Answered step by step

Verified Expert Solution

Question

1 Approved Answer

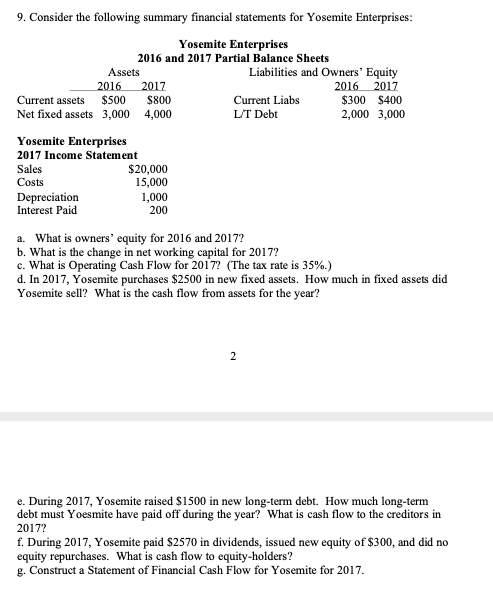

I need help with C-G. I am struggling with C, please show work and formulas used. 9. Consider the following summary financial statements for Yosemite

I need help with C-G. I am struggling with C, please show work and formulas used.

9. Consider the following summary financial statements for Yosemite Enterprises: Yosemite Enterprises 2016 and 2017 Partial Balance Sheets Assets Liabilities and Owners' Equity 2016 2017 2016 2017 Current assets $500 $800 Current Liabs $300 $400 Net fixed assets 3,000 4,000 L/T Debt 2,000 3,000 Yosemite Enterprises 2017 Income Statement Sales $20,000 Costs 15,000 Depreciation 1,000 Interest Paid 200 a. What is owners' equity for 2016 and 2017? b. What is the change in net working capital for 2017? c. What is Operating Cash Flow for 2017? (The tax rate is 35%.) d. In 2017, Yosemite purchases $2500 in new fixed assets. How much in fixed assets did Yosemite sell? What is the cash flow from assets for the year? 2 e. During 2017, Yosemite raised $1500 in new long-term debt. How much long-term debt must Yoesmite have paid off during the year? What is cash flow to the creditors in 2017? f. During 2017, Yosemite paid $2570 in dividends, issued new equity of $300, and did no equity repurchases. What is cash flow to equity-holders? g. Construct a Statement of Financial Cash Flow for Yosemite for 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started