Answered step by step

Verified Expert Solution

Question

1 Approved Answer

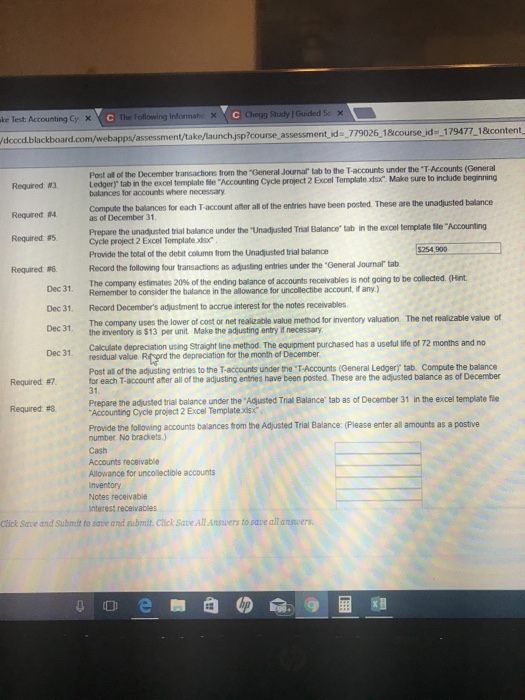

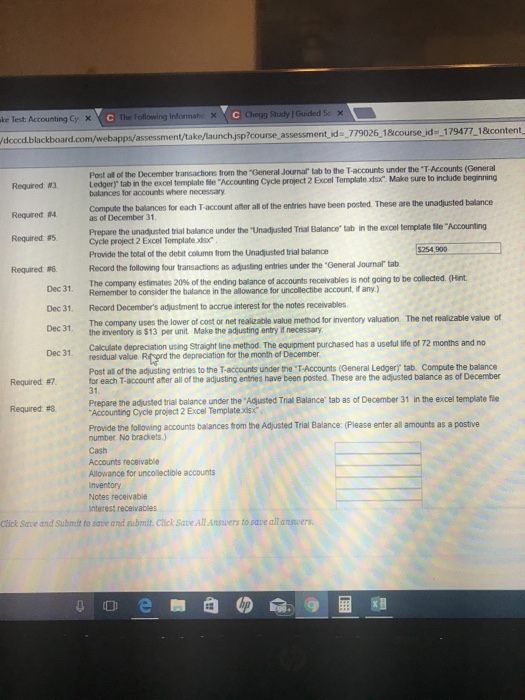

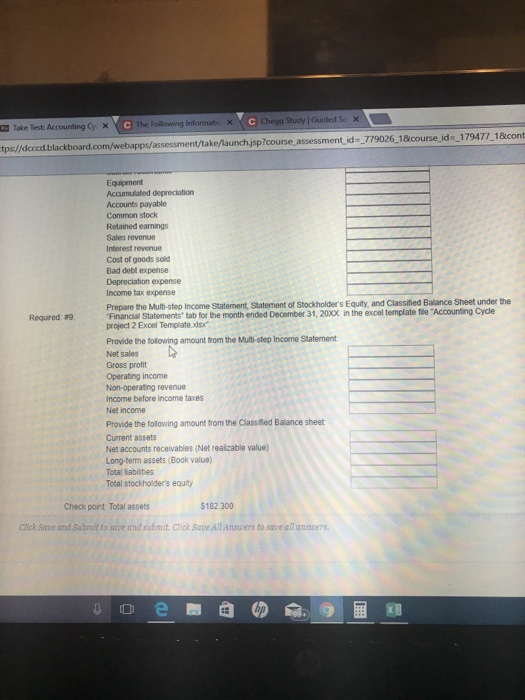

I need help with #6 preferably on how to do dec 31 transactions The Following l N e Chegg Study I Guided Sc x Lake

I need help with #6 preferably on how to do dec 31 transactions

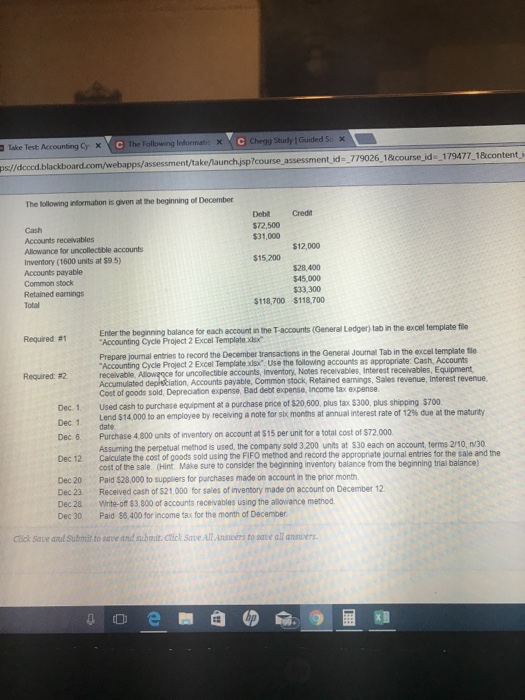

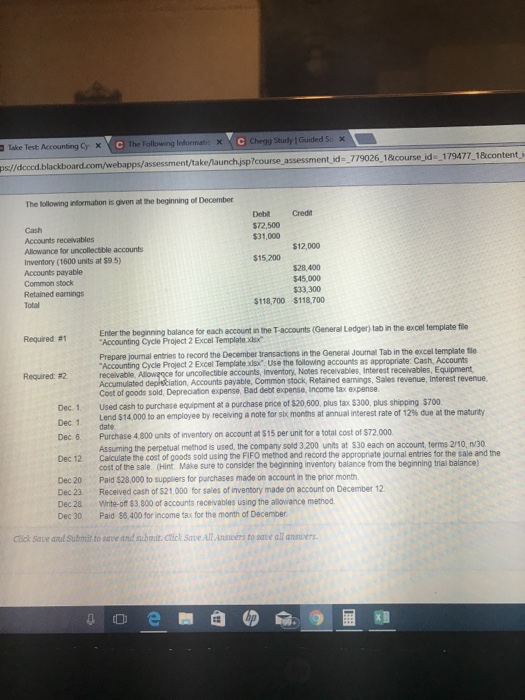

The Following l N e Chegg Study I Guided Sc x Lake Test Accounting Cy 179477.18xcontent ps//dcccd.b pps/assessment take/aunchjsp'course assessment id- 779026, 18course jd The folowing information is given at the beginning of December Debit Cred $72,500 $31,000 Cash Accounts receivables Allowance for uncollectible accounts Inventory (1600 units at $9 5) Accounts payable Common stock Retained earnings Total $12,000 $28,400 $45,000 533,300 $118,700 $118,700 Enter the beginning balance for each account in the T-accounts (General Ledger) tab in the excel template fie Accounting Cycle Project 2 Excel Template xilsx Required #1 Prepare journal entries to record the December transactions in the General Journal Tab in the excel template tle Accounting Cycle Project 2 Excel Template xisx Use the following accounts as appropriate: Cash, Accounts receivable, Allowence Accumulated depiciation, Accounts payable Cost of goods sold, Depreciation expense, Bad deot expense, income tax expense for uncollectible accounts, tion, Accounts payable, Common stock, Retained eamings, Sales revenue, Interest revenue Inventory, Notes receivables, Interest receivables, Equipment Regret #2 Dec 1 Used cash to purchase equipment at a purchase price of $20,600, plus tax $300, plus shipping $700 Dec 1 date Dec 6. Purchase 4,800 units of inventory on account at $15 per unit for a total cost of $72.000 Lend S 14,000 to an employee by receiving a note for six months at annual interest rate of 12% due at the maturity Dec 12 Calculate the cost of goods sold using the FIFO method and record the appropriate journal entries for the sale and the cost of the sale. (Hint Make sure to consider the beginning inventory balance from the beginning trial balance) Dec 20 Paid $28,000 to suppliers for purchases made on account in the prior month Dec 23 Received cash of $21.000 for sales of inventory made on account on December 12 Dec 2a. White-off $3.800 of accounts receivables using the aiovance method. Dec 30 Paid $6,400 for income tax for the month of December Click Save and Submit to save and submit. Chick Save All Ansivers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started