I need help with #29. Could someone please give me an explanation as to why as well.

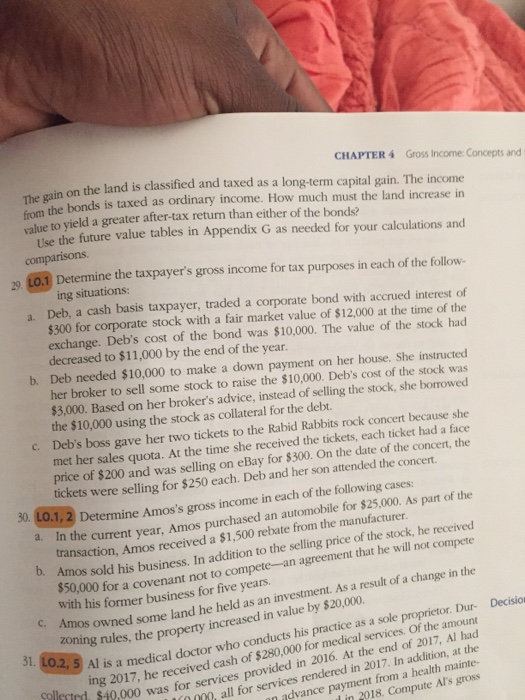

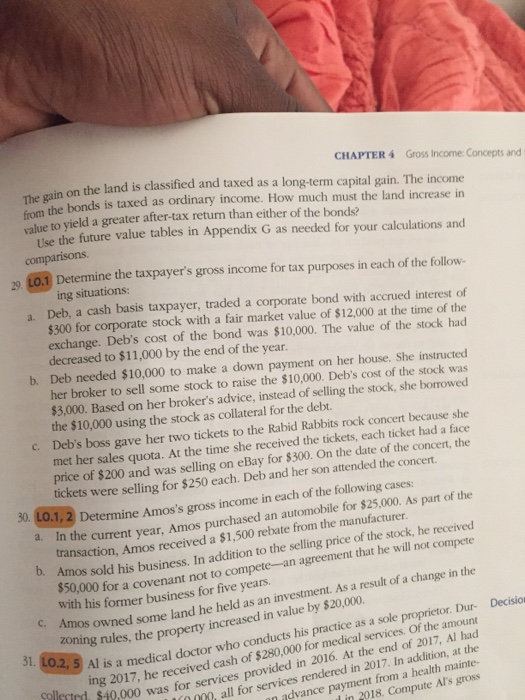

CHAPTER 4 the eain on the land is classified and taxed as a long-term capital gain. The income ing the bonds is taxed as ordinary income. How much must the land increase in Gross Income Concepts and value to yield a greater after-tax return than either of the bonds? Use the future value tables in Appendix G as needed for your alculations and sons. 29. 1o.1 Determine the taxpayer's gross income for tax purposes in each of the follow ing situations: Deb, a cash basis taxpayer, traded a corporate bond with accrued interest of $300 for corporate stock with a fair market value of $12,000 at the time of the exchange. Deb's cost of the bond was $10,000. The value of the stock had decreased to $11,000 by the end of the year. b. Deb needed $10,000 to make a down payment on her house. She instructed her broker to sell some stock to raise the $10,000. Deb's cost of the stock was $3,000. Based on her broker's advice, instead of selling the stock, she borowed the $10,000 using the stock as collateral for the debt. Deb's boss gave her two tickets to the Rabid Rabbits rock concert because she met her sales quota. At the time she received the tickets, each ticket had a face price of $200 and was selling on eBay for $300. On the date of the concert, the tickets were selling for $250 each. Deb and her son attended the concert. c. 30. L0.1,2 Determine Amos's gross income in each of the following cases: a. I n the current year, Amos purchased an automobile for $25,000. As part of the transaction, Amos sold his business. In $50,000 for a covenant not to compet with his former business for five years. Amos received a $1,500 rebate from the manufacturer addition to the selling price of the stock, he received n agreement that he will not compete 0. c. Amos owned some land he held as an investment. As a result of a change in the oning rules, the property increased in value by $20,000 31. Al is a medical doctor who conducts his practice as a sole proprietor. Dur- Decisioa $19,000 was for services provided in 2016. At the end of 2017, Al had 000, all for services rendered in 2017. In addition, at the n advance payment from a health mainte- ing 2017, he received cash of $280,000 for medical services. Of the amount in 2018. Compute Al's gross

I need help with #29. Could someone please give me an explanation as to why as well.

I need help with #29. Could someone please give me an explanation as to why as well.