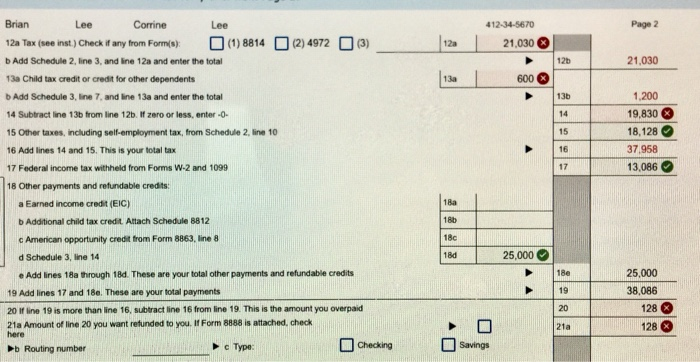

I need help with line 13a please

Child Tax Credit or Credit for other dependents

Thank you

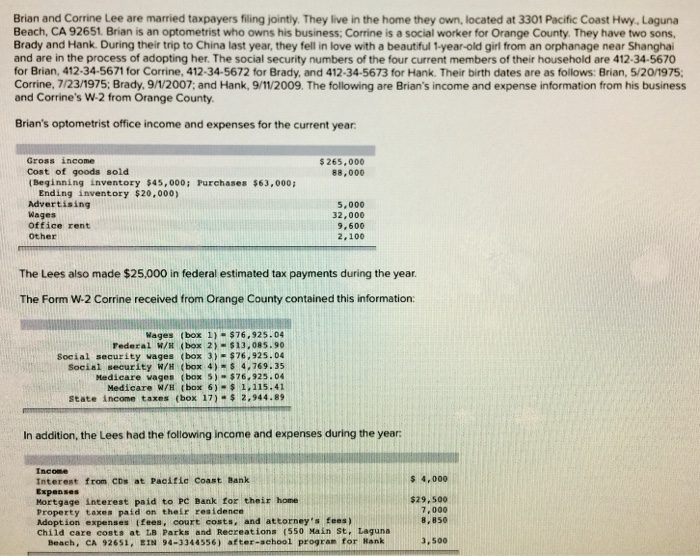

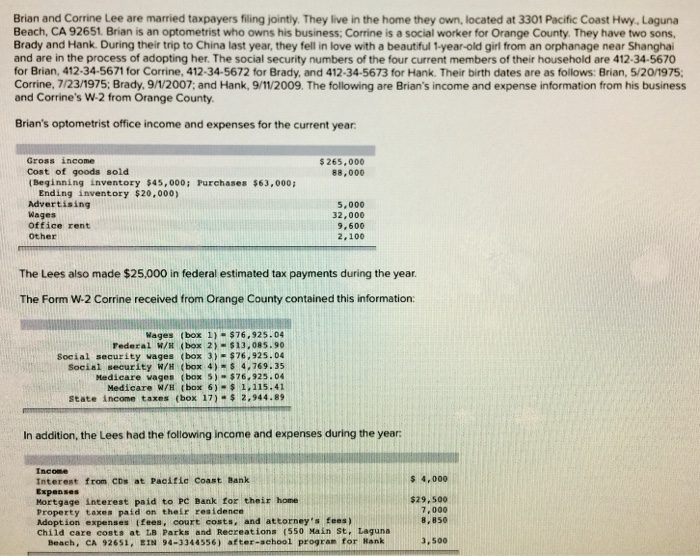

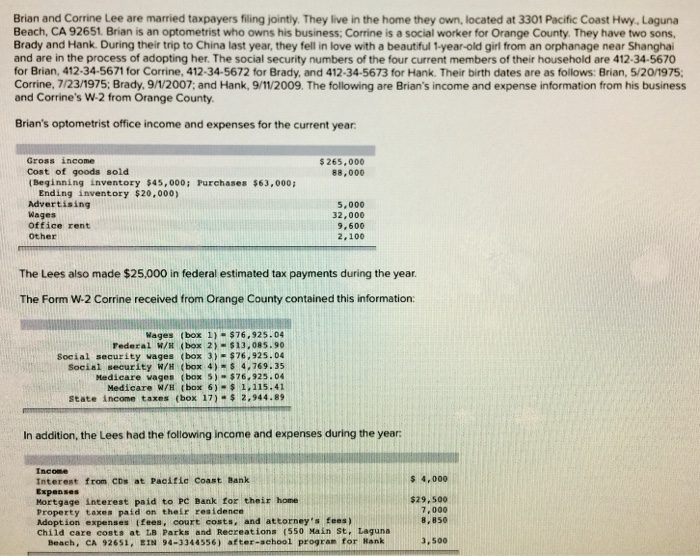

Brian and Corrine Lee are married taxpayers filing jointly. They live in the home they own, located at 3301 Pacific Coast Hwy., Laguna Beach, CA 92651. Brian is an optometrist who owns his business; Corrine is a social worker for Orange County. They have two sons, Brady and Hank. During their trip to China last year, they fell in love with a beautiful 1-year-old girl from an orphanage near Shanghai and are in the process of adopting her. The social security numbers of the four current members of their household are 412-34-5670 for Brian, 412-34-5671 for Corrine, 412-34.5672 for Brady, and 412-34-5673 for Hank. Their birth dates are as follows: Brian, 5/20/1975: Corrine, 7/23/1975; Brady, 9/1/2007, and Hank, 9/11/2009. The following are Brian's income and expense information from his business and Corrine's W-2 from Orange County Brian's optometrist office income and expenses for the current year $ 265,000 88,000 Gross income Cost of goods sold (Beginning inventory $45,000; Purchases $63,000; Ending inventory $20,000) Advertising Wages Office rent Other 5,000 32.000 9.500 2,100 The Lees also made $25,000 in federal estimated tax payments during the year. The Form W-2 Corrine received from Orange County contained this information: Wages (box 1) - $76,925.04 Federal W/H (box 2) - $13,085.90 Social security wages (box 3)- $26.925.04 Social security W/H (box 4) = $4,769.35 Medicare vages (box 5) - $76,925.04 Medicare W/H box 6)- $ 1.115.41 State income taxes (box 17) - $ 2.944.89 In addition, the Lees had the following income and expenses during the year: $ 4.000 Income Interest from CDs at Pacific Coast Bank Expenses Mortgage interest paid to PC Dank for their home Property taxes paid on their residence Adoption expenses (fees, court costs, and attorney's fees) Child care conta at LB Parks and Recreations 550 Main St, Laguna Beach, CA 92651, EIN 94-3344556) after-school program for Hank $29.500 7,000 8,850 3,500 Page 2 412-34-5670 21.030 122 21.030 600 1.200 19,830 18,128 37,958 13,086 Brian Lee Corrine Lee 12a Tax (see inst) Check it any from Form(s) (1) 8814 12) 4972 (3) Add Schedule 2 line 3, and line 12a and enter the total 13a Child tax credit or credit for other dependents Add Schedule 3, line 7 and line 13a and enter the total 14 Subtract line 13b from line 12b. If zero or less, enter-O- 15 Other taxes, including self-employment tax, from Schedule 2 line 10 16 Add lines 14 and 15. This is your total tax 17 Federal income tax withheld from Forms W-2 and 1099 18 Other payments and refundable credits: a Earned income credit (EIC) Additional child tax credit Attach Schedule 8812 c American opportunity credit from Form 8863, line 8 d Schedule 3, line 14 . Add lines 18a through 18d. These are your total other payments and refundable credits 19 Add lines 17 and 180. These are your total payments 20 Wine 19 is more than Ine 16, subtract line 16 from Ine 19. This is the amount you overpaid 21a Amount of line 20 you want refunded to you. If Form 8888 is attached, check > Routing number e Type: Checking 180 25,000 25,000 38,086 128 128 here Savings