Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I Need Help with Item 3: & Item 4:, Thanks Item 1: Entity A incurred the following plant asset expenditures in during the year. List

I Need Help with Item 3: & Item 4:,

Thanks

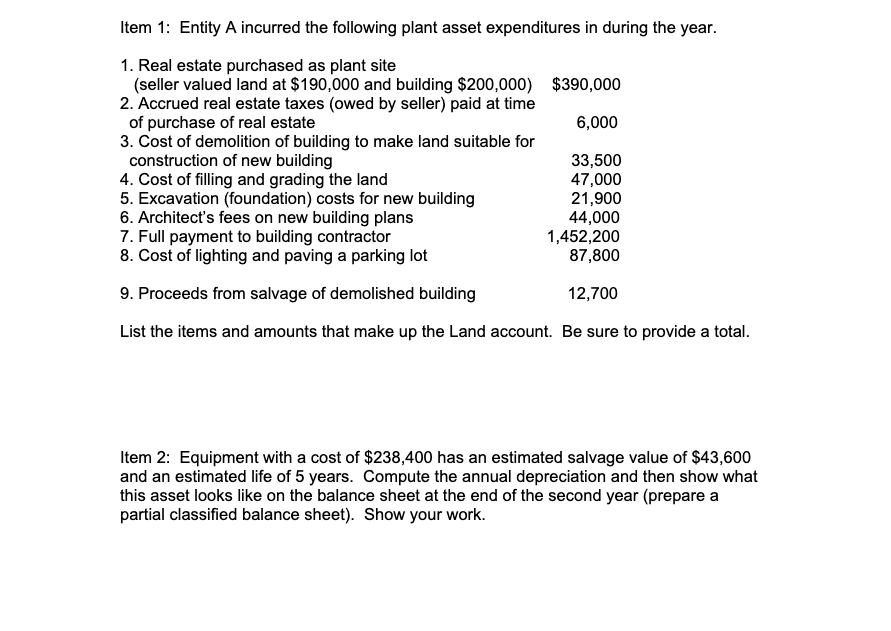

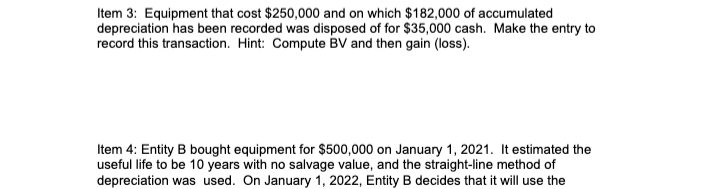

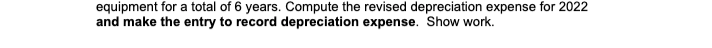

Item 1: Entity A incurred the following plant asset expenditures in during the year. List the items and amounts that make up the Land account. Be sure to provide a total. Item 2: Equipment with a cost of $238,400 has an estimated salvage value of $43,600 and an estimated life of 5 years. Compute the annual depreciation and then show what this asset looks like on the balance sheet at the end of the second year (prepare a partial classified balance sheet). Show your work. Item 3: Equipment that cost $250,000 and on which $182,000 of accumulated depreciation has been recorded was disposed of for $35,000 cash. Make the entry to record this transaction. Hint: Compute BV and then gain (loss). Item 4: Entity B bought equipment for $500,000 on January 1, 2021. It estimated the useful life to be 10 years with no salvage value, and the straight-line method of depreciation was used. On January 1,2022 , Entity B decides that it will use the equipment for a total of 6 years. Compute the revised depreciation expense for 2022 and make the entry to record depreciation expense. Show work. Item 1: Entity A incurred the following plant asset expenditures in during the year. List the items and amounts that make up the Land account. Be sure to provide a total. Item 2: Equipment with a cost of $238,400 has an estimated salvage value of $43,600 and an estimated life of 5 years. Compute the annual depreciation and then show what this asset looks like on the balance sheet at the end of the second year (prepare a partial classified balance sheet). Show your work. Item 3: Equipment that cost $250,000 and on which $182,000 of accumulated depreciation has been recorded was disposed of for $35,000 cash. Make the entry to record this transaction. Hint: Compute BV and then gain (loss). Item 4: Entity B bought equipment for $500,000 on January 1, 2021. It estimated the useful life to be 10 years with no salvage value, and the straight-line method of depreciation was used. On January 1,2022 , Entity B decides that it will use the equipment for a total of 6 years. Compute the revised depreciation expense for 2022 and make the entry to record depreciation expense. Show workStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started