Answered step by step

Verified Expert Solution

Question

1 Approved Answer

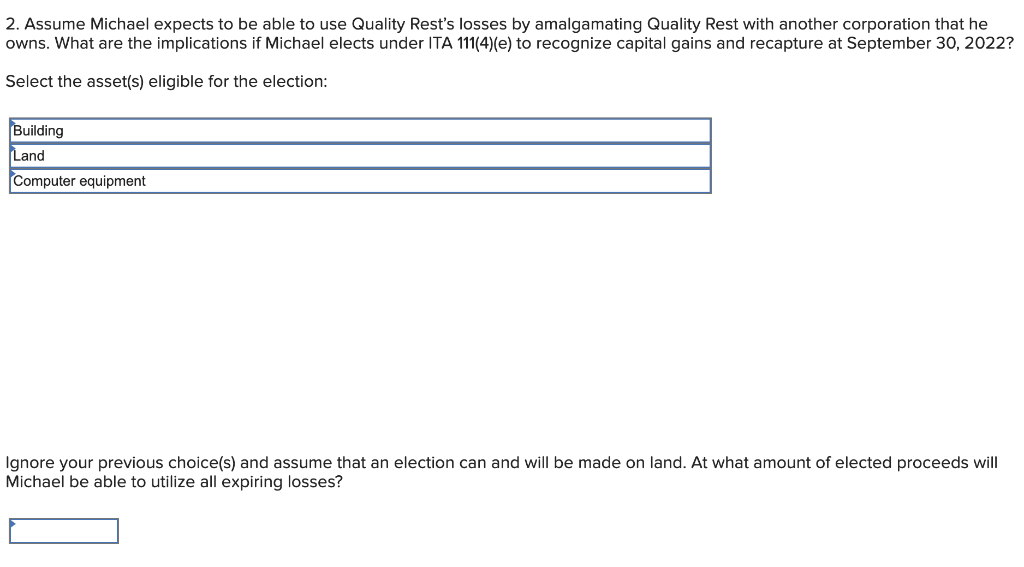

I need help with 2(b) - Ignore your previous choice(s) and assume that an election can and will be made on land. At what amount

I need help with 2(b) - "Ignore your previous choice(s) and assume that an election can and will be made on land. At what amount of elected proceeds will Michael be able to utilize all expiring losses?"

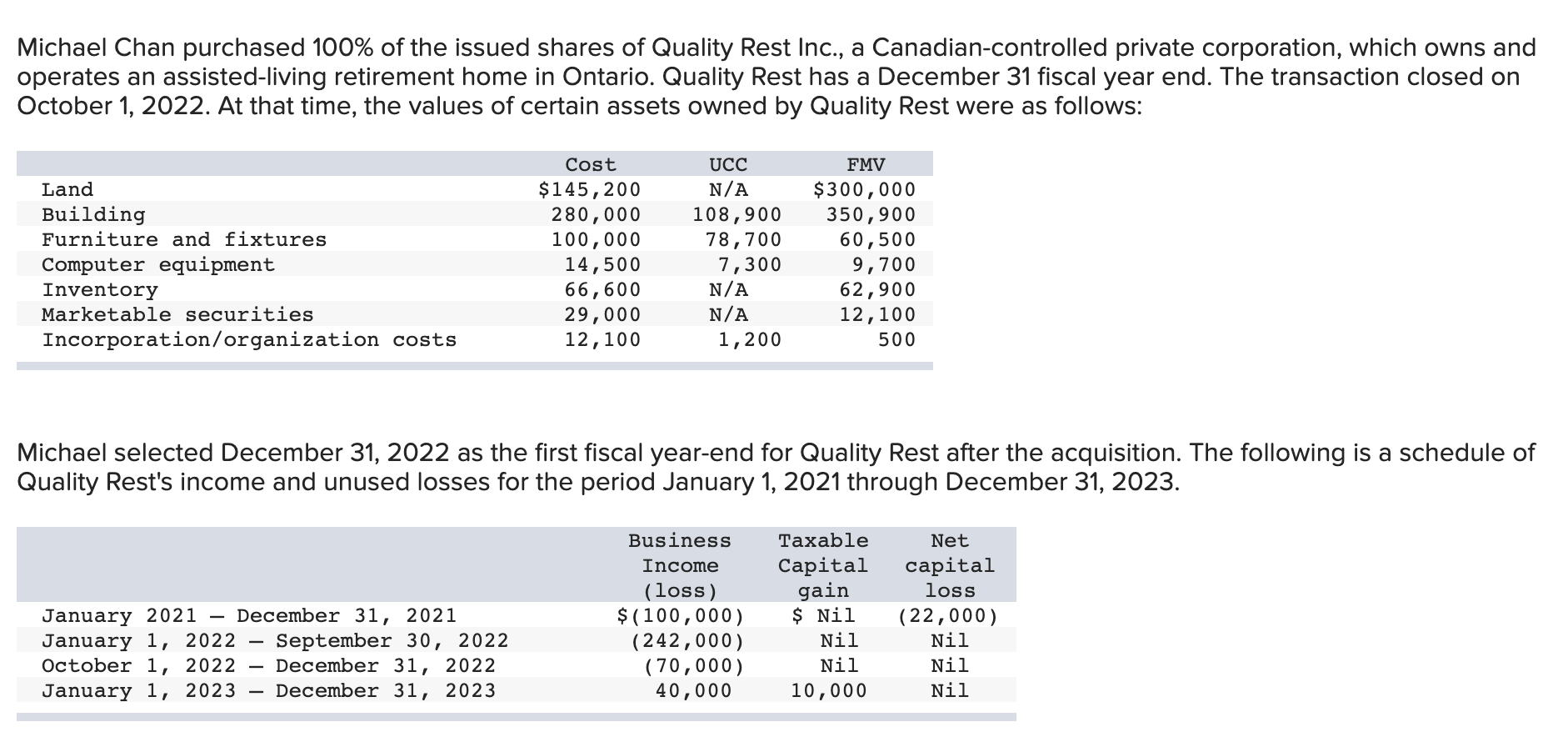

Michael Chan purchased 100% of the issued shares of Quality Rest Inc., a Canadian-controlled private corporation, which owns and operates an assisted-living retirement home in Ontario. Quality Rest has a December 31 fiscal year end. The transaction closed on October 1, 2022. At that time, the values of certain assets owned by Quality Rest were as follows: Michael selected December 31, 2022 as the first fiscal year-end for Quality Rest after the acquisition. The following is a schedule of Quality Rest's income and unused losses for the period January 1, 2021 through December 31, 2023. 2. Assume Michael expects to be able to use Quality Rest's losses by amalgamating Quality Rest with another corporation that he owns. What are the implications if Michael elects under ITA 111(4)(e) to recognize capital gains and recapture at September 30, 2022? Select the asset(s) eligible for the election: Ignore your previous choice(s) and assume that an election can and will be made on land. At what amount of elected proceeds will Michael be able to utilize all expiring lossesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started