Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with questions 13,14 D Question 13 1 pts Due to the integrated nature of their capital markets, investors in both the U.S.

i need help with questions 13,14

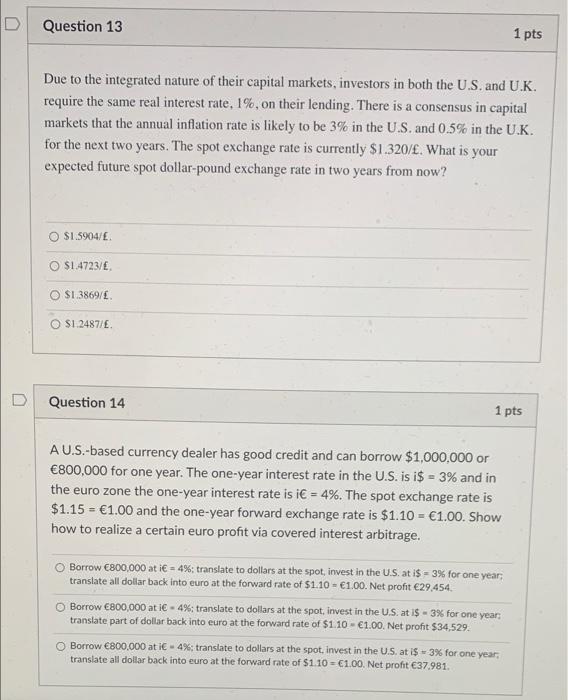

D Question 13 1 pts Due to the integrated nature of their capital markets, investors in both the U.S. and U.K. require the same real interest rate, 1%, on their lending. There is a consensus in capital markets that the annual inflation rate is likely to be 3% in the U.S. and 0.5% in the U.K. for the next two years. The spot exchange rate is currently $1.320/. What is your expected future spot dollar-pound exchange rate in two years from now? S1.5904/ $1.4723/E $1.3869/. S1.2487/E. D Question 14 1 pts A U.S.-based currency dealer has good credit and can borrow $1,000,000 or 800,000 for one year. The one-year interest rate in the U.S. is i$ = 3% and in the euro zone the one-year interest rate is i = 4%. The spot exchange rate is $1.15 = 1.00 and the one-year forward exchange rate is $1.10 = 1.00. Show how to realize a certain euro profit via covered interest arbitrage. Borrow 800,000 at i = 4%; translate to dollars at the spot, invest in the U.S. at i$ - 3% for one year, translate all dollar back into euro at the forward rate of $1.10 - 1.00. Net profit 29,454. Borrow 800,000 at i - 4%; translate to dollars at the spot, invest in the U.S. at i$ - 3% for one year translate part of dollar back into euro at the forward rate of $1.10 - 1.00. Net profit $34,529 Borrow 800,000 at i 4%; translate to dollars at the spot, invest in the U.S. at $ 3% for one year, translate all dollar back into euro at the forward rate of $1.10 - 1.00. Net profit 37.981

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started