I need help with numbers 7 and 8. Please know that this problem do not use debits and credits. Thinks of in term increasing and decreasing. The last excel file is the blank file that we need to fill in as trail balance. Thank you.

I need help with numbers 7 and 8. Please know that this problem do not use debits and credits. Thinks of in term increasing and decreasing. The last excel file is the blank file that we need to fill in as trail balance. Thank you.

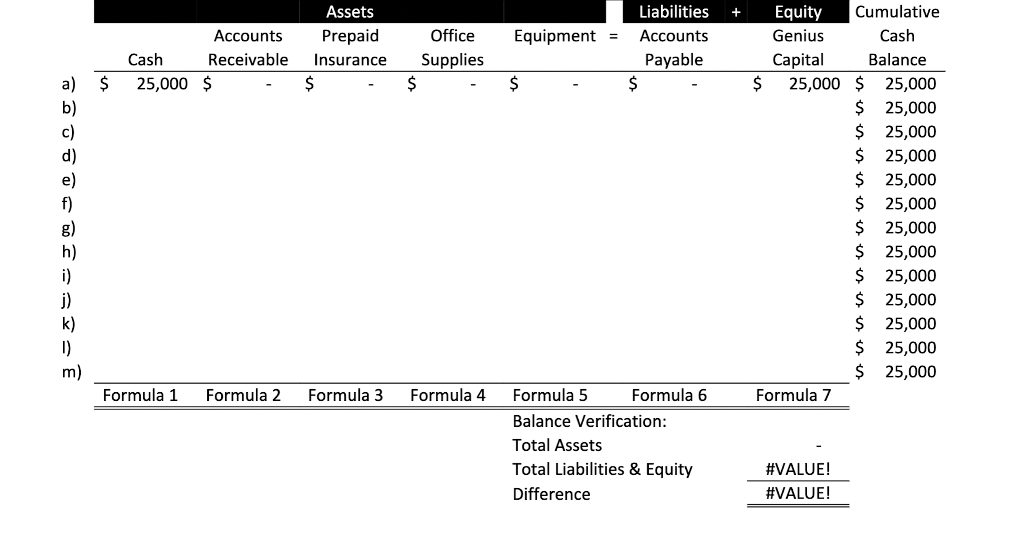

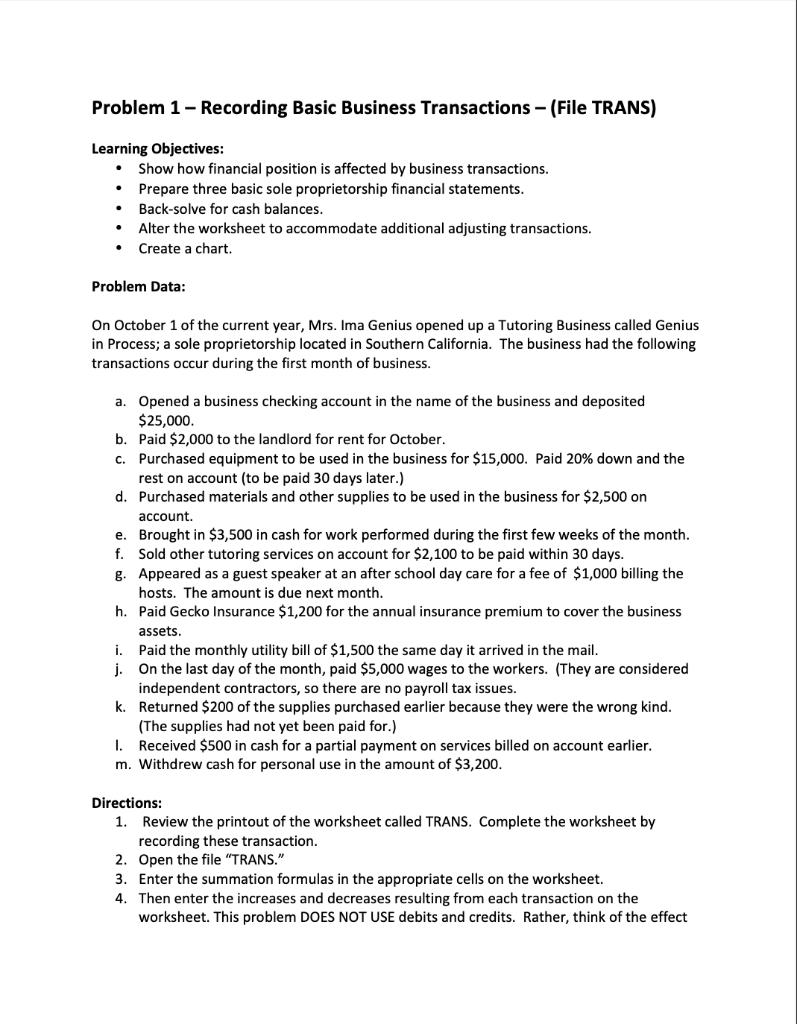

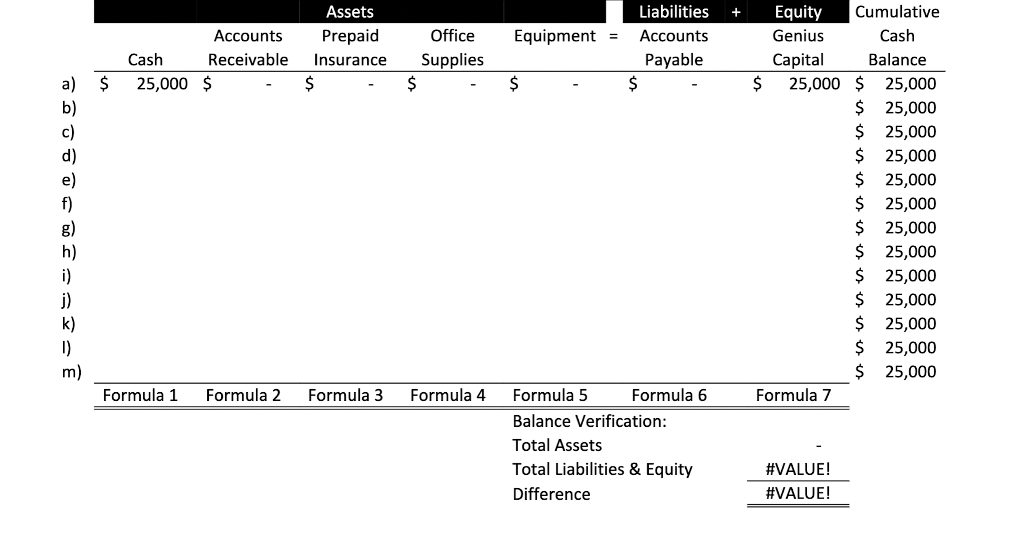

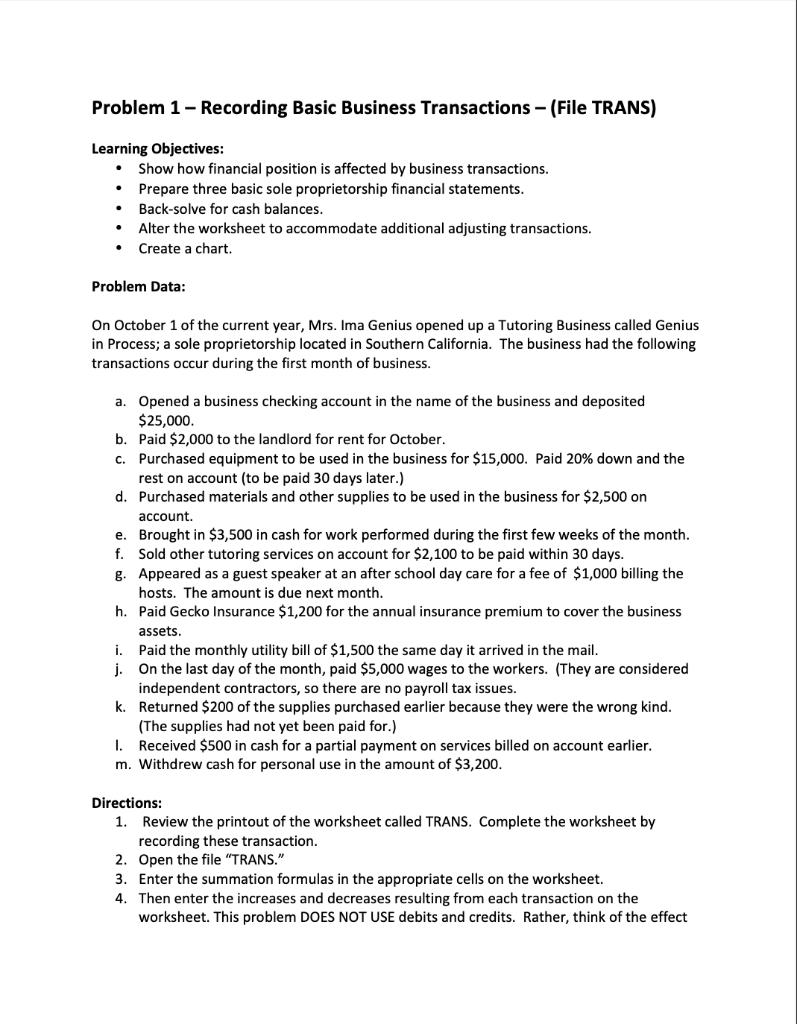

Problem 1 - Recording Basic Business Transactions - (File TRANS) Learning Objectives: Show how financial position is affected by business transactions. Prepare three basic sole proprietorship financial statements. Back-solve for cash balances. Alter the worksheet to accommodate additional adjusting transactions. Create a chart Problem Data: On October 1 of the current year, Mrs. Ima Genius opened up a Tutoring Business called Genius in Process; a sole proprietorship located in Southern California. The business had the following transactions occur during the first month of business. a. Opened a business checking account in the name of the business and deposited $25,000 b. Paid $2,000 to the landlord for rent for October. c. Purchased equipment to be used in the business for $15,000. Paid 20% down and the rest on account (to be paid 30 days later.) d. Purchased materials and other supplies to be used in the business for $2,500 on account. e. Brought in $3,500 in cash for work performed during the first few weeks of the month. f. Sold other tutoring services on account for $2,100 to be paid within 30 days. g. Appeared as a guest speaker at an after school day care for a fee of $1,000 billing the hosts. The amount is due next month. h. Paid Gecko Insurance $1,200 for the annual insurance premium to cover the business assets. i. Paid the monthly utility bill of $1,500 the same day it arrived in the mail. j. On the last day of the month, paid $5,000 wages to the workers. (They are considered independent contractors, so there are no payroll tax issues. k. Returned $200 of the supplies purchased earlier because they were the wrong kind. (The supplies had not yet been paid for.) I. Received $500 in cash for a partial payment on services billed on account earlier. m. Withdrew cash for personal use in the amount of $3,200. Directions: 1. Review the printout of the worksheet called TRANS. Complete the worksheet by recording these transaction. 2. Open the file "TRANS." 3. Enter the summation formulas in the appropriate cells on the worksheet. 4. Then enter the increases and decreases resulting from each transaction on the worksheet. This problem DOES NOT USE debits and credits. Rather, think of the effect + Equipment = Accounts Cash Receivable 25,000 $ Assets Prepaid Insurance $ Office Supplies $ Liabilities Accounts Payable $ $ $ a) b) c) d) e) f) Equity Cumulative Genius Cash Capital Balance $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 Formula 7 h) i) j) k) 1) m) Formula 1 Formula 2 Formula 3 Formula 4 Formula 5 Formula 6 Balance Verification: Total Assets Total Liabilities & Equity Difference #VALUE! #VALUE

I need help with numbers 7 and 8. Please know that this problem do not use debits and credits. Thinks of in term increasing and decreasing. The last excel file is the blank file that we need to fill in as trail balance. Thank you.

I need help with numbers 7 and 8. Please know that this problem do not use debits and credits. Thinks of in term increasing and decreasing. The last excel file is the blank file that we need to fill in as trail balance. Thank you.