I need help with part B please

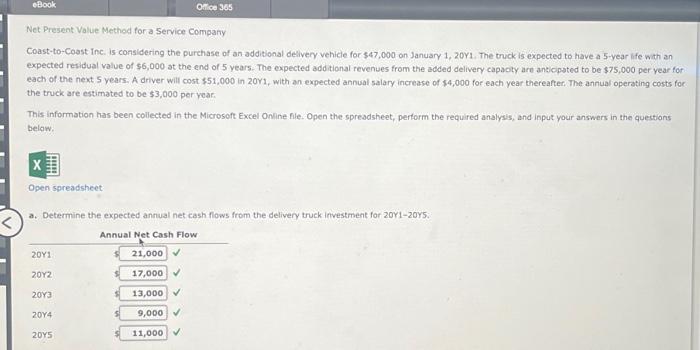

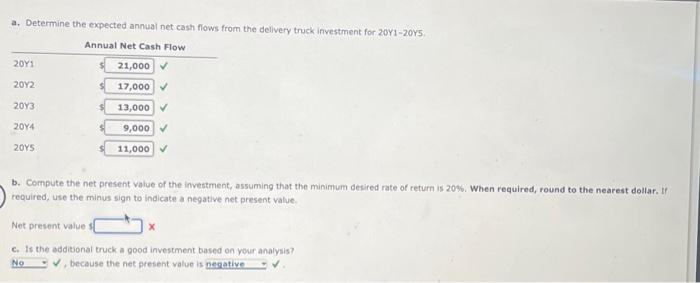

Net Present Value Method for a Service Company Coast-to-Coast Inc. is considering the purchase of an additional delivery vehicle for $47,000 on January 1,20y1, The truck is expected to have a 5 -year life with an expected residual value of $6,000 at the end of 5 years. The expected additional revenues from the added delivery capacty are anticipated to be $75,000 per year for each of the next 5 years. A driver will cost $51,000 in 20r1, with an expected annual salary increase of $4,000 for each year thereafter, The annual operating costs for the truck are estimated to be $3,000 per yoar: This information has been collected in the Microsoft Excel Online fle. Open the spreadsheet, perform the required analyss, and input your answers in the questions below. Open spreadsheet a. Determine the expected annual net cash flows from the delivery truck investment for 20Y1-20y5: a. Determine the expected annual net cash flows from the delivery truck investment for 20 Y1 -20 Y5 b. Compute the net present value of the investment, assuming that the minimum desired rate of ceturn is 20%. When required, round to the nearest dollar. If required, use the minus sign to indlicate a negative net present value. Net present value 1 c. Is the addtionat truck a good investment based on your analysis? , because the net present value is Net Present Value Method for a Service Company Coast-to-Coast Inc. is considering the purchase of an additional delivery vehicle for $47,000 on January 1,20y1, The truck is expected to have a 5 -year life with an expected residual value of $6,000 at the end of 5 years. The expected additional revenues from the added delivery capacty are anticipated to be $75,000 per year for each of the next 5 years. A driver will cost $51,000 in 20r1, with an expected annual salary increase of $4,000 for each year thereafter, The annual operating costs for the truck are estimated to be $3,000 per yoar: This information has been collected in the Microsoft Excel Online fle. Open the spreadsheet, perform the required analyss, and input your answers in the questions below. Open spreadsheet a. Determine the expected annual net cash flows from the delivery truck investment for 20Y1-20y5: a. Determine the expected annual net cash flows from the delivery truck investment for 20 Y1 -20 Y5 b. Compute the net present value of the investment, assuming that the minimum desired rate of ceturn is 20%. When required, round to the nearest dollar. If required, use the minus sign to indlicate a negative net present value. Net present value 1 c. Is the addtionat truck a good investment based on your analysis? , because the net present value is