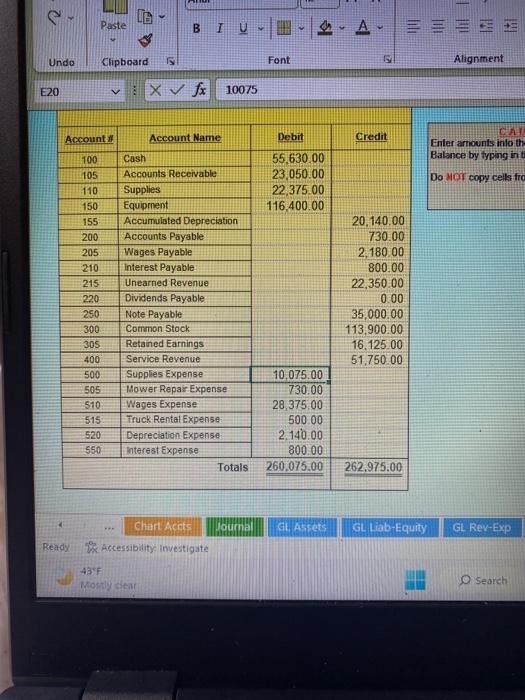

i need help with having my entries to equal the same amount im short by a few thousand and lost!

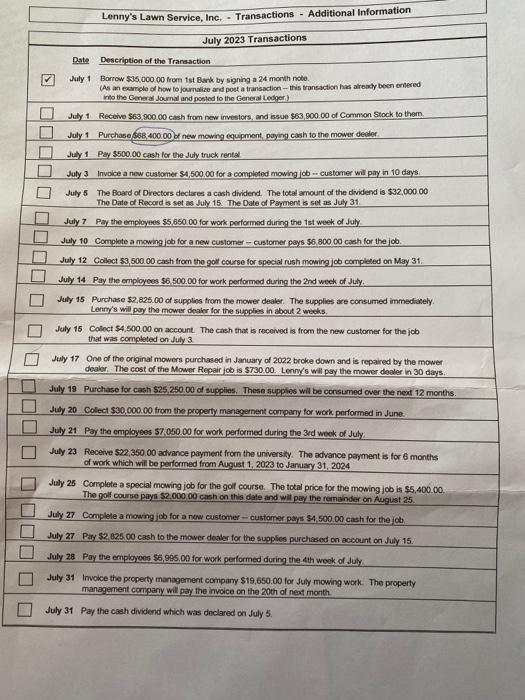

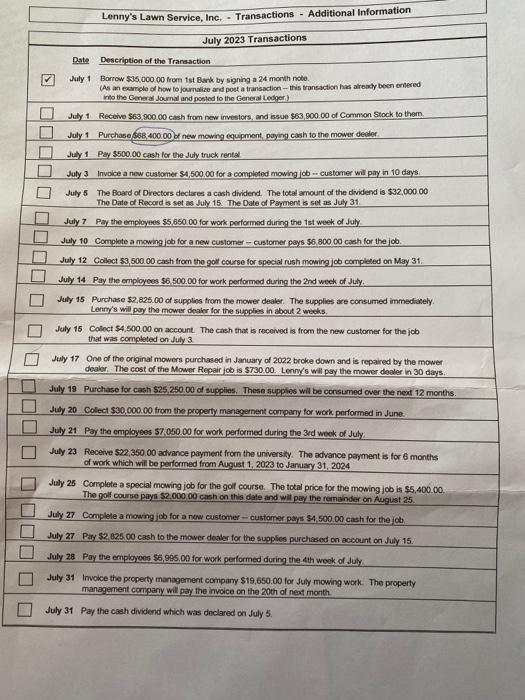

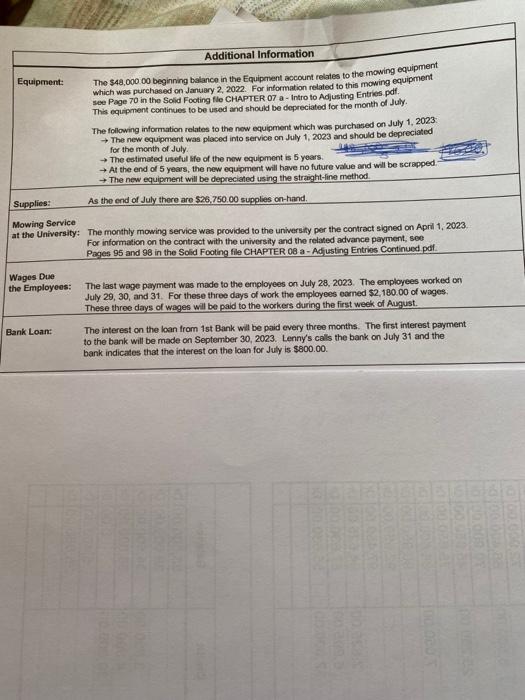

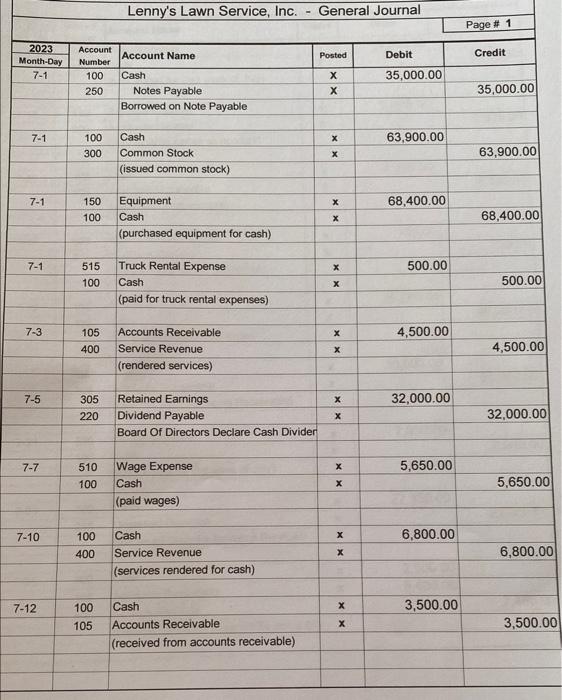

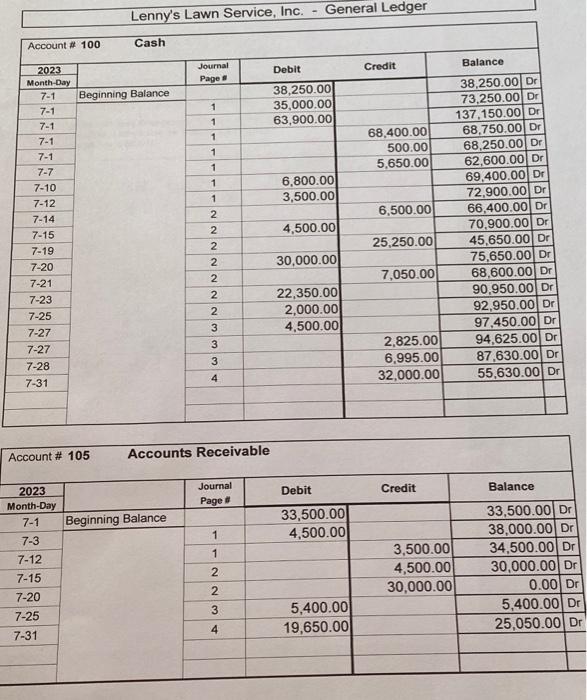

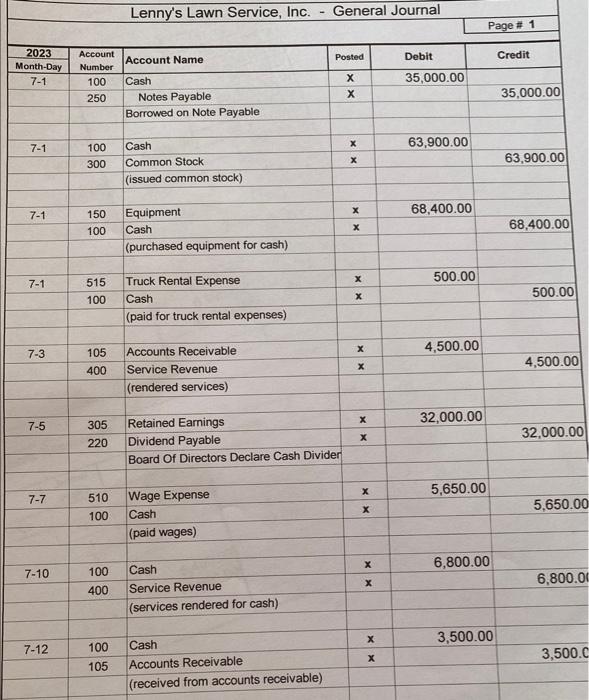

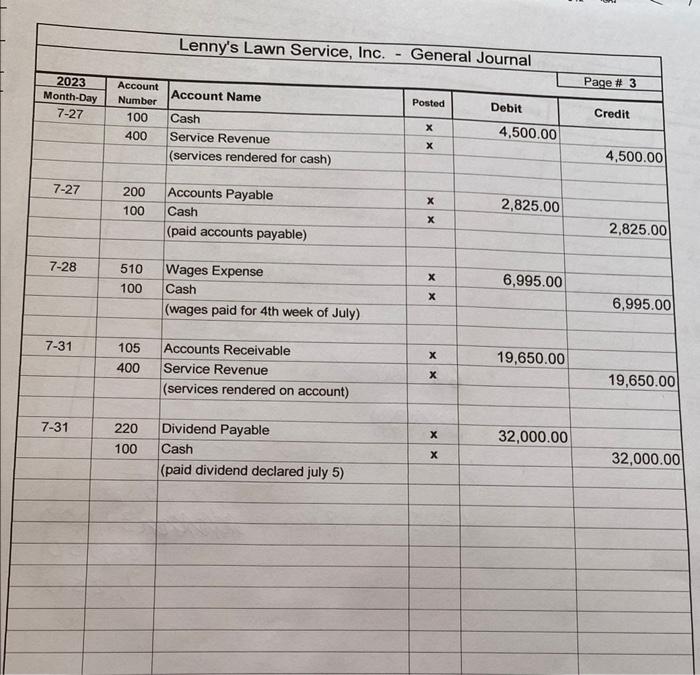

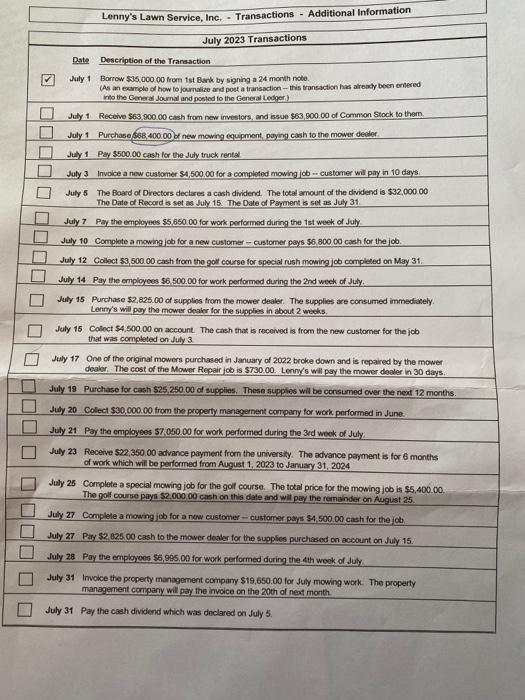

Lenny's Lawn Service, Inc. - Transactions - Additional Information July 2023 Transactions Date Description of the Transaction July 1 Borrow 535.000.00 from tst Bark by signing a 24 month note. (As an eomple of how to journatioe and poet a transaction - this transaction has atroody been entered into the Generil Journal and postied to the General Ledper) July 1 Receive $63.900.00 cash from new investors, and issue $63,900.00 of Common Stock to them. July 1 Purchase 568,400000 of new mowing equipment, paying cash to the mower decier. July 1 Pay 5500.00 cash for the July truck rentad. Juty 3 Involce a new customer $4,500,00 for a completiod mowing job - customer will pay in 10 days. July 5 The Board of Drectors declares a cash dividend. The toeal amount of the devidend is $32,000.00 The Date of Recood is set as July 15. The Date of Payment is sut as July 31. July 7 Pay the employess $5,65000 for work performod during the tst week of July July 10 Complote a mowing job for a new customer - customer pays $5,800.00 cash for the job. July 12 Colloct $3,500.00 cash fram the gott course for special rush mowing job completed on May 31. July 14 Pay the employees $6.500.00 for work perlormed during the 2 nd week of July. July 15 Purchase $2,825.00 of supplis from the mover dealer. The supplies are consumed immediasely. Lenny's will pay the mower deaker for the supples in about 2 weeks. July 15 Coloct $4,50000 an account. The cash that is rocolvod is from the new customer for the job that was completed an July 3 July 17 One of the original mowers purchased in January of 2022 broke down and is repared by the mower dealer. The cost of the Mower Repair job is $730.00. Lenny's will pay the mower dopler in 30 days. July 19 Purchase for cash $25,250.00 of supplies. These supples will be consumed over the nex 12 months. July 20 Colect $30,000,00 from the property managernent company for work performed in June.: July 21 Pay the employees 57,05000 for wook performed during the 3rd wook of July, July 23 Receive 522,350.00 advance payment from the university. The advance payment is for 6 months of work which will be performed from August 1, 2023 to January 31, 2024 July 25 Complete a special mowing job for the golt course. The total price for the mowing job is $5,400.00. The gal course pays $2,000.00 cash on this dafe and will pay the remainder on August 25 . July 27 Complete a mowing iob for a new customer - customer pays 94,500.00 cash for the job. July 27 Pay 32.825.00 cash to the mower doaler for the supplies purchased on account on July 15. July 28 Pay the employoes $5,995.00 for work performed during the sth wook of July July 31 Invoice the property managoment company $19,650.00 for July mowing work. The property management company will pay the involce on the 20 th of neat month. July 31 Pay the cash dividend which was declared on July 5. Additional Information Equipment: The $48,000.00 beginning balance in the Equipment account relates to the moving equipment which was purchased on January 2, 2022. For information related to this mowing equipment see Page 70 in the Solid Footing fle CHAPTER 07 a - Intro to Adjusting Entries pdf. This equipment continues to be used and should be depreciated for the month of July. The following information relates to the now equipment which was purchased on July 1, 2023: The new equipment was placed into service on July 1, 2023 and should be depreciated for the month of July. The estimated useful iffe of the now equipment is 5 years. At the end of 5 years, the new equipment will have no future value and will be scrapped. The new equipment will be depreciated using the straight-fine method. Supplies: As the end of July there are $25,750.00 supplies on-hand. Mowing Service at the University: The monthly mowing service was provided to the university per the contract signed on April 1, 2023. For information on the contract with the university and the related advance payment, see Peges 95 and 98 in the Solid Footing fle CHAPTER 08 a - Adf usting Entrios Continued pdi. Wages Due the Employees: The last wage payment was made to the employees on July 28,2023 . The employees worked on July 29, 30, and 31. For these three days of work the employees earned $2,180.00 of wages: These three days of wages will be paid to the workers during the first week of August. Bank Loan: The interest on the loan from 1st Bank will be paid every three months. The first interest payment to the bank will be made on September 30, 2023. Lenny's calls the bank on July 31 and the bank indicates that the interest on the loan for July is $800.00. Enler artounts ifilo Balance by typing Do yor copy celksfro Lenny's Lawn Service, Inc. - General Ledger Lenny's Lawn Service, Inc. - General Journal Lenny's Lawn Service, Inc. - General Journal