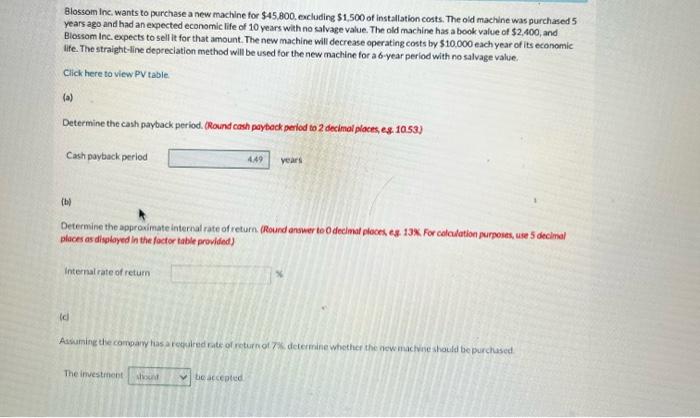

I need help with part B?

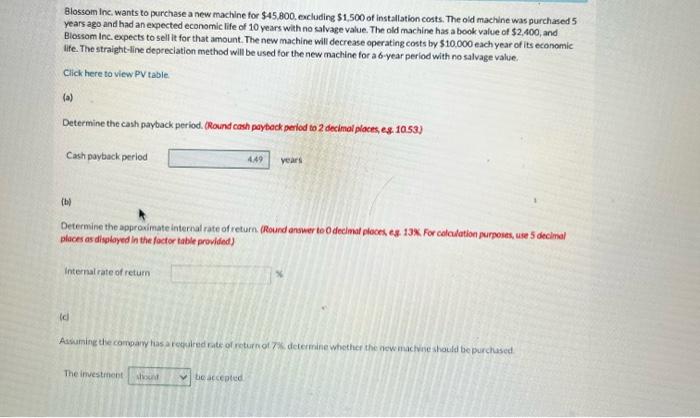

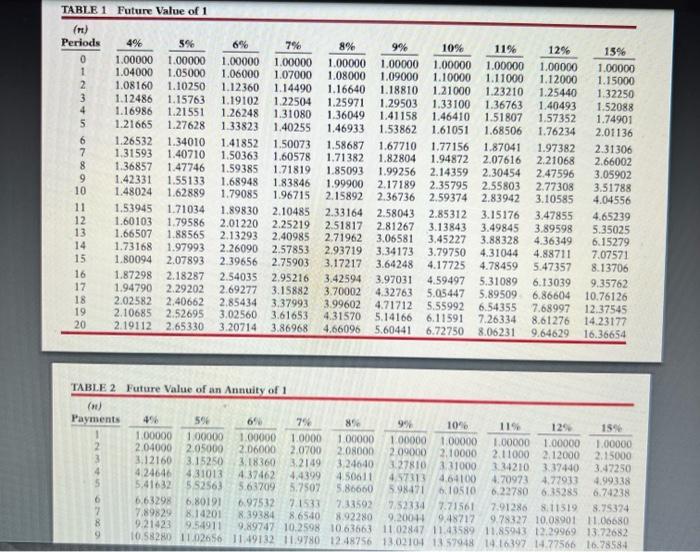

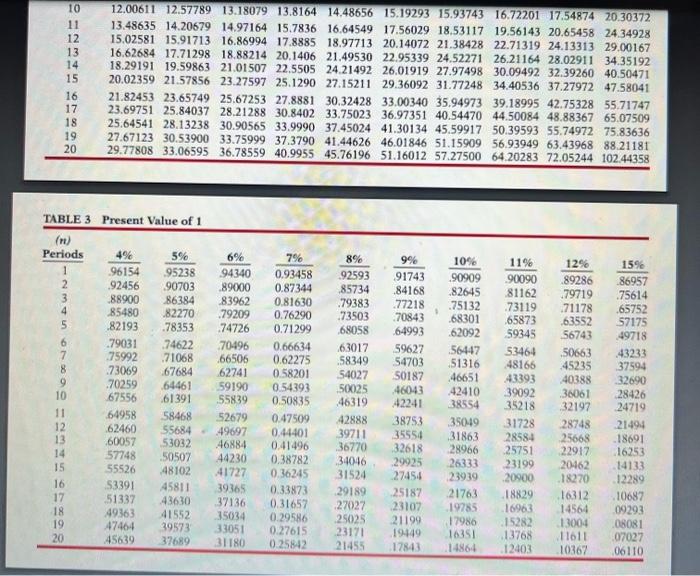

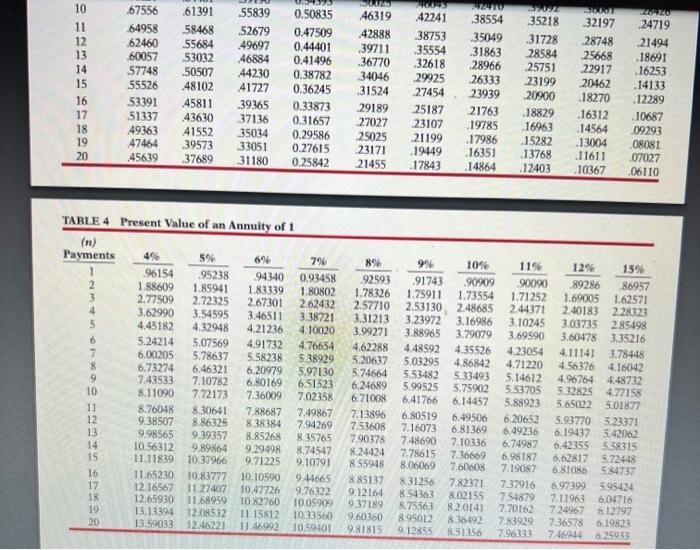

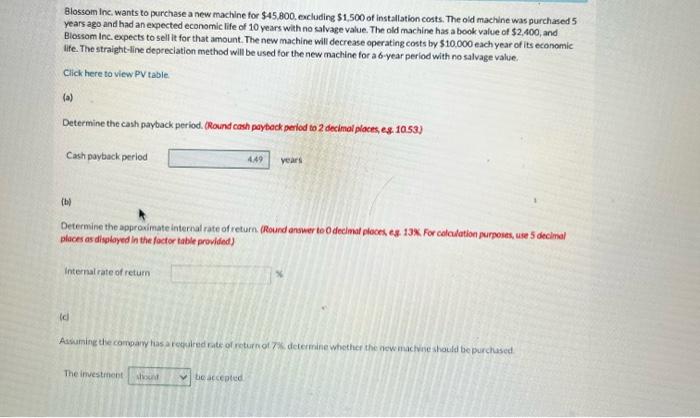

Blossom Inc, wants to purchase a new machine for $45,800, eacluding $1,500 of installation costs. The old machine was purchased 5 years ago and had an expected economic life of 10 years with no salvage value. The old machine has a book value of $2,400, and Blossom Inc. expects to sell it for that amount. The new machine will decrease operating costs by $10,000 each year of its economic life. The straight-line depreciation method will be used for the new machine for a 6-year period with no salvage value. Click here to view PV table (a) Determine the cash payback period. (Round cash paybeck period to 2 decimol ploces, eg. 10.53) Cash payback period vears (b) Determine the approwimate internal rate of return. (Round answer to 0 dedimal ploces es. 13. For coladation purposes, use 5 declinal places as dilyiayed in the foctor table provided) Internal rate of retuin (c) Aswining the compawy has a reckired rate of neturn of 7 . derermine whether the new mactwne should be purchased The investment be accepted TABI.E 1 Future Value of 1 TABL.E 2. Future Value of an Annuity of 1 \begin{tabular}{lllllllllll} 10 & 12.00611 & 12.57789 & 13.18079 & 13.8164 & 14.48656 & 15.19293 & 15.93743 & 16.72201 & 17.54874 & 20.30372 \\ 11 & 13.48635 & 14.20679 & 14.97164 & 15.7836 & 16.64549 & 17.56029 & 18.53117 & 19.56143 & 20.65458 & 24.34928 \\ 12 & 15.02581 & 15.91713 & 16.86994 & 17.8885 & 18.97713 & 20.14072 & 21.38428 & 22.71319 & 24.13313 & 29.00167 \\ 13 & 16.62684 & 17.71298 & 18.88214 & 20.1406 & 21.49530 & 22.95339 & 24.52271 & 26.21164 & 28.02911 & 34.35192 \\ 14 & 18.29191 & 19.59863 & 21.01507 & 22.5505 & 24.21492 & 26.01919 & 27.97498 & 30.09492 & 32.39260 & 40.50471 \\ 15 & 20.02359 & 21.57856 & 23.27597 & 25.1290 & 27.15211 & 29.36092 & 31.77248 & 34.40536 & 37.27972 & 47.58041 \\ 16 & 21.82453 & 23.65749 & 25.67253 & 27.8881 & 30.32428 & 33.00340 & 35.94973 & 39.18995 & 42.75328 & 55.71747 \\ 17 & 23.69751 & 25.84037 & 28.21288 & 30.8402 & 33.75023 & 36.97351 & 40.54470 & 44.50084 & 48.88367 & 65.07509 \\ 18 & 25.64541 & 28.13238 & 30.90565 & 33.9990 & 37.45024 & 41.30134 & 45.59917 & 50.39593 & 55.74972 & 75.83636 \\ 19 & 27.67123 & 30.53900 & 33.75999 & 37.3790 & 41.44626 & 46.01846 & 51.15909 & 56.93949 & 63.43968 & 88.21181 \\ 20 & 29.77808 & 33.06595 & 36.78559 & 40.9955 & 45.76196 & 51.16012 & 57.27500 & 64.20283 & 72.05244 & 102.44358 \\ \hline \end{tabular} TABLE 3 Present Value of 1 TABI.E 4 Present Value of an Annuity of 1