I need help understand how to apply the three different methods of depreciation with the template I am given. It seems like it is asking for more information than I can give them. I don't expect you to enter numbers in for me but since my financial vocabulary is limited can you show me what exactly goes where in the given required fields?

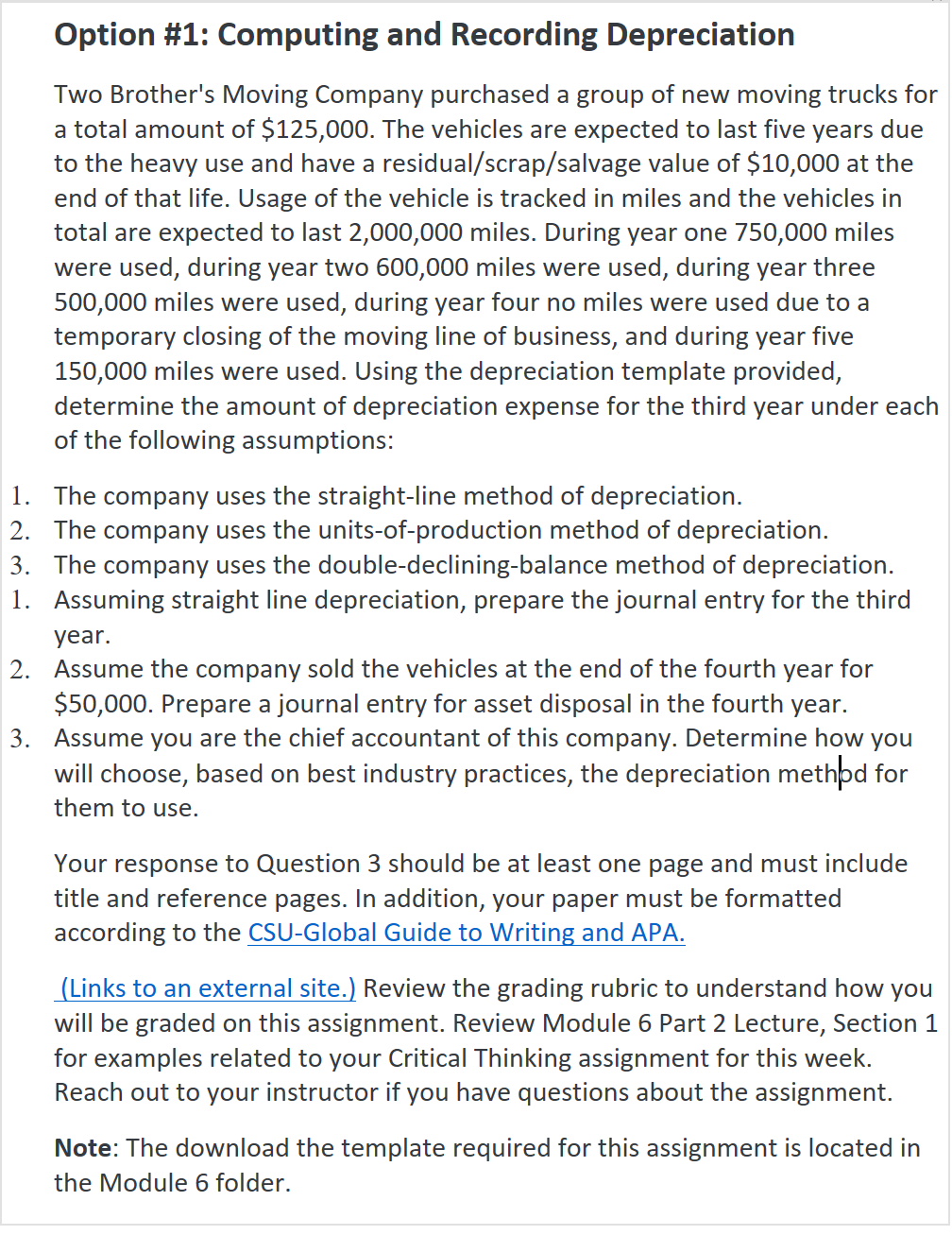

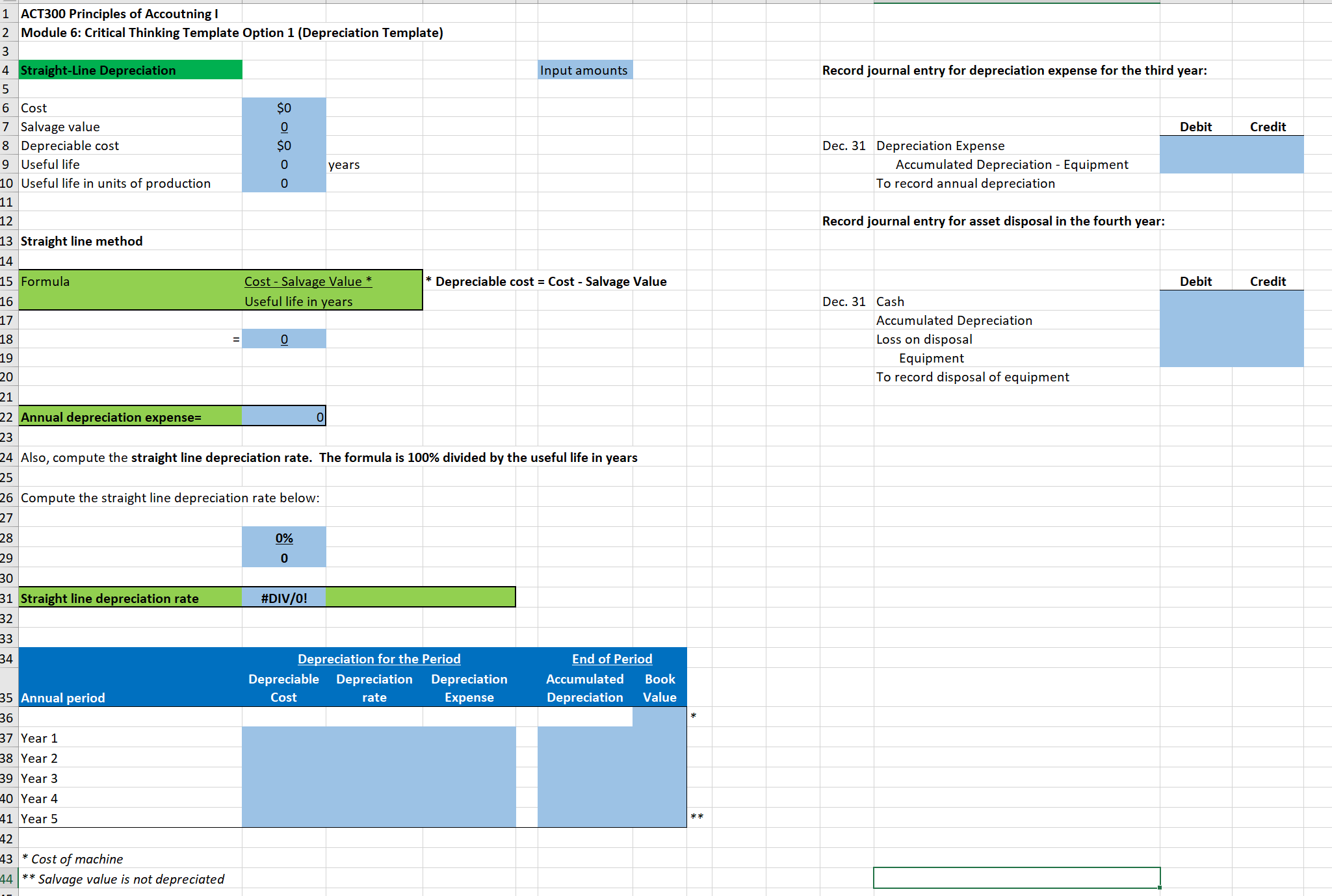

rdUJlNJrd Option #1: Computing and Recording Depreciation Two Brother's Moving Company purchased a group of new moving trucks for a total amount of $125,000. The vehicles are expected to last five years due to the heavy use and have a residual/scrap/salvage value of $10,000 at the end of that life. Usage of the vehicle is tracked in miles and the vehicles in total are expected to last 2,000,000 miles. During year one 750,000 miles were used, during year two 600,000 miles were used, during year three 500,000 miles were used, during year four no miles were used due to a temporary closing of the moving line of business, and during year five 150,000 miles were used. Using the depreciation template provided, determine the amount of depreciation expense for the third year under each of the following assumptions: The company uses the straight-line method of depreciation. The company uses the unitsof-production method of depreciation. The company uses the doubledeclining-balance method of depreciation. Assuming straight line depreciation, prepare the journal entry for the third yeah Assume the company sold the vehicles at the end of the fourth year for $50,000. Prepare a journal entry for asset disposal in the fourth year. Assume you are the chief accountant of this company. Determine how you will choose, based on best industry practices, the depreciation methlod for them to use. Your response to Question 3 should be at least one page and must include title and reference pages. In addition, your paper must be formatted according to the CSU-Global Guide to Writing and APA. (Links to an external site.) Review the grading rubric to understand how you will be graded on this assignment. Review Module 6 Part 2 Lecture, Section 1 for examples related to your Critical Thinking assignment for this week. Reach out to your instructor if you have questions about the assignment. Note: The download the template required for this assignment is located in the Module 6 folder. ACT300 Principles of Accoutning ! Module 6: Critical Thinking Template Option 1 (Depreciation Template) Units of Production Depreciation Input amounts Cost Salvage value 10 Record journal entry for depreciation expense for the third year: Depreciable cost SO Useful life 0 years Useful life in units of production = 0 Debit Credit Dec. 31 Depreciation Expense Accumulated Depreciation - Equipment Units of Production To record annual depreciation Step 1: Depreciation per unit Cost - Salvage Value * * Depreciable cost = Cost - Salvage Value Record journal entry for asset disposal in the fourth year: Useful life in units of production Debit Credit Dec. 31 Cash Accumulated Depreciation Loss on disposal Depreciation per unit = $ Equipment To record disposal of equipment Step 2: Depreciation expense Depreciation per unit x Units of production* = 0.00 0 Depreciation expense = $ Depreciation for the Period End of Period Number of Depreciation Accumulated Book Annual period Units Depreciation per unit Expense Depreciation Value SO Year 3 * Cost of item * * Salvage value is not depreciatedB D E F G H I J K M N 1 ACT300 Principles of Accoutning I 2 Module 6: Critical Thinking Template Option 1 (Depreciation Template) UI P Double Declining Balance Depreciation Input amounts 6 Cost Salvage value Record journal entry for depreciation expense for the third year: Depreciable cost SO 9 Useful life 0 10 Useful life in miles OC years Debit Credit 11 Dec. 31 Depreciation Expense 12 Accumulated Depreciation - Equipment 13 Units of Production To record annual depreciation 14 Step 1: 15 Straight Line Rate = 100% Depreciable cost = Cost - Salvage Value 16 Useful life in years 17 18 19 20 21 Straight line depreciation rate = 22 23 S 24 Double-declining-balance rate 2 x Straight-line rate 25 26 27 2 0% 28 29 Double-declining-balance rate 0% 30 31 Step 3: Depreciation expense Double-Declining- balance rate x Beginning-period book value 33 34 35 0% SO 36 37 Depreciation expense So 38 39 40 41 Depreciation for the Period nd of Period Beginning o Period Book Depreciation Depreciation Accumulated Book 42 Annual period Value Rate Expense Depreciation Value 43 SO 44 Year 1 45 Year 2 46 Year 3 47 Year 4 48 Year 5 49 50 * Cost of equipment 51 Straight-Line Depreciation Units-of-Production Double-Declining Balance +ACT300 Principles of Accoutning ! W N Module 6: Critical Thinking Template Option 1 (Depreciation Template) Straight-Line Depreciation Input amounts Record journal entry for depreciation expense for the third year: 6 Cost $0 Salvage value 0 Debit Credit 8 Depreciable cost SO Dec. 31 Depreciation Expense 9 Useful life 0 years Accumulated Depreciation - Equipment 0 Useful life in units of production 0 To record annual depreciation 11 12 Record journal entry for asset disposal in the fourth year: 13 Straight line method 14 Formula Cost - Salvage Value * *Depreciable cost = Cost - Salvage Value Debit Credit 16 Useful life in years Dec. 31 Cash 17 Accumulated Depreciation 18 = 0 Loss on disposal 19 Equipment 20 To record disposal of equipment 21 22 Annual depreciation expense= 23 24 Also, compute the straight line depreciation rate. The formula is 100% divided by the useful life in years 25 6 Compute the straight line depreciation rate below: 28 0% 29 30 31 Straight line depreciation rate #DIV/O! 32 33 34 Depreciation for the Period nd of Period Depreciable Depreciation Depreciation Accumulated Book 35 Annual period Cost rate Expense Depreciation Value 36 37 Year 1 38 Year 2 9 Year 3 10 Year 4 41 Year 5 * * 42 43 * Cost of machine 14 * * Salvage value is not depreciated