I need help with problems 26 and 23. Thanks.

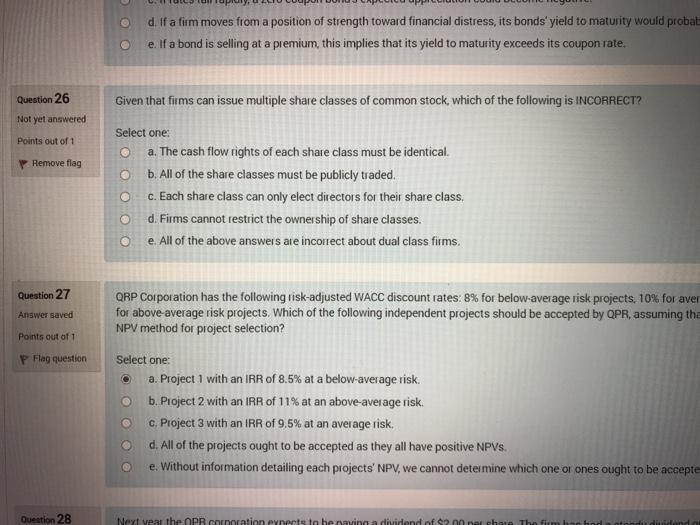

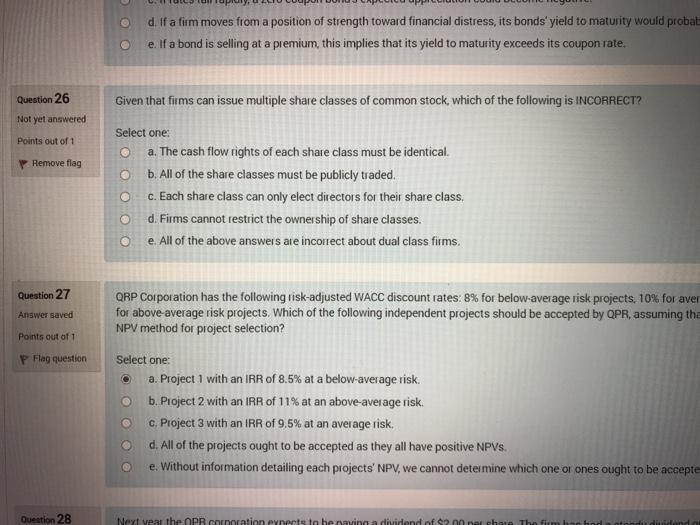

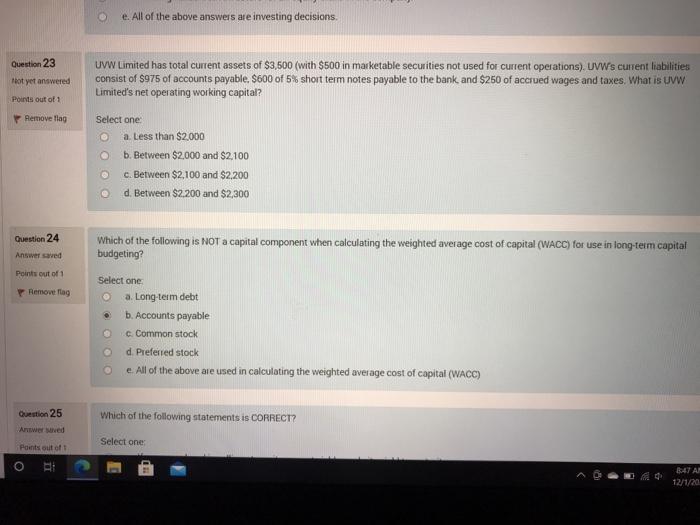

d if a firm moves from a position of strength toward financial distress, its bonds' yield to maturity would probat e. If a bond is selling at a premium, this implies that its yield to maturity exceeds its coupon rate. Given that firms can issue multiple share classes of common stock, which of the following is INCORRECT? Question 26 Not yet answered Points out of 1 Hemove flag Select one: a. The cash flow rights of each share class must be identical. b. All of the share classes must be publicly traded. c. Each share class can only elect directors for their share class. d. Firms cannot restrict the ownership of share classes. e. All of the above answers are incorrect about dual class firms. Question 27 Answer saved QRP Corporation has the following risk-adjusted WACC discount rates: 8% for below-average risk projects, 10% for aver for above average risk projects. Which of the following independent projects should be accepted by QPR, assuming the NPV method for project selection? Points out of 1 P Flag question Select one: a. Project 1 with an IRR of 8.5% at a below-average risk. b. Project 2 with an IRR of 11% at an above-average risk. c. Project 3 with an IRR of 9,5% at an average risk. d. All of the projects ought to be accepted as they all have positive NPVS. e. Without information detailing each projects' NPV, we cannot determine which one or ones ought to be accepte Question 28 Next year the OPR Corporation experts to be paving a dividend of 20 per chase The film hadded e. All of the above answers are investing decisions. Question 23 Tot yet answered UVW Limited has total current assets of $3,500 (with $500 in marketable securities not used for current operations). UVW's current liabilities consist of S975 of accounts payable. $600 of 5% short term notes payable to the bank and $250 of accrued wages and taxes. What is VW Limited's net operating working capital? Points out of 1 Remove Tag Select one: a Less than $2.000 b. Between $2.000 and $2,100 c. Between $2,100 and $2,200 d. Between $2.200 and $2,300 Question 24 Answer saved Which of the following is NOT a capital component when calculating the weighted average cost of capital (WACC) for use in long-term capital budgeting? Points out of 1 Remove Flag Select one a. Long-term debt b. Accounts payable Common stock d. Preferred stock e. All of the above are used in calculating the weighted average cost of capital (WACC) Question 25 Which of the following statements is CORRECT? Antwer ved Select one Points out of 347 AM 12/1/20