Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with an cash flow statment and a statement of owners equity please! i have the balance sheet and an income statment. what

i need help with an cash flow statment and a statement of owners equity please! i have the balance sheet and an income statment.

what else can i give to help? here is all the info that i put into a balance sheet and an income statment . and i just need help with question #4. which the excel files are the income statment and the balance sheet. thank you for your help!

what more statments do you need? i have all that is given to me.

here is all the info that i used for the balance sheet. sorry i did it wrong.

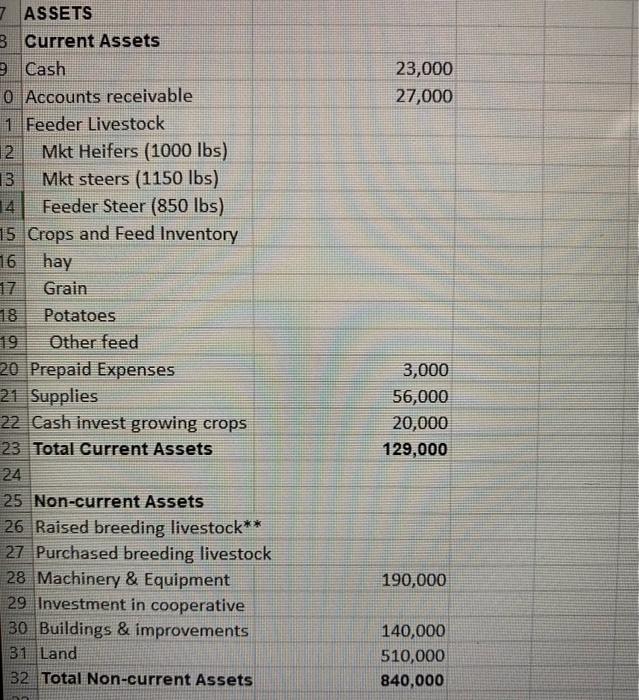

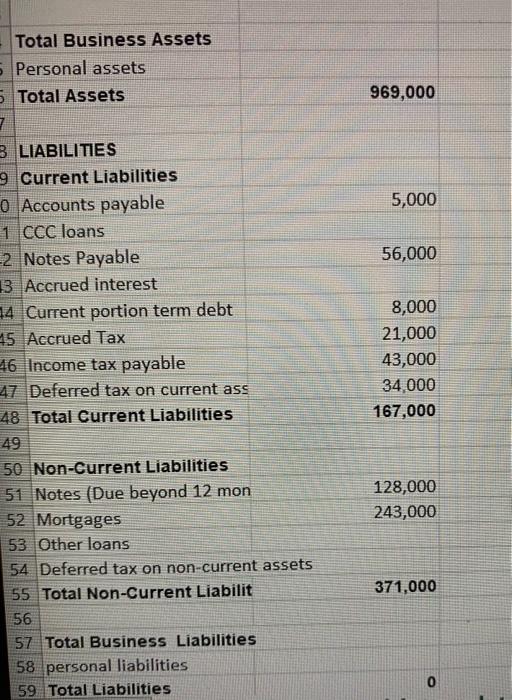

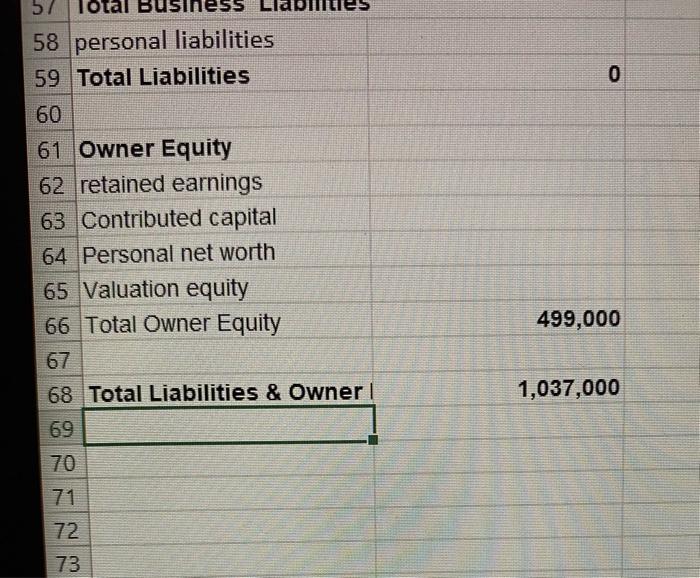

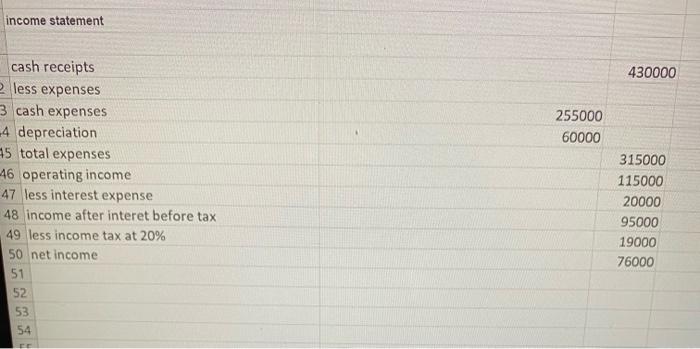

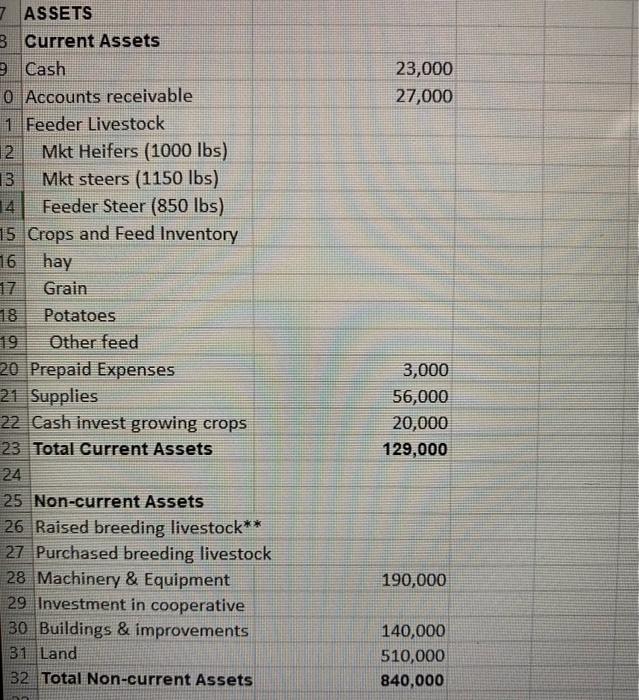

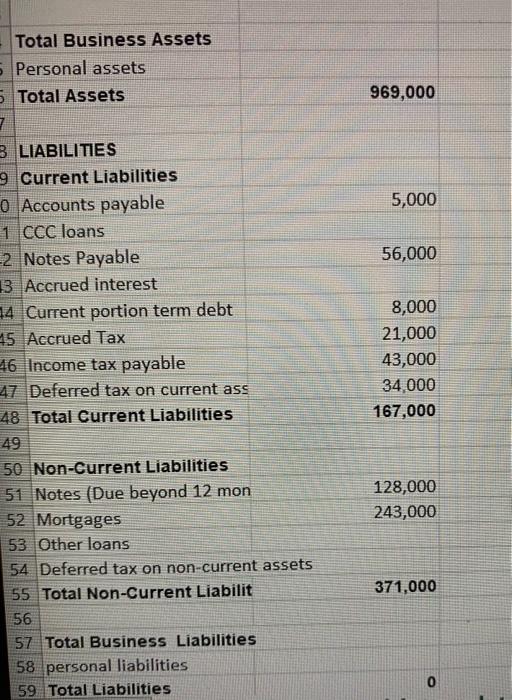

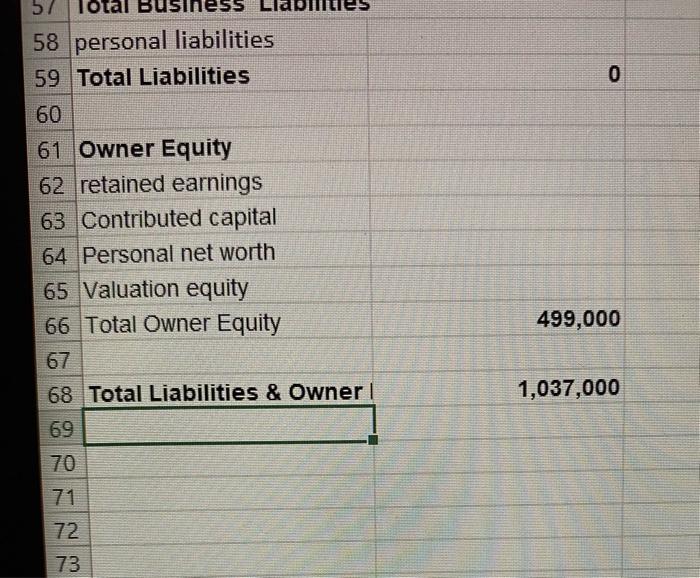

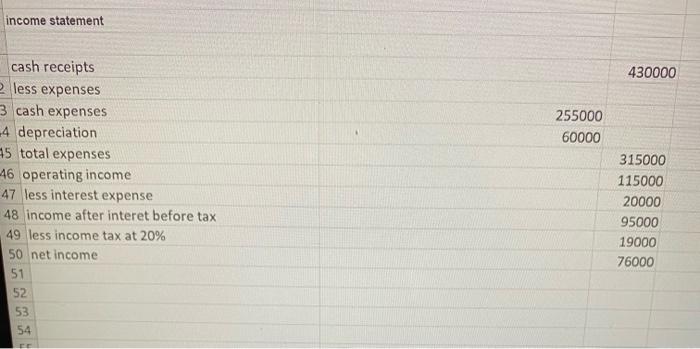

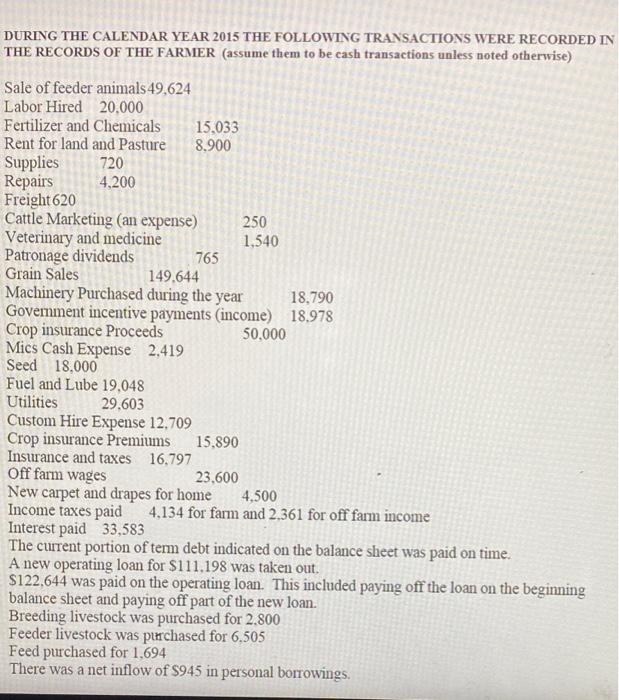

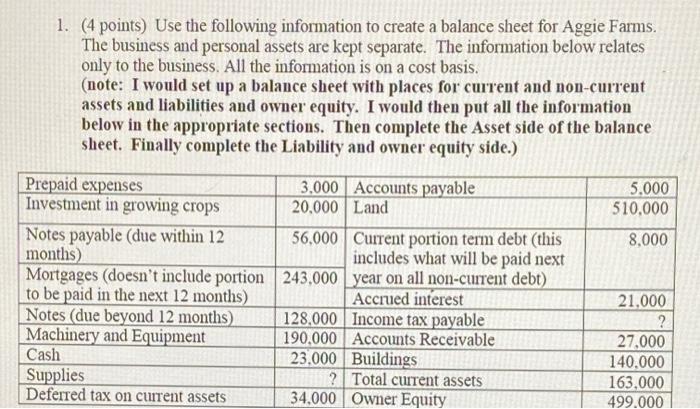

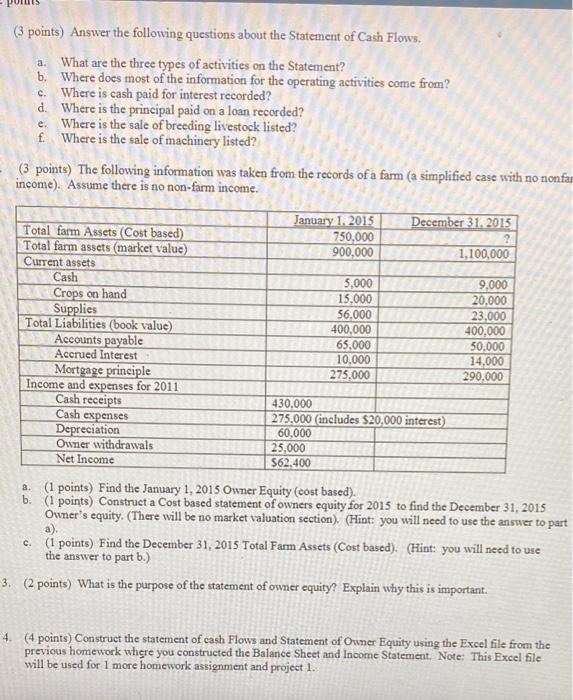

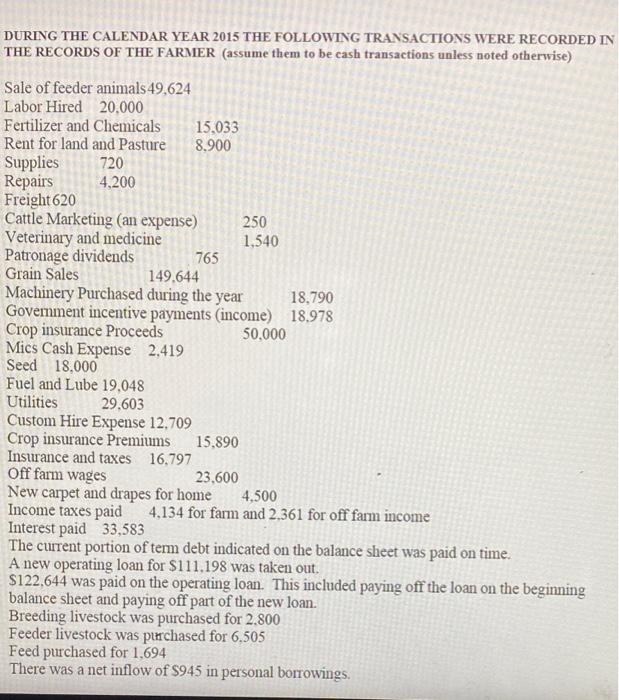

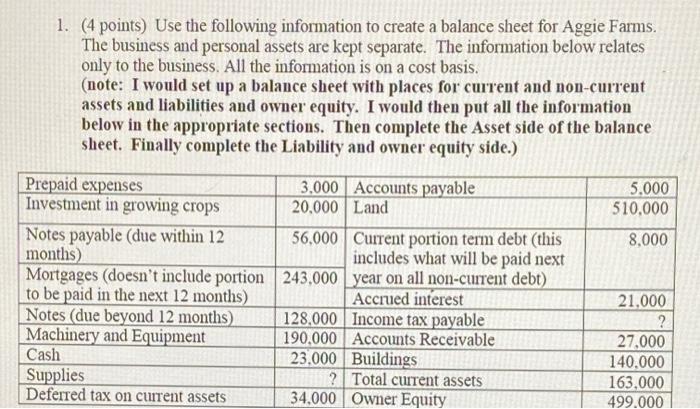

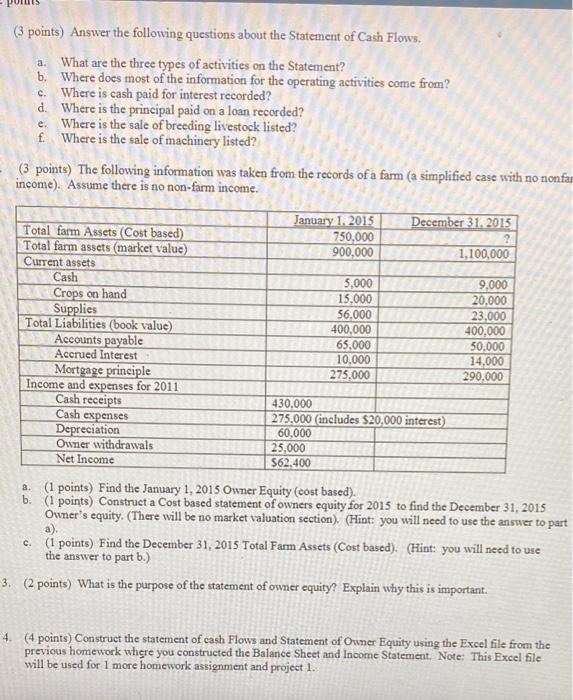

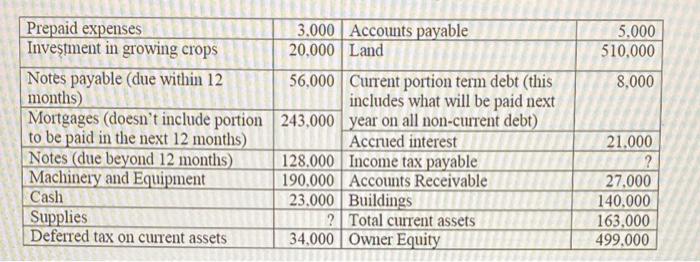

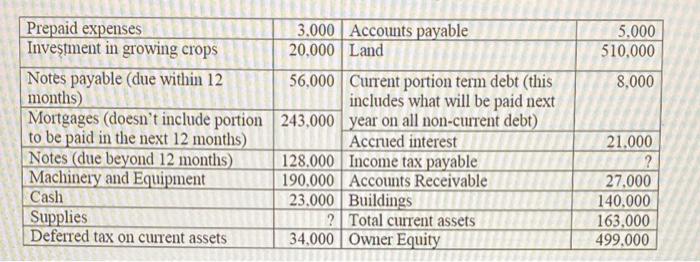

23,000 27,000 7 ASSETS 8. Current Assets 9 Cash 0 Accounts receivable 1 Feeder Livestock 2 Mkt Heifers (1000 lbs) 13 Mkt steers (1150 lbs) Feeder Steer (850 lbs) 15 Crops and Feed Inventory 16 hay Grain 18 Potatoes 19 Other feed 20 Prepaid Expenses 21 Supplies 22 Cash invest growing crops 23 Total Current Assets 24 25 Non-current Assets 26 Raised breeding livestock** 27 Purchased breeding livestock 28 Machinery & Equipment 29 Investment in cooperative 30 Buildings & improvements 31 Land 32 Total Non-current Assets 3,000 56,000 20,000 129,000 190,000 140,000 510,000 840,000 969,000 5,000 56,000 Total Business Assets Personal assets 5 Total Assets 7 3 LIABILITIES 9 Current Liabilities o Accounts payable 1 CCC loans 2 Notes Payable 3 Accrued interest 14 Current portion term debt 45 Accrued Tax 46 Income tax payable 47 Deferred tax on current ass 48 Total Current Liabilities 49 50 Non-Current Liabilities 51 Notes (Due beyond 12 mon 52 Mortgages 53 Other loans 54 Deferred tax on non-current assets 55 Total Non-Current Liabilit 56 57 Total Business Liabilities 58 personal liabilities 59 Total Liabilities 8,000 21,000 43,000 34,000 167,000 128,000 243,000 371,000 0 57 TO 58 personal liabilities 59 Total Liabilities 60 61 Owner Equity 62 retained earnings 63 Contributed capital 64 Personal net worth 65 Valuation equity 66 Total Owner Equity 67 68 Total Liabilities & Owner | 69 499,000 1,037,000 70 71 72 73 income statement 430000 255000 60000 cash receipts 2 less expenses 3 cash expenses -4 depreciation 5 total expenses -46 operating income 47 less interest expense 48 income after interet before tax 49 less income tax at 20% 50 net income 51 52 53 54 315000 115000 20000 95000 19000 76000 FE DURING THE CALENDAR YEAR 2015 THE FOLLOWING TRANSACTIONS WERE RECORDED IN THE RECORDS OF THE FARMER (assume them to be cash transactions unless noted otherwise) Sale of feeder animals 49,624 Labor Hired 20.000 Fertilizer and Chemicals 15.033 Rent for land and Pasture 8.900 Supplies 720 Repairs 4,200 Freight 620 Cattle Marketing (an expense) 250 Veterinary and medicine 1,540 Patronage dividends 765 Grain Sales 149.644 Machinery Purchased during the year 18.790 Government incentive payments (income) 18,978 Crop insurance Proceeds 50,000 Mics Cash Expense 2.419 Seed 18.000 Fuel and Lube 19.048 Utilities 29.603 Custom Hire Expense 12,709 Crop insurance Premiums 15.890 Insurance and taxes 16,797 Off farm wages 23,600 New carpet and drapes for home 4,500 Income taxes paid 4,134 for farm and 2,361 for off farm income Interest paid 33,583 The current portion of term debt indicated on the balance sheet was paid on time. A new operating loan for $111.198 was taken out. $122,644 was paid on the operating loan. This included paying off the loan on the beginning balance sheet and paying off part of the new loan. Breeding livestock was purchased for 2.800 Feeder livestock was purchased for 6.505 Feed purchased for 1,694 There was a net inflow of $945 in personal borrowings. 1. (4 points. Use the following information to create a balance sheet for Aggie Farms. The business and personal assets are kept separate. The information below relates only to the business. All the information is on a cost basis. (note: I would set up a balance sheet with places for current and non-current assets and liabilities and owner equity. I would then put all the information below in the appropriate sections. Then complete the Asset side of the balance sheet. Finally complete the Liability and owner equity side.) 5.000 510,000 8,000 Prepaid expenses 3.000 Accounts payable Investment in growing crops 20,000 Land Notes payable (due within 12 56,000 Current portion term debt (this months) includes what will be paid next Mortgages (doesn't include portion 243,000 year on all non-current debt) to be paid in the next 12 months) Accrued interest Notes (due beyond 12 months) 128.000 Income tax payable Machinery and Equipment 190.000 Accounts Receivable Cash 23.000 Buildings Supplies ? Total current assets Deferred tax on current assets 34,000 Owner Equity 21.000 ? 27,000 140.000 163,000 499.000 (3 points) Answer the following questions about the Statement of Cash Flows, a. What are the three types of activities on the Statement? b. Where does most of the information for the operating activities come from? c. Where is cash paid for interest recorded? d. Where is the principal paid on a loan recorded? e. Where is the sale of breeding livestock listed? f. Where is the sale of machinery listed? (3 points) The following information was taken from the records of a farm (a simplified case with no nonfa income). Assume there is no non-farm income. January 1, 2015 December 31, 2015 Total farm Assets Cost based) 750,000 Total farm assets (market value) 900,000 1,100,000 Current assets Cash 5,000 9,000 Crops on hand 15.000 20,000 Supplies 56.000 23,000 Total Liabilities (book value) 400,000 400,000 Accounts payable 65,000 50.000 Accrued Interest 10.000 14,000 Mortgage principle 275.000 290.000 Income and expenses for 2011 Cash receipts 430,000 Cash expenses 275.000 (includes $20,000 interest) Depreciation 60,000 Owner withdrawals 25.000 Net Income 562.400 a. (1 points) Find the January 1, 2015 Owner Equity (cost based). b. (1 points) Construct a Cost based statement of owners equity for 2015 to find the December 31, 2015 Owner's equity. (There will be no market valuation section). (Hint: you will need to use the answer to part a). (1 points) Find the December 31, 2015 Total Farm Assets (Cost based). (Hint: you will need to use the answer to part b.) 3. (2 points) What is the purpose of the statement of owner equity? Explain why this is important. c. 4. (4 points) Construct the statement of cash Flows and Statement of Owner Equity using the Excel file from the previous homework where you constructed the Balance Sheet and Income Statement. Note: This Excel file will be used for 1 more homework assignment and project 1. 5.000 510,000 8,000 Prepaid expenses 3.000 Accounts payable Investment in growing crops 20.000 Land Notes payable (due within 12 56,000 Current portion term debt (this months) includes what will be paid next Mortgages (doesn't include portion 243,000 year on all non-current debt) to be paid in the next 12 months) Accrued interest Notes (due beyond 12 months) 128.000 Income tax payable Machinery and Equipment 190.000 Accounts Receivable Cash 23.000 Buildings Supplies ? Total current assets Deferred tax on current assets 34.000 Owner Equity 21.000 27.000 140.000 163,000 499.000 23,000 27,000 7 ASSETS 8. Current Assets 9 Cash 0 Accounts receivable 1 Feeder Livestock 2 Mkt Heifers (1000 lbs) 13 Mkt steers (1150 lbs) Feeder Steer (850 lbs) 15 Crops and Feed Inventory 16 hay Grain 18 Potatoes 19 Other feed 20 Prepaid Expenses 21 Supplies 22 Cash invest growing crops 23 Total Current Assets 24 25 Non-current Assets 26 Raised breeding livestock** 27 Purchased breeding livestock 28 Machinery & Equipment 29 Investment in cooperative 30 Buildings & improvements 31 Land 32 Total Non-current Assets 3,000 56,000 20,000 129,000 190,000 140,000 510,000 840,000 969,000 5,000 56,000 Total Business Assets Personal assets 5 Total Assets 7 3 LIABILITIES 9 Current Liabilities o Accounts payable 1 CCC loans 2 Notes Payable 3 Accrued interest 14 Current portion term debt 45 Accrued Tax 46 Income tax payable 47 Deferred tax on current ass 48 Total Current Liabilities 49 50 Non-Current Liabilities 51 Notes (Due beyond 12 mon 52 Mortgages 53 Other loans 54 Deferred tax on non-current assets 55 Total Non-Current Liabilit 56 57 Total Business Liabilities 58 personal liabilities 59 Total Liabilities 8,000 21,000 43,000 34,000 167,000 128,000 243,000 371,000 0 57 TO 58 personal liabilities 59 Total Liabilities 60 61 Owner Equity 62 retained earnings 63 Contributed capital 64 Personal net worth 65 Valuation equity 66 Total Owner Equity 67 68 Total Liabilities & Owner | 69 499,000 1,037,000 70 71 72 73 income statement 430000 255000 60000 cash receipts 2 less expenses 3 cash expenses -4 depreciation 5 total expenses -46 operating income 47 less interest expense 48 income after interet before tax 49 less income tax at 20% 50 net income 51 52 53 54 315000 115000 20000 95000 19000 76000 FE DURING THE CALENDAR YEAR 2015 THE FOLLOWING TRANSACTIONS WERE RECORDED IN THE RECORDS OF THE FARMER (assume them to be cash transactions unless noted otherwise) Sale of feeder animals 49,624 Labor Hired 20.000 Fertilizer and Chemicals 15.033 Rent for land and Pasture 8.900 Supplies 720 Repairs 4,200 Freight 620 Cattle Marketing (an expense) 250 Veterinary and medicine 1,540 Patronage dividends 765 Grain Sales 149.644 Machinery Purchased during the year 18.790 Government incentive payments (income) 18,978 Crop insurance Proceeds 50,000 Mics Cash Expense 2.419 Seed 18.000 Fuel and Lube 19.048 Utilities 29.603 Custom Hire Expense 12,709 Crop insurance Premiums 15.890 Insurance and taxes 16,797 Off farm wages 23,600 New carpet and drapes for home 4,500 Income taxes paid 4,134 for farm and 2,361 for off farm income Interest paid 33,583 The current portion of term debt indicated on the balance sheet was paid on time. A new operating loan for $111.198 was taken out. $122,644 was paid on the operating loan. This included paying off the loan on the beginning balance sheet and paying off part of the new loan. Breeding livestock was purchased for 2.800 Feeder livestock was purchased for 6.505 Feed purchased for 1,694 There was a net inflow of $945 in personal borrowings. 1. (4 points. Use the following information to create a balance sheet for Aggie Farms. The business and personal assets are kept separate. The information below relates only to the business. All the information is on a cost basis. (note: I would set up a balance sheet with places for current and non-current assets and liabilities and owner equity. I would then put all the information below in the appropriate sections. Then complete the Asset side of the balance sheet. Finally complete the Liability and owner equity side.) 5.000 510,000 8,000 Prepaid expenses 3.000 Accounts payable Investment in growing crops 20,000 Land Notes payable (due within 12 56,000 Current portion term debt (this months) includes what will be paid next Mortgages (doesn't include portion 243,000 year on all non-current debt) to be paid in the next 12 months) Accrued interest Notes (due beyond 12 months) 128.000 Income tax payable Machinery and Equipment 190.000 Accounts Receivable Cash 23.000 Buildings Supplies ? Total current assets Deferred tax on current assets 34,000 Owner Equity 21.000 ? 27,000 140.000 163,000 499.000 (3 points) Answer the following questions about the Statement of Cash Flows, a. What are the three types of activities on the Statement? b. Where does most of the information for the operating activities come from? c. Where is cash paid for interest recorded? d. Where is the principal paid on a loan recorded? e. Where is the sale of breeding livestock listed? f. Where is the sale of machinery listed? (3 points) The following information was taken from the records of a farm (a simplified case with no nonfa income). Assume there is no non-farm income. January 1, 2015 December 31, 2015 Total farm Assets Cost based) 750,000 Total farm assets (market value) 900,000 1,100,000 Current assets Cash 5,000 9,000 Crops on hand 15.000 20,000 Supplies 56.000 23,000 Total Liabilities (book value) 400,000 400,000 Accounts payable 65,000 50.000 Accrued Interest 10.000 14,000 Mortgage principle 275.000 290.000 Income and expenses for 2011 Cash receipts 430,000 Cash expenses 275.000 (includes $20,000 interest) Depreciation 60,000 Owner withdrawals 25.000 Net Income 562.400 a. (1 points) Find the January 1, 2015 Owner Equity (cost based). b. (1 points) Construct a Cost based statement of owners equity for 2015 to find the December 31, 2015 Owner's equity. (There will be no market valuation section). (Hint: you will need to use the answer to part a). (1 points) Find the December 31, 2015 Total Farm Assets (Cost based). (Hint: you will need to use the answer to part b.) 3. (2 points) What is the purpose of the statement of owner equity? Explain why this is important. c. 4. (4 points) Construct the statement of cash Flows and Statement of Owner Equity using the Excel file from the previous homework where you constructed the Balance Sheet and Income Statement. Note: This Excel file will be used for 1 more homework assignment and project 1. 5.000 510,000 8,000 Prepaid expenses 3.000 Accounts payable Investment in growing crops 20.000 Land Notes payable (due within 12 56,000 Current portion term debt (this months) includes what will be paid next Mortgages (doesn't include portion 243,000 year on all non-current debt) to be paid in the next 12 months) Accrued interest Notes (due beyond 12 months) 128.000 Income tax payable Machinery and Equipment 190.000 Accounts Receivable Cash 23.000 Buildings Supplies ? Total current assets Deferred tax on current assets 34.000 Owner Equity 21.000 27.000 140.000 163,000 499.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started