Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with part c for both domestic AND international. I have to use that formula but cannot figure out which of the numbers

I need help with part c for both domestic AND international. I have to use that formula but cannot figure out which of the numbers correspond with the letters. If you could help me with writing everything down so I know where exactly you got the numbers. Thank you!! :)

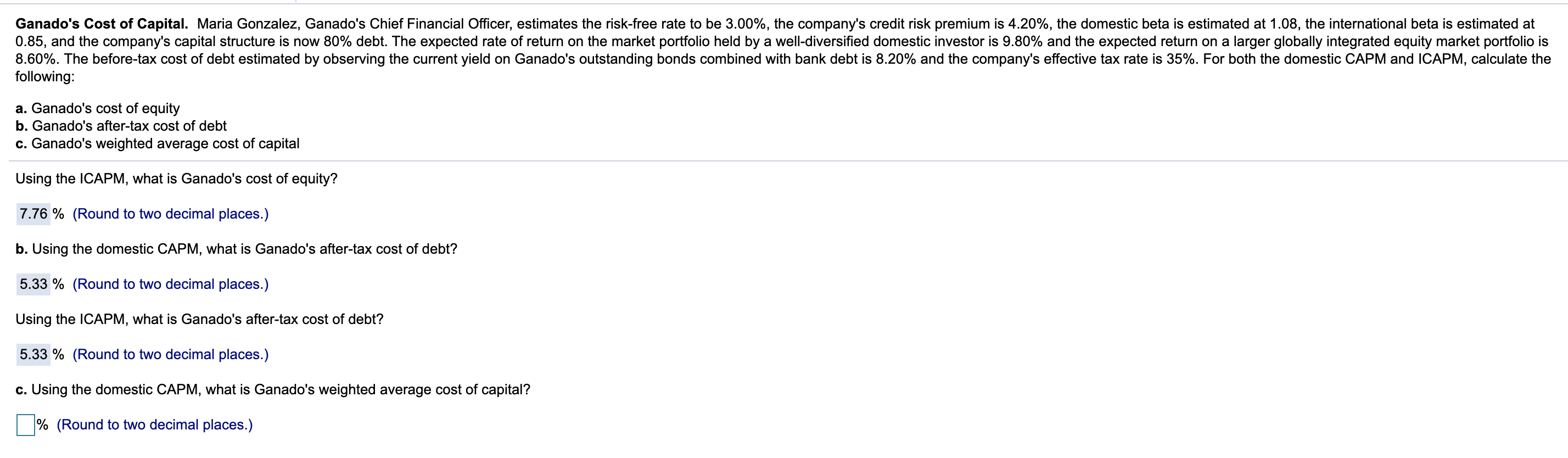

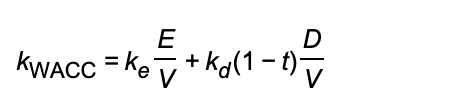

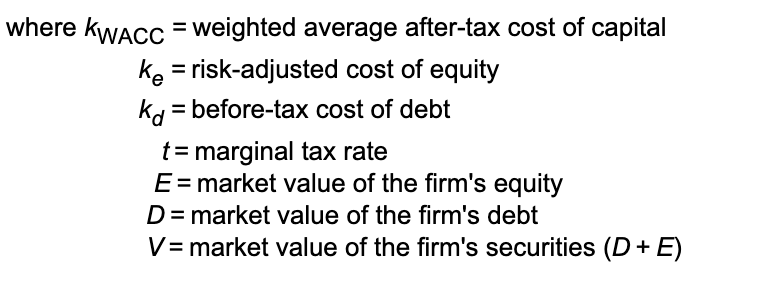

Ganado's Cost of Capital. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.00%, the company's credit risk premium is 4.20%, the domestic beta is estimated at 1.08, the international beta is estimated at 0.85, and the company's capital structure is now 80% debt. The expected rate of return on the market portfolio held by a well-diversified domestic investor is 9.80% and the expected return on a larger globally integrated equity market portfolio is 8.60%. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 8.20% and the company's effective tax rate is 35%. For both the domestic CAPM and ICAPM, calculate the following: a. Ganado's cost of equity b. Ganado's after-tax cost of debt c. Ganado's weighted average cost of capital Using the ICAPM, what is Ganado's cost of equity? 7.76 % (Round to two decimal places.) b. Using the domestic CAPM, what is Ganado's after-tax cost of debt? 5.33 % (Round to two decimal places.) Using the ICAPM, what is Ganado's after-tax cost of debt? 5.33 % (Round to two decimal places.) c. Using the domestic CAPM, what is Ganado's weighted average cost of capital? % (Round to two decimal places.) Kwacc = ke v + ka(1 V where kwacc = weighted average after-tax cost of capital ke = risk-adjusted cost of equity ko = before-tax cost of debt t= marginal tax rate E=market value of the firm's equity D= market value of the firm's debt V= market value of the firm's securities (D + E)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started