Question

I need help with Question 2 on this problem. Ive gotten the rest of the questions and subquestions correct. Problem 4-5A Preparing trial balances, closing

I need help with Question 2 on this problem. Ive gotten the rest of the questions and subquestions correct.

Problem 4-5A Preparing trial balances, closing entries, and financial statements LO C3, P2, P3

The adjusted trial balance of Karise Repairs on December 31, 2017, follows.

| KARISE REPAIRS Adjusted Trial Balance December 31, 2017 | |||||||||

| No. | Account Title | Debit | Credit | ||||||

| 101 | Cash | $ | 14,000 | ||||||

| 124 | Office supplies | 1,300 | |||||||

| 128 | Prepaid insurance | 2,050 | |||||||

| 167 | Equipment | 50,000 | |||||||

| 168 | Accumulated depreciationEquipment | $ | 5,000 | ||||||

| 201 | Accounts payable | 14,000 | |||||||

| 210 | Wages payable | 600 | |||||||

| 301 | C. Karise, Capital | 33,000 | |||||||

| 302 | C. Karise, Withdrawals | 16,000 | |||||||

| 401 | Repair fees earned | 90,950 | |||||||

| 612 | Depreciation expenseEquipment | 5,000 | |||||||

| 623 | Wages expense | 37,500 | |||||||

| 637 | Insurance expense | 800 | |||||||

| 640 | Rent expense | 10,600 | |||||||

| 650 | Office supplies expense | 3,600 | |||||||

| 690 | Utilities expense | 2,700 | |||||||

| Totals | $ | 143,550 | $ | 143,550 | |||||

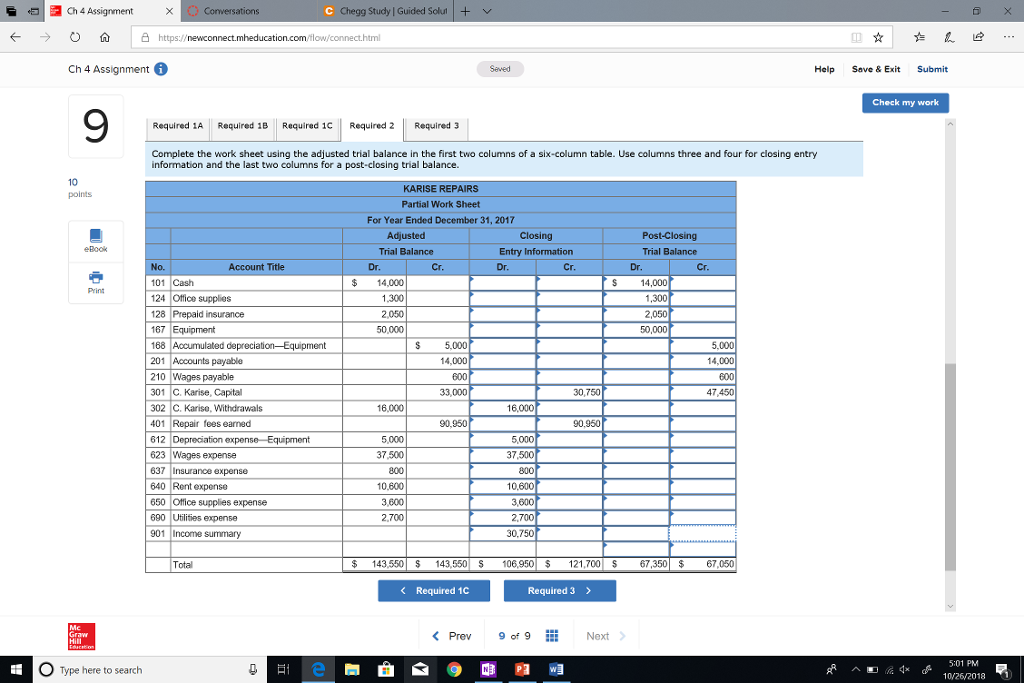

Assume there are no owner investments in 2017. Required: 1a. Prepare an income statement for the year 2017. 1b. Prepare a statement of owner's equity for the year 2017. 1c. Prepare a classified balance sheet at December 31, 2017. 2. Complete the work sheet using the adjusted trial balance in the first two columns of a six-column table. Use columns three and four for closing entry information and the last two columns for a post-closing trial balance. 3. Using information from the work sheet in Requirement 2, prepare the appropriate closing entries.

Ch 4 Assignment Chegg Study I Guided Solu+ |https:/ewc Ch 4 Assignment Help Save & Exit Submit Check my work 9 Required 1A Required 1B Required 1C Required 2 Required 3 Complete the work sheet using the adjusted trial balance in the first two columns of a six-column table. Use columns three and four for closing entry information and the last two columns for a post-closing trial balance. KARISE REPAIRS Partial Work Sheet For Year Ended December 31, 2017 Closing Entry Information Post-Closing Adjusted Trial Balance Trial Balance 101 Cash 124 Office supplies 128 Prepaid insurance 167 Equipment 168 Accumulated de 201 Accounts payable 210 Wages payable 301 C. Karise, Capital 302 C. Kariso. Withdrawals 401 Repair fees earned $14,000 1.300 2,050 50,000 S 14,000 2,050 50,000 S 5,000 14,000 5.000 14,000 33,000 30,750 47 450 16,000 16,000 90,950 90.950 5,000 37,500 623 Wages expense 637 Insurance expense 640 Rent expense 650 Ofice supplies expense 690 Utlities expense 901 Income summary 37,500 10,600 3,600 2,700 10,600 3,600 2,700 30,750 Tota $ 121,700S67,350 67,350$ 67,050 Required 1C Required 3 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started