i need help with b-1 Project B and e-1 Project B

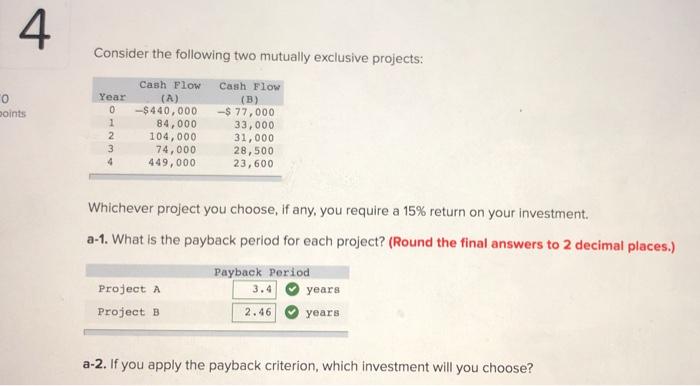

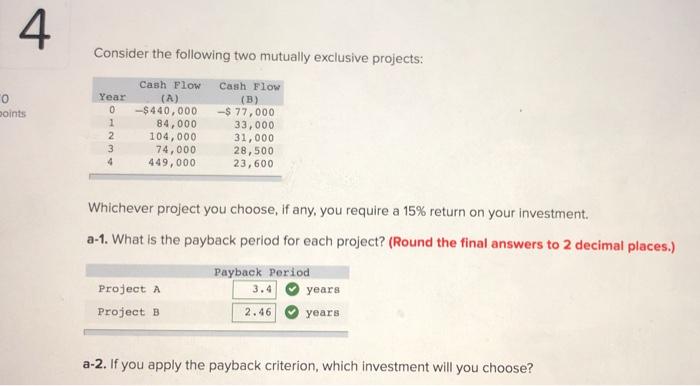

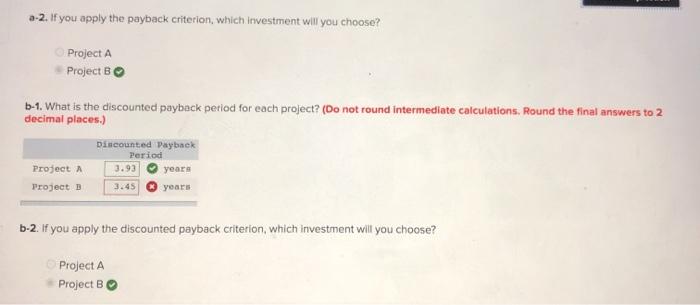

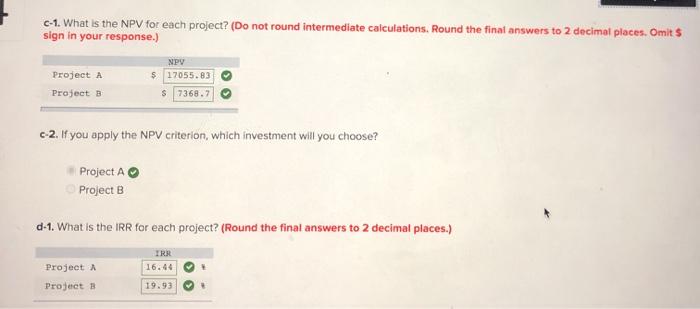

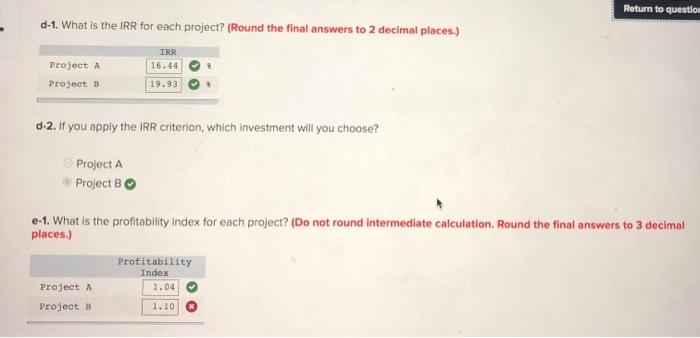

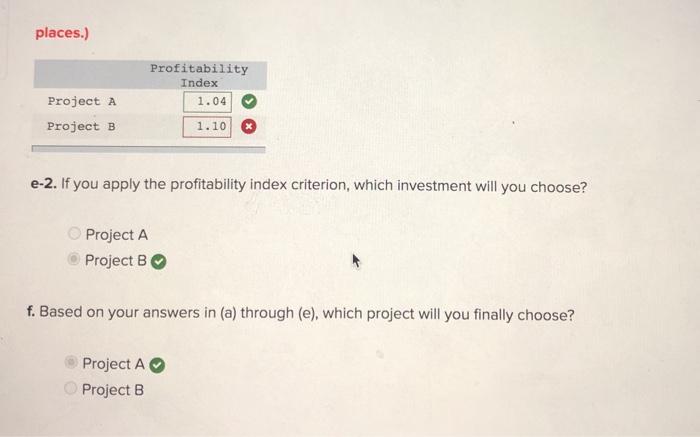

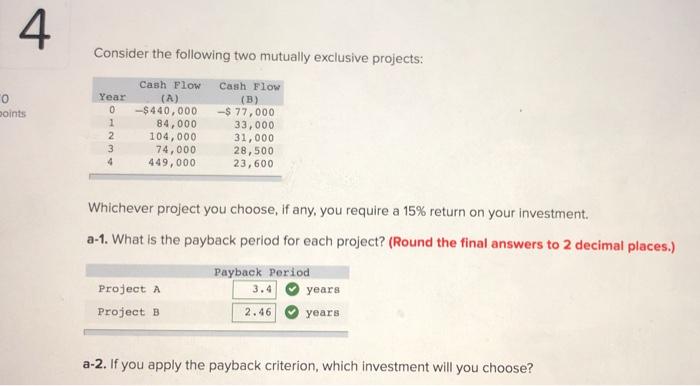

4 Consider the following two mutually exclusive projects: Cash Flow 0 points Year 0 1 2 3 4 -$440,000 84,000 104,000 74,000 449,000 Cash Flow (B) -$ 77,000 33,000 31,000 28,500 23,600 Whichever project you choose, if any, you require a 15% return on your investment a-1. What is the payback period for each project? (Round the final answers to 2 decimal places.) Payback Period Project A years Project B years 3.4 2.46 a-2. If you apply the payback criterion, which investment will you choose? a-2. If you apply the payback criterion, which investment will you choose? Project A Project B b-1. What is the discounted payback period for each project? (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Discounted Payback Project 3.93 Project B Period years 3.45 years b-2. If you apply the discounted payback criterion, which investment will you choose? Project A Project B 1. What is the NPV for each project? (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) Project A Project B NPV $ 17055.83 S 7368.7 c-2. If you apply the NPV criterion, which investment will you choose? Project A Project B d-1. What is the IRR for each project? (Round the final answers to 2 decimal places.) IRR 16.44 Project A Project 1 19.93 Return to questio d-1. What is the IRR for each project? (Round the final answers to 2 decimal places.) IRR 16.44 Project A Project B 19.93 d-2. If you apply the IRR criterion, which investment will you choose? Project A Project B e-1. What is the profitability Index for each project? (Do not round intermediate calculation. Round the final answers to 3 decimal places.) Profitability Index 1.04 Project A Project B 1.10 places.) Profitability Index 1.04 Project A Project B 1.10 e-2. If you apply the profitability index criterion, which investment will you choose? Project A Project B f. Based on your answers in (a) through (e), which project will you finally choose? Project A Project B