Answered step by step

Verified Expert Solution

Question

1 Approved Answer

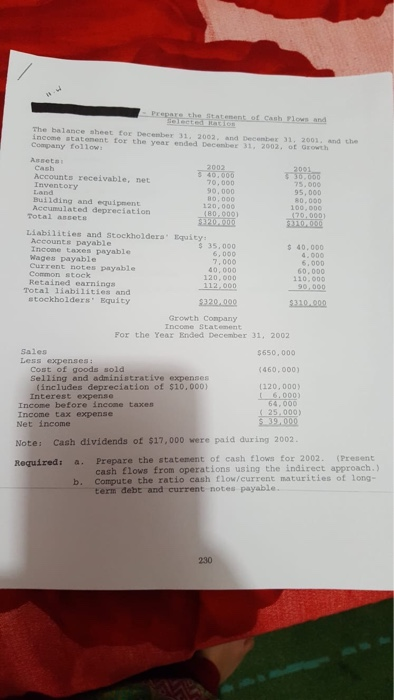

i need help with my statement analysis class The balance sheet for Decenbex 31. 2002, and Decenbex 31, 2003, and the income statenent for the

i need help with my statement analysis class

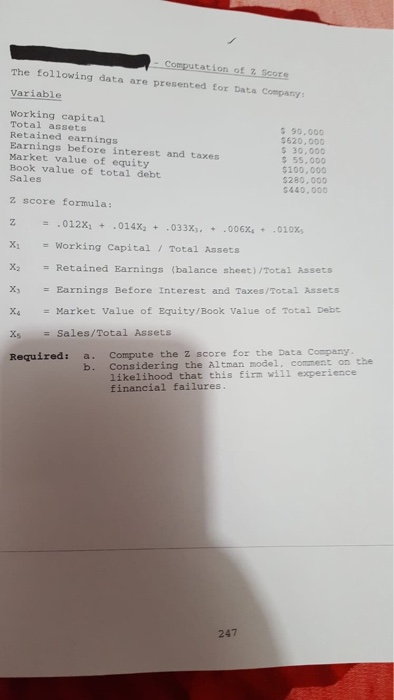

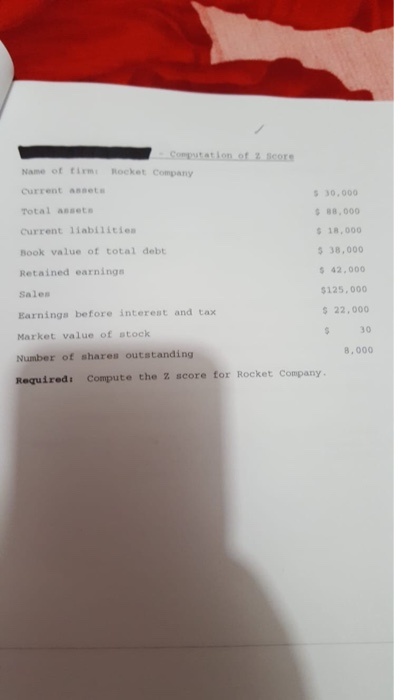

The balance sheet for Decenbex 31. 2002, and Decenbex 31, 2003, and the income statenent for the year ended Decenber 31, 2002, ot Growth Company follow Asset cash Accounts receivable, net Inventory 70,000 90,000 95, 000 80,000 Building and equipment Total assets Liabilities and Stockholdera Equity Accounts payable Income taxes payable Wages payable Current notes payable Common stock Retained earninga s 40,000 S 35, 000 7,000 40, 000 120,000 60, 000 110,000 Total liabilities and stockholders Equity Growth Company Income Statement For the Year Ended December 31, 2002 Sales Less expenses 460,000) Cost of goods sold Selling and administrative expenses (includes depreciation of $10, 000) (120,000) Interest expense Income before incone taxes Income tax expense Net income 000) Note: Cash dividends of $17,000 were paid during 2002 t a. Prepare the statement of cash flows for 2002. (Present cash flows from operations using the indirect approach.) b. Compute the ratio cash flow/current maturities of long- Required: term debt and current notes payable 230 -Computation of Z score The following data are presented for Data Company Variable working capital Total assets Retained earnings Earnings before interest and taxes Market value of equity Book value of total debt Sales 90.000 620,000 S 30,000 55.000 $100,000 S280,000 440.000 z score formula: X1 = working capital / Total Assets X2 = Retained Earnings (balance sheet)/Total Assets X3 = Earnings Before Interest and Taxes /Total Assets xMarket Value of Equity/Book Value of Total Debt 3Sales/Total Assets Required: a. Compute the 2 score for the Data Company likelihood that this firm will experience financial failures b. Considering the Altman mode1. comment on the 247 Name of tim Rocket Company Current assets Total ansets Current liabi1itien Book value of total debt Retained earnings Sales Earnings before interest and tax Market value of stock Number of shares outstanding 30,000 88,000 s 18, 000 538,000 s 42,000 $125,000 s22,000 30 8,000 Requireds Compute the z score for Rocket Company Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started