Answered step by step

Verified Expert Solution

Question

1 Approved Answer

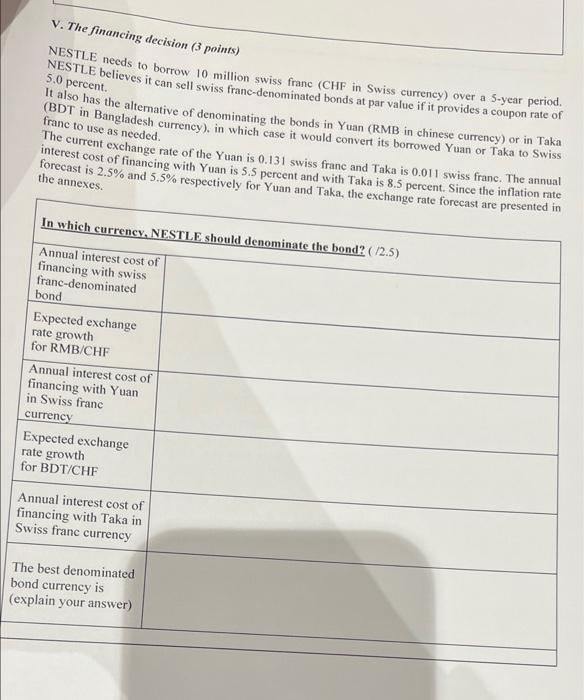

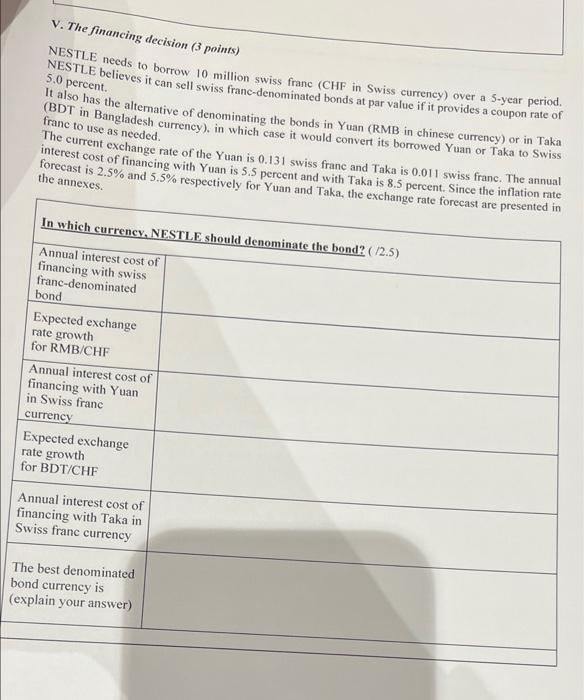

i need help V. The financing decision (3 points) 5.0 percent NESTLE needs to borrow 10 million swiss franc (CHF in Swiss currency) over a

i need help

V. The financing decision (3 points) 5.0 percent NESTLE needs to borrow 10 million swiss franc (CHF in Swiss currency) over a 5-year period NESTLE believes it can sell swiss franc-denominated bonds at par value if it provides a coupon rate of It also has the alternative of denominating the bonds in Yuan (RMB in chinese currency) or in Taka (BDT in Bangladesh currency), in which case it would convert its borrowed Yuan or Taka to Swiss franc to use as needed. The current exchange rate of the Yuan is 0.131 swiss frane and Taka is 0.011 swiss franc. The annual interest cost of financing with Yuan is 5.5 percent and with Taka is 8.5 percent. Since the inflation rate the annexes forecast is 2.5% and 5.5% respectively for Yuan and Taka, the exchange rate forecast are presented in In which currency, NESTLE should denominate the bond? (2.5) Annual interest cost of financing with swiss franc-denominated bond Expected exchange rate growth for RMB/CHF Annual interest cost of financing with Yuan in Swiss franc currency Expected exchange rate growth for BDT/CHE Annual interest cost of financing with Taka in Swiss franc currency The best denominated bond currency is (explain your answer) V. The financing decision (3 points) 5.0 percent NESTLE needs to borrow 10 million swiss franc (CHF in Swiss currency) over a 5-year period NESTLE believes it can sell swiss franc-denominated bonds at par value if it provides a coupon rate of It also has the alternative of denominating the bonds in Yuan (RMB in chinese currency) or in Taka (BDT in Bangladesh currency), in which case it would convert its borrowed Yuan or Taka to Swiss franc to use as needed. The current exchange rate of the Yuan is 0.131 swiss frane and Taka is 0.011 swiss franc. The annual interest cost of financing with Yuan is 5.5 percent and with Taka is 8.5 percent. Since the inflation rate the annexes forecast is 2.5% and 5.5% respectively for Yuan and Taka, the exchange rate forecast are presented in In which currency, NESTLE should denominate the bond? (2.5) Annual interest cost of financing with swiss franc-denominated bond Expected exchange rate growth for RMB/CHF Annual interest cost of financing with Yuan in Swiss franc currency Expected exchange rate growth for BDT/CHE Annual interest cost of financing with Taka in Swiss franc currency The best denominated bond currency is (explain your answer)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started