Answered step by step

Verified Expert Solution

Question

1 Approved Answer

***I need help with #3 please*** Thanks :) Amy is single and 25 years old. She graduated two years ago and has been working full

***I need help with #3 please*** Thanks :)

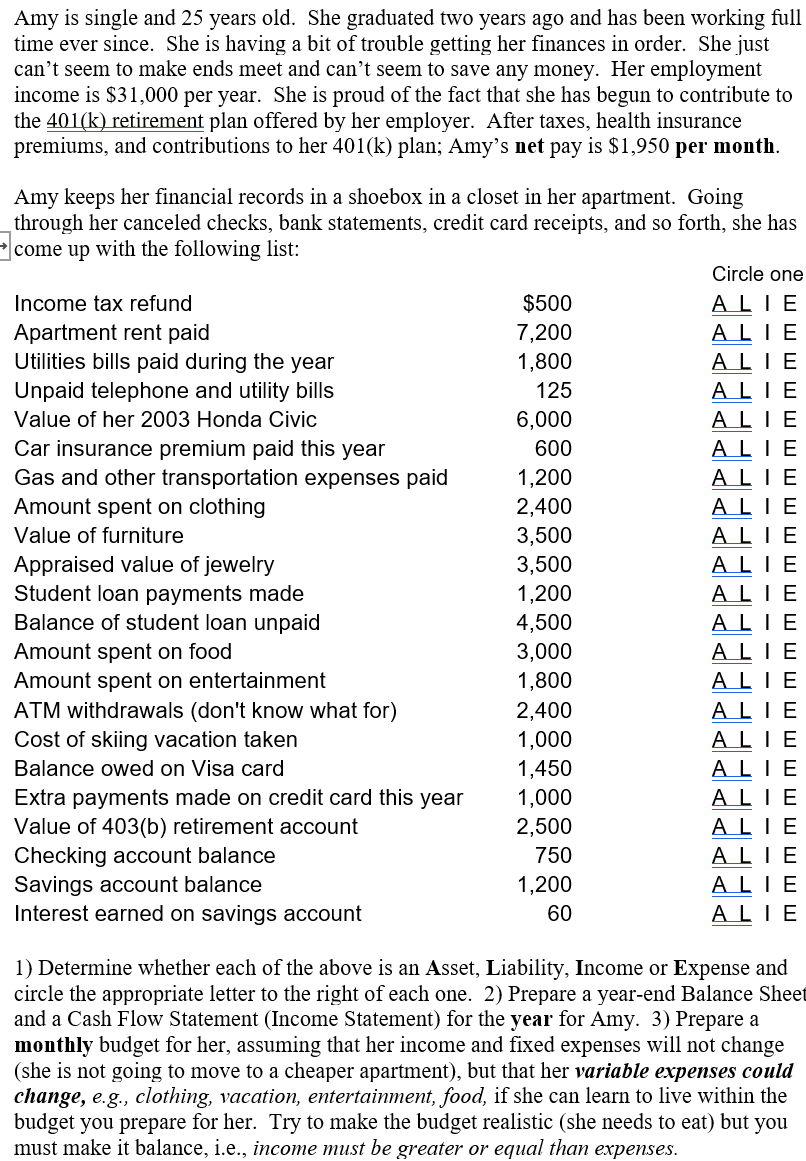

Amy is single and 25 years old. She graduated two years ago and has been working full time ever since. She is having a bit of trouble getting her finances in order. She just can't seem to make ends meet and can't seem to save any money. Her employment income is $31,000 per year. She is proud of the fact that she has begun to contribute to the 401(k) retirement plan offered by her employer. After taxes, health insurance premiums, and contributions to her 401(k) plan; Amy's net pay is $1,950 per month. Amy keeps her financial records in a shoebox in a closet in her apartment. Going _through her canceled checks, bank statements, credit card receipts, and so forth, she has come up with the following list: Circle one Income tax refund $500 ALIE Apartment rent paid 7,200 ALIE Utilities bills paid during the year 1,800 ALIE Unpaid telephone and utility bills 125 ALIE Value of her 2003 Honda Civic 6,000 ALIE Car insurance premium paid this year 600 ALIE Gas and other transportation expenses paid 1,200 ALIE Amount spent on clothing 2,400 ALIE Value of furniture 3,500 ALIE Appraised value of jewelry 3,500 ALIE Student loan payments made 1,200 ALIE Balance of student loan unpaid 4,500 ALIE Amount spent on food 3,000 ALIE Amount spent on entertainment 1,800 ALIE ATM withdrawals (don't know what for) 2,400 ALIE Cost of skiing vacation taken 1,000 ALIE Balance owed on Visa card 1,450 ALIE Extra payments made on credit card this year 1,000 ALIE Value of 403(b) retirement account 2,500 ALIE Checking account balance 750 ALIE Savings account balance 1,200 ALIE Interest earned on savings account ALIE 60 1) Determine whether each of the above is an Asset, Liability, Income or Expense and circle the appropriate letter to the right of each one. 2) Prepare a year-end Balance Sheet and a Cash Flow Statement (Income Statement) for the year for Amy. 3) Prepare a monthly budget for her, assuming that her income and fixed expenses will not change (she is not going to move to a cheaper apartment), but that her variable expenses could change, e.g., clothing, vacation, entertainment, food, if she can learn to live within the budget you prepare for her. Try to make the budget realistic (she needs to eat) but you must make it balance, i.e., income must be greater or equal than expensesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started