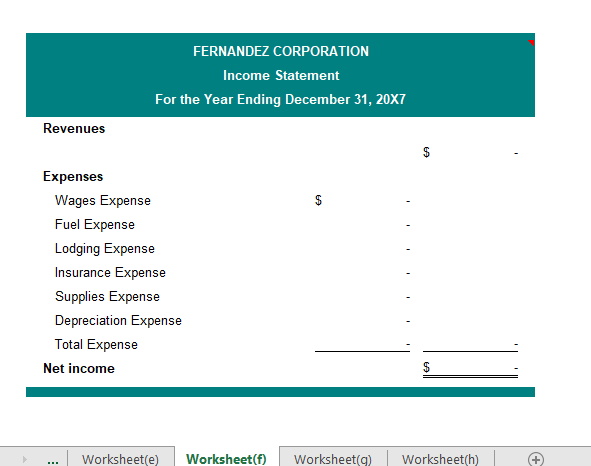

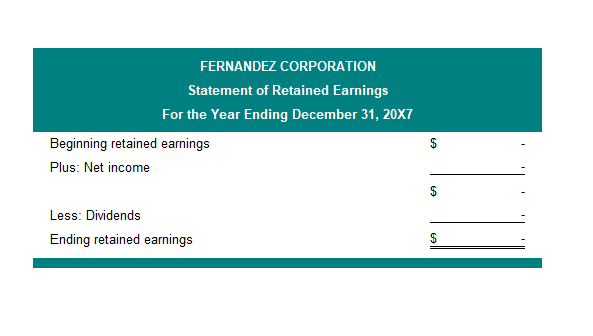

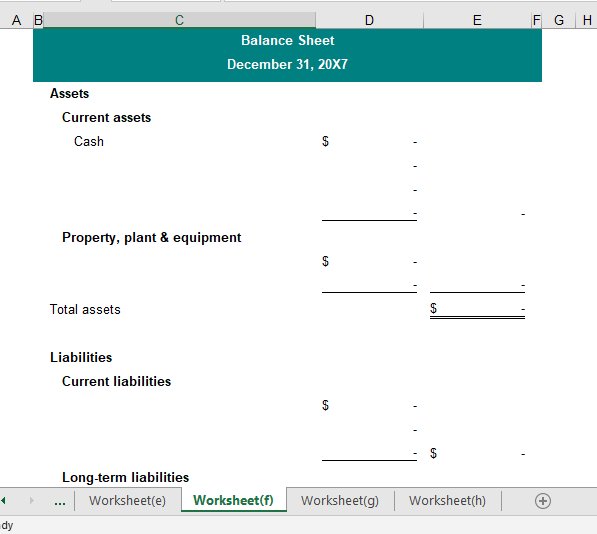

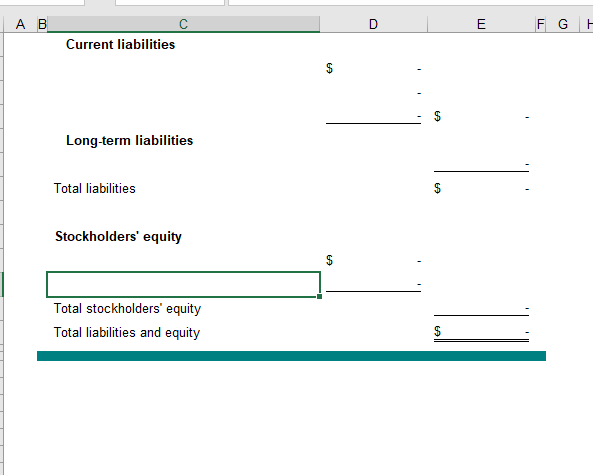

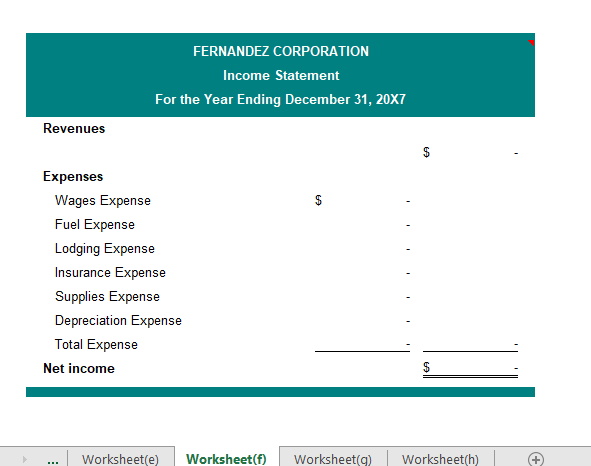

I need help with JUST need help with question (F). The Income statements. Here is the information.

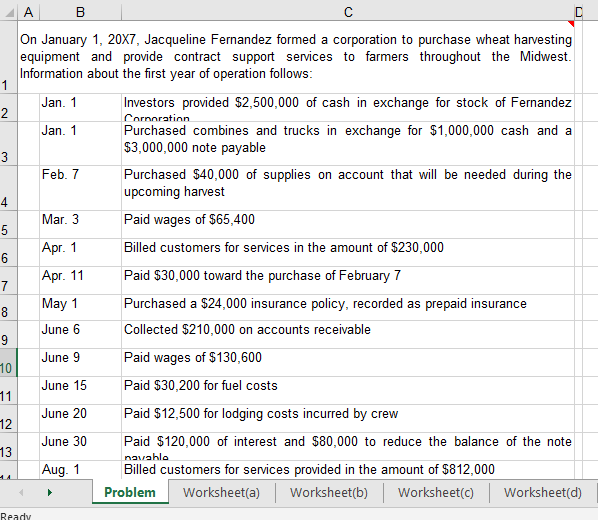

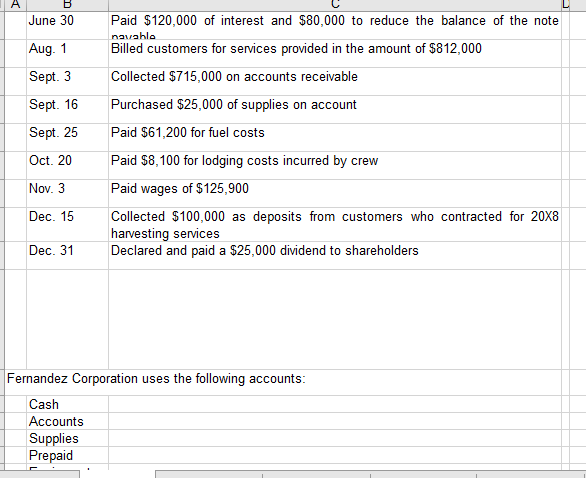

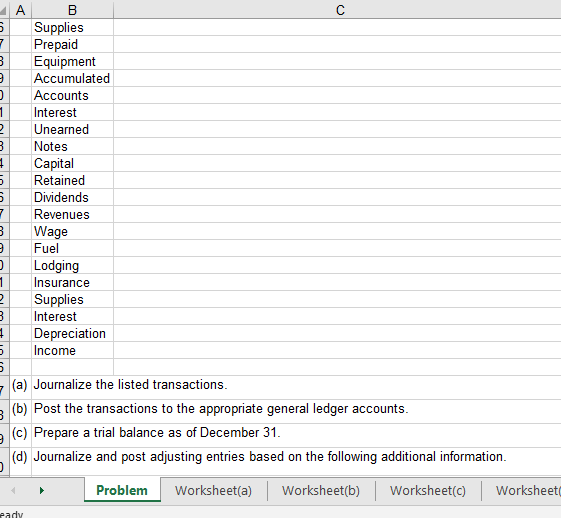

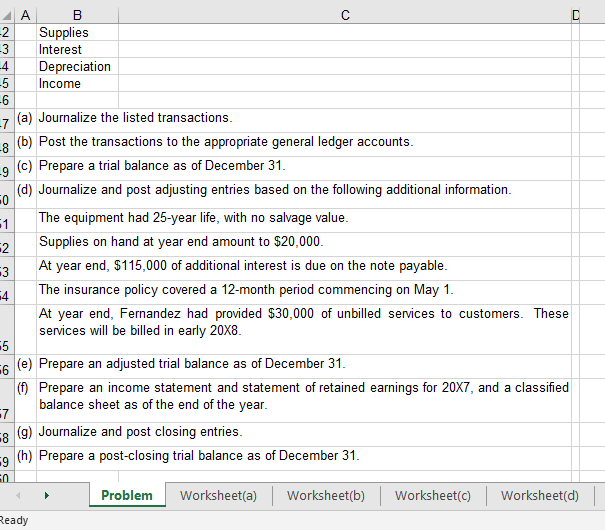

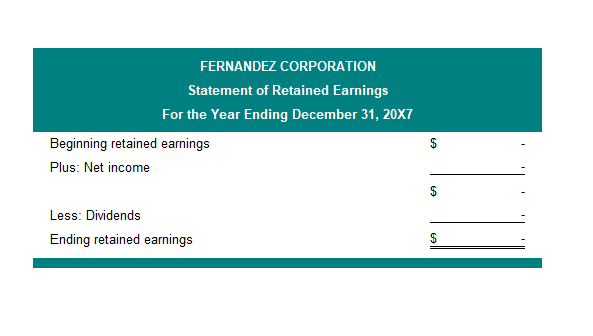

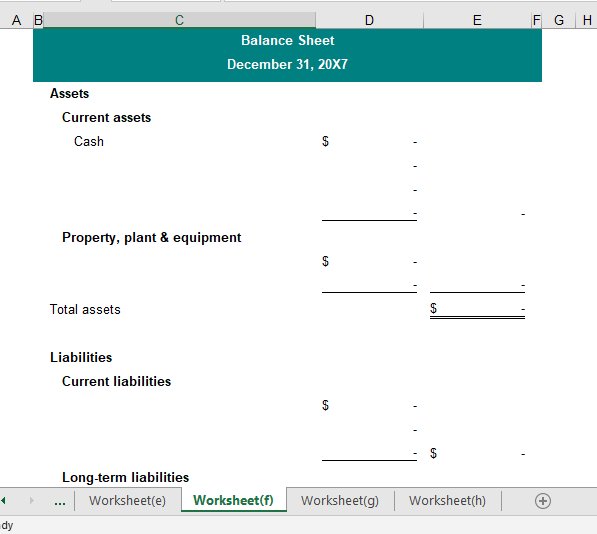

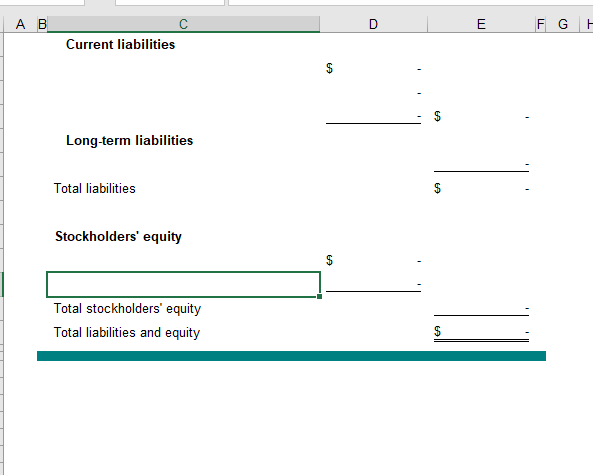

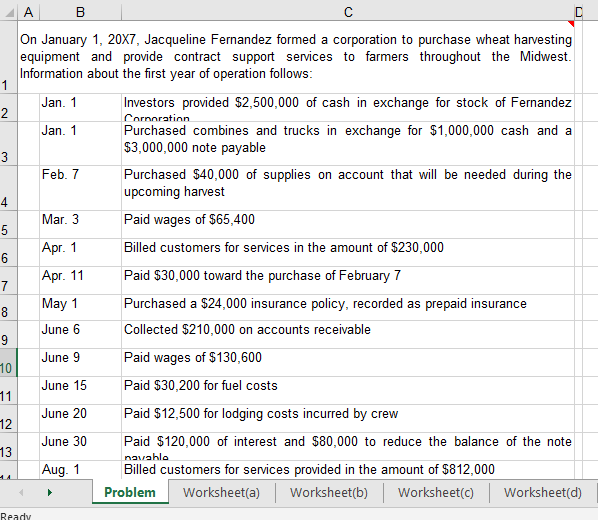

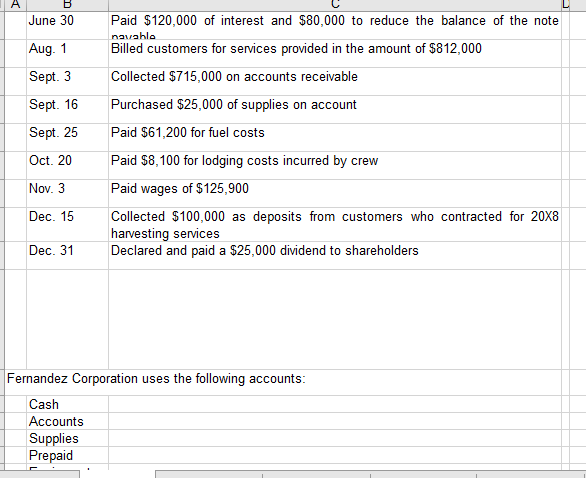

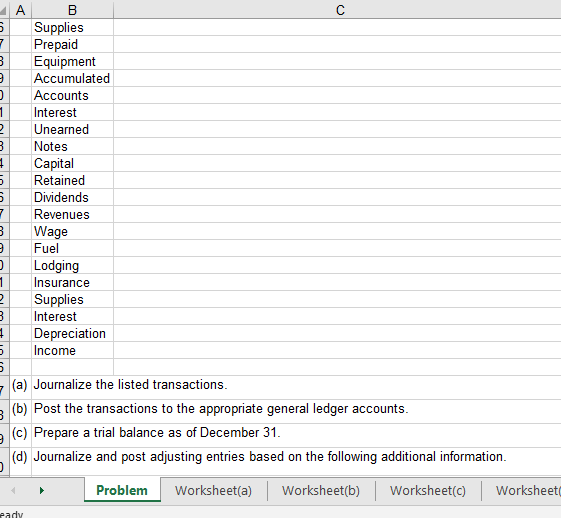

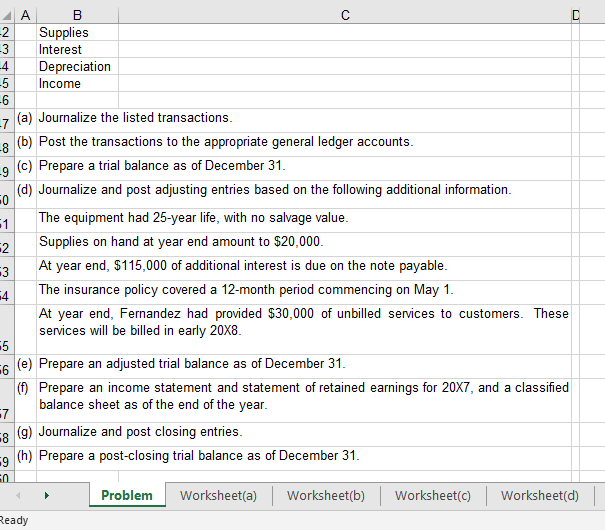

FERNANDEZ CORPORATION Income Statement For the Year Ending December 31, 20X7 Revenues Wages Expense Fuel Expense Lodging Expense Insurance Expense Supplies Expense Depreciation Expense Total Expense Net income I | | | I Worksheet(e) Worksheet(f) Worksheet(g) Worksheet(h) FERNANDEZ CORPORATION Statement of Retained Earnings For the Year Ending December 31, 20X7 Beginning retained earnings Plus: Net income Less: Dividends Ending retained earnings F G H A B Balance Sheet December 31, 20X7 Assets Current assets Property, plant & equipment Total assets Liabilities Current liabilities Long-term liabilities Worksheet(e) Worksheetf Worksheet(g) Worksheet(h) dy F G h A B Current liabilities Long-term liabilities Total liabilities Stockholders' equity Total stockholders' equity Total liabilities and equity On January 1, 20X7, Jacqueline Fernandez formed a corporation to purchase wheat harvesting equipment and provide contract support services to farmers throughout the Midwest Information about the first year of operation follows Jan. 1 Investors provided $2,500,000 of cash in exchange for stock of Fernandez Cornnratinn Purchased combines and trucks in exchange for $1,000,000 cash and a $3,000,000 note payable Jan. 1 Feb. 7 Purchased $40,000 of supplies on account that will be needed during the upcoming harvest Mar. 3 Apr. 1 Apr. 11 May 1 June 6 June 9 June 15 June 20 June 30 Aug. 1 Paid wages of $65,400 Billed customers for services in the amount of $230,000 Paid $30,000 toward the purchase of February 7 Purchased a $24,000 insurance policy, recorded as prepaid insurance Collected $210,000 on accounts receivable Paid wages of $130,600 Paid $30,200 for fuel costs Paid $12,500 for lodging costs incurred by crew Paid $120,000 of interest and $80,000 to reduce the balance of the note Billed customers for services provided in the amount of $812,000 12 Problem Worksheet(a)Worksheet(b)Worksheet(c) Worksheet(d) Ready June 30 Aug. 1 Sept. 3 Sept. 16 Sept. 25 Oct. 20 Nov. 3 Dec. 15 Dec. 31 Paid $120,000 of interest and $80,000 to reduce the balance of the note Billed customers for services provided in the amount of $812,000 Collected $715,000 on accounts receivable Purchased $25,000 of supplies on account Paid $61,200 for fuel costs Paid $8,100 for lodging costs incurred by crew Paid wages of $125,900 Collected $100,000 as deposits from customers who contracted for 20X8 harvesting services Declared and paid a $25,000 dividend to shareholders Fernandez Corporation uses the following accounts Cash Accounts Supplies Prepaid 5 Supplies 7 Prepaid Equipment Accumulated Accounts Interest Unearned Notes Capital Retained Dividends Revenues Wage Fuel Lodging Insurance Supplies Interest epreciation 5 Income (a) Journalize the listed transactions (b) Post the transactions to the appropriate general ledger accounts (c) Prepare a trial balance as of December 31 (d) Journalize and post adjusting entries based on the following additional information Problem Worksheet(a)Worksheet(b)Worksheet(c) Worksheet 2 Supplies 3 Interest Depreciation 5 Income (a) Journalize the listed transactions (b) Post the transactions to the appropriate general ledger accounts 9 (c) Prepare a trial balance as of December 31 (d) Journalize and post adjusting entries based on the following additional information 0 The equipment had 25-year life, with no salvage value Supplies on hand at year end amount to $20,000 At year end, $115,000 of additional interest is due on the note payable The insurance policy covered a 12-month period commencing on May 1 At year end, Fernandez had provided $30,000 of unbilled services to customers. These services will be billed in early 20X8 2 3 4 5 6 e) Prepare an adjusted trial balance as of December 31 (f) Prepare an income statement and statement of retained earnings for 20X7, and a classified balance sheet as of the end of the year 7 (g) Journaie and post closing entries 9 (h) Prepare a post-closing trial balance as of December 31 Problem Worksheet(a)Worksheet(b)Worksheet(c) Worksheet(d) eady FERNANDEZ CORPORATION Income Statement For the Year Ending December 31, 20X7 Revenues Wages Expense Fuel Expense Lodging Expense Insurance Expense Supplies Expense Depreciation Expense Total Expense Net income I | | | I Worksheet(e) Worksheet(f) Worksheet(g) Worksheet(h) FERNANDEZ CORPORATION Statement of Retained Earnings For the Year Ending December 31, 20X7 Beginning retained earnings Plus: Net income Less: Dividends Ending retained earnings F G H A B Balance Sheet December 31, 20X7 Assets Current assets Property, plant & equipment Total assets Liabilities Current liabilities Long-term liabilities Worksheet(e) Worksheetf Worksheet(g) Worksheet(h) dy F G h A B Current liabilities Long-term liabilities Total liabilities Stockholders' equity Total stockholders' equity Total liabilities and equity On January 1, 20X7, Jacqueline Fernandez formed a corporation to purchase wheat harvesting equipment and provide contract support services to farmers throughout the Midwest Information about the first year of operation follows Jan. 1 Investors provided $2,500,000 of cash in exchange for stock of Fernandez Cornnratinn Purchased combines and trucks in exchange for $1,000,000 cash and a $3,000,000 note payable Jan. 1 Feb. 7 Purchased $40,000 of supplies on account that will be needed during the upcoming harvest Mar. 3 Apr. 1 Apr. 11 May 1 June 6 June 9 June 15 June 20 June 30 Aug. 1 Paid wages of $65,400 Billed customers for services in the amount of $230,000 Paid $30,000 toward the purchase of February 7 Purchased a $24,000 insurance policy, recorded as prepaid insurance Collected $210,000 on accounts receivable Paid wages of $130,600 Paid $30,200 for fuel costs Paid $12,500 for lodging costs incurred by crew Paid $120,000 of interest and $80,000 to reduce the balance of the note Billed customers for services provided in the amount of $812,000 12 Problem Worksheet(a)Worksheet(b)Worksheet(c) Worksheet(d) Ready June 30 Aug. 1 Sept. 3 Sept. 16 Sept. 25 Oct. 20 Nov. 3 Dec. 15 Dec. 31 Paid $120,000 of interest and $80,000 to reduce the balance of the note Billed customers for services provided in the amount of $812,000 Collected $715,000 on accounts receivable Purchased $25,000 of supplies on account Paid $61,200 for fuel costs Paid $8,100 for lodging costs incurred by crew Paid wages of $125,900 Collected $100,000 as deposits from customers who contracted for 20X8 harvesting services Declared and paid a $25,000 dividend to shareholders Fernandez Corporation uses the following accounts Cash Accounts Supplies Prepaid 5 Supplies 7 Prepaid Equipment Accumulated Accounts Interest Unearned Notes Capital Retained Dividends Revenues Wage Fuel Lodging Insurance Supplies Interest epreciation 5 Income (a) Journalize the listed transactions (b) Post the transactions to the appropriate general ledger accounts (c) Prepare a trial balance as of December 31 (d) Journalize and post adjusting entries based on the following additional information Problem Worksheet(a)Worksheet(b)Worksheet(c) Worksheet 2 Supplies 3 Interest Depreciation 5 Income (a) Journalize the listed transactions (b) Post the transactions to the appropriate general ledger accounts 9 (c) Prepare a trial balance as of December 31 (d) Journalize and post adjusting entries based on the following additional information 0 The equipment had 25-year life, with no salvage value Supplies on hand at year end amount to $20,000 At year end, $115,000 of additional interest is due on the note payable The insurance policy covered a 12-month period commencing on May 1 At year end, Fernandez had provided $30,000 of unbilled services to customers. These services will be billed in early 20X8 2 3 4 5 6 e) Prepare an adjusted trial balance as of December 31 (f) Prepare an income statement and statement of retained earnings for 20X7, and a classified balance sheet as of the end of the year 7 (g) Journaie and post closing entries 9 (h) Prepare a post-closing trial balance as of December 31 Problem Worksheet(a)Worksheet(b)Worksheet(c) Worksheet(d) eady