I need help with all these questions. Thank you

I need help with all these questions. Thank you

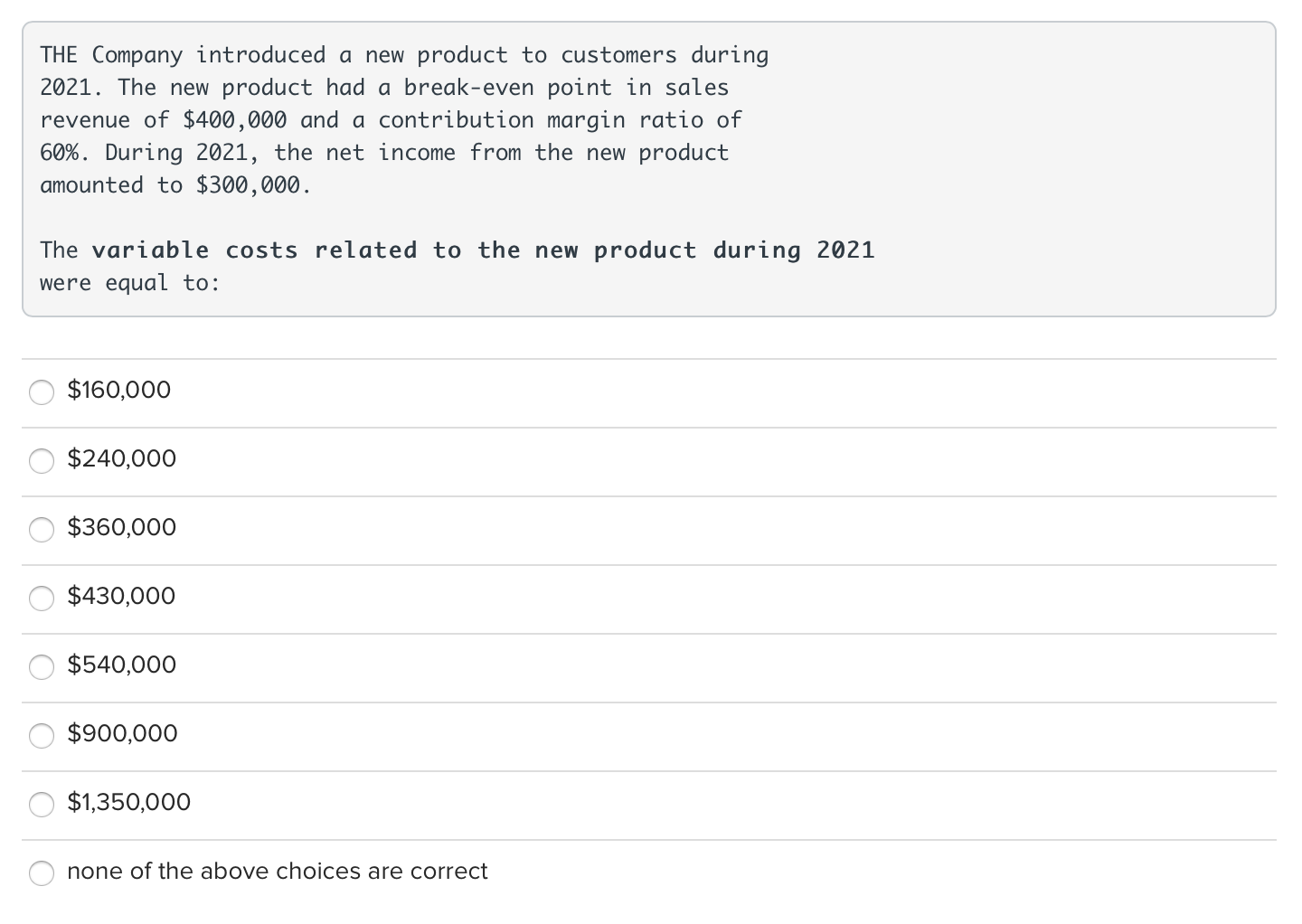

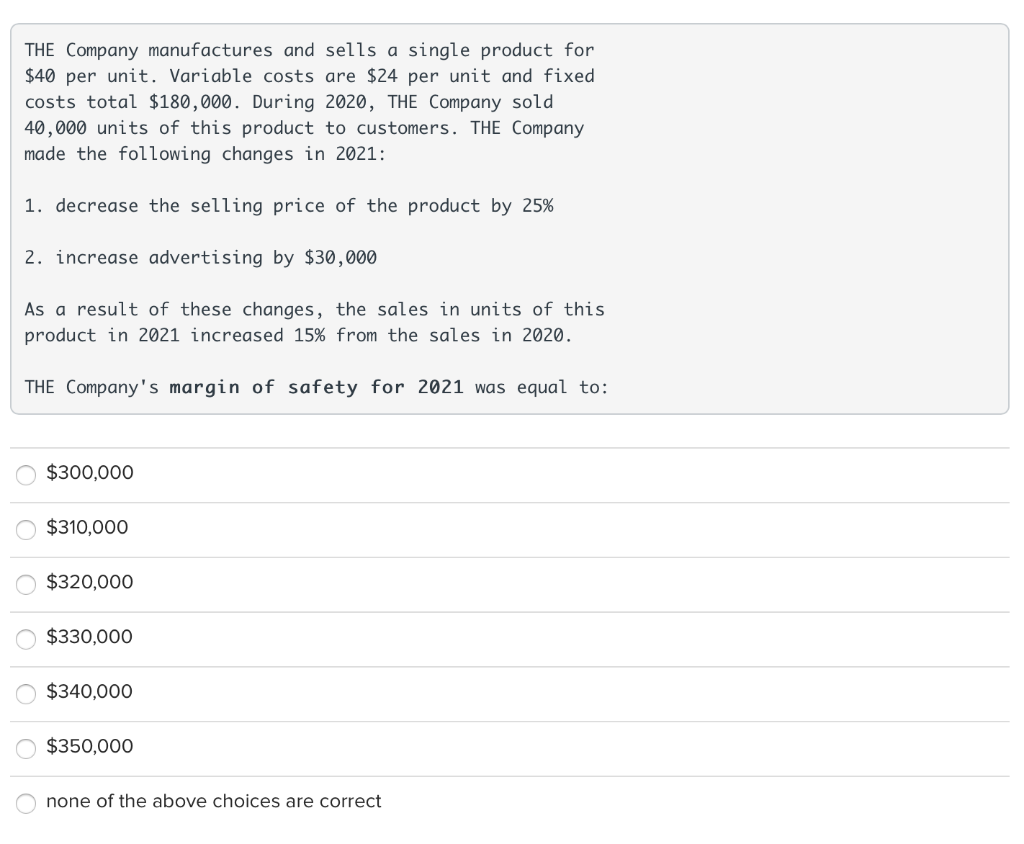

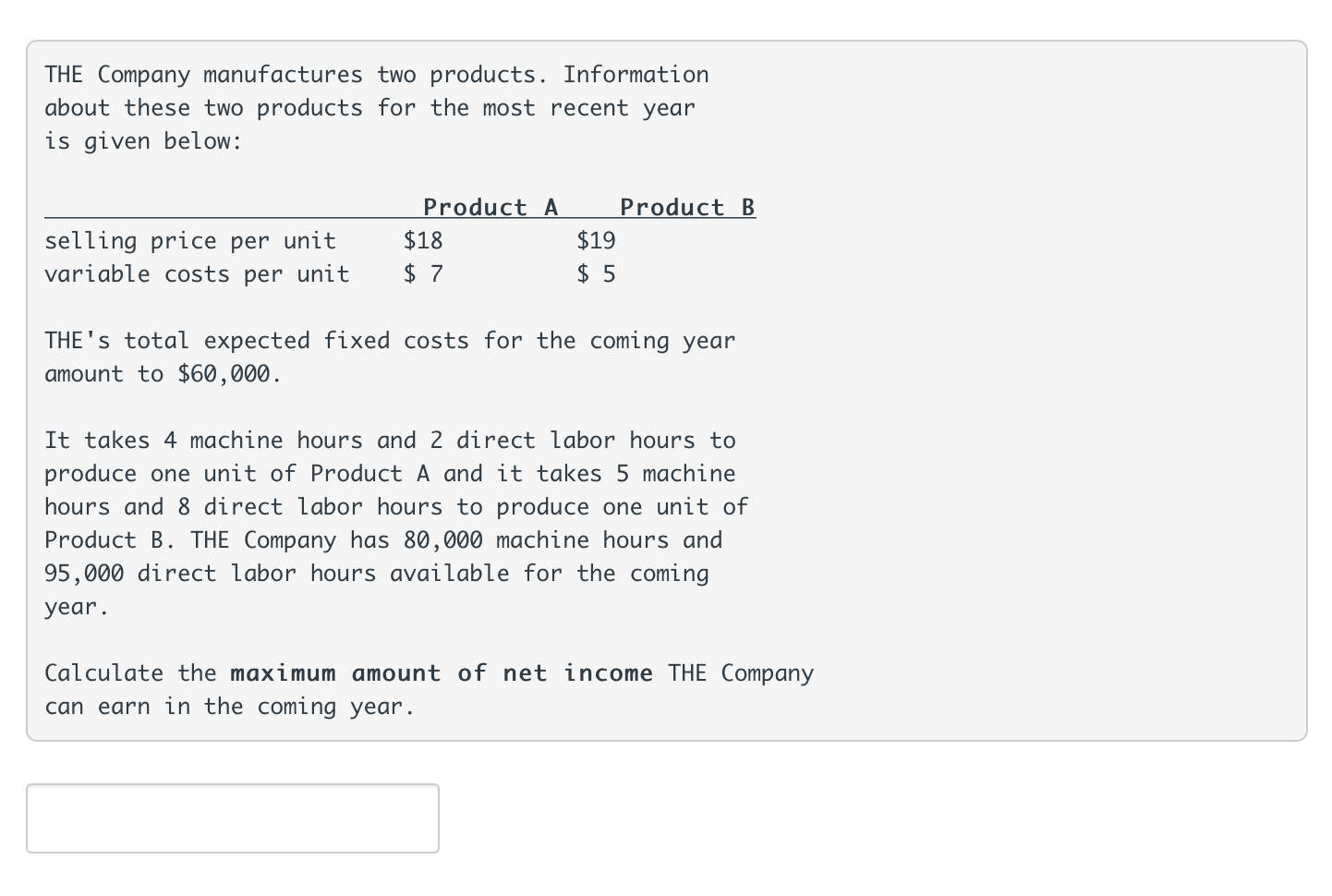

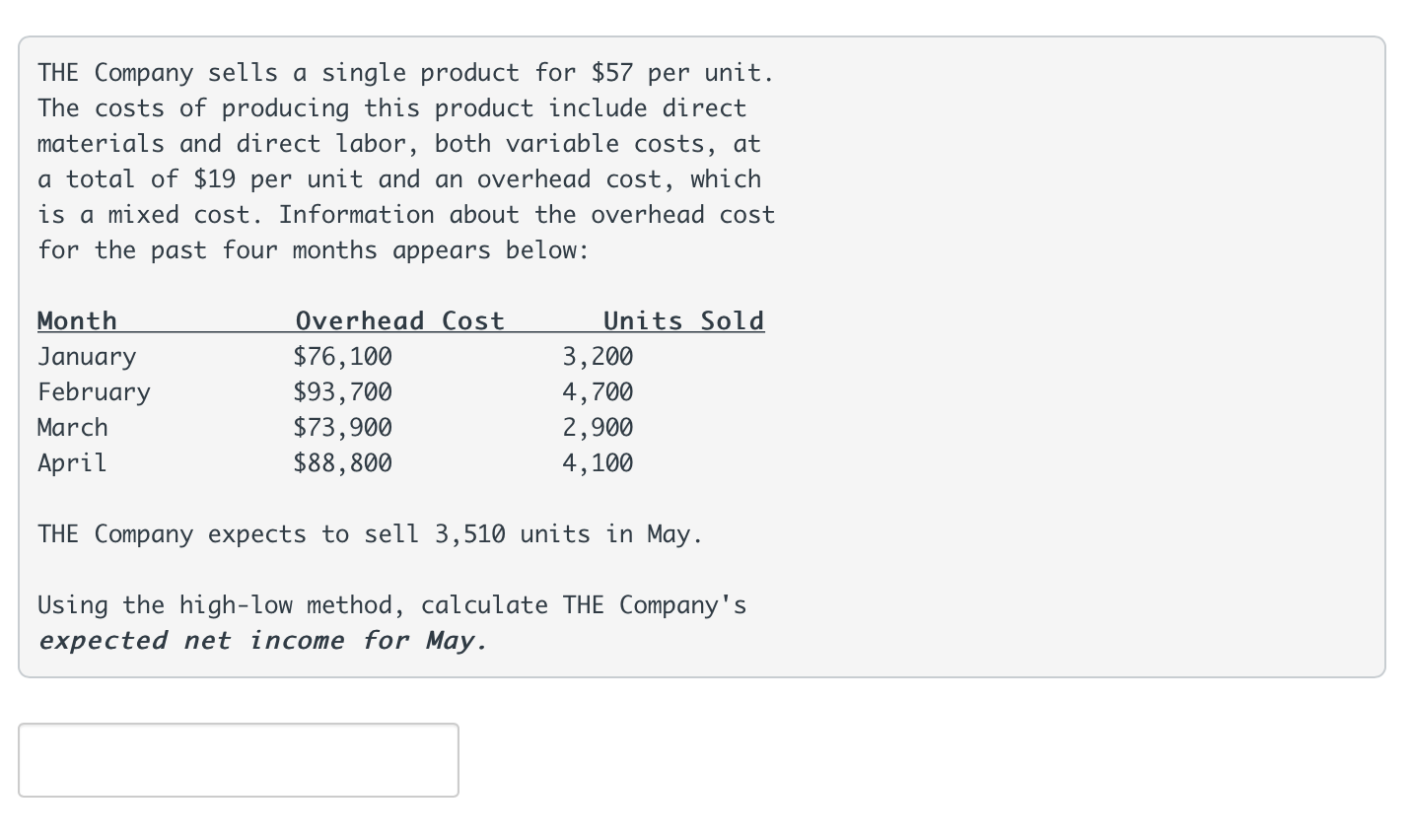

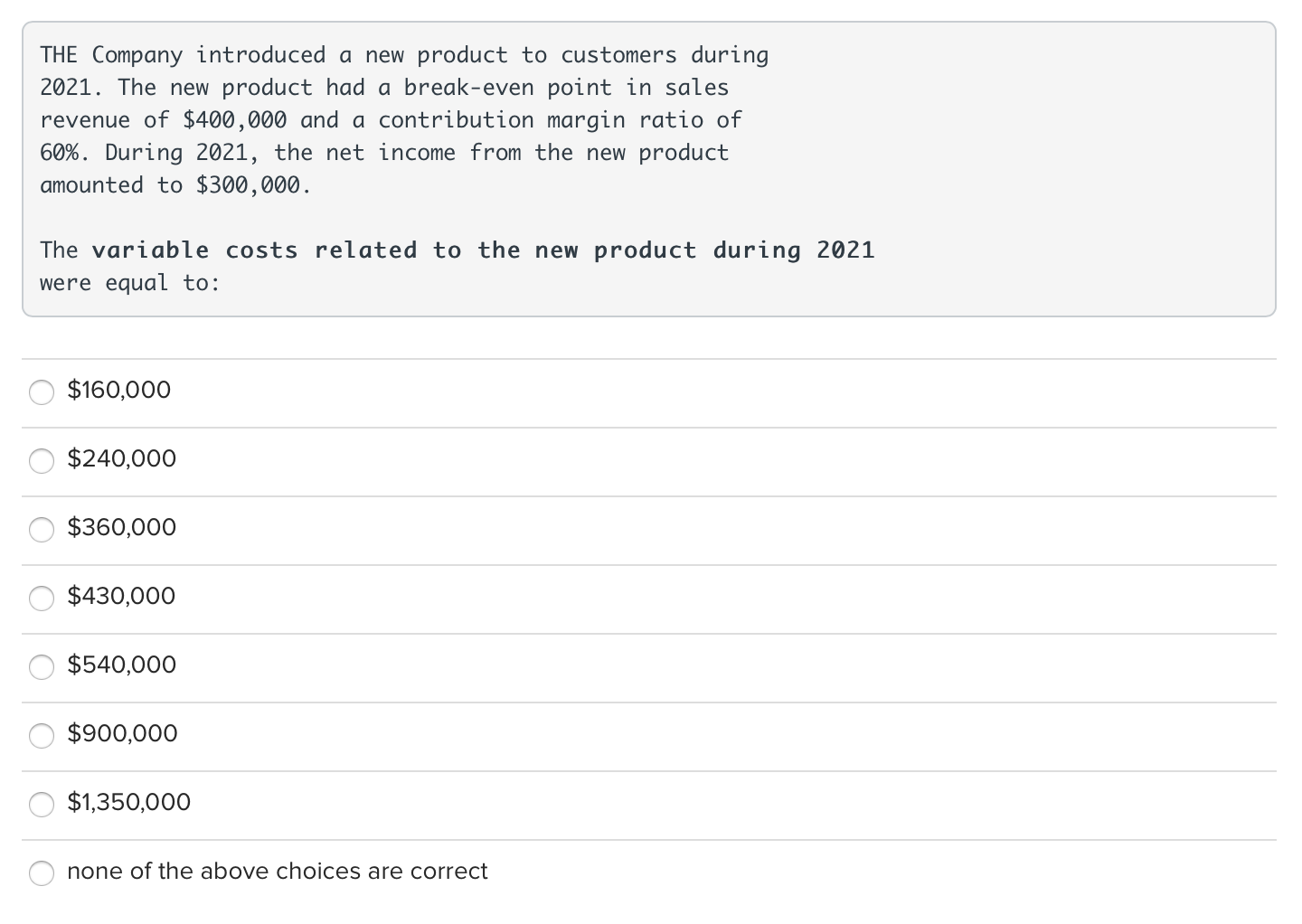

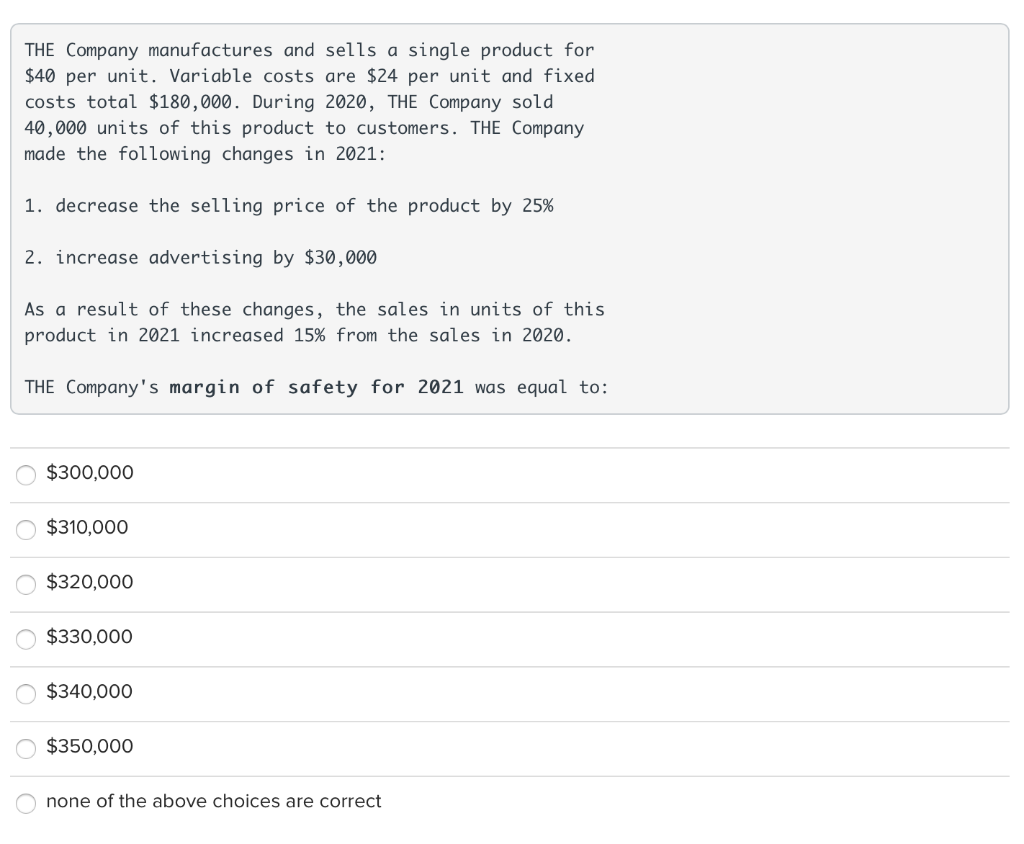

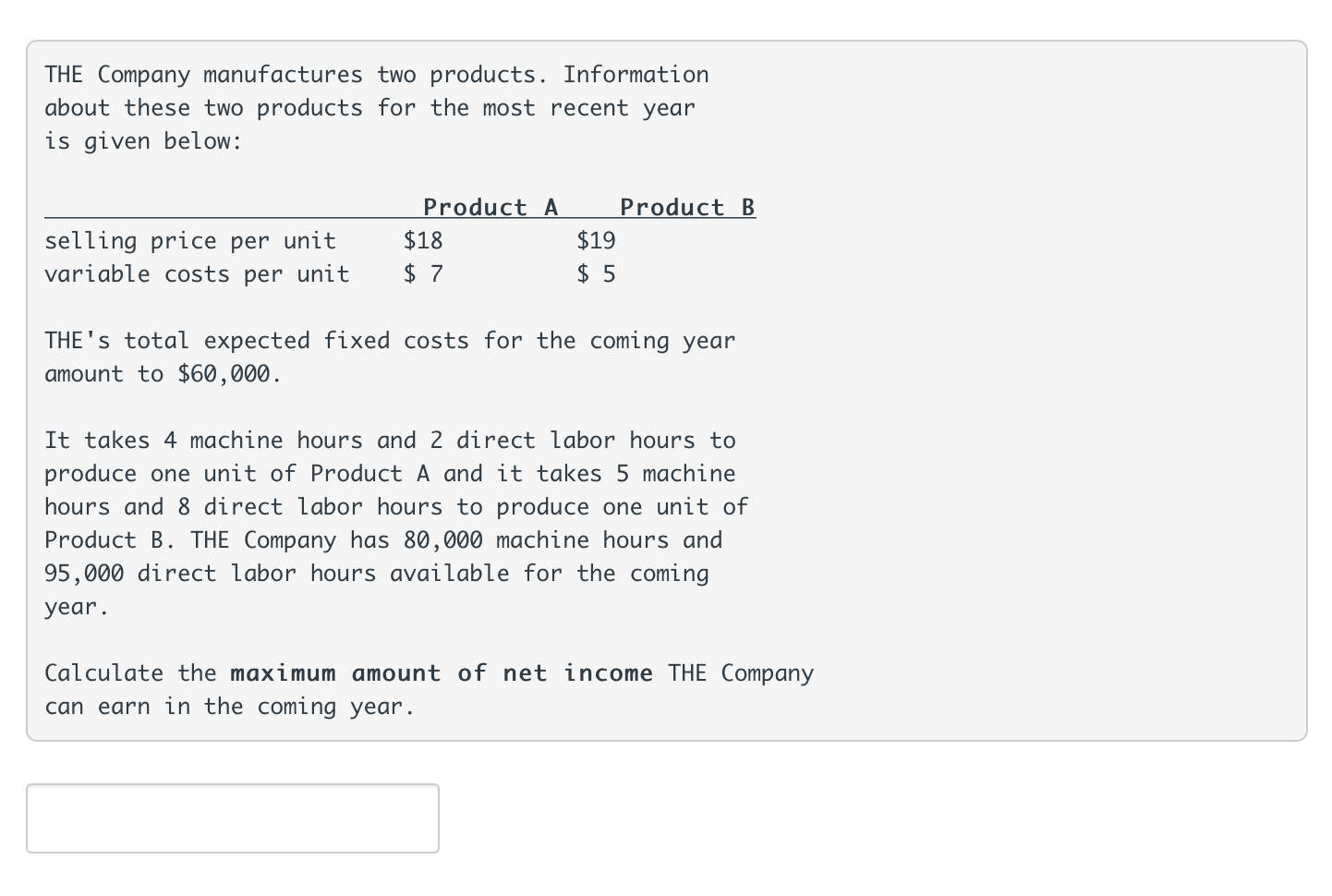

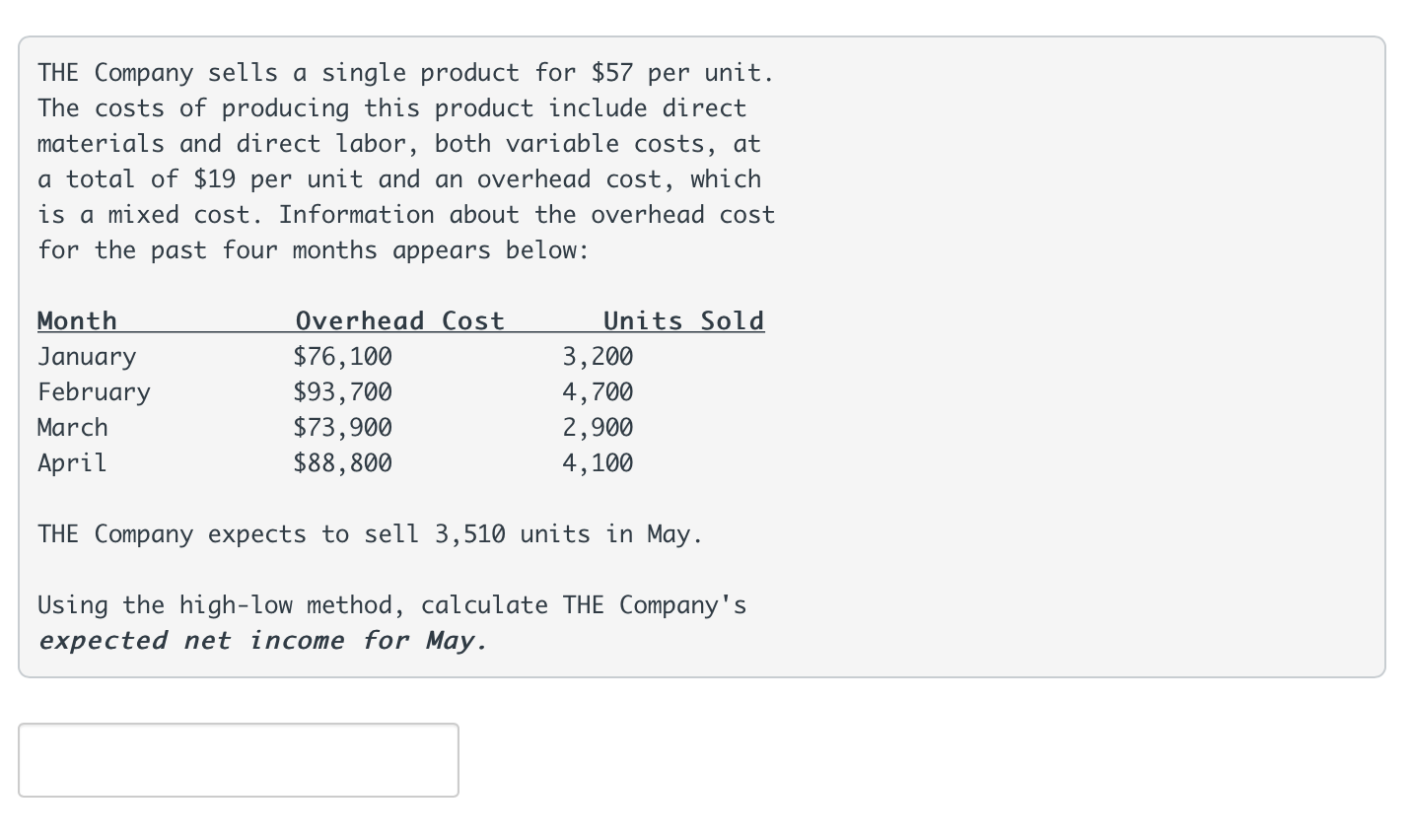

THE Company introduced a new product to customers during 2021. The new product had a break-even point in sales revenue of $400,000 and a contribution margin ratio of 60%. During 2021, the net income from the new product amounted to $300,000. The variable costs related to the new product during 2021 were equal to: $160,000 $240,000 $360,000 $430,000 $540,000 $900,000 $1,350,000 none of the above choices are correct THE Company manufactures and sells a single product for $40 per unit. Variable costs are $24 per unit and fixed costs total $180,000. During 2020, THE Company sold 40,000 units of this product to customers. THE Company made the following changes in 2021: 1. decrease the selling price of the product by 25% 2. increase advertising by $30,000 As a result of these changes, the sales in units of this product in 2021 increased 15% from the sales in 2020. THE Company's margin of safety for 2021 was equal to: $300,000 $310,000 $320,000 $330,000 $340,000 $350,000 none of the above choices are correct THE Company manufactures two products. Information about these two products for the most recent year is given below: selling price per unit variable costs per unit Product A $18 $ 7 Product B $19 $ 5 THE's total expected fixed costs for the coming year amount to $60,000. It takes 4 machine hours and 2 direct labor hours to produce one unit of Product A and it takes 5 machine hours and 8 direct labor hours to produce one unit of Product B. THE Company has 80,000 machine hours and 95,000 direct labor hours available for the coming year. Calculate the maximum amount of net income THE Company can earn in the coming year. THE Company sells a single product for $57 per unit. The costs of producing this product include direct materials and direct labor, both variable costs, at a total of $19 per unit and an overhead cost, which is a mixed cost. Information about the overhead cost for the past four months appears below: Month January February March April Overhead Cost $76,100 $93,700 $73,900 $88,800 Units Sold 3,200 4,700 2,900 4,100 THE Company expects to sell 3,510 units in May. Using the high-low method, calculate THE Company's expected net income for May

I need help with all these questions. Thank you

I need help with all these questions. Thank you