i need help with problems A/B/C/D/E can someone assist ?

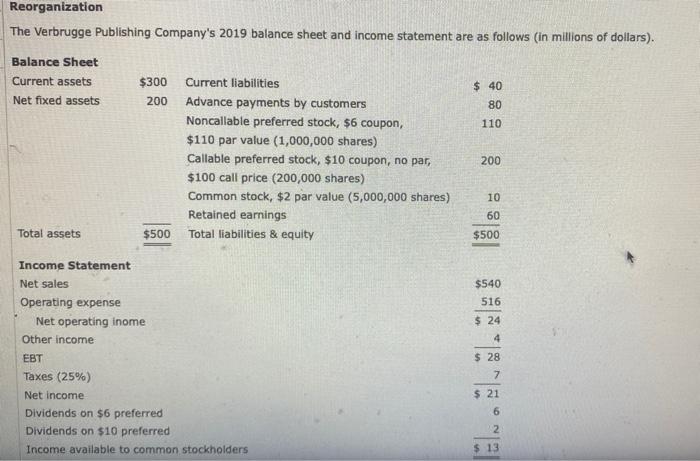

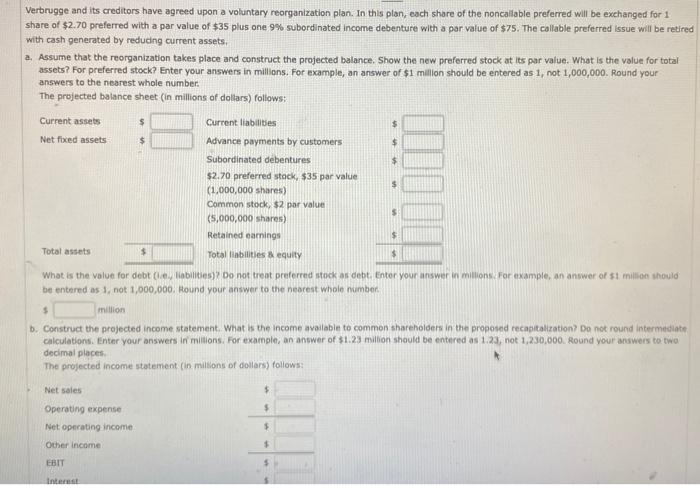

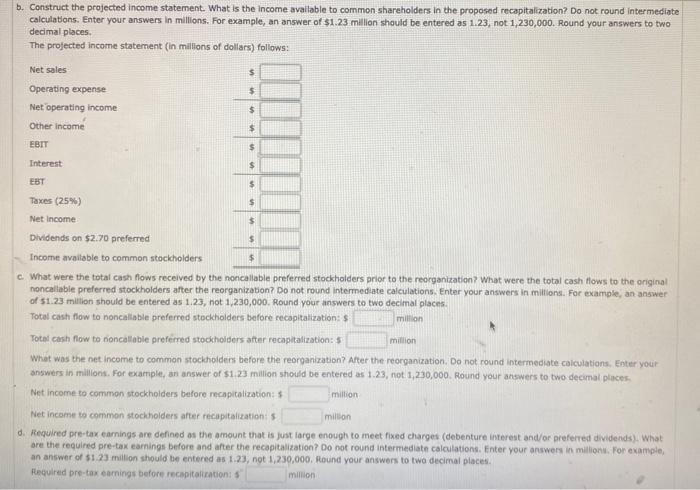

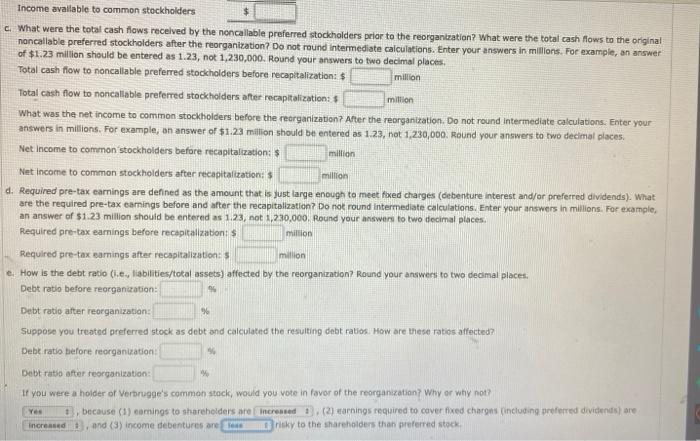

Reorganization The Verbrugge Publishing Company's 2019 balance sheet and income statement are as follows (in millions of dollars). Balance Sheet Current assets $300 $ 40 Net fixed assets 200 80 110 Current liabilities Advance payments by customers Noncallable preferred stock, $6 coupon, $110 par value (1,000,000 shares) Callable preferred stock, $10 coupon, no par, $100 call price (200,000 shares) Common stock, $2 par value (5,000,000 shares) Retained earnings 200 10 60 Total assets $500 Total liabilities & equity $500 Income Statement Net sales $540 516 Operating expense Net operating inome $ 24 Other income 4 EBT $ 28 Taxes (25%) 7 Net Income $ 21 Dividends on $6 preferred 6 Dividends on $10 preferred 2 Income available to common stockholders $ 13 Verbrugge and its creditors have agreed upon a voluntary reorganization plan. In this plan, each share of the noncallable preferred will be exchanged for 1 share of $2.70 preferred with a par value of $35 plus one 9% subordinated income debenture with a par value of $75. The collable preferred issue will be retired with cash generated by reducing current assets. a. Assume that the reorganization takes place and construct the projected balance. Show the new preferred stock at its par value. What is the value for total assets? For preferred stock? Enter your answers in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answers to the nearest whole number The projected balance sheet (in millions of dollars) follows: Current assets $ Current liabilities Net fixed assets $ Advance payments by customers Subordinated debentures $2.70 preferred stock, $35 par value (1,000,000 shares) Common stock, $2 par value (5,000,000 shares) Retained earnings $ Total assets $ Total liabilities & equity $ What is the value for debt (y liabilities)? Do not treat preferred stock as debt. Enter your answer in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answer to the nearest whole number million b. Construct the projected income statement. What is the income available to common shareholders in the proposed recapitalization? Do not round Intermediate calculations. Enter your answers in millions. For example, an antwer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answers to two The projected income statement (in Millions of dollars follows: decimal places Net sales $ Operating expense $ Net operating income $ Other income EBIT Inter b. Construct the projected income statement. What is the income available to common shareholders in the proposed recapitalization? Do not round Intermediate calculations. Enter your answers in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answers to two decimal places The projected income statement (in millions of dollars) follows: Net sales $ Operating expense $ Net operating income $ Other Income $ EBIT $ Interest $ $ EBT $ Taxes (259) $ Net Income $ Dividends on $2.70 preferred $ Income available to common stockholders $ c. What were the total cash flows received by the noncaltable preferred stockholders prior to the reorganization? What were the total cash flows to the original noncallable preferred stockholders after the reorganization? Do not round Intermediate calculations. Enter your answers in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answers to two decimal places. Total cash flow to noncaltable preferred stockholders before recapitalization: $ million Total cash flow to rioncallable preferred stockholders after recapitalization: $ million What was the net income to common stockholders before the reorganization? After the reorganization. Do not round intermediate calculations. Enter your answers in millions. For example, an answer of $123 million should be entered as 1.23, not 1,230,000. Round your answers to two decimal places Net Income to common stockholders before recapitalization: $ million Net income to common stockholders after recapitalization: 5 d. Required pre-tax earnings are defined as the amount that is just farge enough to meet fixed charges (debenture interest and/or preferred dividends). What are the required pre-tax earnings before and after the recapitalization? Do not round Intermediate calculations. Enter your answers in million. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answers to two decimal places Required pre-tax comings before recapitalizations million million Income available to common stockholders c. What were the total cash flows received by the noncallable preferred stockholders prior to the reorganization? What were the total cash flows to the original noncallable preferred stockholders after the reorganization? Do not round intermediate calculations. Enter your answers in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answers to two decimal places, Total cash flow to noncallable preferred stockholders before recapitalization: $ million Total cash flow to noncallable preferred stockholders after recapitalization: $ million What was the net income to common stockholders before the reorganization? After the reorganization. Do not round Intermediate calculations. Enter your answers in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answers to two decimal places. Net Income to common stockholders before recapitalization: Net Income to common stockholders after recapitalization: $ million million d. Required pre-tax earnings are defined as the amount that is just large enough to meet fixed charges (debenture interest and/or preferred dividends). What are the required pre-tax camnings before and after the recapitalization? Do not round intermediate calculations. Enter your answers in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answers to two decimal places Required pre-tax earnings before recapitalizations million Required pre-tax earnings after recapitalizations e How is the debt ratio (le, liabilities/total assets) affected by the reorganization? Round your answers to two decimal places, Debt ratio before reorganization: million 9 Debt ratio after reorganization: Suppose you treated preferred stock as debt and calculated the resulting debt ratios. How are these ratios affected? Debt ratio before reorganization 46 Debt ratio after reorganization If you were a holder of Verbrugge's common stock, would you vote in favor of the reorganization? Why or why not? t, because (1) camnings to shareholders are increased (2) earnings required to cover fixed charges (including preferred dividends are Increased and (3) income debentures are res risky to the shareholders than preferred stock Yes