Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with D. The answer is not $1,528 or $1,389. D. Jeremy acquired the two automobile dealerships but was not in the automobile

I need help with D. The answer is not $1,528 or $1,389.

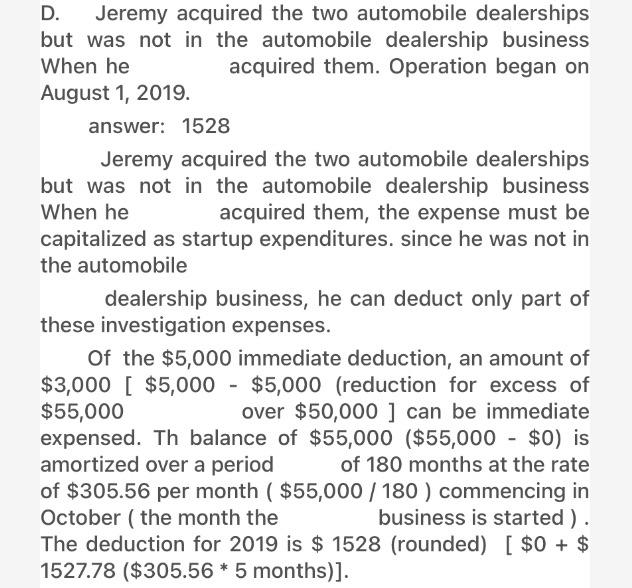

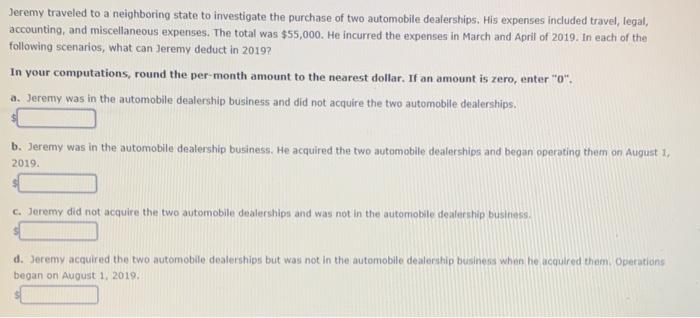

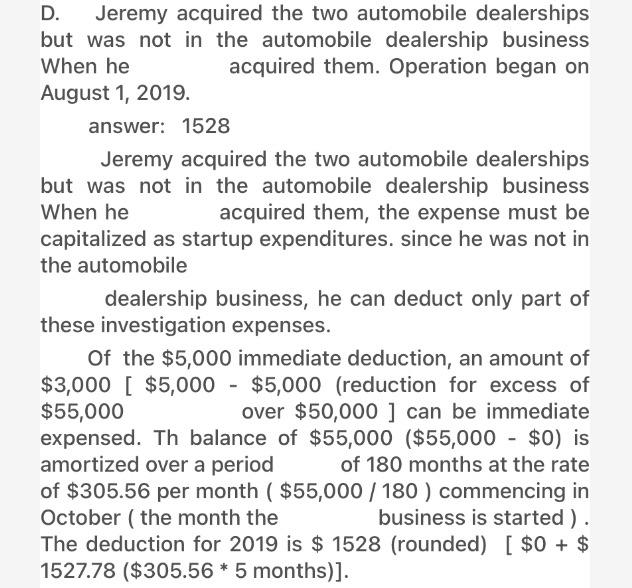

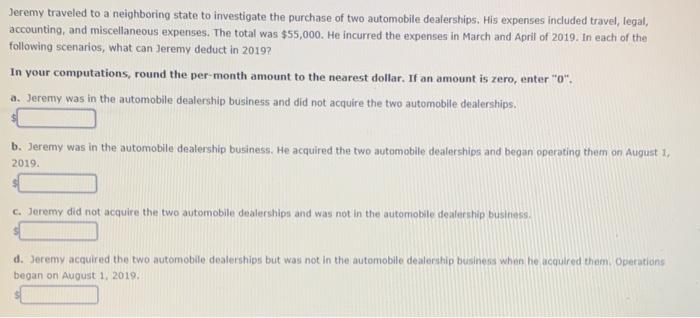

D. Jeremy acquired the two automobile dealerships but was not in the automobile dealership business When he acquired them. Operation began on August 1, 2019. answer: 1528 Jeremy acquired the two automobile dealerships but was not in the automobile dealership business When he acquired them, the expense must be capitalized as startup expenditures. since he was not in the automobile dealership business, he can deduct only part of these investigation expenses. Of the $5,000 immediate deduction, an amount of $3,000 [ $5,000 - $5,000 (reduction for excess of $55,000 over $50,000 ] can be immediate expensed. Th balance of $55,000 ($55,000 - $0) is amortized over a period of 180 months at the rate of $305.56 per month ( $55,000 / 180 ) commencing in October ( the month the business is started). The deduction for 2019 is $ 1528 (rounded) [ $0 + $ 1527.78 ($305.56 * 5 months)]. Jeremy traveled to a neighboring state to investigate the purchase of two automobile dealerships. His expenses included travel, legal, accounting, and miscellaneous expenses. The total was $55,000. He incurred the expenses in March and April of 2019. In each of the following scenarios, what can Jeremy deduct in 2019? In your computations, round the per month amount to the nearest dollar. If an amount is zero, enter "o". a. Jeremy was in the automobile dealership business and did not acquire the two automobile dealerships. b. Jeremy was in the automobile dealership business. He acquired the two automobile dealerships and began operating them on August 1, 2019. c. Jeremy did not acquire the two automobile dealerships and was not in the automobile dealership business d. Jeremy acquired the two automobile dealerships but was not in the automobile dealership business when he acquired them. Operations began on August 1, 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started