Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help to figure out where I've gone wrong with the answers that are marked incorrect on requirements 2, 3, 4 and 7. Thanks

I need help to figure out where I've gone wrong with the answers that are marked incorrect on requirements 2, 3, 4 and 7. Thanks in advance!

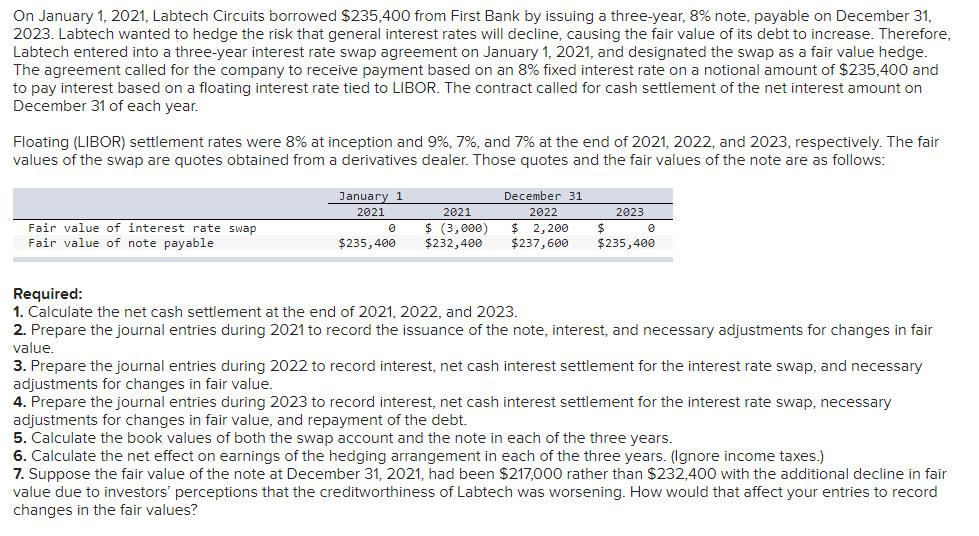

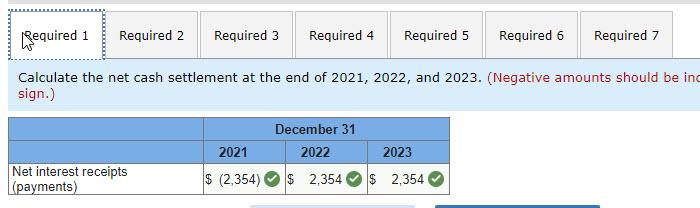

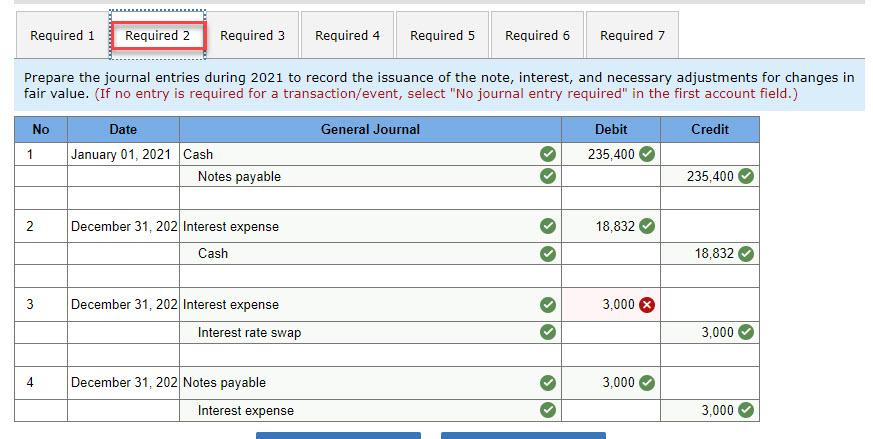

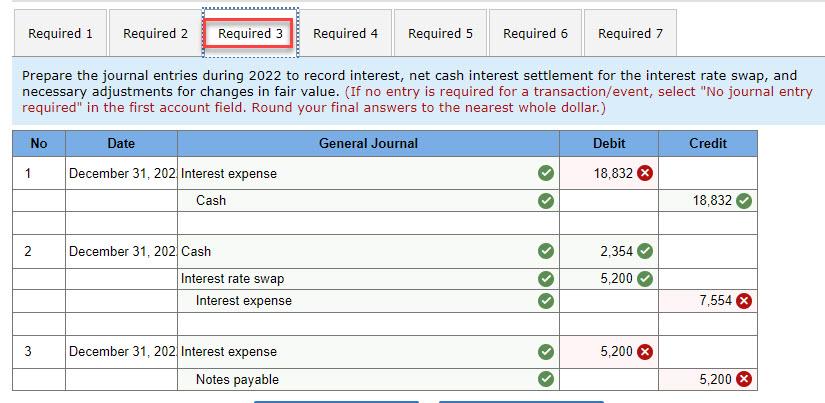

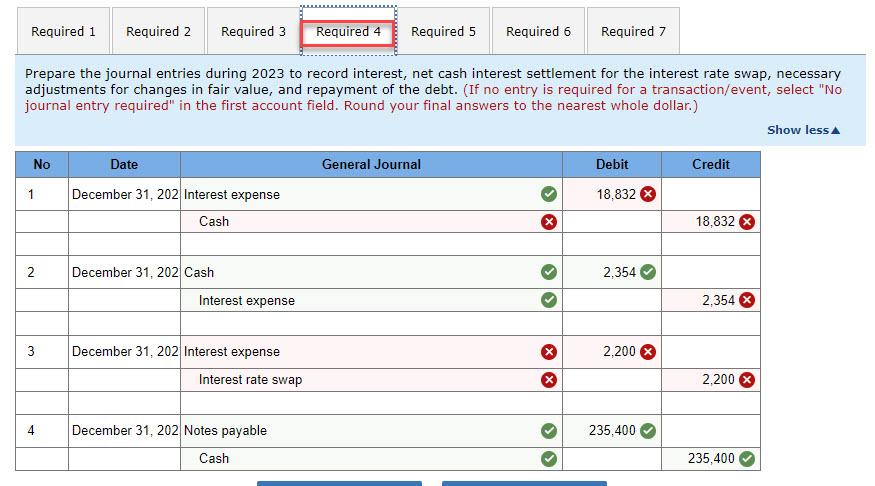

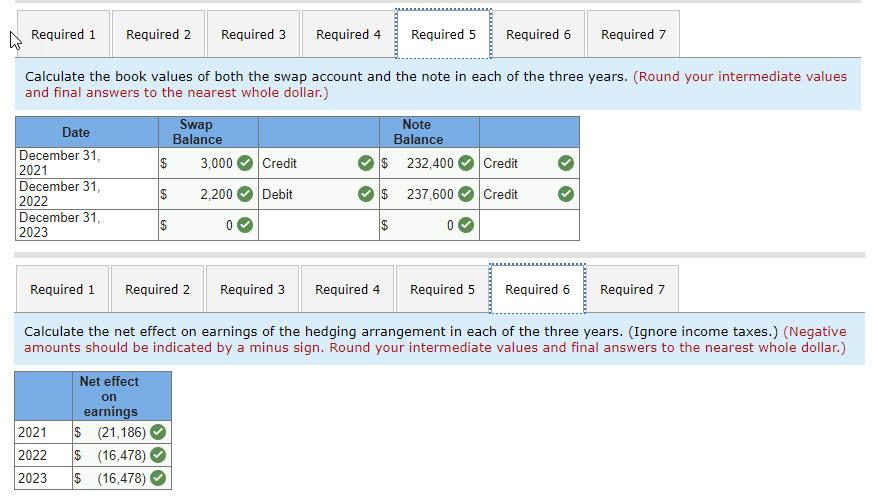

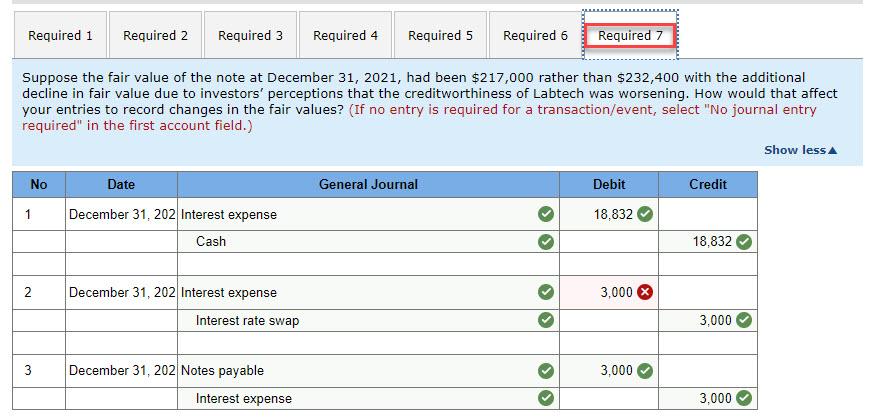

On January 1, 2021, Labtech Circuits borrowed $235,400 from First Bank by issuing a three-year, 8% note, payable on December 31, 2023. Labtech wanted to hedge the risk that general interest rates will decline, causing the fair value of its debt to increase. Therefore, Labtech entered into a three-year interest rate swap agreement on January 1, 2021, and designated the swap as a fair value hedge. The agreement called for the company to receive payment based on an 8% fixed interest rate on a notional amount of $235,400 and to pay interest based on a floating interest rate tied to LIBOR. The contract called for cash settlement of the net interest amount on December 31 of each year. Floating (LIBOR) settlement rates were 8% at inception and 9%, 7%, and 7% at the end of 2021, 2022, and 2023, respectively. The fair values of the swap are quotes obtained from a derivatives dealer. Those quotes and the fair values of the note are as follows: January 1 2021 Fair value of interest rate swap Fair value of note payable 2021 $ (3,000) $232,400 December 31 2022 $ 2,200 $237,600 2023 $ 0 $235,400 $235,400 Required: 1. Calculate the net cash settlement at the end of 2021, 2022, and 2023. 2. Prepare the journal entries during 2021 to record the issuance of the note, interest, and necessary adjustments for changes in fair value. 3. Prepare the journal entries during 2022 to record interest, net cash interest settlement for the interest rate swap, and necessary adjustments for changes in fair value. 4. Prepare the journal entries during 2023 to record interest, net cash interest settlement for the interest rate swap, necessary adjustments for changes in fair value, and repayment of the debt. 5. Calculate the book values of both the swap account and the note in each of the three years. 6. Calculate the net effect on earnings of the hedging arrangement in each of the three years. (Ignore income taxes.) 7. Suppose the fair value of the note at December 31, 2021, had been $217,000 rather than $232,400 with the additional decline in fair value due to investors' perceptions that the creditworthiness of Labtech was worsening. How would that affect your entries to record changes in the fair values? Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Calculate the net cash settlement at the end of 2021, 2022, and 2023. (Negative amounts should be in sign.) December 31 2021 2022 2023 Net interest receipts $ (2,354) $ 2,354 $ 2,354 (payments) Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Prepare the journal entries during 2021 to record the issuance of the note, interest, and necessary adjustments for changes in fair value. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No General Journal Credit Date January 01, 2021 Cash Notes payable 1 Debit 235,400 235,400 N 2 18,832 December 31, 202 Interest expense Cash 18,832 3 3,000 X December 31, 202 Interest expense Interest rate swap 3,000 4 3,000 December 31, 202 Notes payable Interest expense 3,000 Required 1 Required 2 Required 3 MOOCET Required 4 Required 5 Required 6 Required 7 Prepare the journal entries during 2022 to record interest, net cash interest settlement for the interest rate swap, and necessary adjustments for changes in fair value. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar.) No Date General Journal Debit Credit 1 18,832 X December 31, 202 Interest expense Cash 18,832 2 2.354 December 31, 202 Cash Interest rate swap Interest expense 5,200 7,554 3 5,200 December 31, 202 Interest expense Notes payable 5,200 Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Prepare the journal entries during 2023 to record interest, net cash interest settlement for the interest rate swap, necessary adjustments for changes in fair value, and repayment of the debt. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar.) Show less No Date General Journal Debit Credit 1 18,832 December 31, 202 Interest expense Cash 18,832 2 December 31, 202 Cash 2,354 N Interest expense 2,354 X 3 2,200 X December 31, 202 Interest expense Interest rate swap 2,200 4 235,400 December 31, 202 Notes payable Cash 235,400 Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Calculate the book values of both the swap account and the note in each of the three years. (Round your intermediate values and final answers to the nearest whole dollar.) Swap Balance 3,000 Note Balance $ 232,400 $ Credit Credit Date December 31, 2021 December 31, 2022 December 31 2023 $ 2,200 Debit $ 237,600 Credit $ 0 Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Calculate the net effect on earnings of the hedging arrangement in each of the three years. (Ignore income taxes.) (Negative amounts should be indicated by a minus sign. Round your intermediate values and final answers to the nearest whole dollar.) 2021 2022 Net effect on earnings $ (21,186) $ (16,478) $ (16,478) 2023 Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Suppose the fair value of the note at December 31, 2021, had been $217,000 rather than $232,400 with the additional decline in fair value due to investors' perceptions that the creditworthiness of Labtech was worsening. How would that affect your entries to record changes in the fair values? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show less No Date General Journal Debit Credit 1 18,832 December 31, 202 Interest expense Cash 18,832 2 3,000 X December 31, 202 Interest expense Interest rate swap 3,000 3 3,000 December 31, 202 Notes payable Interest expense 3,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started