Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with just 3 and 4. Will give thumbs up thank you! Use the following information to complete question 1-4. The 6 month

I need help with just 3 and 4. Will give thumbs up thank you!

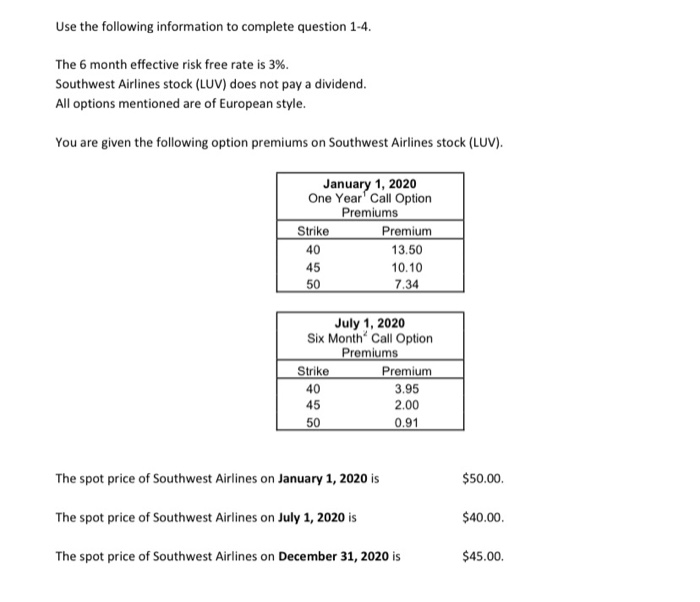

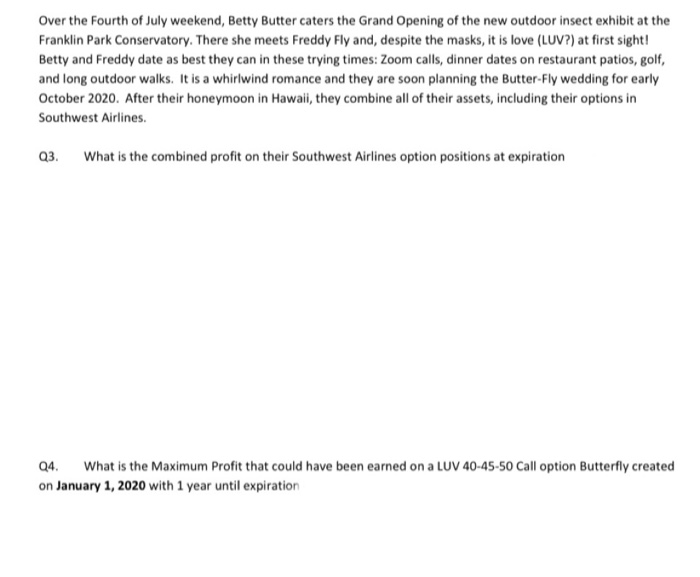

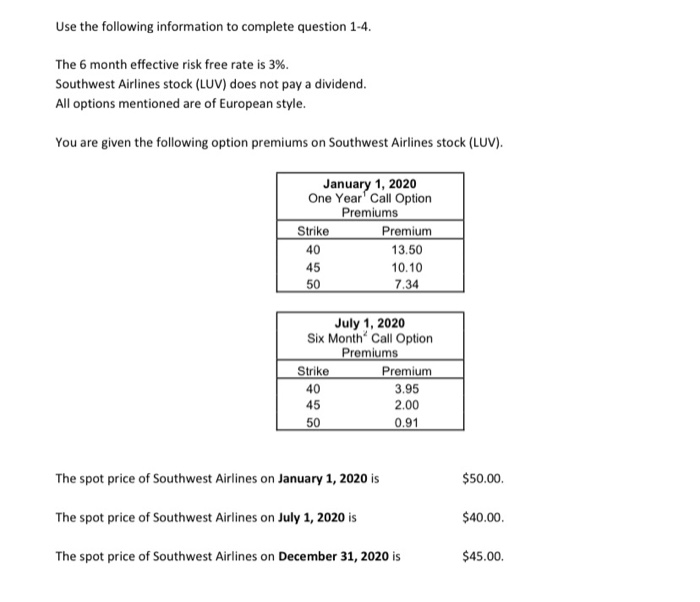

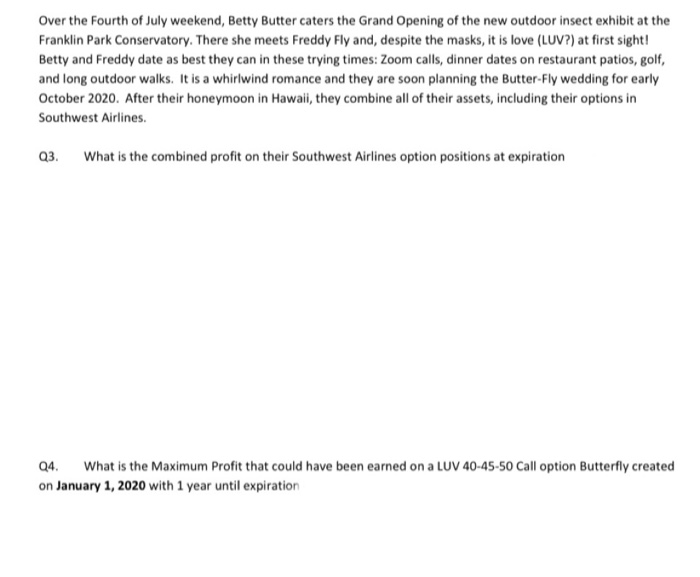

Use the following information to complete question 1-4. The 6 month effective risk free rate is 3%. Southwest Airlines stock (LUV) does not pay a dividend. All options mentioned are of European style. You are given the following option premiums on Southwest Airlines stock (LUV). January 1, 2020 One Year' Call Option Premiums Strike Premium 40 13.50 45 10.10 50 7.34 July 1, 2020 Six Month Call Option Premiums Strike Premium 40 3.95 45 2.00 50 0.91 The spot price of Southwest Airlines on January 1, 2020 is $50.00 The spot price of Southwest Airlines on July 1, 2020 is $40.00 The spot price of Southwest Airlines on December 31, 2020 is $45.00 Over the Fourth of July weekend, Betty Butter caters the Grand Opening of the new outdoor insect exhibit at the Franklin Park Conservatory. There she meets Freddy Fly and, despite the masks, it is love (LUV?) at first sight! Betty and Freddy date as best they can in these trying times: Zoom calls, dinner dates on restaurant patios, golf, and long outdoor walks. It is a whirlwind romance and they are soon planning the Butter-Fly wedding for early October 2020. After their honeymoon in Hawaii, they combine all of their assets, including their options in Southwest Airlines Q3. What is the combined profit on their Southwest Airlines option positions at expiration Q4. What is the Maximum Profit that could have been earned on a LUV 40-45-50 Call option Butterfly created on January 1, 2020 with 1 year until expiration Use the following information to complete question 1-4. The 6 month effective risk free rate is 3%. Southwest Airlines stock (LUV) does not pay a dividend. All options mentioned are of European style. You are given the following option premiums on Southwest Airlines stock (LUV). January 1, 2020 One Year' Call Option Premiums Strike Premium 40 13.50 45 10.10 50 7.34 July 1, 2020 Six Month Call Option Premiums Strike Premium 40 3.95 45 2.00 50 0.91 The spot price of Southwest Airlines on January 1, 2020 is $50.00 The spot price of Southwest Airlines on July 1, 2020 is $40.00 The spot price of Southwest Airlines on December 31, 2020 is $45.00 Over the Fourth of July weekend, Betty Butter caters the Grand Opening of the new outdoor insect exhibit at the Franklin Park Conservatory. There she meets Freddy Fly and, despite the masks, it is love (LUV?) at first sight! Betty and Freddy date as best they can in these trying times: Zoom calls, dinner dates on restaurant patios, golf, and long outdoor walks. It is a whirlwind romance and they are soon planning the Butter-Fly wedding for early October 2020. After their honeymoon in Hawaii, they combine all of their assets, including their options in Southwest Airlines Q3. What is the combined profit on their Southwest Airlines option positions at expiration Q4. What is the Maximum Profit that could have been earned on a LUV 40-45-50 Call option Butterfly created on January 1, 2020 with 1 year until expiration

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started