I need help with my second part of my assignment. What do I need to calculate?. Thank you.

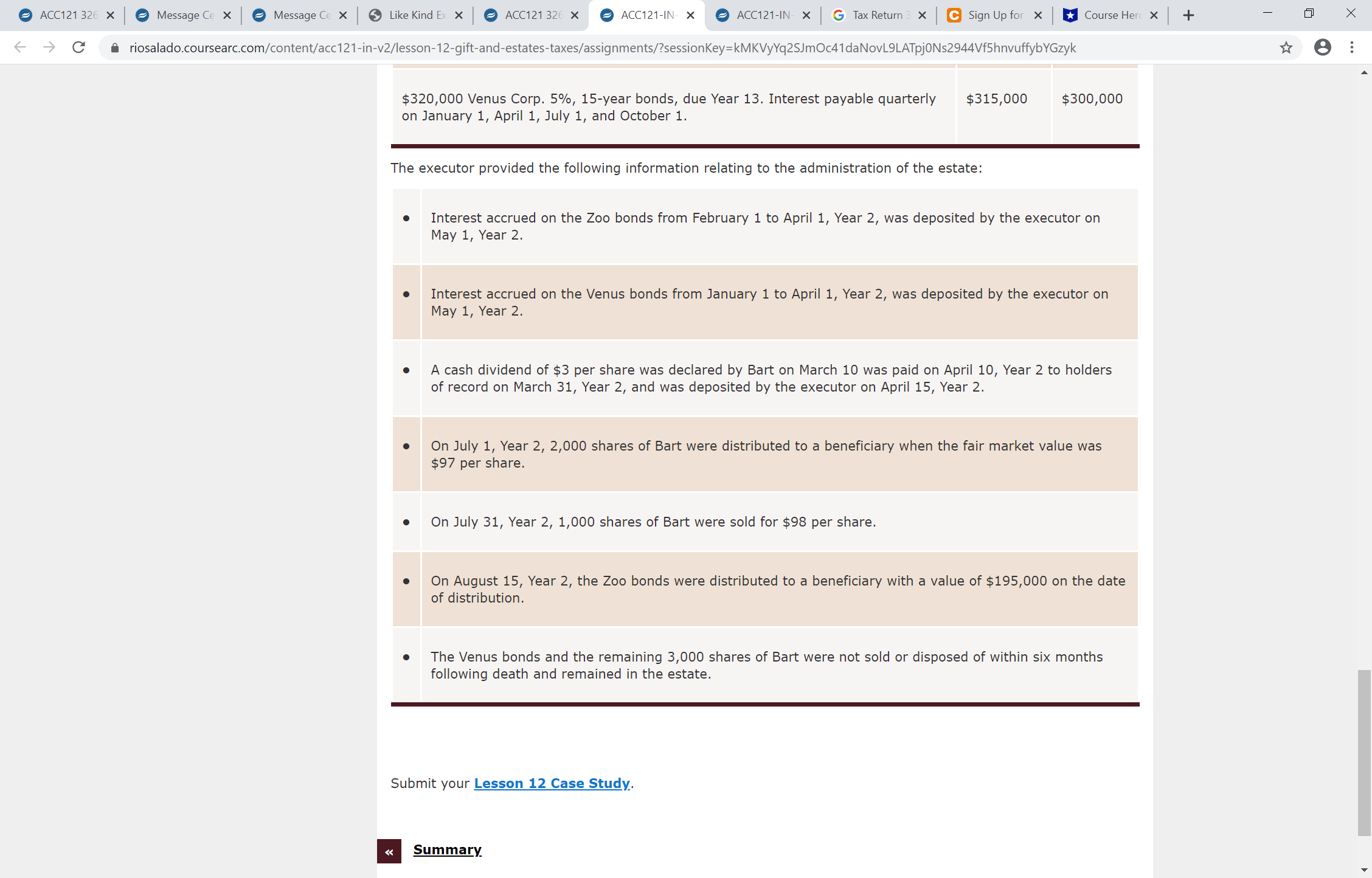

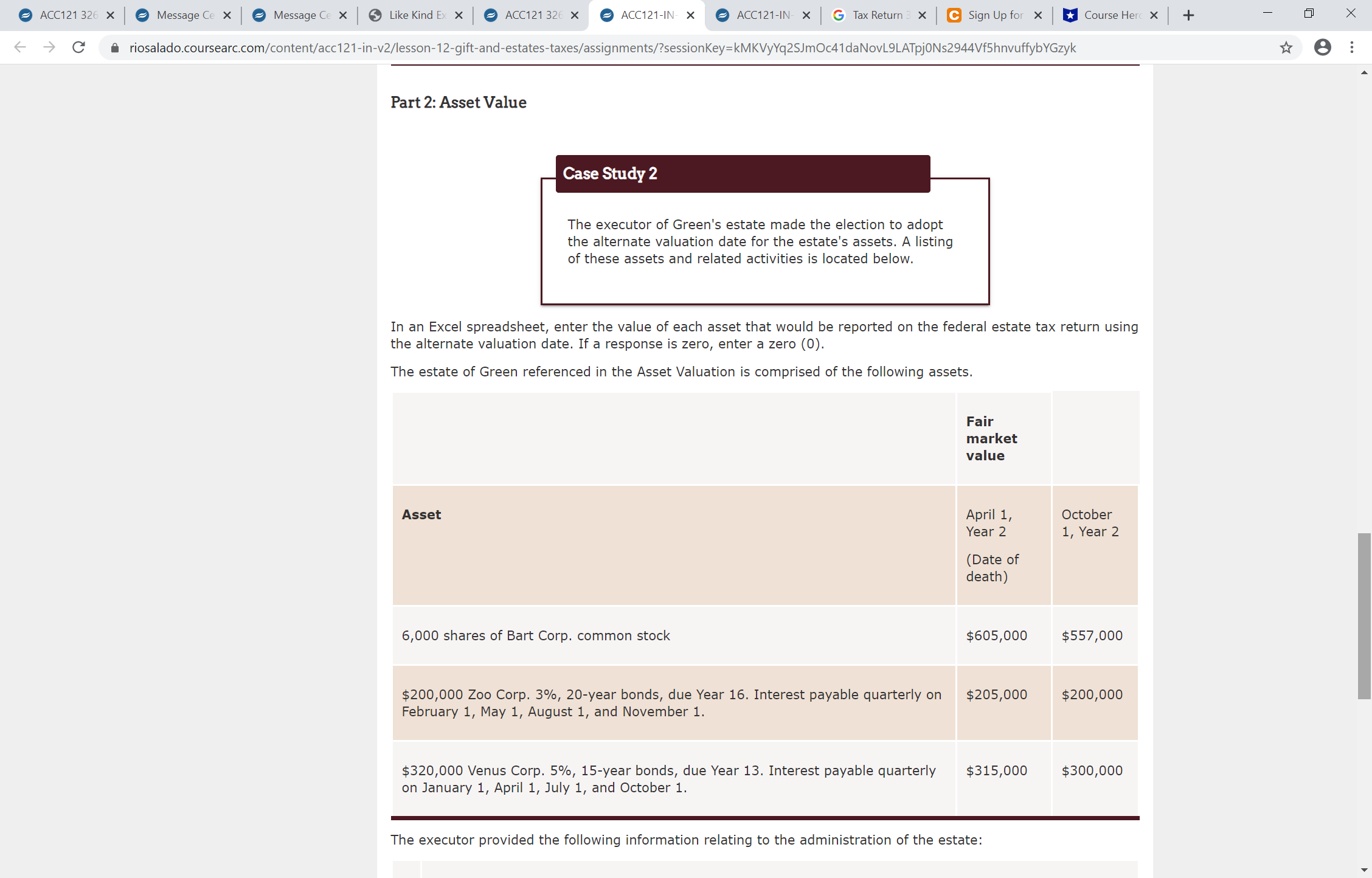

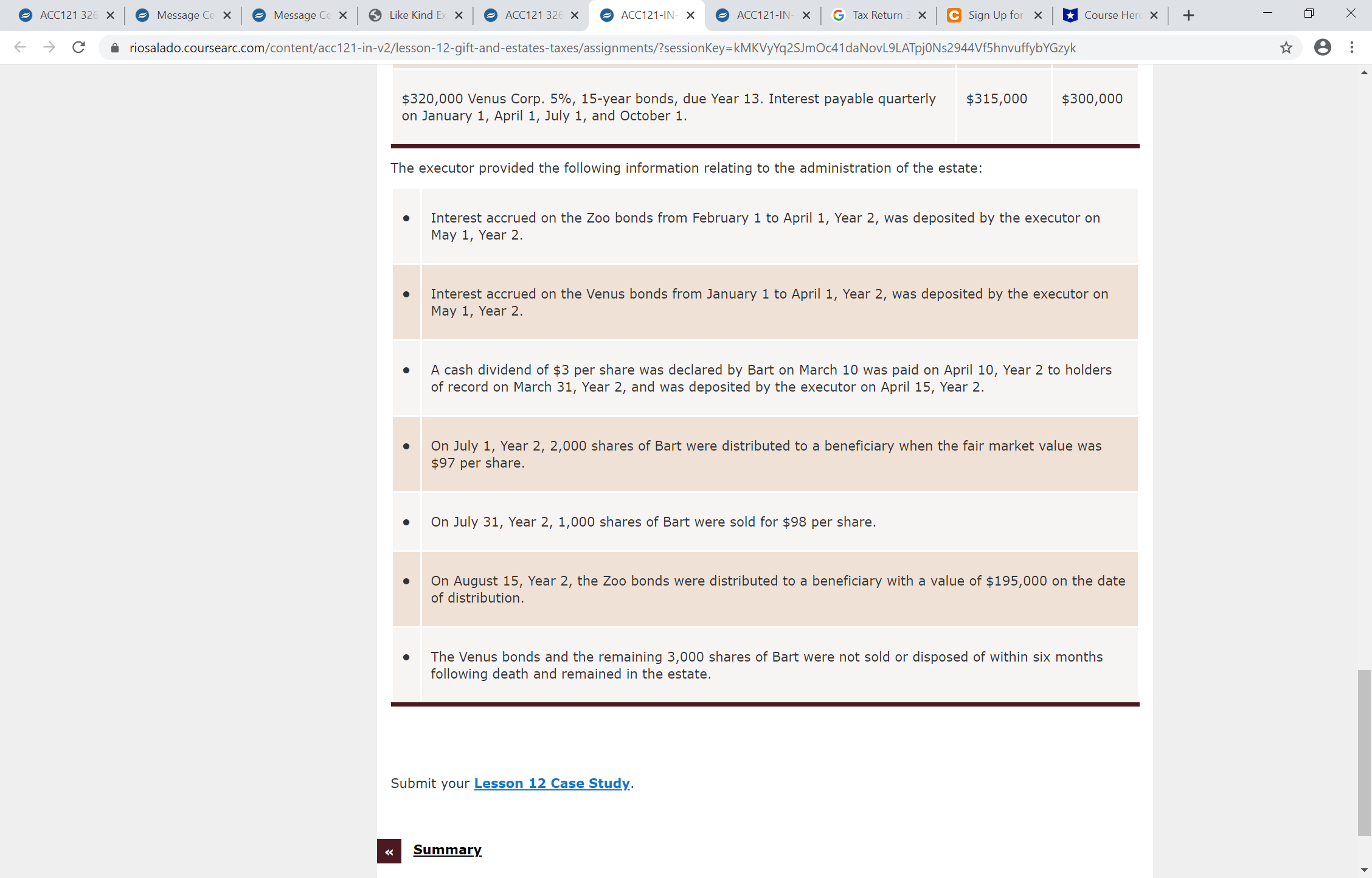

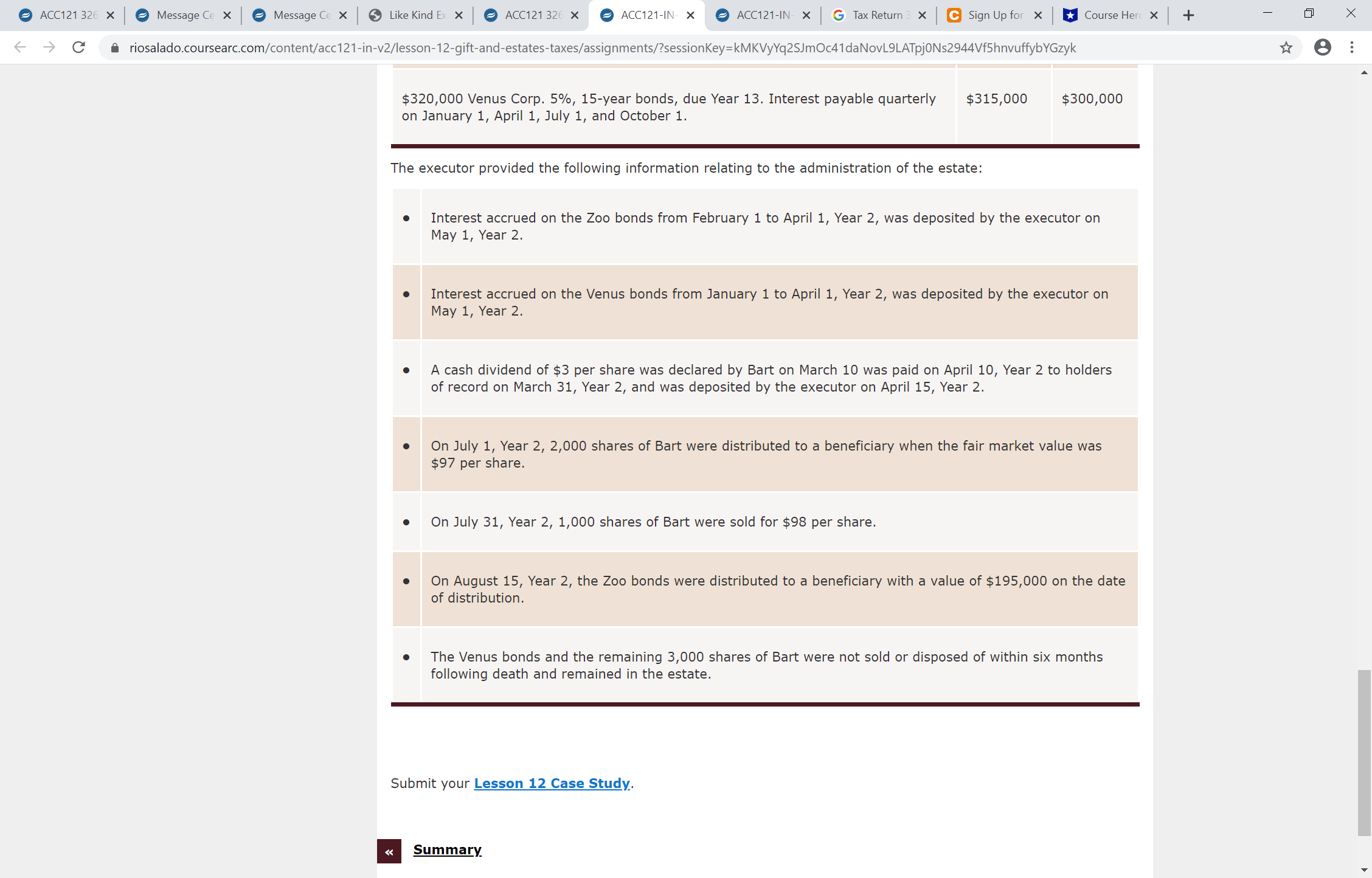

ACC121 326 X Message Ce X Message Ce X Like Kind Ex X ACC121 326 X ACC121-IN- X ACC121-IN- X G Tax Return 3 X C Sign Up for x Course Her( X + X riosalado.coursearc.com/content/acc121-in-v2/lesson-12-gift-and-estates-taxes/assignments/?sessionKey=kMKVyYq25JmOc41daNovL9LATpjONs2944Vf5hnvuffybYGzyk Part 2: Asset Value Case Study 2 The executor of Green's estate made the election to adopt the alternate valuation date for the estate's assets. A listing of these assets and related activities is located below. In an Excel spreadsheet, enter the value of each asset that would be reported on the federal estate tax return using the alternate valuation date. If a response is zero, enter a zero (0). The estate of Green referenced in the Asset Valuation is comprised of the following assets. Fair market value Asset April 1, October Year 2 1, Year 2 (Date of death) 6,000 shares of Bart Corp. common stock $605,000 $557,000 $200,000 Zoo Corp. 3%, 20-year bonds, due Year 16. Interest payable quarterly on $205,000 $200,000 February 1, May 1, August 1, and November 1. $320,000 Venus Corp. 5%, 15-year bonds, due Year 13. Interest payable quarterly $315,000 $300,000 on January 1, April 1, July 1, and October 1. The executor provided the following information relating to the administration of the estate:ACC121 326 X Message Ce X Message Ce X Like Kind Ex X ACC121 326 X ACC121-IN- X ACC121-IN- X G Tax Return 3 X C Sign Up for x Course Herc X + X A riosalado.coursearc.com/content/acc121-in-v2/lesson-12-gift-and-estates-taxes/assignments/?sessionKey=kMKVyYq25JmOc41daNovL9LATpjONs2944Vf5hnvuffybYGzyk $320,000 Venus Corp. 5%, 15-year bonds, due Year 13. Interest payable quarterly $315,000 $300,000 on January 1, April 1, July 1, and October 1. The executor provided the following information relating to the administration of the estate: Interest accrued on the Zoo bonds from February 1 to April 1, Year 2, was deposited by the executor on May 1, Year 2. Interest accrued on the Venus bonds from January 1 to April 1, Year 2, was deposited by the executor on May 1, Year 2. A cash dividend of $3 per share was declared by Bart on March 10 was paid on April 10, Year 2 to holders of record on March 31, Year 2, and was deposited by the executor on April 15, Year 2. . On July 1, Year 2, 2,000 shares of Bart were distributed to a beneficiary when the fair market value was $97 per share. On July 31, Year 2, 1,000 shares of Bart were sold for $98 per share. On August 15, Year 2, the Zoo bonds were distributed to a beneficiary with a value of $195,000 on the date of distribution. The Venus bonds and the remaining 3,000 shares of Bart were not sold or disposed of within six months following death and remained in the estate. Submit your Lesson 12 Case Study. Summary