Answered step by step

Verified Expert Solution

Question

1 Approved Answer

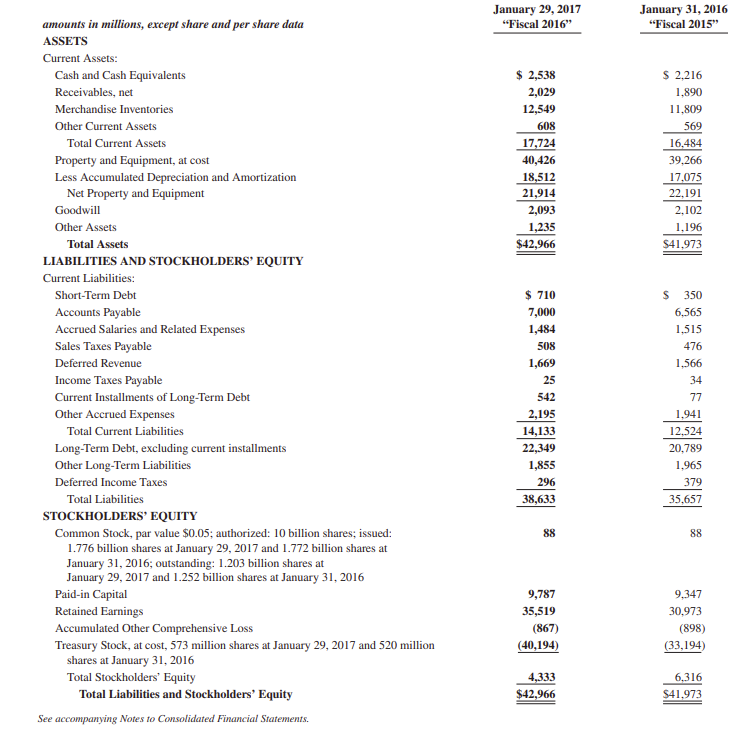

I need help with parts 1-6, please help :( January 29, 2017 Fiscal 2016 January 31, 2016 Fiscal 2015 $ 2,538 2,029 12,549 608 17,724

I need help with parts 1-6, please help :(

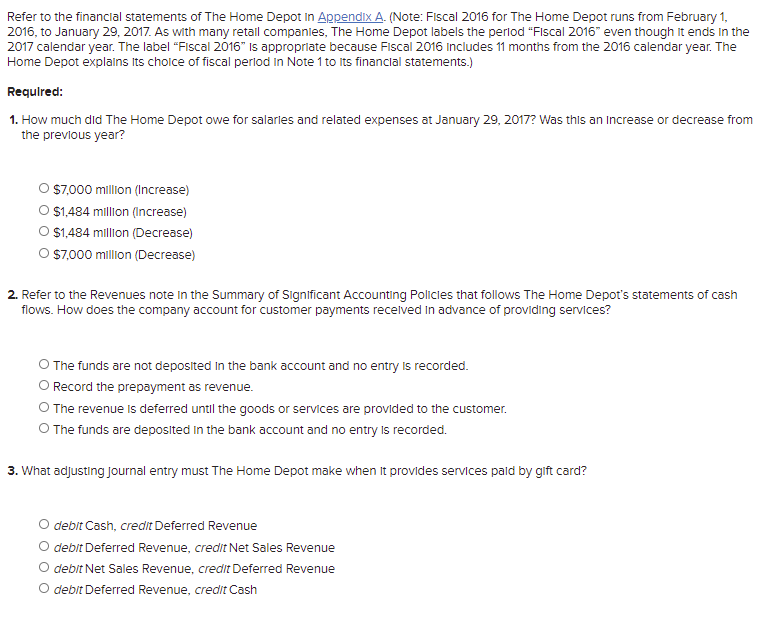

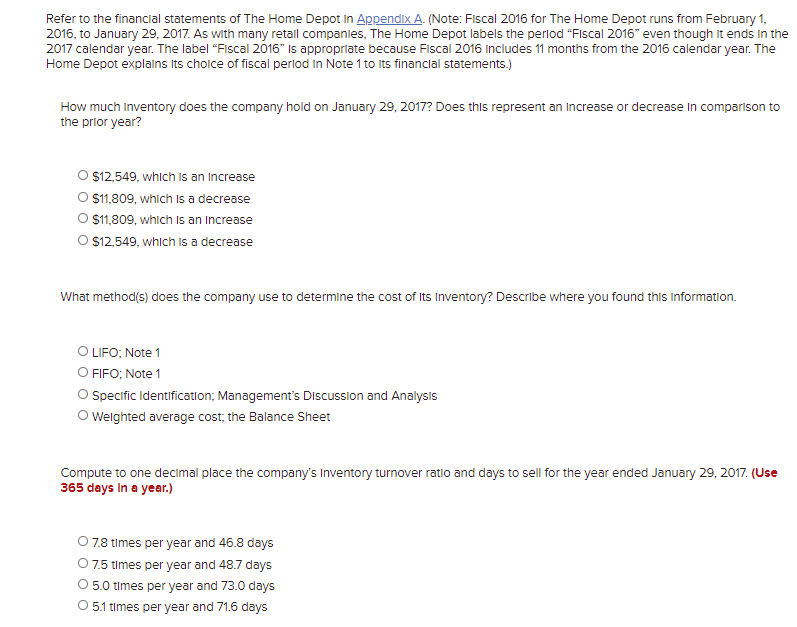

January 29, 2017 "Fiscal 2016" January 31, 2016 "Fiscal 2015" $ 2,538 2,029 12,549 608 17,724 40,426 18,512 21,914 2,093 1,235 $42,966 $ 2,216 1.890 11.809 569 16,484 39.266 17.075 22,191 2,102 1.196 $41.973 $ 710 amounts in millions, except share and per share data ASSETS Current Assets: Cash and Cash Equivalents Receivables, net Merchandise Inventories Other Current Assets Total Current Assets Property and Equipment, at cost Less Accumulated Depreciation and Amortization Net Property and Equipment Goodwill Other Assets Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Short-Term Debt Accounts Payable Accrued Salaries and Related Expenses Sales Taxes Payable Deferred Revenue Income Taxes Payable Current Installments of Long-Term Debt Other Accrued Expenses Total Current Liabilities Long-Term Debt, excluding current installments Other Long-Term Liabilities Deferred Income Taxes Total Liabilities STOCKHOLDERS' EQUITY Common Stock, par value $0.05; authorized: 10 billion shares; issued: 1.776 billion shares at January 29, 2017 and 1.772 billion shares at January 31, 2016; outstanding: 1.203 billion shares at January 29, 2017 and 1.252 billion shares at January 31, 2016 Paid-in Capital Retained Earnings Accumulated Other Comprehensive Loss Treasury Stock, at cost, 573 million shares at January 29, 2017 and 520 million shares at January 31, 2016 Total Stockholders' Equity Total Liabilities and Stockholders' Equity See accompanying Notes to Consolidated Financial Statements. 7,000 1,484 508 1,669 25 542 2,195 14,133 22,349 1,855 296 38,633 $ 350 6,565 1.515 476 1.566 34 77 1.941 12.524 20.789 1.965 379 35,657 88 88 9,787 35,519 (867) (40,194) 9.347 30.973 (898) (33,194) 4,333 $42,966 6.316 $41.973 Refer to the financial statements of The Home Depot In Appendix A. (Note: Fiscal 2016 for The Home Depot runs from February 1, 2016, to January 29, 2017. As with many retail companies, The Home Depot labels the period "Fiscal 2016" even though it ends in the 2017 calendar year. The label "Fiscal 2016" is appropriate because Fiscal 2016 Includes 11 months from the 2016 calendar year. The Home Depot explains its choice of fiscal period In Note 1 to its financial statements.) Required: 1. How much did The Home Depot owe for salarles and related expenses at January 29, 2017? Was this an increase or decrease from the previous year? $7,000 million (Increase) O $1,484 million (Increase) O $1,484 million (Decrease) $7,000 million (Decrease) 2. Refer to the Revenues note in the Summary of Significant Accounting Policies that follows The Home Depot's statements of cash flows. How does the company account for customer payments received in advance of providing services? The funds are not deposited in the bank account and no entry is recorded. Record the prepayment as revenue. The revenue is deferred until the goods or services are provided to the customer. The funds are deposited in the bank account and no entry is recorded. 3. What adjusting Journal entry must The Home Depot make when it provides services paid by gift card? debit Cash, credit Deferred Revenue debit Deferred Revenue, credit Net Sales Revenue O debit Net Sales Revenue, credit Deferred Revenue O debit Deferred Revenue, credit Cash Refer to the financial statements of The Home Depot In Appendix A. (Note: Fiscal 2016 for The Home Depot runs from February 1, 2016, to January 29, 2017. As with many retail companies, The Home Depot labels the period "Fiscal 2016" even though it ends in the 2017 calendar year. The label "Fiscal 2016" is appropriate because Fiscal 2016 Includes 11 months from the 2016 calendar year. The Home Depot explains its choice of fiscal period in Note 1 to its financial statements.) How much Inventory does the company hold on January 29, 2017? Does this represent an increase or decrease in comparison to the prior year? $12,549, which is an Increase O $11,809, which is a decrease O $11,809, which is an increase $12,549, which is a decrease What method(s) does the company use to determine the cost of Its Inventory? Describe where you found this information. OLIFO; Note 1 O FIFO; Note 1 Specific Identification; Management's Discussion and Analysis Weighted average cost; the Balance Sheet Compute to one decimal place the company's Inventory turnover ratio and days to sell for the year ended January 29, 2017. (Use 365 days in a year.) O 7.8 times per year and 46.8 days 75 times per year and 48.7 days 5.0 times per year and 73.0 days 5.1 times per year and 71.6 days January 29, 2017 "Fiscal 2016" January 31, 2016 "Fiscal 2015" $ 2,538 2,029 12,549 608 17,724 40,426 18,512 21,914 2,093 1,235 $42,966 $ 2,216 1.890 11.809 569 16,484 39.266 17.075 22,191 2,102 1.196 $41.973 $ 710 amounts in millions, except share and per share data ASSETS Current Assets: Cash and Cash Equivalents Receivables, net Merchandise Inventories Other Current Assets Total Current Assets Property and Equipment, at cost Less Accumulated Depreciation and Amortization Net Property and Equipment Goodwill Other Assets Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Short-Term Debt Accounts Payable Accrued Salaries and Related Expenses Sales Taxes Payable Deferred Revenue Income Taxes Payable Current Installments of Long-Term Debt Other Accrued Expenses Total Current Liabilities Long-Term Debt, excluding current installments Other Long-Term Liabilities Deferred Income Taxes Total Liabilities STOCKHOLDERS' EQUITY Common Stock, par value $0.05; authorized: 10 billion shares; issued: 1.776 billion shares at January 29, 2017 and 1.772 billion shares at January 31, 2016; outstanding: 1.203 billion shares at January 29, 2017 and 1.252 billion shares at January 31, 2016 Paid-in Capital Retained Earnings Accumulated Other Comprehensive Loss Treasury Stock, at cost, 573 million shares at January 29, 2017 and 520 million shares at January 31, 2016 Total Stockholders' Equity Total Liabilities and Stockholders' Equity See accompanying Notes to Consolidated Financial Statements. 7,000 1,484 508 1,669 25 542 2,195 14,133 22,349 1,855 296 38,633 $ 350 6,565 1.515 476 1.566 34 77 1.941 12.524 20.789 1.965 379 35,657 88 88 9,787 35,519 (867) (40,194) 9.347 30.973 (898) (33,194) 4,333 $42,966 6.316 $41.973 Refer to the financial statements of The Home Depot In Appendix A. (Note: Fiscal 2016 for The Home Depot runs from February 1, 2016, to January 29, 2017. As with many retail companies, The Home Depot labels the period "Fiscal 2016" even though it ends in the 2017 calendar year. The label "Fiscal 2016" is appropriate because Fiscal 2016 Includes 11 months from the 2016 calendar year. The Home Depot explains its choice of fiscal period In Note 1 to its financial statements.) Required: 1. How much did The Home Depot owe for salarles and related expenses at January 29, 2017? Was this an increase or decrease from the previous year? $7,000 million (Increase) O $1,484 million (Increase) O $1,484 million (Decrease) $7,000 million (Decrease) 2. Refer to the Revenues note in the Summary of Significant Accounting Policies that follows The Home Depot's statements of cash flows. How does the company account for customer payments received in advance of providing services? The funds are not deposited in the bank account and no entry is recorded. Record the prepayment as revenue. The revenue is deferred until the goods or services are provided to the customer. The funds are deposited in the bank account and no entry is recorded. 3. What adjusting Journal entry must The Home Depot make when it provides services paid by gift card? debit Cash, credit Deferred Revenue debit Deferred Revenue, credit Net Sales Revenue O debit Net Sales Revenue, credit Deferred Revenue O debit Deferred Revenue, credit Cash Refer to the financial statements of The Home Depot In Appendix A. (Note: Fiscal 2016 for The Home Depot runs from February 1, 2016, to January 29, 2017. As with many retail companies, The Home Depot labels the period "Fiscal 2016" even though it ends in the 2017 calendar year. The label "Fiscal 2016" is appropriate because Fiscal 2016 Includes 11 months from the 2016 calendar year. The Home Depot explains its choice of fiscal period in Note 1 to its financial statements.) How much Inventory does the company hold on January 29, 2017? Does this represent an increase or decrease in comparison to the prior year? $12,549, which is an Increase O $11,809, which is a decrease O $11,809, which is an increase $12,549, which is a decrease What method(s) does the company use to determine the cost of Its Inventory? Describe where you found this information. OLIFO; Note 1 O FIFO; Note 1 Specific Identification; Management's Discussion and Analysis Weighted average cost; the Balance Sheet Compute to one decimal place the company's Inventory turnover ratio and days to sell for the year ended January 29, 2017. (Use 365 days in a year.) O 7.8 times per year and 46.8 days 75 times per year and 48.7 days 5.0 times per year and 73.0 days 5.1 times per year and 71.6 daysStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started