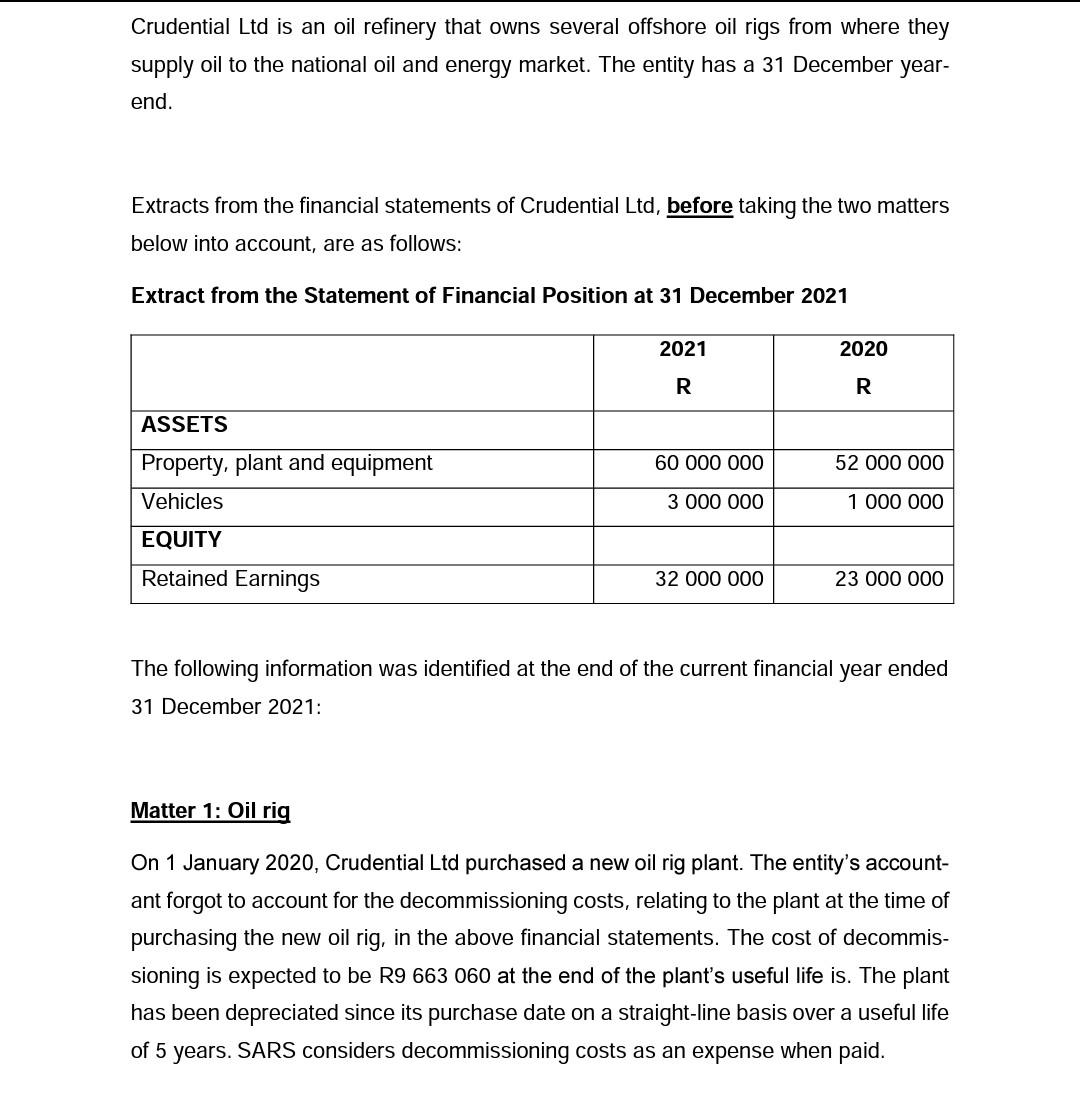

Crudential Ltd is an oil refinery that owns several offshore oil rigs from where they supply oil to the national oil and energy market. The entity has a 31 December yearend. Extracts from the financial statements of Crudential Ltd, before taking the two matters below into account, are as follows: Extract from the Statement of Financial Position at 31 December 2021 The following information was identified at the end of the current financial year ended 31 December 2021: Matter 1: Oil riq On 1 January 2020, Crudential Ltd purchased a new oil rig plant. The entity's accountant forgot to account for the decommissioning costs, relating to the plant at the time of purchasing the new oil rig, in the above financial statements. The cost of decommissioning is expected to be R9 663060 at the end of the plant's useful life is. The plant has been depreciated since its purchase date on a straight-line basis over a useful life of 5 years. SARS considers decommissioning costs as an expense when paid. Matter 2: Oil tankers (vehicles) On 1 January 2021, Crudential Ltd also purchased four specialised oil tankers (vehicles) for a total of R800 000 (i.e. R200 000 per oil tanker). The oil tankers were depreciated at a rate of 10% on a straight-line basis, with a zero residual value, to reflect the expected pattern at which the oil tankers would generate economic benefits as decided at the time of purchase. The depreciation has been accounted for accordingly in the above financial statements extracts. Management however has decided that a more suitable method would have been to depreciate the oil tankers on a straight-line basis using a total useful life of 4 years and a residual value of R120000 in total (i.e. R30 000 per oil tanker). Additional information: - The market interest rate (discount rate) is 10%. - The South African income tax rate has remained unchanged at 28% for the past three years. - Ignore any VAT implications. - Include all income tax implications. 93 HFAC232-1-Jul-Dec2022-FA2-SK-V2-27062022 ANNEXURE I: FORMATIVE ASSESSMENT 2 REQUIRED: 1.1) With regards to matters 1 and 2, disclose the relevant information in the correction of error note to the annual financial statements of Crudential Ltd for the financial year ended 31 December 2021, according to the requirements of IAS 8 only. Show all workings. Include comparatives for the prior year. Round to the nearest Rand where applicableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started