Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with getting the right answers for these questions Question 3 (7 points) 4) Listen If you start saving $2,000 each year for

i need help with getting the right answers for these questions

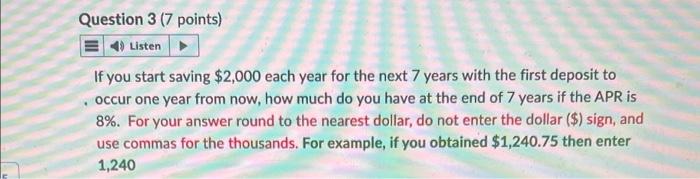

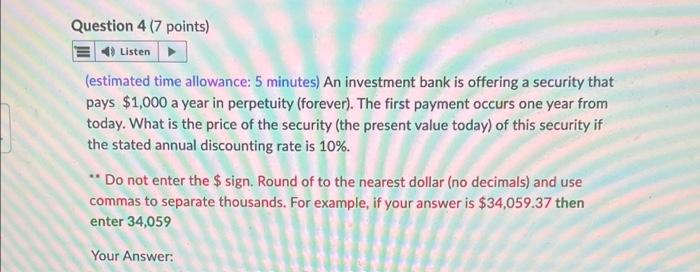

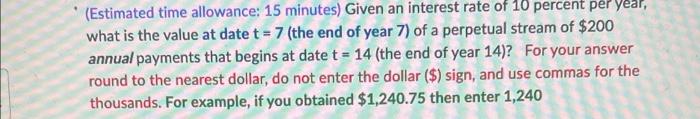

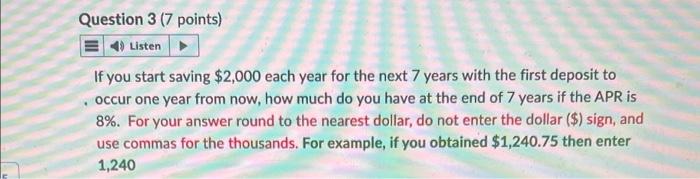

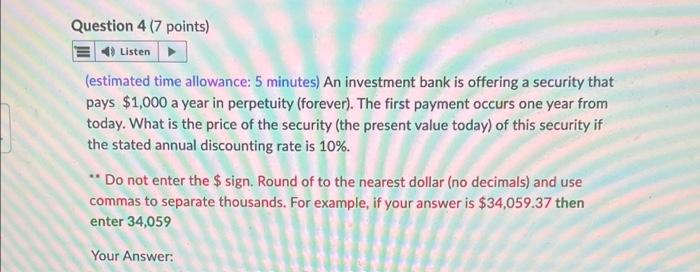

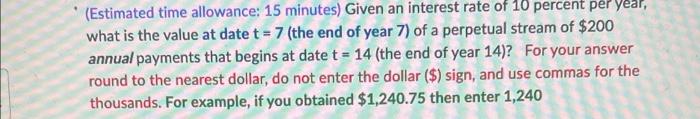

Question 3 (7 points) 4) Listen If you start saving $2,000 each year for the next 7 years with the first deposit to occur one year from now, how much do you have at the end of 7 years if the APR is 8%. For your answer round to the nearest dollar, do not enter the dollar ($) sign, and use commas for the thousands. For example, if you obtained $1,240.75 then enter 1,240 Question 4 (7 points) 4) Listen (estimated time allowance: 5 minutes) An investment bank is offering a security that pays $1,000 a year in perpetuity (forever). The first payment occurs one year from today. What is the price of the security (the present value today) of this security if the stated annual discounting rate is 10%. **Do not enter the $ sign. Round of to the nearest dollar (no decimals) and use commas to separate thousands. For example, if your answer is $34,059.37 then enter 34,059 Your Answer: (Estimated time allowance: 15 minutes) Given an interest rate of 10 percent per year, what is the value at date t = 7 (the end of year 7) of a perpetual stream of $200 annual payments that begins at date t = 14 (the end of year 14)? For your answer round to the nearest dollar, do not enter the dollar ($) sign, and use commas for the thousands. For example, if you obtained $1,240.75 then enter 1,240

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started