Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with 2A and 3A Sharkey's Fun Center contains a number of electronic games as well as a miniature golf course and various

i need help with 2A and 3A

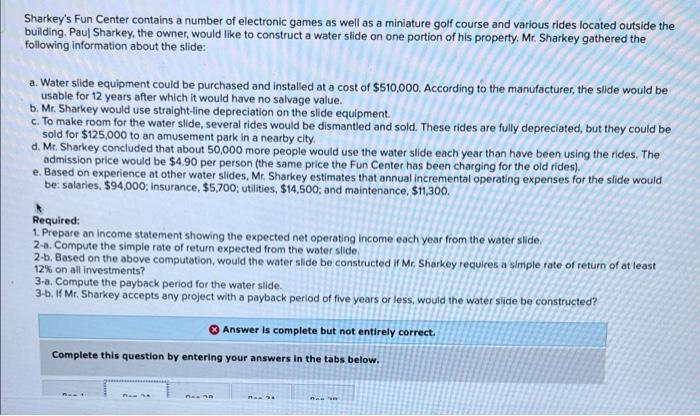

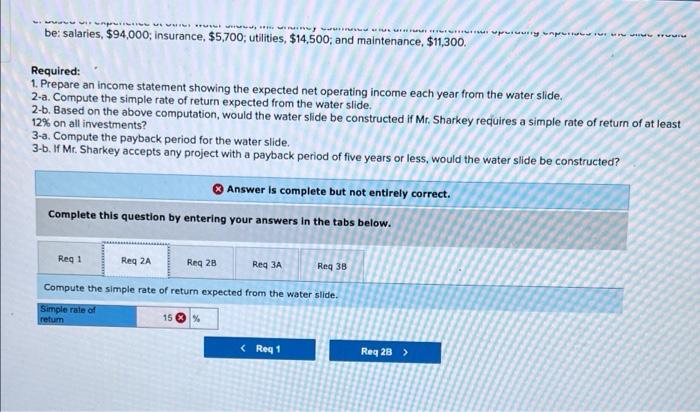

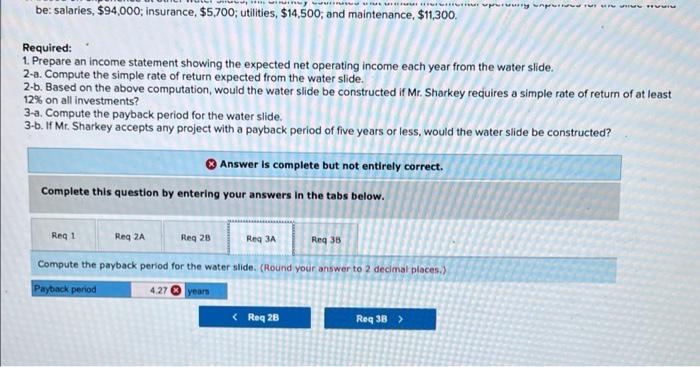

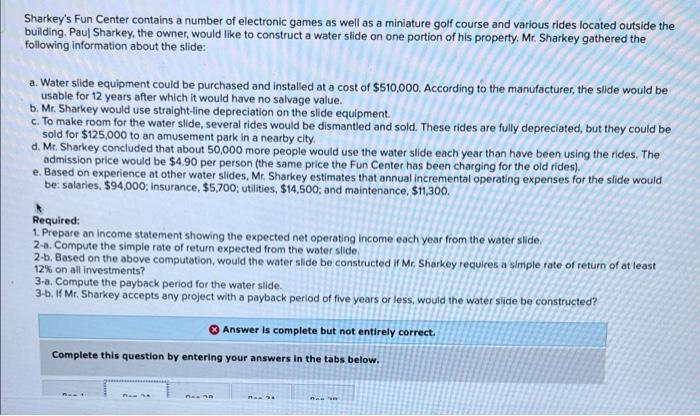

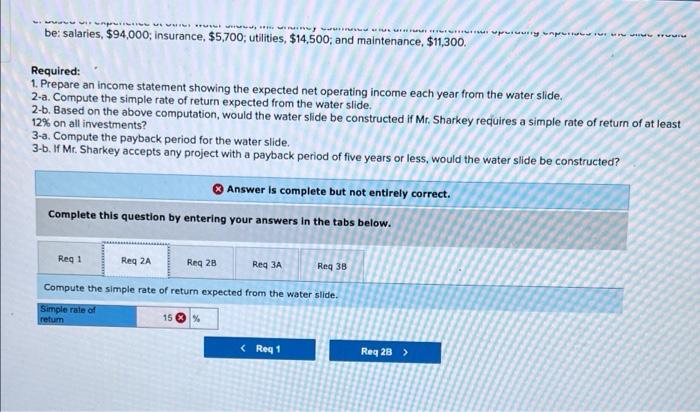

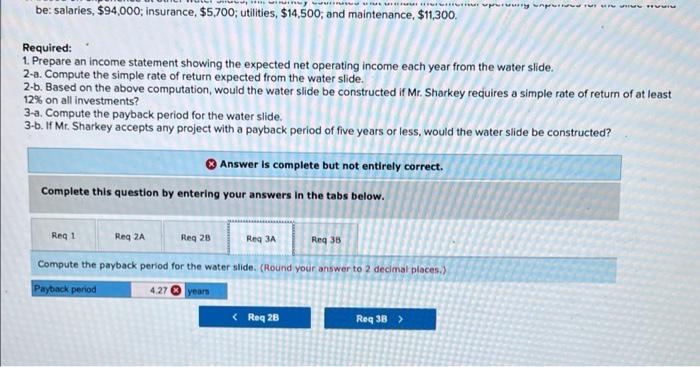

Sharkey's Fun Center contains a number of electronic games as well as a miniature golf course and various rides located outside the building, Paul Sharkey, the owner, would like to construct a water slide on one portion of his property, Mr. Sharkey gathered the following information about the slide: a. Water slide equipment could be purchased and installed at a cost of $510,000. According to the manufacturer, the slide would be usable for 12 years after which it would have no salvage value. b. Mr. Sharkey would use straight-line depreciation on the slide equipment c. To make room for the water slide, several rides would be dismantled and sold. These rides are fully depreciated, but they could be sold for $125,000 to an amusement park in a nearby city, d. Mr. Sharkey concluded that about 50,000 more people would use the water slide each year than have been using the rides. The admission price would be $4.90 per person (the same price the Fun Center has been charging for the old rides). e. Based on experience at other water slides, Mr. Sharkey estimates that annual incremental operating expenses for the slide would be: salaries. $94,000; insurance $5,700; utilities, $14,500; and maintenance, $11,300. Required: 1. Prepare an income statement showing the expected net operating income each year from the water slide. 2-a. Compute the simple rate of return expected from the water slide 2-b. Based on the above computation, would the water slide be constructed if Mr. Sharkey requires a simple rate of return of at least 12% on all investments? 3-a. Compute the payback period for the water slide. 3-b. If Mr. Sharkey accepts any project with a payback period of five years or less, would the water slide be constructed? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. nan be: salaries, $94,000; insurance, $5,700, utilities, $14,500; and maintenance, $11,300. Hurry Sur Required: 1. Prepare an income statement showing the expected net operating income each year from the water slide. 2-a. Compute the simple rate of return expected from the water slide. 2-b. Based on the above computation would the water slide be constructed if Mr. Sharkey requires a simple rate of return of at least 12% on all investments? 3-a. Compute the payback period for the water slide. 3-5. I Mr. Sharkey accepts any project with a payback period of five years or less, would the water slide be constructed? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 2B Req 3A Req 38 Compute the simple rate of return expected from the water slide. Simple rate of retum 15 % WE REI be: salaries, $94,000; insurance, $5,700; utilities, $14,500, and maintenance, $11,300. Required: 1. Prepare an income statement showing the expected net operating income each year from the water slide. 2-a. Compute the simple rate of return expected from the water slide. 2.b. Based on the above computation, would the water slide be constructed if Mr. Sharkey requires a simple rate of return of at least 12% on all investments? 3-a. Compute the payback period for the water slide. 3-5. If Mr. Sharkey accepts any project with a payback period of five years or less, would the water slide be constructed? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 28 Reg 3A Reg 35 Compute the payback period for the water slide. (Round your answer to 2 decimal places.) Payback period 4.27 year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started