i need help with all of the questions please

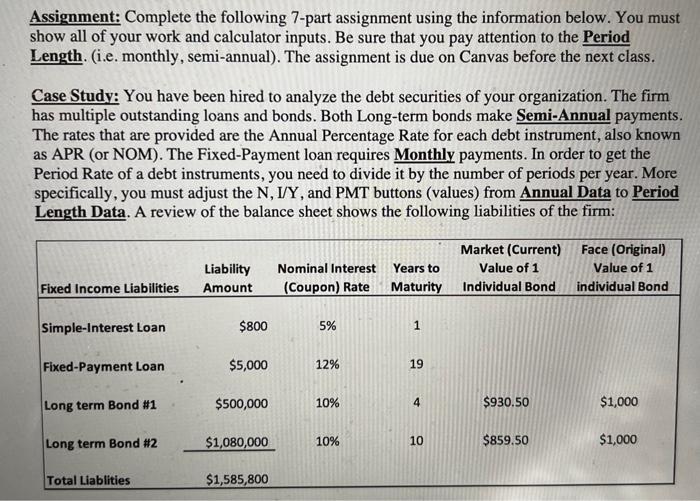

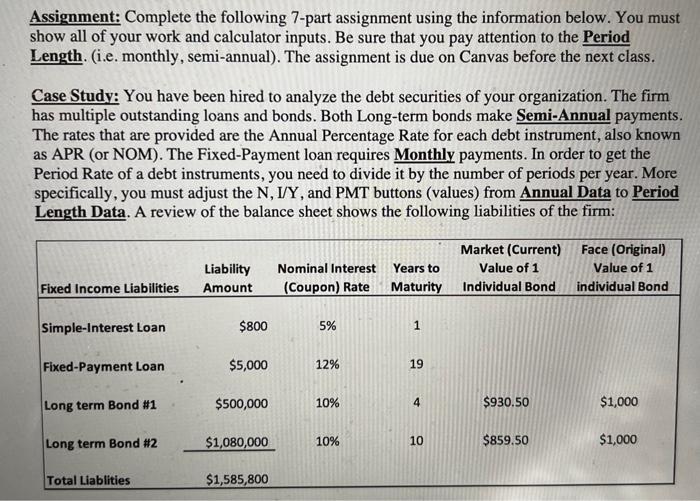

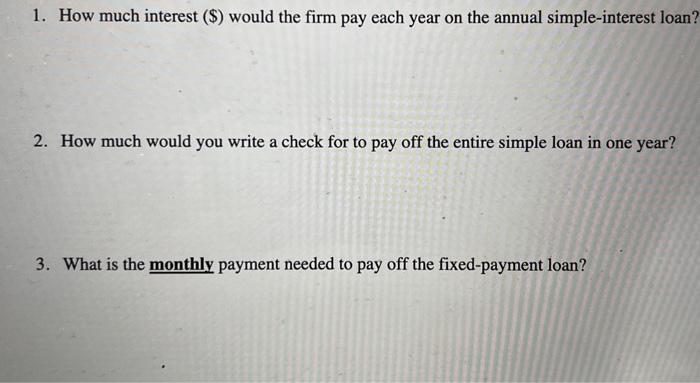

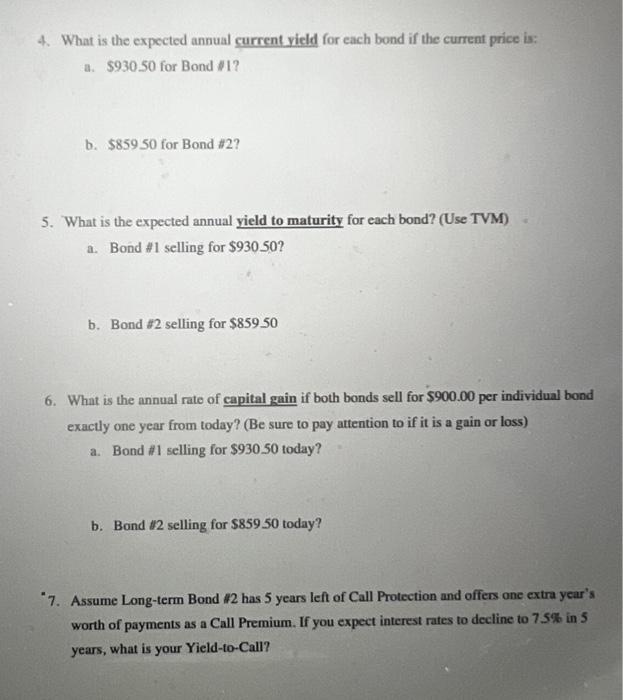

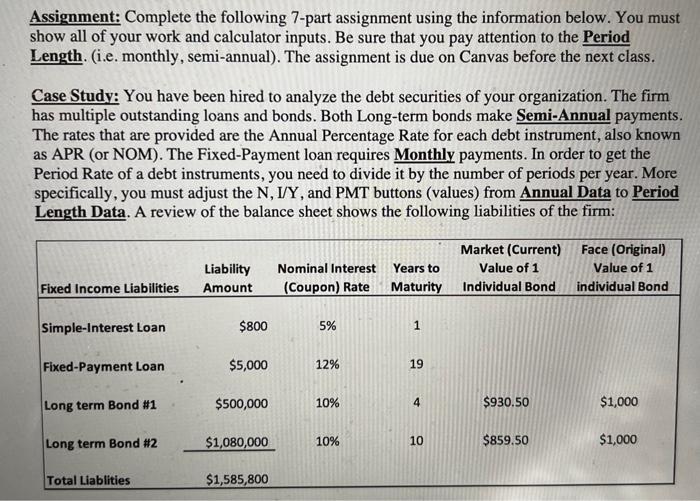

Assignment: Complete the following 7-part assignment using the information below. You must show all of your work and calculator inputs. Be sure that you pay attention to the Period Length. (i.e. monthly, semi-annual). The assignment is due on Canvas before the next class. Case Study: You have been hired to analyze the debt securities of your organization. The firm has multiple outstanding loans and bonds. Both Long-term bonds make Semi-Annual payments. The rates that are provided are the Annual Percentage Rate for each debt instrument, also known as APR (or NOM). The Fixed-Payment loan requires Monthly payments. In order to get the Period Rate of a debt instruments, you need to divide it by the number of periods per year. More specifically, you must adjust the N, I/Y, and PMT buttons (values) from Annual Data to Period Length Data. A review of the balance sheet shows the following liabilities of the firm: 1. How much interest ($) would the firm pay each year on the annual simple-interest loan? 2. How much would you write a check for to pay off the entire simple loan in one year? 3. What is the monthly payment needed to pay off the fixed-payment loan? 4. What is the expected annual current vield for each bond if the current price is: a. $930.50 for Bond $1 ? b. $85950 for Bond #2? 5. What is the expected annual yield to maturity for each bond? (Use TVM) a. Bond #1 selling for $930.50 ? b. Bond #2 selling for $859.50 6. What is the annual rate of capital gain if both bonds sell for $900.00 per individual bond exactly one year from today? (Be sure to pay attention to if it is a gain or loss) a. Bond #1 selling for $930.50 today? b. Bond 2 selling for $85950 today? "7. Assume Long-term Bond $2 has 5 years left of Call Protection and offers one extra year's worth of payments as a Call Premium. If you expect interest rates to decline to 7.5% in 5 years, what is your Yield-to-Call? Assignment: Complete the following 7-part assignment using the information below. You must show all of your work and calculator inputs. Be sure that you pay attention to the Period Length. (i.e. monthly, semi-annual). The assignment is due on Canvas before the next class. Case Study: You have been hired to analyze the debt securities of your organization. The firm has multiple outstanding loans and bonds. Both Long-term bonds make Semi-Annual payments. The rates that are provided are the Annual Percentage Rate for each debt instrument, also known as APR (or NOM). The Fixed-Payment loan requires Monthly payments. In order to get the Period Rate of a debt instruments, you need to divide it by the number of periods per year. More specifically, you must adjust the N, I/Y, and PMT buttons (values) from Annual Data to Period Length Data. A review of the balance sheet shows the following liabilities of the firm: 1. How much interest ($) would the firm pay each year on the annual simple-interest loan? 2. How much would you write a check for to pay off the entire simple loan in one year? 3. What is the monthly payment needed to pay off the fixed-payment loan? 4. What is the expected annual current vield for each bond if the current price is: a. $930.50 for Bond $1 ? b. $85950 for Bond #2? 5. What is the expected annual yield to maturity for each bond? (Use TVM) a. Bond #1 selling for $930.50 ? b. Bond #2 selling for $859.50 6. What is the annual rate of capital gain if both bonds sell for $900.00 per individual bond exactly one year from today? (Be sure to pay attention to if it is a gain or loss) a. Bond #1 selling for $930.50 today? b. Bond 2 selling for $85950 today? "7. Assume Long-term Bond $2 has 5 years left of Call Protection and offers one extra year's worth of payments as a Call Premium. If you expect interest rates to decline to 7.5% in 5 years, what is your Yield-to-Call