Answered step by step

Verified Expert Solution

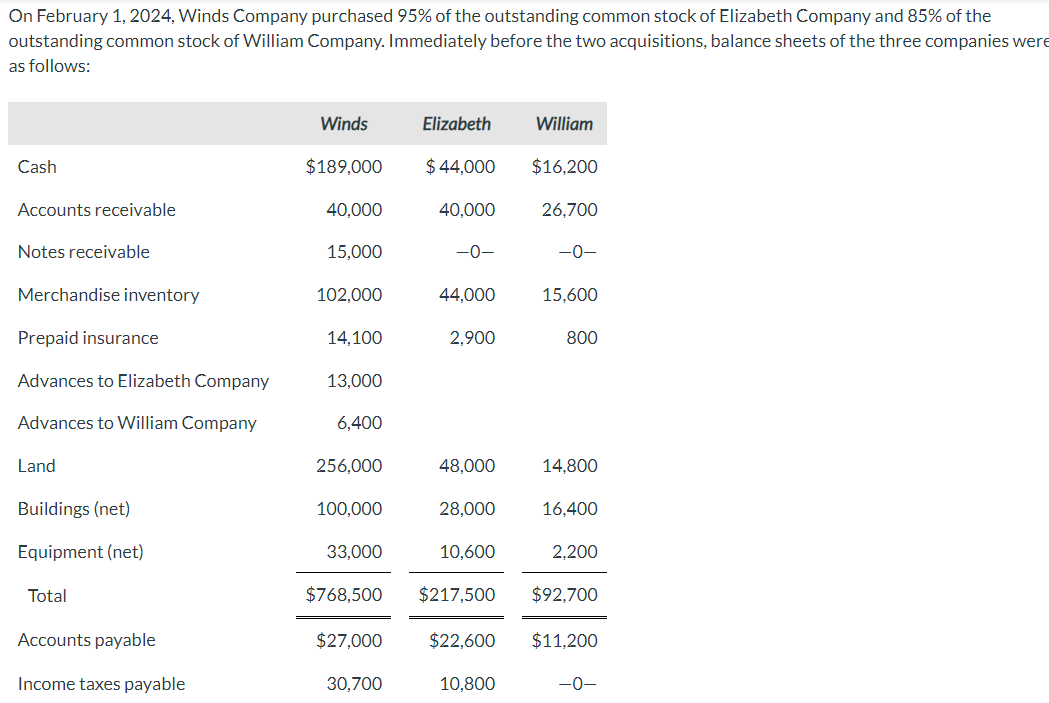

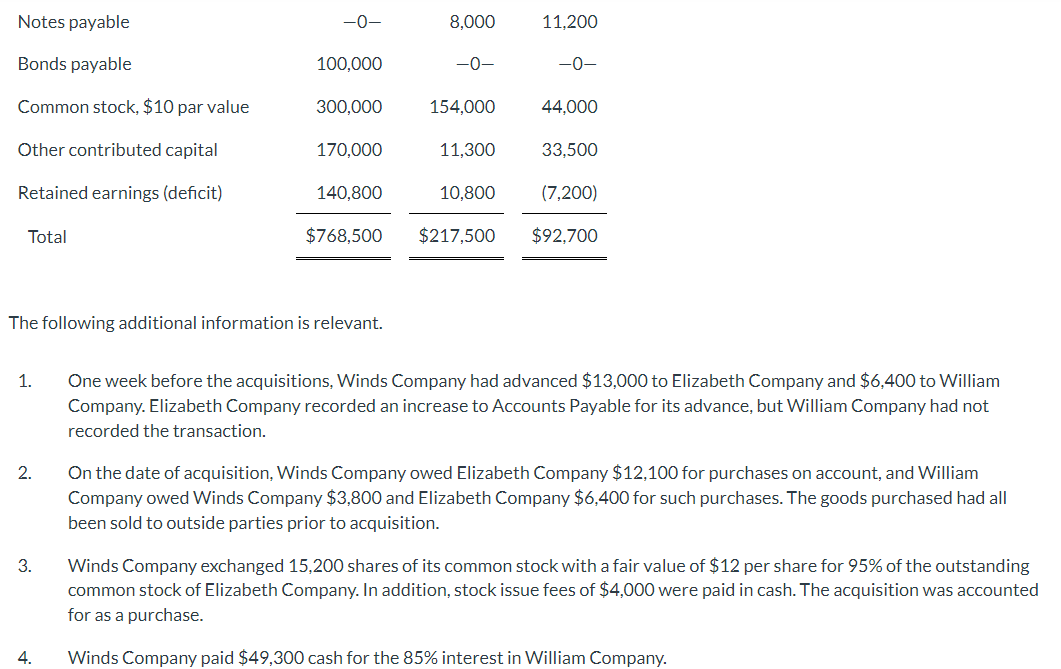

Question

1 Approved Answer

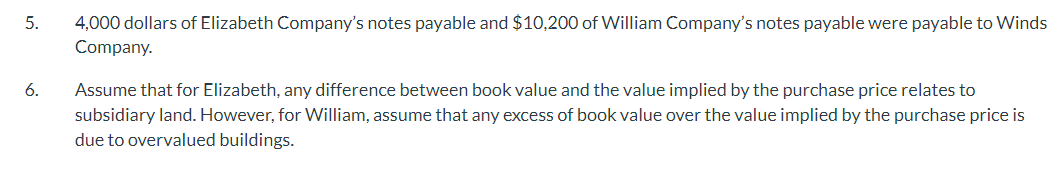

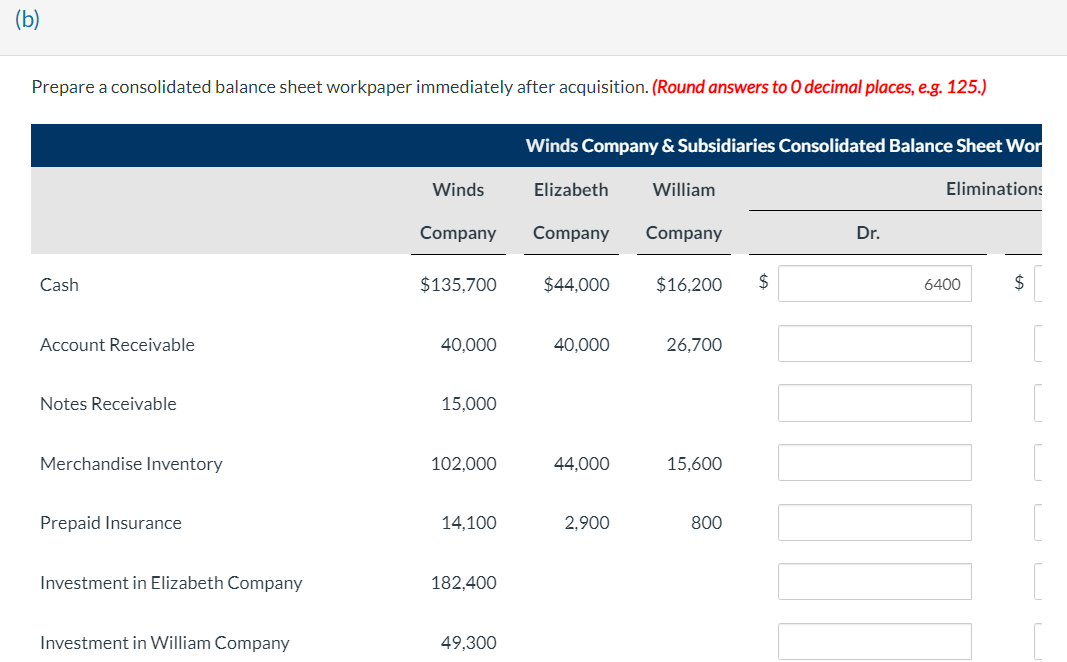

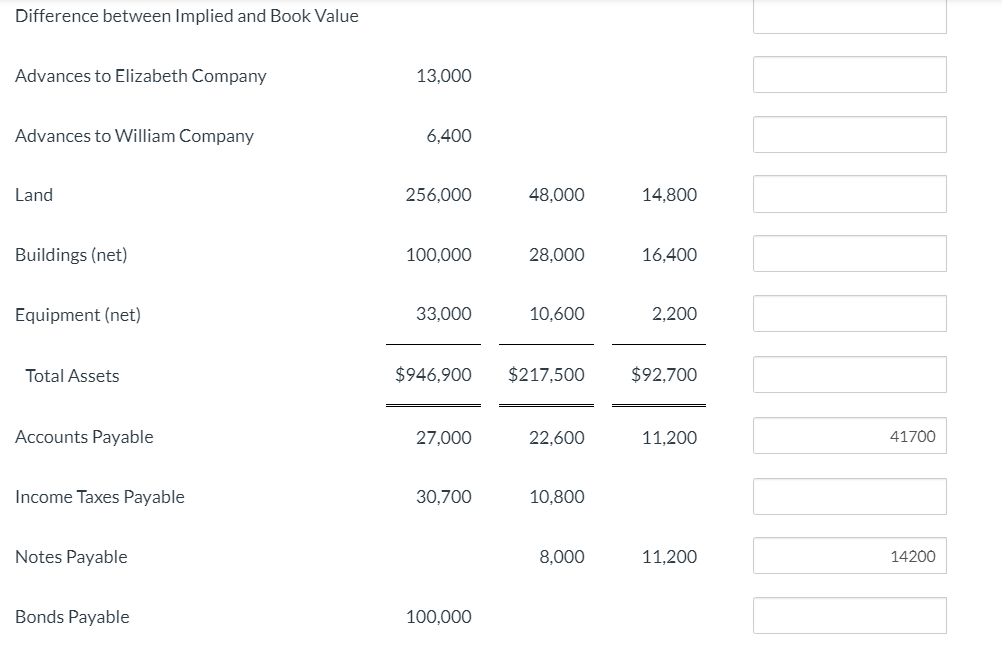

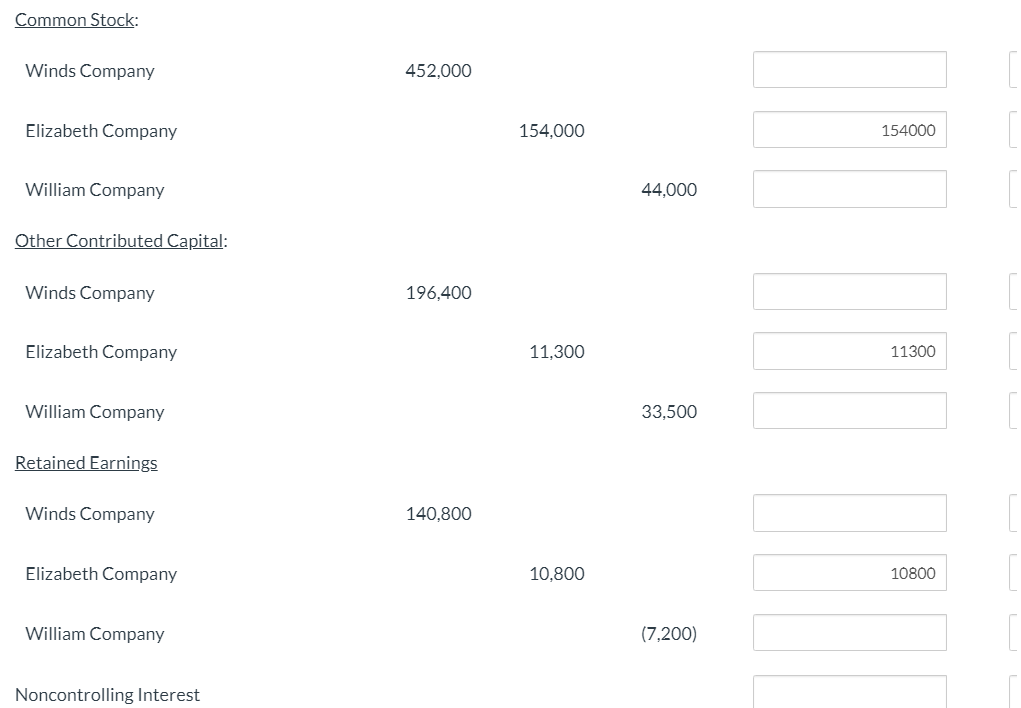

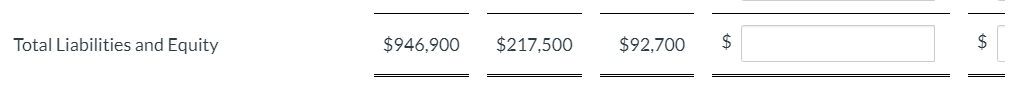

I need help with Part B which is to prepare the adjustments for the consolidated balance sheet. I couldn't capture it in the screenshots, but

I need help with Part B which is to prepare the adjustments for the consolidated balance sheet. I couldn't capture it in the screenshots, but there is a debit and credit column next to each one for the adjusting entry. Please help.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started