Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1: Cost of capital and capital budgeting decision VL Co., is one of the world's leading diversified natural resources companies and it involved in

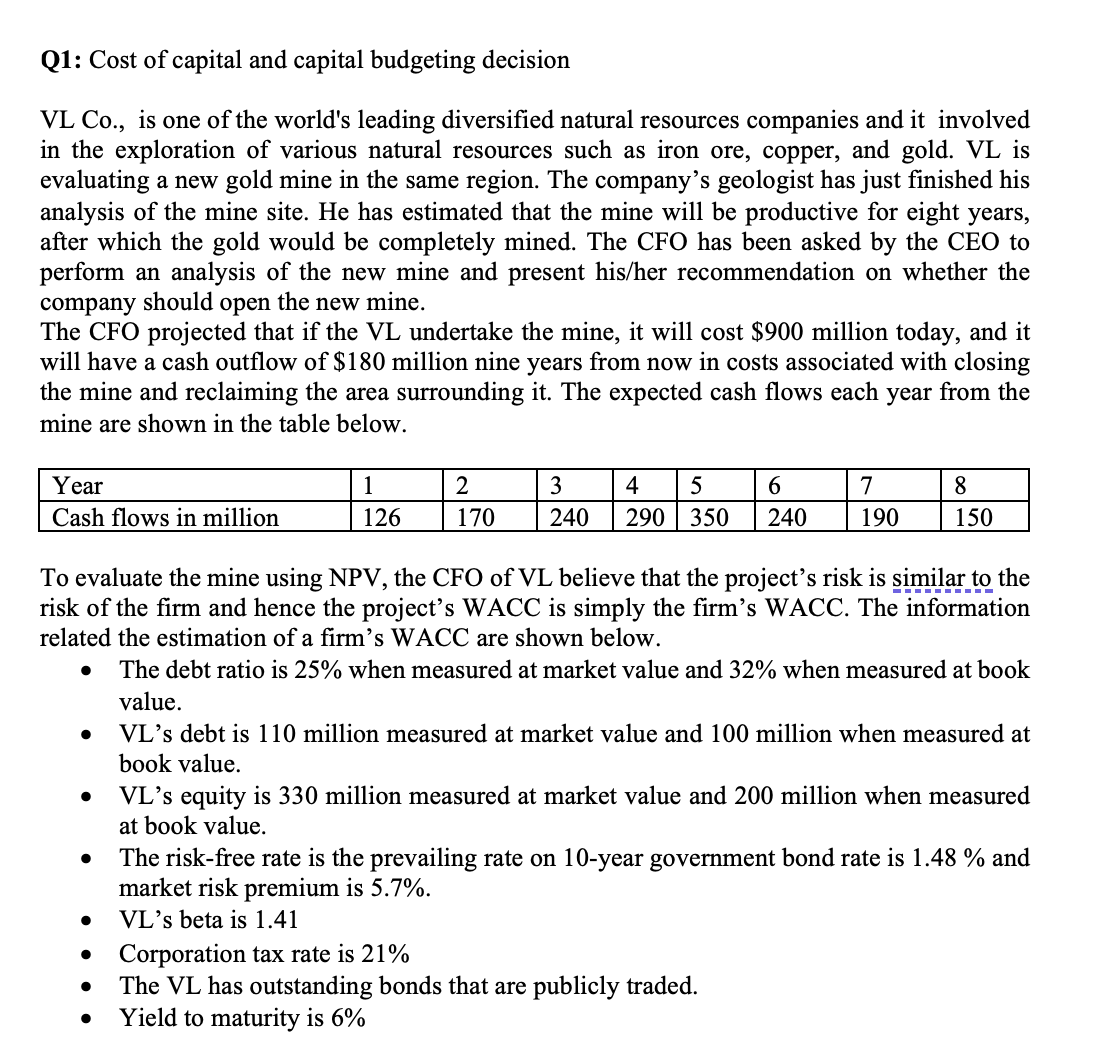

Q1: Cost of capital and capital budgeting decision VL Co., is one of the world's leading diversified natural resources companies and it involved in the exploration of various natural resources such as iron ore, copper, and gold. VL is evaluating a new gold mine in the same region. The company's geologist has just finished his analysis of the mine site. He has estimated that the mine will be productive for eight years, after which the gold would be completely mined. The CFO has been asked by the CEO to perform an analysis of the new mine and present his/her recommendation on whether the company should open the new mine. The CFO projected that if the VL undertake the mine, it will cost $900 million today, and it will have a cash outflow of $180 million nine years from now in costs associated with closing the mine and reclaiming the area surrounding it. The expected cash flows each year from the mine are shown in the table below. Year 1 2 Cash flows in million 126 170 3 240 4 5 6 7 290 350 240 190 8 150 To evaluate the mine using NPV, the CFO of VL believe that the project's risk is similar to the risk of the firm and hence the project's WACC is simply the firm's WACC. The information related the estimation of a firm's WACC are shown below. The debt ratio is 25% when measured at market value and 32% when measured at book value. VL's debt is 110 million measured at market value and 100 million when measured at book value. VL's equity is 330 million measured at market value and 200 million when measured at book value. The risk-free rate is the prevailing rate on 10-year government bond rate is 1.48 % and market risk premium is 5.7%. Corporation tax rate is 21% VL's beta is 1.41 The VL has outstanding bonds that are publicly traded. Yield to maturity is 6%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION As the CFO of VL Co I have analyzed the new gold mine project using the Net Present Value NPV method Based on the information provided here i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started