Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with section 2 only . i need help with section 2 mainly and maybe section 3 too. Section 1 1. Analyse each

i need help with section 2 only .

i need help with section 2 mainly and maybe section 3 too.

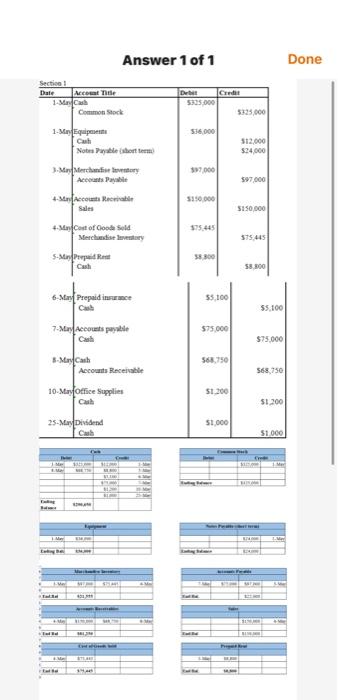

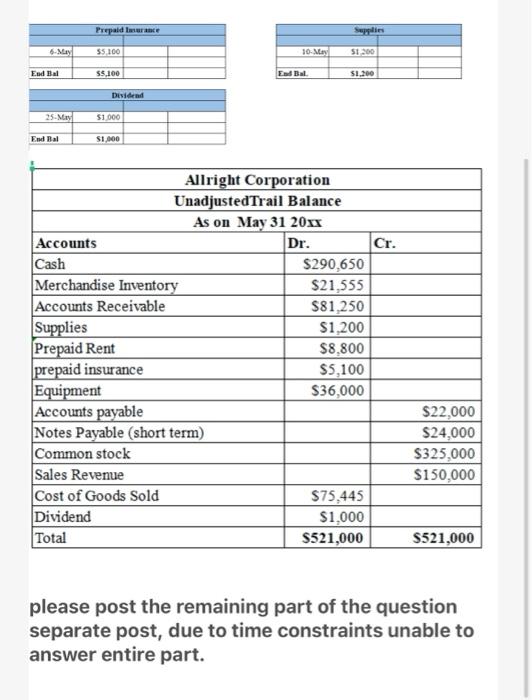

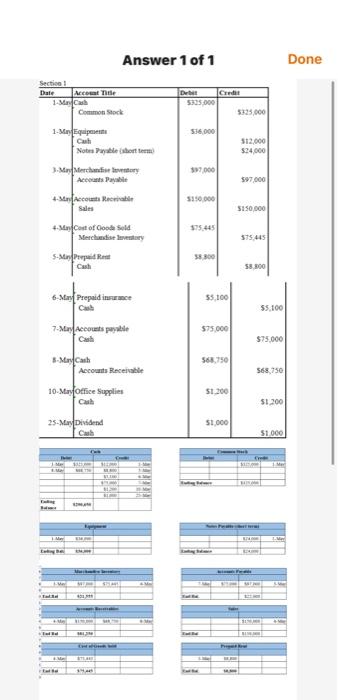

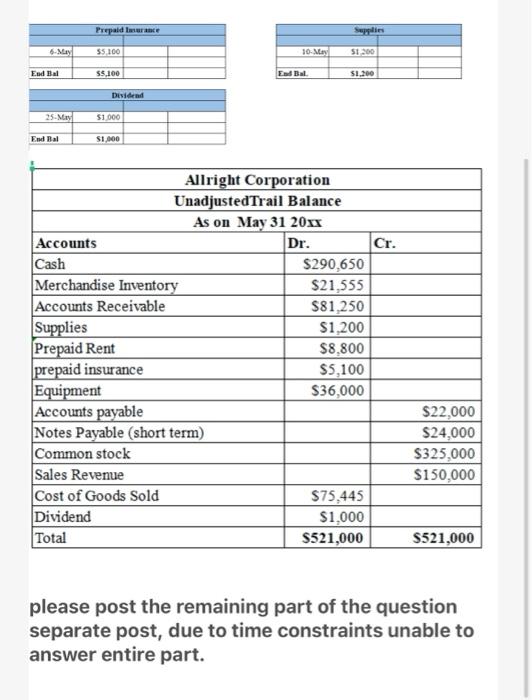

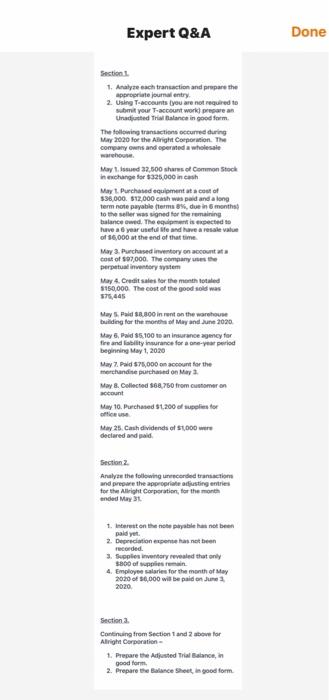

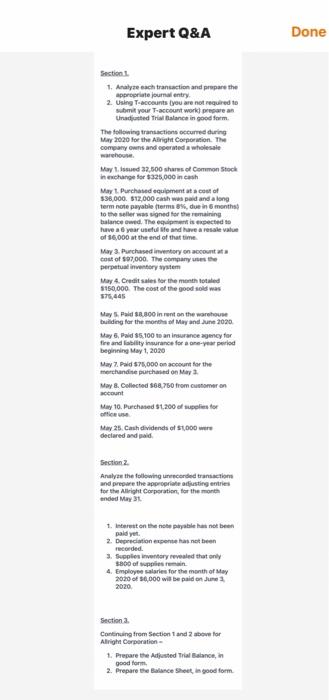

Section 1 1. Analyse each transaction and prepare the appropriate journal entry 2. Using T-accounts you are not required to submit your account work prepare an Unadjunted Trial Balance in good form. The following transactions occurred during May 2020 for the right Corporation. The company owns and operated a wholesale Warehouse May 1.issued 32,500 shares of Common Stock in exchange for $325,000 in cash May 1. Purchased equipment at a cost of $36.000 $12.000 cash was paid and a long term not payable terms due in months to the seller was signed for the remaining to have a year of and have a resale value of 56,000 at the end of that time May 3. Purchased Inventory on montata cost of $7,000. The company uses the perpetual inventory system May 4. Credit sales for the month totaled 5150,000. The cost of the good sold was 875,445 May 5. Paid $8,800 in rent on the warehouse building for the month of May and June 2020 May 6 Paid $5,100 to an insurance agency for fire and ability Insurance for a one-year period beginning May 12020 May 7. Paid 575,000 on account for the merchandise purchased on Mary May & Collected $68,750 from customer on account May 10. Purchased SL200 ot supplies for May 25. Cash dividends of $1,000 were declared and paid Section 2 Analyze the following recorded transactions and prepare the appropriate adjusting entries for the Alright Corporation for the month anded May 31 1. Interest on the note payable has not been 2. Depreciation expense has not been recorded 2. Supplies inventory revealed that only 4. Employee aries for the month of May 2020 of 36,000 will be paid on June 2020 Section 3 Continuing from Section 1 and 2 above for Alright Corporation 1. Prepare the vid Trillanes, in 2. Prepare the Balance Sheet in good form. good for Answer 1 of 1 Done Section 1 Date Account Title 1-Cash Common Stock Crede 5325.000 5325.000 536.000 1. Marque Cul Notable short $12.000 $24,000 3. Many Merchandise 597000 5150 000 4. Man Account Recman Sales 5150,000 315.445 4. Most of Good Sold Merchandise 375.445 38300 S-Marie Cash 58.00 6 May Prepaid in me 55,100 55100 7- Mary Accounts payable Cash $75.000 $75.000 568.750 3- MyCash Accounts Receivable 568,750 $1.300 10- Mary Office Supplies Cal $1200 25-May Dividend 51.000 $1.000 . HELE 11 ITE Prepaid were Supplies 55100 10- Ney SI 200 Eud Bal 55,100 Es Bal $1,200 Desidend 25-May 51 000 End Bal S1000 Allright Corporation Unadjusted Trail Balance As on May 31 20xx Accounts Dr. Cr. Cash $290,650 Merchandise Inventory $21,555 Accounts Receivable $81,250 Supplies $1,200 Prepaid Rent $8.800 prepaid insurance $5,100 Equipment $36,000 Accounts payable Notes Payable (short term) Common stock Sales Revenue Cost of Goods Sold $75,445 Dividend $1,000 Total S521,000 $22,000 $24,000 $325,000 $150,000 S521,000 please post the remaining part of the question separate post, due to time constraints unable to answer entire part. Expert Q&A Done Section 1 1. Analyse each transaction and prepare the appropriate journal entry 2. Using T-accounts you are not required to submit your account work) prepare an United Trial Balance in good form. The following transactions occurred during May 2020 for the right Corporation. The company owns and operated a wholesale May 1, Issue 3,500 shares of Common Stock in exchange for $325,000 in cash May Purchased equipment of 538,000 12,000 cash was paid and a long term note payable terms 8%, due in 6 months to the seller was signed for the remaining to we year usluble and have a resale value of 36,000 at the end of that time May 3. Purchased inventory on court cost of $7,000. The company the perpetua inventory system May 4. Credit sales for the month totaled 5150,000. The cost of the good old was 575,445 May Paid 8.00 in rent on the warehouse building for the month of May and June 2020 May 5, Pald 5.100 to an insurance agency for fire and ability insurance for a one-year period beginning May 1, 2020 May Paid $75,000 on account for the merchandise purchased on May 1 May 8. Collected $68,750 from customer on May 10. Purchased 1.200 of for office May 25. Cash dividends of S1000re declared and paid Section 2 Analyse the following recorded transaction and prepare the appropriate adjusting entries to the right Corporation for the month ended May 31 1. Interest on the note payable has not be 2. Depreciation experte has not been recorded 3. Supplies inventory revealed that only 5800 of supplies remain 4. Employee salaries for the month of May 2020 of 36,000 will be paid on June 2020 Section Continuing from Section and above for Alright Corporation 1. Prepare the Adjusted Trial Balance in good form. 2. Prepare the Balance Sheet, in good form

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started