Answered step by step

Verified Expert Solution

Question

1 Approved Answer

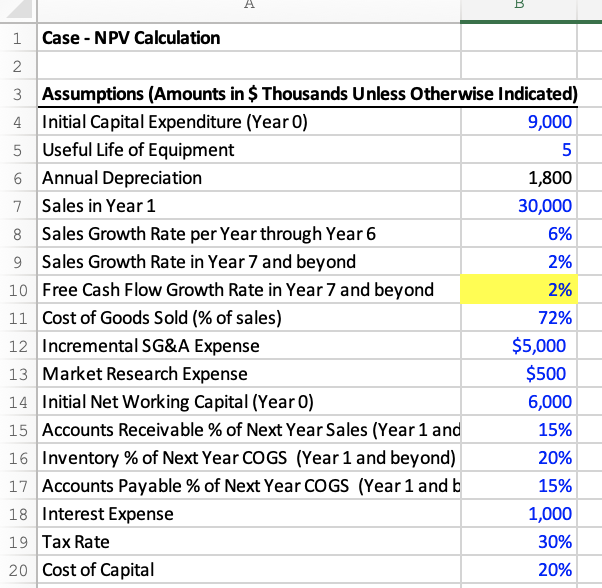

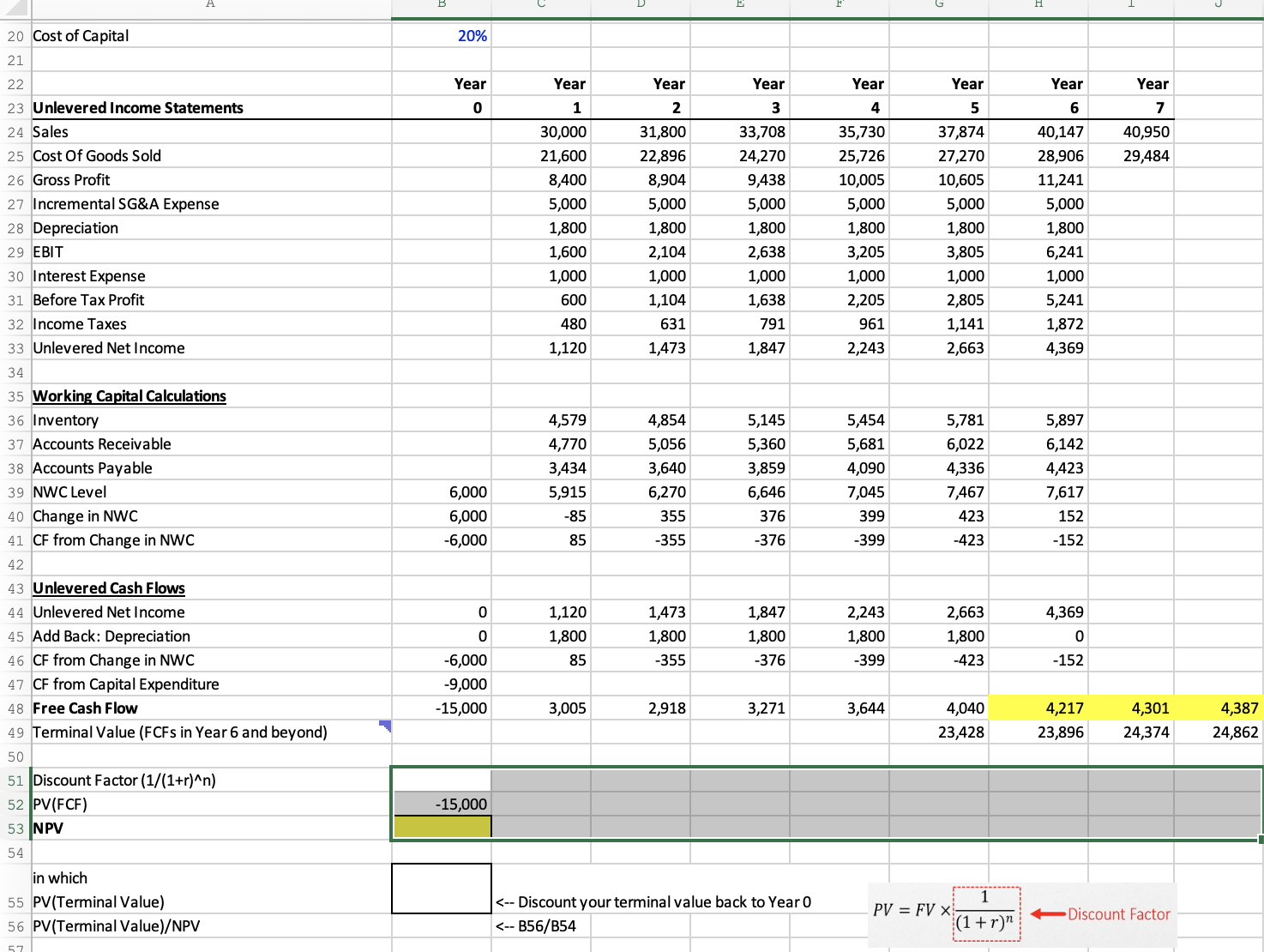

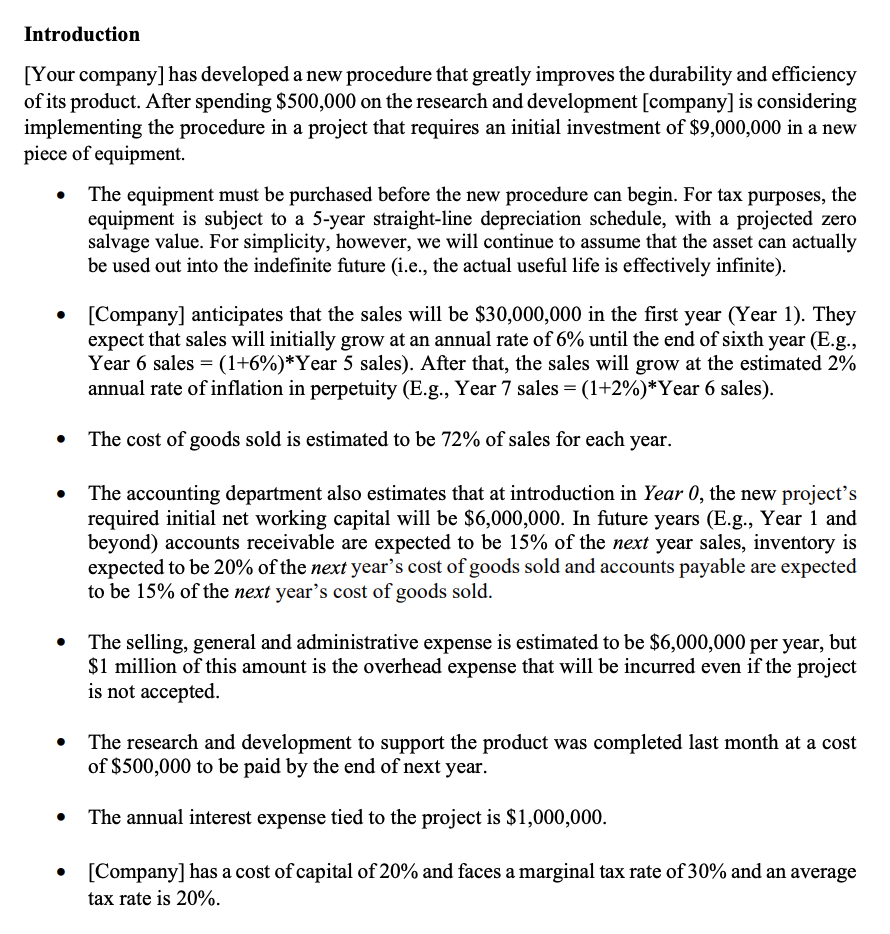

I need help with rows 51-53. Thank you begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} hline 20 & Cost of Capital & 20% & & & & & & & &

I need help with rows 51-53. Thank you

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline 20 & Cost of Capital & 20% & & & & & & & & \\ \hline \multicolumn{11}{|l|}{21} \\ \hline 22 & & Year & Year & Year & Year & Year & Year & Year & Year & \\ \hline 23 & Unlevered Income Statements & 0 & 1 & 2 & 3 & 4 & 5 & 6 & 7 & \\ \hline 24 & Sales & & 30,000 & 31,800 & 33,708 & 35,730 & 37,874 & 40,147 & 40,950 & \\ \hline 25 & Cost Of Goods Sold & & 21,600 & 22,896 & 24,270 & 25,726 & 27,270 & 28,906 & 29,484 & \\ \hline 26 & Gross Profit & & 8,400 & 8,904 & 9,438 & 10,005 & 10,605 & 11,241 & & \\ \hline 27 & Incremental SG\&A Expense & & 5,000 & 5,000 & 5,000 & 5,000 & 5,000 & 5,000 & & \\ \hline 28 & Depreciation & & 1,800 & 1,800 & 1,800 & 1,800 & 1,800 & 1,800 & & \\ \hline 29 & EBIT & & 1,600 & 2,104 & 2,638 & 3,205 & 3,805 & 6,241 & & \\ \hline 30 & Interest Expense & & 1,000 & 1,000 & 1,000 & 1,000 & 1,000 & 1,000 & & \\ \hline 31 & Before Tax Profit & & 600 & 1,104 & 1,638 & 2,205 & 2,805 & 5,241 & & \\ \hline 32 & Income Taxes & & 480 & 631 & 791 & 961 & 1,141 & 1,872 & & \\ \hline 33 & Unlevered Net Income & & 1,120 & 1,473 & 1,847 & 2,243 & 2,663 & 4,369 & & \\ \hline \multicolumn{11}{|l|}{34} \\ \hline \multicolumn{11}{|c|}{35 Working Capital Calculations } \\ \hline 36 & Inventory & & 4,579 & 4,854 & 5,145 & 5,454 & 5,781 & 5,897 & & \\ \hline 37 & Accounts Receivable & & 4,770 & 5,056 & 5,360 & 5,681 & 6,022 & 6,142 & & \\ \hline 38 & Accounts Payable & & 3,434 & 3,640 & 3,859 & 4,090 & 4,336 & 4,423 & & \\ \hline 39 & NWC Level & 6,000 & 5,915 & 6,270 & 6,646 & 7,045 & 7,467 & 7,617 & & \\ \hline 40 & Change in NWC & 6,000 & -85 & 355 & 376 & 399 & 423 & 152 & & \\ \hline 41 & CF from Change in NWC & 6,000 & 85 & -355 & -376 & -399 & -423 & -152 & & \\ \hline \multicolumn{11}{|l|}{42} \\ \hline \multicolumn{11}{|c|}{43 Unlevered Cash Flows } \\ \hline 44 & Unlevered Net Income & 0 & 1,120 & 1,473 & 1,847 & 2,243 & 2,663 & 4,369 & & \\ \hline 45 & Add Back: Depreciation & 0 & 1,800 & 1,800 & 1,800 & 1,800 & 1,800 & 0 & & \\ \hline 46 & CF from Change in NWC & 6,000 & 85 & -355 & -376 & -399 & -423 & -152 & & \\ \hline 47 & CF from Capital Expenditure & 9,000 & & & & & & & & \\ \hline 48 & Free Cash Flow & 15,000 & 3,005 & 2,918 & 3,271 & 3,644 & 4,040 & 4,217 & 4,301 & 4,387 \\ \hline 49 & Terminal Value (FCFs in Year 6 and beyond) & & & & & & 23,428 & 23,896 & 24,374 & 24,862 \\ \hline \multicolumn{11}{|l|}{50} \\ \hline \multicolumn{11}{|c|}{51 Discount Factor (1/(1+r)n)} \\ \hline 52 & PV(FCF) & 15,000 & & & & & & & & \\ \hline \multicolumn{11}{|c|}{53 NPV } \\ \hline \multicolumn{11}{|l|}{54} \\ \hline & in which & & \multirow{2}{*}{\multicolumn{4}{|c|}{ Discount Factor }} & \\ \hline 55 & PV(Terminal Value) & & & & & & 1 & & & \\ \hline 56 & PV(Terminal Value)/NPV & &Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started