I need help with problem 4-12. Thank you!

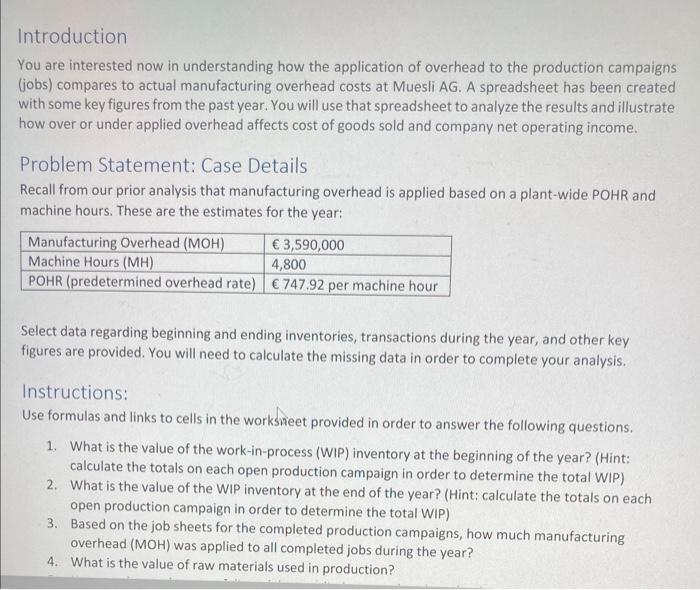

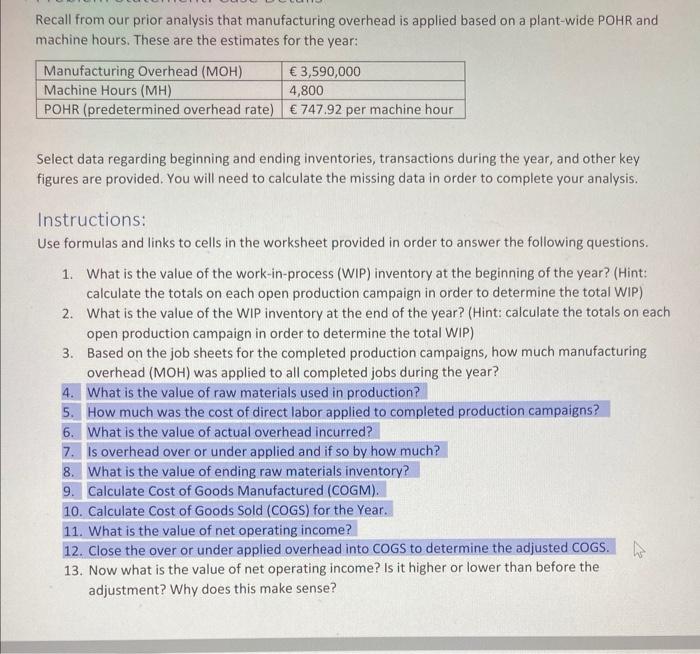

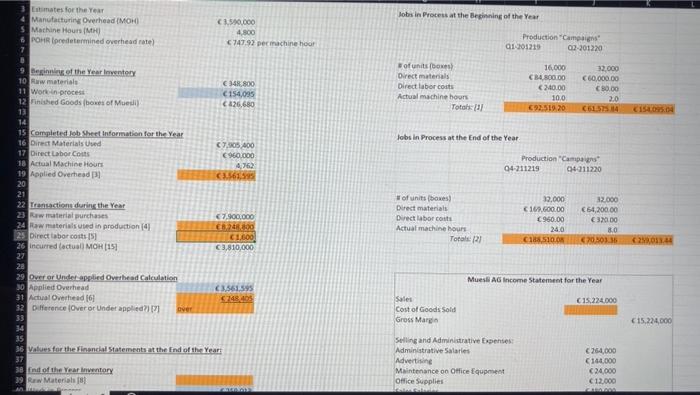

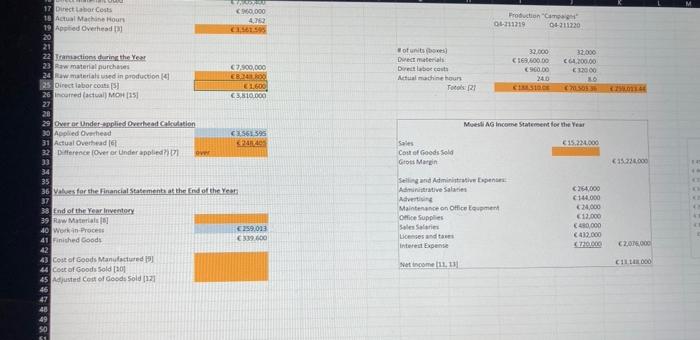

Introduction You are interested now in understanding how the application of overhead to the production campaigns (jobs) compares to actual manufacturing overhead costs at Muesli AG. A spreadsheet has been created with some key figures from the past year. You will use that spreadsheet to analyze the results and illustrate how over or under applied overhead affects cost of goods sold and company net operating income. Problem Statement: Case Details Recall from our prior analysis that manufacturing overhead is applied based on a plant-wide POHR and machine hours. These are the estimates for the year: Select data regarding beginning and ending inventories, transactions during the year, and other key figures are provided. You will need to calculate the missing data in order to complete your analysis. Instructions: Use formulas and links to cells in the workshieet provided in order to answer the following questions. 1. What is the value of the work-in-process (WIP) inventory at the beginning of the year? (Hint: calculate the totals on each open production campaign in order to determine the total WIP) 2. What is the value of the WIP inventory at the end of the year? (Hint: calculate the totals on each open production campaign in order to determine the total WIP) 3. Based on the job sheets for the completed production campaigns, how much manufacturing overhead (MOH) was applied to all completed jobs during the year? 4. What is the value of raw materials used in production? Recall from our prior analysis that manufacturing overhead is applied based on a plant-wide POHR and machine hours. These are the estimates for the year: Select data regarding beginning and ending inventories, transactions during the year, and other key figures are provided. You will need to calculate the missing data in order to complete your analysis. Instructions: Use formulas and links to cells in the worksheet provided in order to answer the following questions. 1. What is the value of the work-in-process (WIP) inventory at the beginning of the year? (Hint: calculate the totals on each open production campaign in order to determine the total WIP) 2. What is the value of the WIP inventory at the end of the year? (Hint: calculate the totals on each open production campaign in order to determine the total WIP) 3. Based on the job sheets for the completed production campaigns, how much manufacturing overhead (MOH) was applied to all completed jobs during the year? 4. What is the value of raw materials used in production? 5. How much was the cost of direct labor applied to completed production campaigns? 6. What is the value of actual overhead incurred? 7. Is overhead over or under applied and if so by how much? 8. What is the value of ending raw materials inventory? 9. Calculate Cost of Goods Manufactured (COGM). 10. Calculate Cost of Goods Sold (COGS) for the Year. 11. What is the value of net operating income? 12. Close the over or under applied overhead into COGS to determine the adjusted COGS. 13. Now what is the value of net operating income? Is it higher or lower than before the adjustment? Why does this make sense? Wakes for the Hinancial Stasements at the frid of the Yewr Introduction You are interested now in understanding how the application of overhead to the production campaigns (jobs) compares to actual manufacturing overhead costs at Muesli AG. A spreadsheet has been created with some key figures from the past year. You will use that spreadsheet to analyze the results and illustrate how over or under applied overhead affects cost of goods sold and company net operating income. Problem Statement: Case Details Recall from our prior analysis that manufacturing overhead is applied based on a plant-wide POHR and machine hours. These are the estimates for the year: Select data regarding beginning and ending inventories, transactions during the year, and other key figures are provided. You will need to calculate the missing data in order to complete your analysis. Instructions: Use formulas and links to cells in the workshieet provided in order to answer the following questions. 1. What is the value of the work-in-process (WIP) inventory at the beginning of the year? (Hint: calculate the totals on each open production campaign in order to determine the total WIP) 2. What is the value of the WIP inventory at the end of the year? (Hint: calculate the totals on each open production campaign in order to determine the total WIP) 3. Based on the job sheets for the completed production campaigns, how much manufacturing overhead (MOH) was applied to all completed jobs during the year? 4. What is the value of raw materials used in production? Recall from our prior analysis that manufacturing overhead is applied based on a plant-wide POHR and machine hours. These are the estimates for the year: Select data regarding beginning and ending inventories, transactions during the year, and other key figures are provided. You will need to calculate the missing data in order to complete your analysis. Instructions: Use formulas and links to cells in the worksheet provided in order to answer the following questions. 1. What is the value of the work-in-process (WIP) inventory at the beginning of the year? (Hint: calculate the totals on each open production campaign in order to determine the total WIP) 2. What is the value of the WIP inventory at the end of the year? (Hint: calculate the totals on each open production campaign in order to determine the total WIP) 3. Based on the job sheets for the completed production campaigns, how much manufacturing overhead (MOH) was applied to all completed jobs during the year? 4. What is the value of raw materials used in production? 5. How much was the cost of direct labor applied to completed production campaigns? 6. What is the value of actual overhead incurred? 7. Is overhead over or under applied and if so by how much? 8. What is the value of ending raw materials inventory? 9. Calculate Cost of Goods Manufactured (COGM). 10. Calculate Cost of Goods Sold (COGS) for the Year. 11. What is the value of net operating income? 12. Close the over or under applied overhead into COGS to determine the adjusted COGS. 13. Now what is the value of net operating income? Is it higher or lower than before the adjustment? Why does this make sense? Wakes for the Hinancial Stasements at the frid of the Yewr