Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with question 1b. i need help with 1a. 1b.and 2. i need help with average rate of return cash back method net

I need help with question 1b.

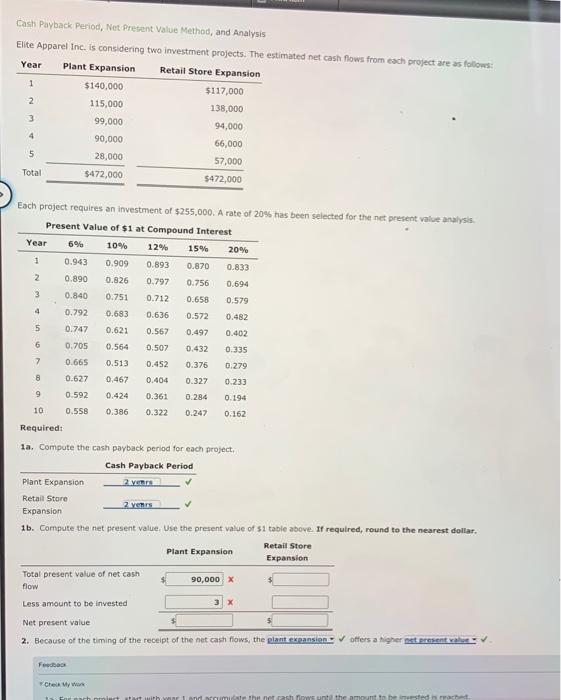

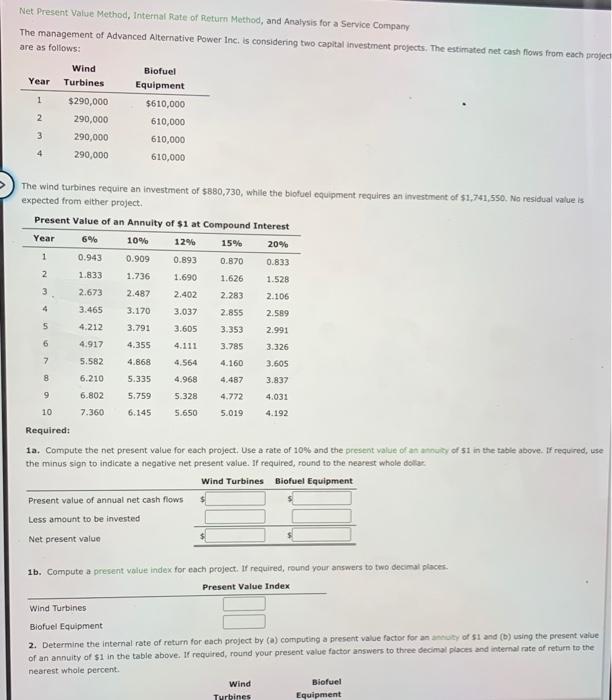

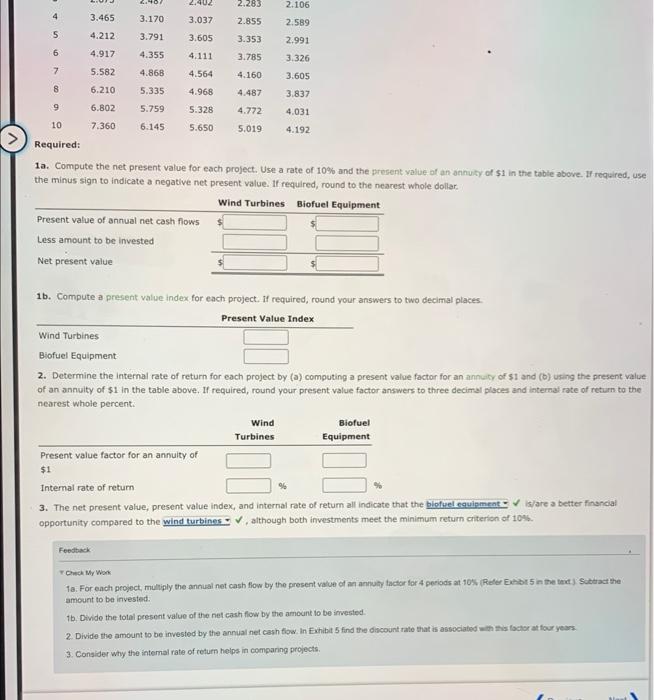

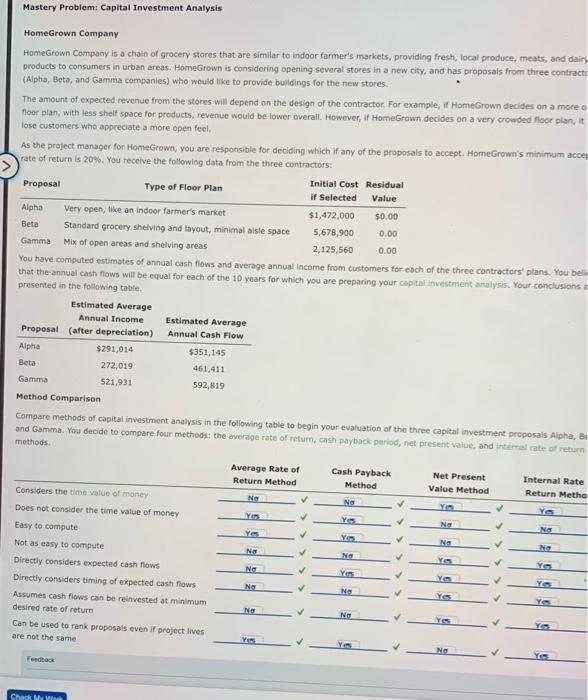

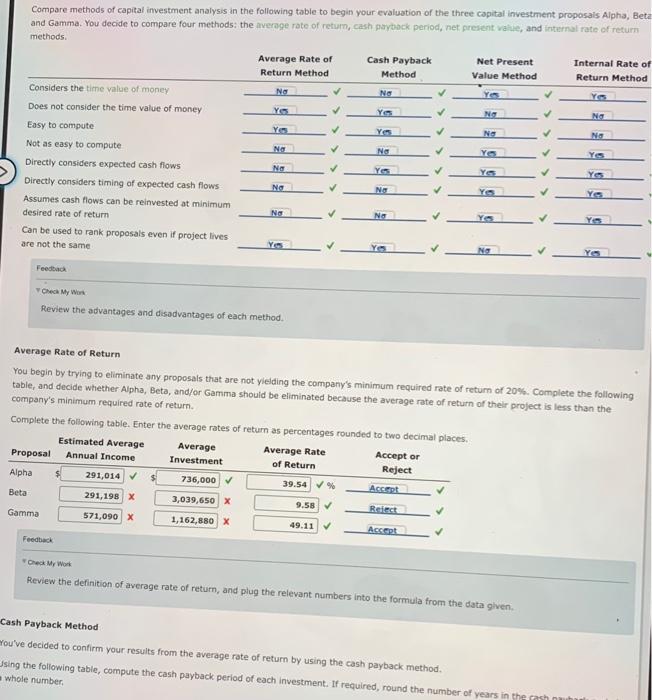

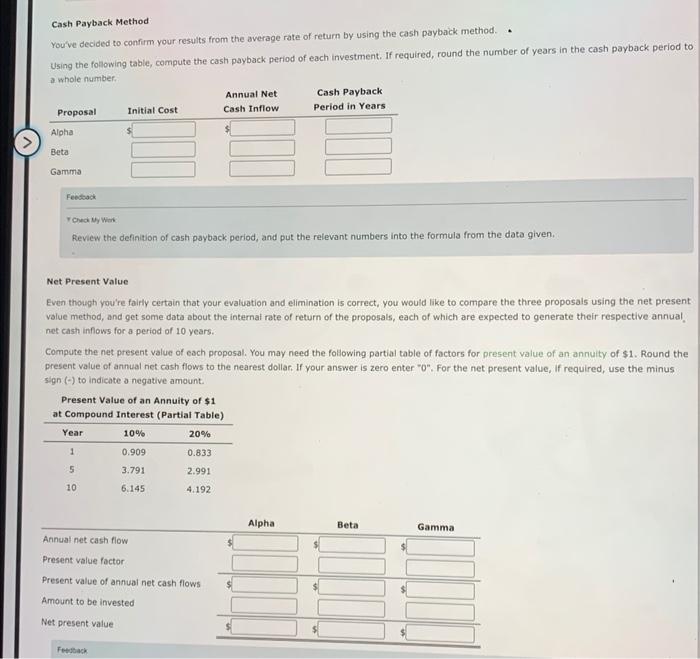

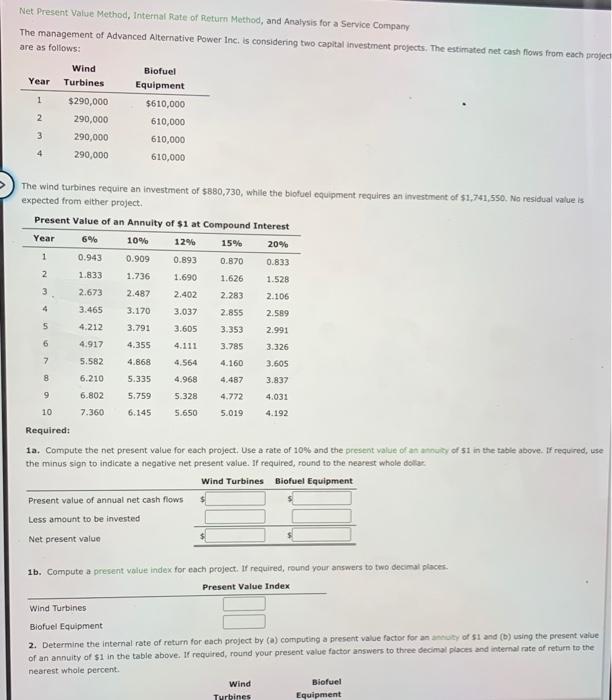

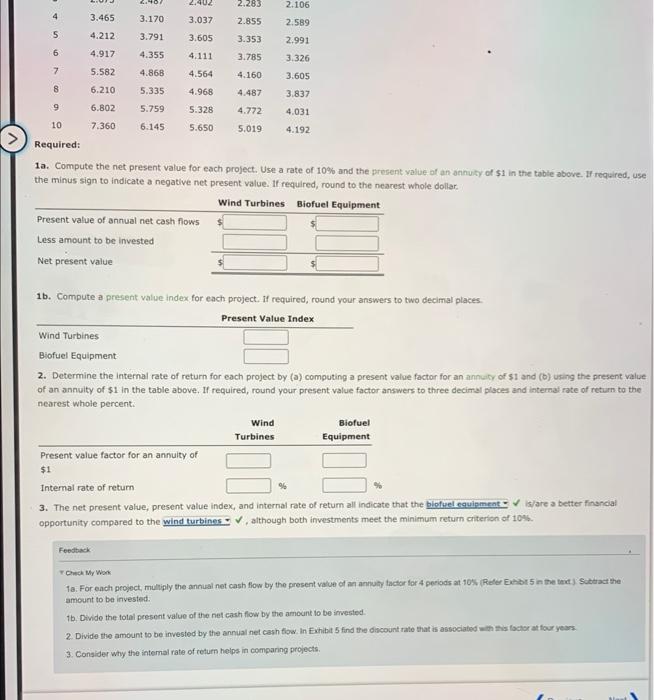

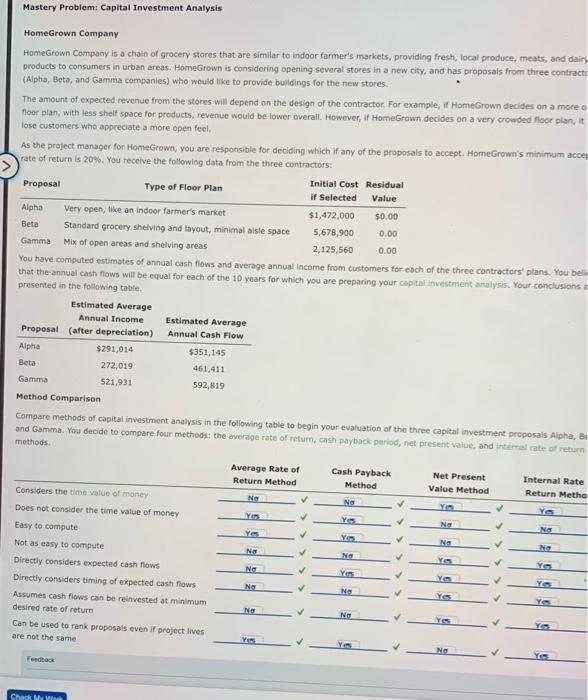

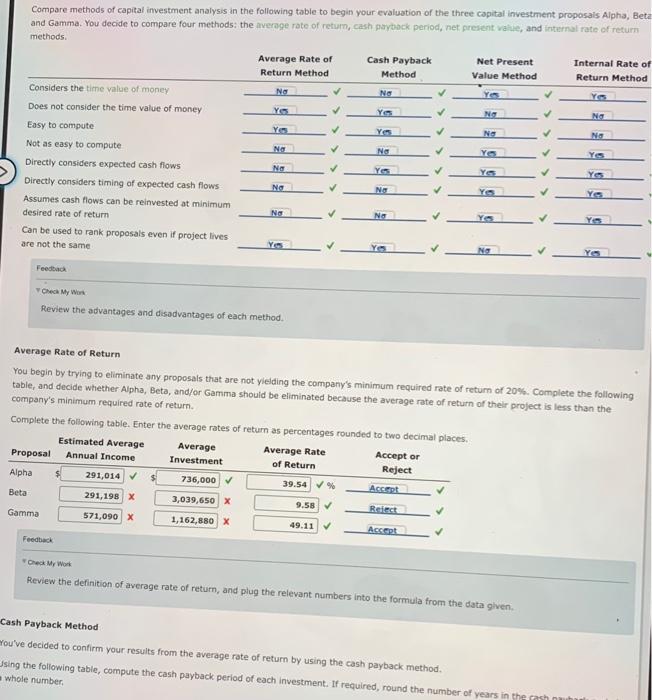

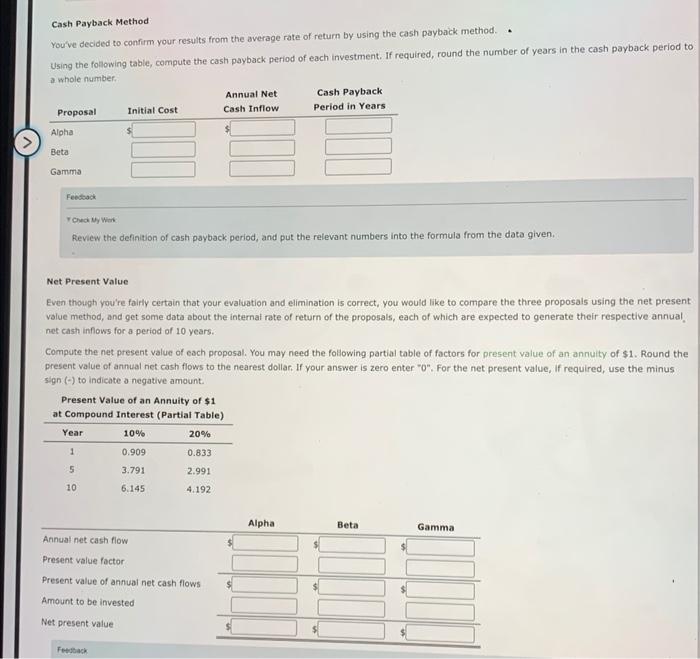

Gash Payback Period, Net Pretent Value Method, and Analysis Elite Apparel Inc. is considering two investment nomierte Thin estimated net cash flows from each project are as follows: Each project requires an investment of $255,000. A rate of 20%5 has been selected for the net present value analysis. Dromane.... kequirea 1a. Compute the cash payback period for each project. 1b. Compute the net present value, Use the present value of $1 table above. If required, round to the nearest dollar. 2. Because of the timing of the receipt of the net cash flows, the offers a kigher Findeas rerein My wis. Net Present Value Method, Internal Rate of Return Method, and Analysis for a Service Company The management of Advanced Alternative Power Inc, is considering two capital investment projects, The estimated net cash fiows from each proje are as follows: The wind turbines require an investment of $880,730, while the biofuel equipment requires an investment of $1,741,550. Na residual value is expected from either project. Present 1a. Compute the net present value for each project. Use a rate of 10% and the present value of an annutity of 51 in the table above. If required, use the minus sign to indicate a negative net present value. If required, round to the nearest whole dolla: 1b. Compute a present volue index for each project. If required, round your answers to twe decimal places. 2. Determine the internal rate of return for each project by (a) computing a present value factor for an ancuth of 51 and (b) using the present value of an annuity of $1 in the table above. If required, round your present value factor answers to three decimal ploces and internal rate of return te the equired: 1a. Compute the net present value for each project. Use a rate of 10% and the present value af an annuty of $1 in the table above. If required, use the minus sign to indicate a negative net present value. If required, round to the nearest whole dollar. 16. Compute a present value index for each project. If required, round your answers to two decimal places. 2. Determine the internal rate of return for each project by (a) computing a present value factor for an annuiry of s1 and (b) using the present value of an annulty of $1 in the table above. If required, round your present value factor answers to three decimal places and internal rate of return to the nearest whole percent: 3. The net present value, present value index, and internal rate of retum all indicate that the opportunity compared to the Feethack V Check My Wonk 19. For each project, multiply the annual net cash flow by the present value of an annuty factor for 4 periods at 10:4 (Fieler Exhibit 5 in the taid ) Saberact the amount to be invested. 16, Divide the total present value of the net cash flow by the amount to be invested. 2. Divide the amount to be invested by the annual net cash fiow. In Exhibit 5 find the diccount rate that is asseciated w th this foctor at four years. 3. Consider why the intemal rate of return helps in comparing projects. Mastery Problem: Capital Investment Analysis HomeGrown Company HomeGrown Company is a chain of grocery stores that are similar to indoor farmer's markets, providing fresh, local produce, meats, and dairy products to consumers in urban areas. HomeGrown is considering opening several stores in a new city, and has proposals from three contracti (Alpha, Beta, and Gamma companies) who would like to provide buildings for the new stores. The amount of expected rewenue from the stores will depend on the design of the contractor. For example; if HormeGrown decides on a more io floor plan, with less shelf space for products, revenue would be lower overail. However, if HomeGrown decides on a very crowded flocr plan, it lose customers who appreciate a more open feel. As the project manager for HomeGrown, you are responsible for deciding which if any of the proposals to accept. HormeGrown's minimum acce rate of return is 20\%. You receive the following data from the three contractors: nuu mave computed estimates of annual cash flows and average annual income from customers for each of the throe contractors' plans. You beli that the-annual cash flows will be equal for each of the 10 years far which you are preparing your copital investrnent armalysis. Your conclusions a presented in the follawing table. Cornpare methods of capital investment analysis in the following table to begin your evaluation of the three capital imvestmert proposals Alpha, Bt and Gamma. You decide to compare four methods: the average rate of return, cash payback period, net. present value, and interral rate of refurn Compare methods of capital investment analysis in the following table to begin your evaluation of the three capital investment proposais Alpha, Bet. and Gamma. You decide to compare four methods: the iveroge rote of return, cash parbock period, net, present value, and irtarnal rate of return methods. Feedbuck F Check My Wirs. Review the advantages and disadvantages of each method. Average Rate of Return You begin by trying to eliminate any proposals that are not yielding the company's minimum required rate of return of 20%, Complete the following table, and decide whether Alpha, Beta, and/or Gamma should be eliminated because the average rate of return of their project is less than the company's minimum required rate of return. Complete the following table. Enter the average rates of return as percentages rounded to twin tha voreck Mr work Review the definition of average rate of return, and plug the relevant numbers into the formula from the data given. Cash Payback Method rou've decided to confirm your results from the average rate of return by using the cash payback method. fsing the followis whole number. Cash Payback Method You've decided to confirm your results from the average rate of return by using the cash payback method. Using the following table, compute the cash payback period of each investment. If required, round the number of years in the cash payback period to a whole number. Feediack r Chack Vy Wirk. Review the definition of cash payback period, and put the relevant numbers into the formula from the data given. Net Present Value Even though you're fairly certain that your evaluation and elimination is correct, you would like to compare the three proposals using the net present value method, and get some data about the internal rate of return of the proposals, each of which are expected to generate their respective annual net cash inflows for a period of 10 years. Compute the net present value of esch proposal. You may need the following partial table of factors for present value of an annuity of s1. Round the present value of annual net cash flows to the nearest dollar, If your answer is zero enter "o". For the net present value, If required, use the minus. sign () to indicate a negative amount. Present Value of an Annuity of $1 at Comnnumd Totaratet IDartial Taklal

i need help with 1a. 1b.and 2.

i need help with average rate of return

cash back method

net present value

thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started